What should a 55 year old invest in?

Turning 55 marks a significant stage in life, often accompanied by evolving financial goals and risk tolerance. Investment strategies need to adapt to this new chapter, focusing on securing long-term financial stability while potentially maximizing returns.

This article explores suitable investment options for 55-year-olds, considering factors like retirement planning, potential healthcare costs, and desired legacy.

We'll delve into a range of choices, from low-risk, stable investments to potentially higher-yielding options, helping you navigate this crucial financial decision-making period.

What Investment Strategies are Best for a 55-Year-Old?

Retirement Accounts: Maximizing Your Savings

At 55, the focus shifts heavily towards securing a comfortable retirement. Maximize contributions to tax-advantaged retirement accounts like 401(k)s and IRAs. If eligible, consider making catch-up contributions, which allow older workers to contribute more than younger individuals. Diversify your holdings within these accounts across various asset classes to mitigate risk.

Carefully review your asset allocation to ensure it aligns with your risk tolerance and time horizon – remember you're closer to retirement, and thus generally prefer less risk. Consider consulting a financial advisor to optimize your retirement savings strategy and ensure you're on track to meet your retirement goals.

Managing Risk and Preserving Capital: A Conservative Approach

With retirement nearing, capital preservation becomes paramount. A more conservative investment strategy is typically recommended. This might involve shifting a larger portion of your portfolio to lower-risk investments such as bonds, certificates of deposit (CDs), or money market accounts.

While these options generally offer lower returns than stocks, they provide greater stability and reduce the potential for significant losses in the later years before retirement.

Diversification is still key, even within a conservative portfolio, to spread risk and potentially maximize returns within acceptable limits. Regularly review your portfolio's performance and make adjustments as needed to adapt to market changes.

Exploring Additional Income Streams: Beyond Traditional Investments

Supplementing retirement savings with additional income streams can enhance financial security. Consider part-time work, consulting, or starting a small business based on your skills and interests. Real estate investments, such as rental properties or REITs, could provide passive income, but carry significant risk and require careful due diligence.

Annuities can offer a guaranteed income stream in retirement, but may involve high fees and limited access to your principal. Carefully research and understand the implications of any additional income strategy before committing your resources.

This content may interest you! How much should a 50 year old have in savings UK?

How much should a 50 year old have in savings UK?Remember to factor in the tax implications of all income streams when planning for your retirement.

| Investment Type | Risk Level | Potential Return | Suitability for a 55-Year-Old |

|---|---|---|---|

| Stocks | High | High | Consider reducing exposure closer to retirement |

| Bonds | Low to Moderate | Moderate | Increasingly suitable as retirement nears |

| Real Estate | Moderate to High | Moderate to High | Requires careful consideration and due diligence |

| CDs/Money Market Accounts | Low | Low | Good for preserving capital |

| Annuities | Low to Moderate | Moderate | Requires thorough understanding of fees and terms |

Where should I be financially at 55?

Where you should be financially at 55 depends heavily on your individual circumstances, goals, and risk tolerance. There's no one-size-fits-all answer.

However, some general benchmarks and considerations can help guide you. Ideally, at 55, you should be nearing or in a position where your passive income streams (investments, rental properties, etc.) are substantially covering your living expenses, or at least a significant portion of them.

This allows for a smoother transition into retirement, reduces reliance on continued employment, and provides a safety net for unexpected expenses. The level of financial security you need will depend on your desired lifestyle in retirement and the availability of other sources of income, such as Social Security or a pension.

Debt Management

By age 55, you should ideally have significantly reduced or eliminated high-interest debt, such as credit card debt and personal loans. These types of debts carry high interest rates that can significantly eat into your retirement savings.

Focusing on paying off these debts earlier can free up more of your income to invest for retirement and provide greater financial peace of mind. Lowering your debt-to-income ratio is essential for a comfortable retirement. The process of managing your debt should involve a proactive approach.

- Create a budget to track your income and expenses, identifying areas where you can cut back.

- Develop a debt repayment plan, prioritizing high-interest debts. Consider methods like the debt snowball or debt avalanche.

- Explore debt consolidation options to potentially lower interest rates and simplify repayments.

Retirement Savings

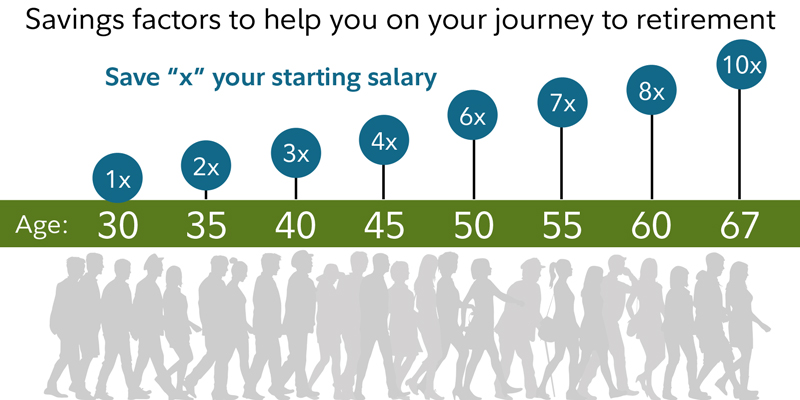

The amount of retirement savings you should have by 55 is highly variable and depends on your retirement goals, lifestyle, and expected expenses. However, a common rule of thumb is to have saved at least 8-10 times your annual expenses.

This provides a cushion for unexpected costs and inflation. It's important to consider not just your savings, but also the growth potential of your investments. Regularly reviewing and adjusting your investment strategy to reflect your risk tolerance and time horizon is key.

Consider diversifying your investments across different asset classes to mitigate risk.

This content may interest you! Is saving $1000 a month good in the UK?

Is saving $1000 a month good in the UK?- Regularly contribute to tax-advantaged retirement accounts like 401(k)s and IRAs, maximizing contributions whenever possible.

- Assess your investment portfolio's allocation, ensuring it aligns with your risk tolerance and retirement timeframe.

- Consult with a financial advisor to create a personalized retirement savings plan that takes into account your specific circumstances.

Healthcare Planning

Healthcare costs can be substantial in retirement, and planning for these expenses is crucial as you approach 55. Review your health insurance coverage options, including Medicare eligibility and supplemental insurance plans.

Consider the potential costs of long-term care, such as assisted living or nursing home care, and explore options like long-term care insurance. You should strive to have sufficient savings to cover potential unexpected medical bills.

Understanding your healthcare options and having a plan in place will ease financial stress in later years.

- Research Medicare plans and supplemental insurance options to ensure adequate coverage for medical expenses.

- Explore long-term care insurance to protect against the high costs of long-term care services.

- Maintain a healthy lifestyle to help minimize future healthcare costs.

Is 55 too late to start investing?

No, 55 is not too late to start investing. While it's true that the longer you invest, the more time your money has to grow through compounding, starting at 55 still offers significant benefits.

The power of compounding may be diminished compared to someone who started at 25, but even a shorter timeframe can yield substantial returns, especially if you invest aggressively and wisely. Your specific goals, risk tolerance, and investment choices will greatly impact your success.

The key is to create a well-defined plan, potentially focusing on lower-risk, higher-yield investments to maximize returns within the remaining time horizon. Remember to consult with a financial advisor to develop a personalized strategy tailored to your individual circumstances and retirement goals.

What are the benefits of starting at 55?

Even though the time horizon is shorter, starting to invest at 55 still provides several advantages. You can still accumulate a substantial nest egg for retirement or other goals, and the sooner you begin, the more you'll benefit from any growth.

This can significantly supplement your existing savings and social security. Even modest regular contributions can add up considerably over time, especially with the benefit of smart investment strategies. This is particularly true if you're investing in assets that grow at a significant rate.

Consider the following:

This content may interest you! What should your net worth be at 50 UK?

What should your net worth be at 50 UK?- Improved financial security in retirement: Investing at 55 gives you more control over your retirement income, reducing reliance on Social Security alone.

- Increased flexibility: Having additional retirement funds can provide greater financial flexibility to pursue hobbies, travel, or other activities during retirement.

- Legacy planning: Investing can provide a way to build a legacy for your heirs, providing them with financial support after your passing.

What investment strategies are suitable for someone starting at 55?

At 55, it's generally recommended to focus on lower-risk investment options to protect your principal while still aiming for reasonable returns. You may not have as much time to recover from significant market downturns as someone younger, so a balanced approach is crucial.

Diversification across asset classes also helps to mitigate risk. Consider these options when consulting a financial professional:

- Index funds and ETFs: These provide diversified exposure to a range of stocks or bonds, offering a relatively low-cost way to invest.

- Bonds: Bonds are generally considered less risky than stocks, offering a steadier income stream. However, their returns might be lower.

- Annuities: Annuities can provide guaranteed income streams in retirement, offering a degree of security.

What are the potential challenges of starting late?

Starting at 55 presents certain challenges compared to starting younger. The most significant is the shorter time horizon for your investments to grow. This means that you'll need to be more aggressive in your investment strategy to achieve your desired goals, which comes with inherently higher risks.

Careful planning and potentially higher contributions are necessary to make up for lost time. Keep in mind:

- Limited time for compounding: The magic of compounding requires time. While you can still benefit from it, the impact will be less than if you had started younger.

- Higher risk tolerance: To achieve your goals, you may need to take on more investment risk, which could lead to potential losses.

- Need for larger contributions: You might need to save and invest a larger percentage of your income to achieve your desired retirement goals.

How much should a 55 year old have in savings?

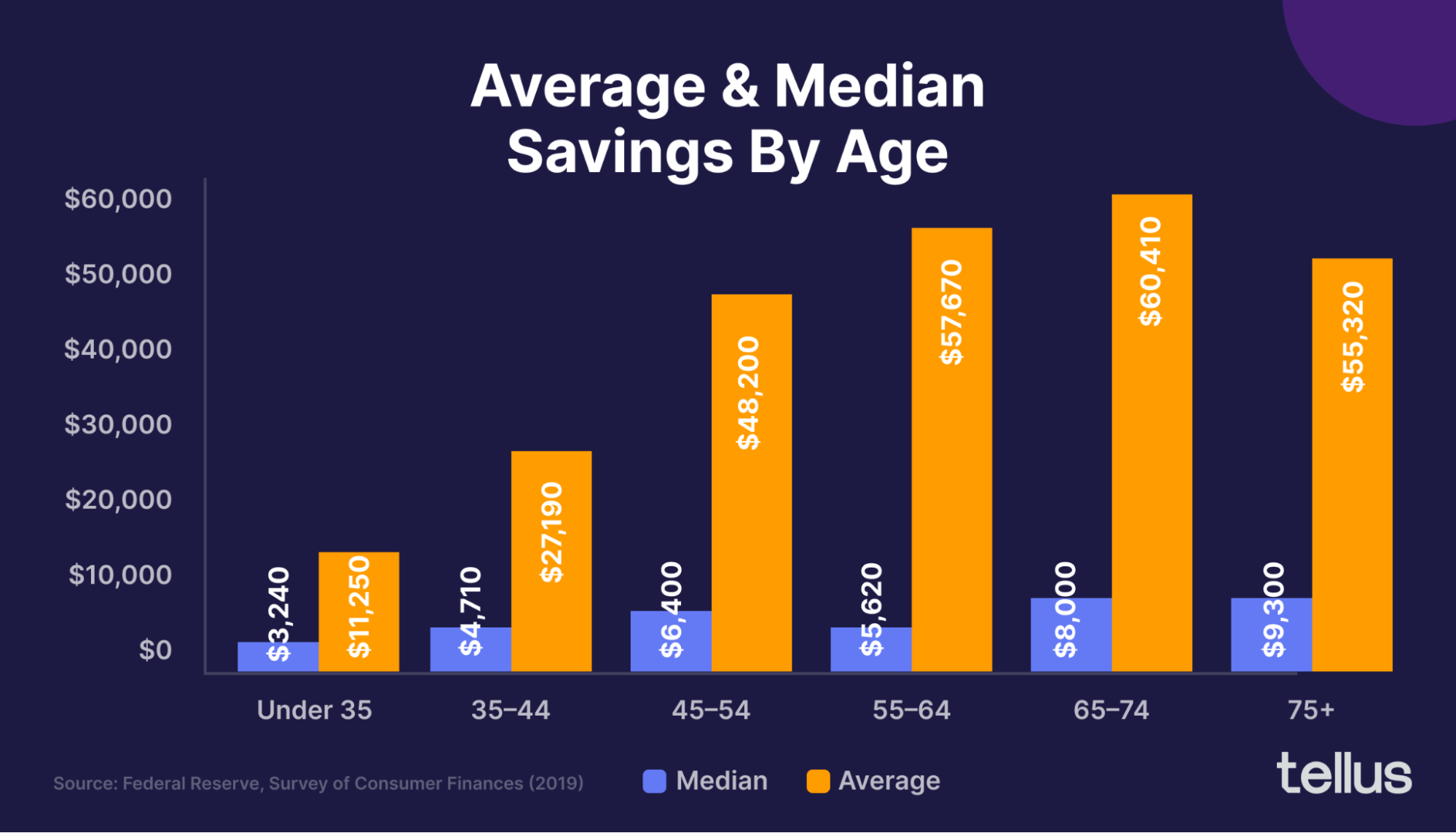

There's no single answer to how much a 55-year-old should have in savings. The ideal amount depends heavily on individual circumstances, including: their income, expenses, desired retirement lifestyle, health status, debt levels, and existing assets (like a home or investments). However, we can explore some general guidelines and factors to consider.

A rule of thumb often cited is having 7-10 times your annual income saved by age 55, but this is just a starting point and may not be realistic for everyone. Many financial advisors recommend having a substantial nest egg by this age to prepare for retirement, particularly if they don't anticipate continued income after age 65.

Factors like significant health concerns or unexpected major expenses can also impact the necessary savings amount.

Factors Influencing Savings Goals at 55

Several key factors determine the appropriate savings level for a 55-year-old. Income plays a crucial role; higher earners generally need a larger nest egg to maintain a similar lifestyle in retirement. Expenses, especially healthcare costs, which tend to increase with age, also heavily influence savings requirements.

The desired retirement lifestyle is a critical consideration; those aiming for extensive travel or luxury accommodations will need significantly more savings than those with more modest plans. Pre-existing debts, such as mortgages or loans, also reduce the available savings for retirement.

This content may interest you! How do I invest with very little money?

How do I invest with very little money?Finally, existing assets, including home equity and investment portfolios, should be factored into the overall financial picture.

- Current Income and Projected Retirement Income

- Estimated Retirement Expenses (Healthcare, Housing, Travel, etc.)

- Existing Assets (Home Equity, Investments, Retirement Accounts)

Retirement Planning Strategies for the 55-Year-Old

At 55, individuals should actively focus on optimizing their retirement savings strategies. This involves assessing their current savings, evaluating their investment portfolio's risk tolerance and diversification, and exploring options to boost their retirement income.

Strategies might include increasing contributions to retirement accounts like 401(k)s or IRAs, if possible, and carefully considering the tax implications of different investment choices. Consulting with a financial advisor can provide personalized guidance on maximizing savings and mitigating potential risks.

- Review and Rebalance Investment Portfolio

- Maximize Retirement Account Contributions

- Explore Additional Income Streams (Part-Time Work, Rental Properties)

Assessing Risk and Potential Shortfalls

It's crucial for a 55-year-old to honestly assess potential risks and shortfalls in their retirement planning. Unforeseen events, such as health issues or economic downturns, can significantly impact retirement savings.

Analyzing potential scenarios and developing contingency plans is essential. This might involve creating a detailed budget to understand expenses, exploring long-term care insurance options to address potential healthcare costs, and adjusting spending habits to ensure funds are sufficient for a comfortable retirement.

Regularly reviewing and adjusting the retirement plan is crucial to address changes in circumstances or market conditions.

- Evaluate Health Insurance Needs and Long-Term Care Options

- Develop a Contingency Plan for Unexpected Expenses

- Regularly Review and Adjust Retirement Savings Plan

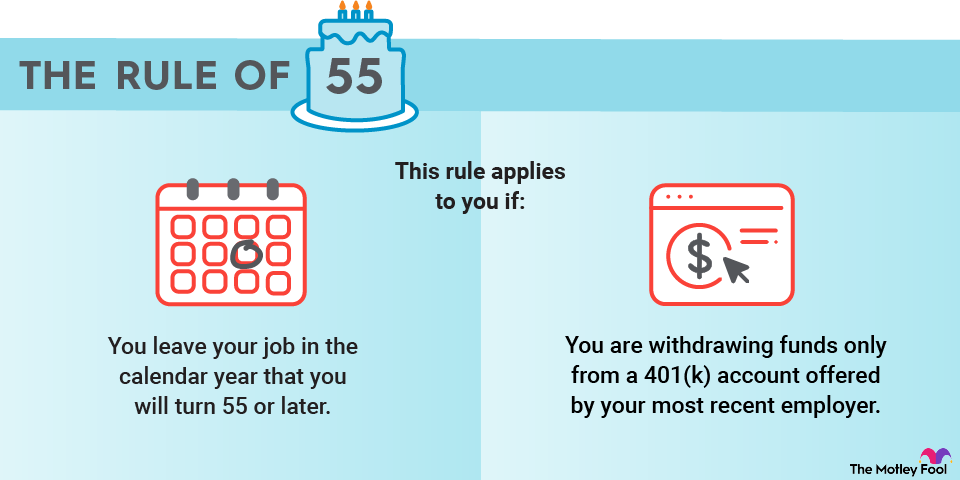

Is 55 too late to start a 401k?

Whether 55 is too late to start a 401(k) depends entirely on your individual circumstances, financial goals, and risk tolerance. It's not ideal to start so late, as the power of compounding interest has less time to work its magic, but it's certainly not impossible to benefit.

The amount you can save, your investment choices, and the time until retirement will all play a significant role in determining the eventual impact.

How much can you contribute?

While starting at 55 significantly reduces the time for your investments to grow, it's still worthwhile to contribute as much as you can. The contribution limits for 401(k)s change annually, but even smaller contributions can make a difference over time.

This content may interest you! What is the best investment for a small amount?

What is the best investment for a small amount?The key here is consistency. Regular contributions, however small, will accumulate over the years. Consider increasing your contributions gradually to maximize your savings potential without placing an undue burden on your current budget.

- Check the current contribution limits set by the IRS.

- Determine a manageable contribution amount based on your income and expenses.

- Consider automatic contributions to ensure consistency.

What investment strategy should you use?

Given the shorter timeframe, you'll likely want to focus on a moderately conservative investment strategy. This means prioritizing lower-risk investments to protect your principal while still aiming for growth.

While you could still include some higher-growth options, the overall portfolio should be tilted toward stability. Diversification remains crucial to mitigate potential losses.

- Consult with a financial advisor to develop a suitable investment strategy.

- Consider a mix of stocks and bonds appropriate for your risk tolerance.

- Regularly rebalance your portfolio to maintain your desired asset allocation.

What are the potential benefits despite the late start?

Even starting at 55 offers some advantages. The tax advantages of a 401(k) are significant, allowing you to reduce your current taxable income. This can free up more cash flow now, and the tax-deferred growth can significantly boost your retirement savings over time, even with a shorter investment horizon.

Furthermore, some employers offer matching contributions, essentially offering free money that should not be overlooked.

- Take advantage of employer matching contributions, if available.

- Benefit from tax advantages, reducing current income tax liability.

- Aim for consistent contributions to maximize long-term growth, however modest.

Frequently Asked Questions

What investment strategies are suitable for a 55-year-old nearing retirement?

At 55, your investment horizon shrinks, emphasizing preservation of capital and generating income. Consider a balanced portfolio with a lower risk tolerance. This might involve a mix of high-quality bonds, dividend-paying stocks, and potentially some real estate investment trusts (REITs) for stable income streams.

Annuities can offer guaranteed income, but come with fees. Consult a financial advisor to determine the best asset allocation based on your specific retirement goals and risk profile. Diversification across different asset classes remains crucial to mitigate potential losses.

How much risk should a 55-year-old take with their investments?

Risk tolerance significantly decreases as retirement nears. While some growth is still desirable, prioritizing capital preservation becomes paramount. A conservative approach is generally recommended, minimizing exposure to volatile assets like individual stocks or speculative investments.

Focus on investments with a proven track record of stability and steady returns. A portfolio heavily weighted towards bonds and lower-risk equities would be more suitable than a highly aggressive growth-oriented strategy. Remember, the goal is to secure your retirement funds, not to chase potentially high but risky returns.

What are some specific investment options for a 55-year-old?

Several options cater to a 55-year-old's needs. Index funds or ETFs tracking broad market indices offer diversification and lower expense ratios. Dividend-paying stocks provide a regular income stream. Government bonds and high-quality corporate bonds offer relative safety and predictable returns.

This content may interest you! How much savings should I have per age?

How much savings should I have per age?Annuities, while carrying fees, can provide guaranteed income in retirement. Real estate investment trusts (REITs) can offer both income and potential appreciation. However, it's crucial to diversify across asset classes to minimize risk and align your investments with your risk tolerance and retirement goals.

Should a 55-year-old consider Roth conversions or other tax optimization strategies?

Tax optimization is crucial for retirement planning. Roth conversions, where pre-tax retirement funds are converted to Roth accounts, can be beneficial if you anticipate being in a higher tax bracket in retirement. This allows you to withdraw tax-free in retirement.

However, it involves immediate tax implications. Tax-loss harvesting, where losses are used to offset gains, can also be advantageous.

A financial advisor can help determine the most suitable tax strategies based on your specific situation, income, and retirement goals, ensuring you minimize your tax liability both now and during retirement.

Leave a Reply