How much should a 16 year old save?

Saving money at 16 is a crucial step towards financial independence. But how much should teenagers actually be saving? The answer isn't a simple number, as it depends heavily on individual circumstances, including income sources (part-time jobs, allowances), expenses, and future goals. This article explores various saving strategies tailored for 16-year-olds, addressing common challenges and providing practical advice on budgeting, saving methods, and investing small amounts of money. We'll help you determine a realistic savings target and navigate the world of personal finance at a young age.

How Much Savings is Right for a 16-Year-Old?

Short-Term Savings Goals for Teens

For a 16-year-old, short-term savings should focus on immediate needs and wants. This could include things like a new phone, video games, clothes, or contributing towards a driver's license or car. The amount saved will vary greatly depending on individual spending habits and income sources (part-time job, allowance, gifts). A good starting point is to aim for a savings goal that aligns with a specific purchase, rather than a fixed percentage of their income. Tracking progress towards a concrete goal can be highly motivating, fostering better savings habits early on. Think of it as learning to budget and manage money responsibly before larger, long-term financial responsibilities emerge.

Building an Emergency Fund at 16

While seemingly distant, an emergency fund is crucial at any age. For a 16-year-old, this might cover unexpected repairs to their bike or phone, or unforeseen medical expenses. While a large emergency fund isn’t typically realistic at this age, starting small is key. Aiming for even a small amount, such as one or two hundred dollars, provides a safety net for minor emergencies. This teaches the importance of financial preparedness and can instill a sense of security. This fund also reduces the need to rely on parents for every small unexpected expense, promoting greater independence.

Long-Term Savings & Investment for the Future

At 16, thinking about the future might seem daunting, but starting long-term savings early yields significant benefits. This could include saving for college, future travel, or even a down payment on a house. Even small regular contributions to a savings or investment account, perhaps with the help of a parent or guardian's Roth IRA, can accumulate substantially over time due to the power of compound interest. Learning about different investment options and seeking guidance from a financial advisor can help make these savings work harder in the long run. This early exposure to financial planning sets a strong foundation for future financial success.

| Savings Goal | Amount | Timeframe |

|---|---|---|

| Short-Term (e.g., new phone) | Varies depending on the cost | Few weeks to several months |

| Emergency Fund | $100 - $500 (as a starting point) | Ongoing, continually replenished |

| Long-Term (e.g., college, travel) | Varies depending on the goal | Years |

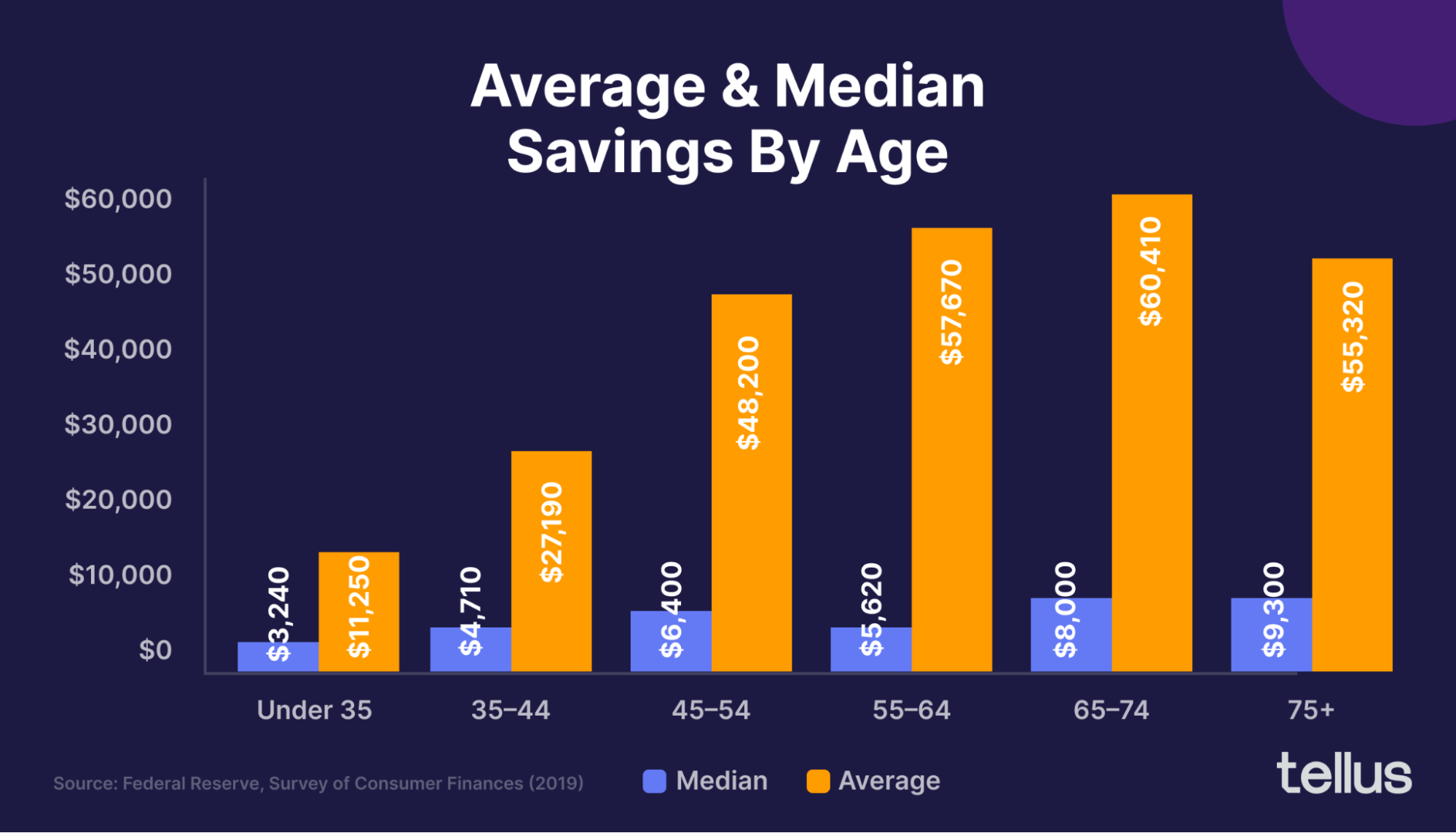

How much money is average for a 16 year old?

Should a 15 year old save money?

Should a 15 year old save money?How much money a 16-year-old has varies significantly depending on several factors, including location, family background, and whether they have a job. There's no single "average" figure. Some teenagers might receive a regular allowance from their parents, ranging from a few dollars a week to several hundred. Others might work part-time jobs, earning minimum wage or more depending on their skills and the type of work. The amount they earn will depend on the number of hours they work and the applicable minimum wage in their area. Some teenagers might also receive gifts of money for birthdays or holidays, contributing to their overall funds. Therefore, a wide range of amounts is possible, from practically nothing to several thousand dollars in savings or readily available cash.

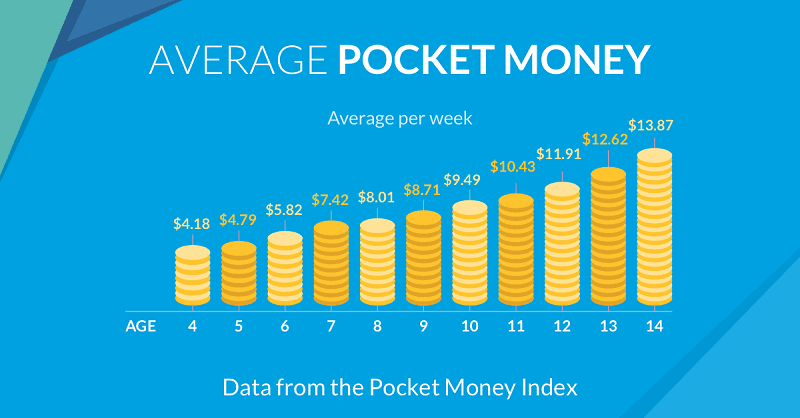

Allowance and Gifts

A significant portion of a 16-year-old's money often comes from allowances or gifts. The amount received varies greatly based on family income and values. Some parents provide a fixed weekly or monthly allowance to teach financial responsibility, while others may offer money for specific tasks or achievements. Gifts, particularly for birthdays and holidays, can significantly impact the total amount available. This income source is often irregular and less predictable than earned income.

- Allowance amounts can range widely, from a few dollars a week to upwards of $100 per month, depending on parental financial capabilities and expectations.

- Birthday and holiday gifts often contribute a substantial, albeit irregular, sum to a teenager's overall funds.

- The amount received is heavily influenced by cultural norms and family values, with some families emphasizing the importance of earning money, and others prioritizing providing financial support.

Part-Time Jobs and Earnings

Many 16-year-olds supplement their income with part-time jobs. The amount earned varies greatly depending on the minimum wage in their region, the number of hours worked, and the type of job. Minimum wage jobs such as fast food or retail work provide a base level of income, while other jobs, requiring more skills or responsibility, may offer higher pay. The availability of suitable jobs also plays a crucial role.

- Minimum wage varies significantly across different locations and countries, directly affecting the potential earnings.

- The number of hours a 16-year-old can legally work is often restricted by law, thus limiting their earning potential.

- The type of job significantly impacts earning potential. Jobs requiring specialized skills, like tutoring or babysitting, may offer better pay than minimum wage entry-level positions.

Savings and Spending Habits

The amount of money a 16-year-old possesses is also affected by their saving and spending habits. Teenagers with strong saving habits and financial literacy are more likely to accumulate larger sums. Conversely, teenagers who spend freely or lack financial awareness may have less money saved, even if they earn a relatively high income. Learning effective budgeting and saving strategies is crucial for financial well-being at this age.

- Financial literacy plays a critical role in managing money effectively; teenagers with strong financial skills are better equipped to save and budget.

- Spending habits significantly impact the amount of money accumulated. Impulse purchases can quickly deplete savings.

- Saving goals, such as buying a car or saving for college, can motivate teenagers to manage their finances more effectively.

How much should a 16 year old have in savings?

How much money should a 14-year-old have?

How much money should a 14-year-old have?How Much Should a 16-Year-Old Have in Savings?

There's no single right answer to how much a 16-year-old should have in savings. The appropriate amount depends heavily on several factors, including the teen's individual circumstances, family financial situation, and goals. A teenager with a part-time job and frugal habits will likely have more savings than a teen without income or who spends more freely. It's more helpful to focus on establishing good saving habits and building a financial foundation rather than targeting a specific dollar amount. Consider the teen's spending habits, financial literacy, and future plans – whether it’s saving for college, a car, or other significant purchases. A reasonable savings goal should align with these factors.

Factors Influencing Savings Goals

Several crucial factors influence how much a 16-year-old should aim to save. These factors paint a clearer picture beyond just a numerical target. It's about establishing a healthy relationship with money and planning for the future. Consider these aspects when determining a suitable savings amount:

- Income Level: A teenager with a part-time job will naturally have more opportunities to save compared to one without. Savings should be a percentage of their income, not a fixed dollar amount.

- Spending Habits: Mindful spending habits are essential. A teen who prioritizes saving over impulsive purchases will accumulate more savings over time. Tracking expenses and creating a budget can significantly influence savings.

- Financial Goals: Long-term financial goals, such as college tuition, a car, or travel, heavily influence savings targets. Defining these goals provides motivation and allows for realistic savings planning.

Establishing Good Savings Habits

More important than the specific amount saved is the development of healthy financial habits. Teaching a 16-year-old how to budget, save, and invest early lays the groundwork for a secure financial future. This involves more than simply putting money aside; it's about cultivating responsibility and understanding the value of money.

- Budgeting: Create a simple budget to track income and expenses. This teaches responsible spending and helps identify areas where spending can be reduced.

- Saving Regularly: Encourage regular saving, even small amounts, to instill the habit of consistent saving. Automatic transfers from a checking to a savings account can be beneficial.

- Financial Literacy: Learning about budgeting, investing, and debt management empowers teens to make informed financial decisions and helps them understand the importance of saving.

Types of Savings Accounts and Investment Options

Understanding different savings accounts and investment options appropriate for a 16-year-old is crucial. This empowers them to make informed choices about where to keep their money and how to potentially grow it. Starting early can significantly impact long-term financial well-being.

This content may interest you! Should a 12 year old save money?

Should a 12 year old save money?- Savings Accounts: High-yield savings accounts offer higher interest rates than regular savings accounts, allowing the money to grow more quickly. This is a good starting point for younger savers.

- College Savings Plans (529 Plans): If the goal is college funding, a 529 plan allows tax-advantaged savings specifically for educational expenses. Contributions can grow tax-free and withdrawals are tax-free when used for qualified education expenses.

- Minor Custodial Accounts (UTMA/UGMA): These accounts allow a guardian to manage investments on behalf of a minor, providing opportunities to invest in stocks, bonds, or mutual funds for potential long-term growth. However, it’s important to note that investment accounts involve risk.

How much of my money should I save from my paycheck at 16?

How much of your money should you save from your paycheck at 16?

There's no single right answer to how much of your paycheck you should save at 16. It depends heavily on your individual circumstances, spending habits, and financial goals. However, a good starting point is to aim for saving at least 10-20% of your earnings. This might seem like a small amount, but consistently saving even a little will add up over time and establish good financial habits early in life. Consider that you're building a foundation for future financial security, and every saved dollar is a step toward that goal. The most important thing is to create a budget that you can stick to, ensuring you're saving something, even if it's just a small amount consistently.

The Importance of Budgeting and Tracking Expenses

At 16, understanding where your money goes is crucial before you start saving. Budgeting helps you see how much you spend on various things, like entertainment, food, and clothes. Once you see your spending patterns, you can identify areas where you can cut back to save more.

- Create a simple budget: Track your income and expenses for a month to understand your spending habits.

- Identify non-essential spending: Look for areas where you can reduce spending without significantly impacting your lifestyle.

- Prioritize saving: Allocate a specific amount from each paycheck for savings before you spend on anything else. This makes saving a non-negotiable part of your budget.

Short-Term vs. Long-Term Savings Goals

Your savings goals will influence how much you save. Short-term goals might include buying a new phone, saving for a car, or funding a summer trip. Long-term goals might include paying for college, buying a house, or investing for retirement. Understanding your timeline helps you determine how aggressively you need to save.

This content may interest you! What age should I start budgeting?

What age should I start budgeting?- Short-term goals: Requires saving a larger portion of your paycheck more quickly. You might prioritize saving more if a specific purchase or trip is coming up.

- Long-term goals: Allows for a slower saving pace. Even small consistent savings can accumulate substantially over several years.

- Consider both: Balance short-term wants with long-term needs. A good strategy might be to save a percentage for both short-term goals and long-term savings.

Exploring Different Savings Vehicles

Once you start saving, it’s wise to think about where to keep your money. Different accounts offer different benefits. A savings account is a good place for easy access to funds for short-term goals. As you mature, you might consider higher-yield savings accounts or even investment accounts for long-term growth.

- Savings account: Offers easy access to your money and protects it from theft or loss. Interest rates are generally low.

- High-yield savings account: Pays higher interest than a regular savings account. May have minimum balance requirements.

- Investment accounts (with parental guidance): Offer potential for higher returns over the long term, though they involve risk. Requires adult assistance or understanding before investing.

How much pocket money for a 16 year old?

Pocket Money for a 16-Year-Old

How much pocket money a 16-year-old should receive depends heavily on several factors. There's no single "right" amount. Consider the teenager's responsibilities, their spending habits, the family's financial situation, and the prevailing cultural norms. A teenager with a part-time job might need less pocket money than one without. Similarly, a family with a higher income might be able to afford more. Some families choose to tie pocket money to chores or responsibilities, while others give a fixed amount regardless. Ultimately, open communication between parents and the teenager is crucial to determine a fair and suitable amount. It's important to find a balance that teaches responsible spending and financial management without creating undue hardship or resentment.

Factors Influencing Pocket Money Amounts

Several key factors influence the appropriate amount of pocket money for a 16-year-old. These factors should be carefully considered when deciding how much to give. Open communication between parents and the teenager can help determine a suitable and fair amount, ensuring it aligns with the individual's needs and responsibilities. Regular review of the amount may be necessary as the teenager's needs and circumstances change.

This content may interest you! How to save money if you don't have a job?

How to save money if you don't have a job?- Family Income: Higher-income families may be able to provide more pocket money than those with lower incomes. This reflects the family's overall financial capacity.

- Responsibilities: Does the teenager have chores or part-time jobs? If they contribute to the household, the need for additional pocket money might be reduced.

- Spending Habits: A teenager who spends money frivolously may require more careful budgeting and potentially a lower allowance to encourage responsible spending.

Alternative Approaches to Pocket Money

Giving a fixed allowance isn't the only way to manage a teenager's finances. Alternative approaches can encourage responsibility and financial literacy. These methods can be more effective in teaching valuable financial skills, allowing the teenager to learn the value of money and budgeting in a practical way.

- Allowance Tied to Chores: Linking pocket money to completed chores teaches the value of work and earning money. This can be a good method to encourage responsibility and contribute to household tasks.

- Joint Bank Account: A joint account allows the teenager to see their money grow while learning about saving and responsible banking practices. Parental oversight can offer guidance on financial decision-making.

- Budgeting and Financial Education: Combining pocket money with regular discussions about budgeting, saving, and spending habits can provide valuable life skills. This approach empowers teenagers to make informed financial choices.

Common Pocket Money Ranges

While specific amounts vary greatly depending on location and individual circumstances, some general ranges can provide a point of reference. These are broad estimates and should be adjusted based on the factors discussed earlier. The most important aspect is open communication and a system that works for the entire family.

- Lower Range: $20 - $50 per week or month, depending on the frequency of payment. This might be suitable for teenagers with part-time jobs or who have fewer expenses.

- Mid-Range: $50 - $100 per week or month. This is a common range, balancing personal spending with responsible financial habits.

- Higher Range: $100+ per week or month, typically for teenagers with significant expenses or those in families with higher incomes. This range necessitates a higher level of financial responsibility.

How much should a 16-year-old save each month?

There's no magic number, as it depends heavily on individual circumstances. Consider their income sources (part-time job, allowance, gifts), expenses (school lunches, transportation, entertainment), and financial goals (saving for a car, college, or travel). A good starting point might be 10-20% of their earnings, but even small, consistent savings are valuable. Prioritize needs over wants, and build a budget to track income and spending, allowing for adjustments as needed. Focus on forming a good savings habit rather than a specific amount.

What should a 16-year-old save their money for?

Short-term goals like a new phone or concert tickets can be motivating, but long-term savings are crucial. College education is a major expense, and starting early offers significant advantages. A car, driving lessons, and insurance represent considerable costs, and saving beforehand can minimize reliance on loans. Building an emergency fund, even a small one, provides security for unexpected events. Consider a combination of short-term and long-term goals to maintain enthusiasm and financial preparedness.

What's the best way for a 16-year-old to save money?

Utilizing a savings account specifically designed for teenagers offers several advantages, including building good financial habits from a young age and often including parental oversight features. Online banking tools allow for easy monitoring and tracking of savings progress. A piggy bank or even a simple envelope system can work for smaller amounts, but a dedicated account promotes a more structured approach. Setting up automatic transfers from their checking account to their savings account can help ensure regular contributions.

This content may interest you! How much should a young person save?

How much should a young person save?Should a 16-year-old invest their savings?

While investing offers potential for greater returns, it also carries risk. At 16, focus should remain primarily on building a solid savings base. Learning about investing and understanding risk tolerance is important, but diversification and long-term strategies are crucial and often require adult guidance. Exploring age-appropriate investment options, perhaps with parental involvement, can lay the groundwork for future investment decisions. Prioritize saving first, then consider adding a small portion to a low-risk investment portfolio as they gain knowledge.

Leave a Reply