How to convince your parents to give you $500?

Securing $500 from your parents might seem like a monumental task, but with the right approach, it's entirely achievable. This article provides a strategic guide on how to successfully persuade your parents to grant your financial request. We'll explore effective communication techniques, highlighting the importance of demonstrating responsibility, outlining a compelling plan for using the money, and emphasizing your commitment to repayment if necessary. Prepare to present a well-reasoned case that will leave your parents impressed and more likely to say "yes." Let's dive into the art of persuasive negotiation.

Crafting a Compelling Case: How to Persuade Your Parents for $500

Demonstrate Responsibility and Maturity

Before even broaching the subject of money, showcase your responsibility and maturity. This means consistently completing chores, exceeding expectations in school (good grades and active participation), and demonstrating reliability in your commitments. If you have a part-time job, highlight your strong work ethic and responsible handling of your earnings. Parents are more likely to trust you with a significant sum if they see evidence of your capability to manage finances and responsibilities effectively. Show, don't just tell them, that you're ready for this level of financial independence. The more you demonstrate these qualities, the stronger your argument will be.

Present a Well-Defined Plan and Purpose

Don't just ask for $500; present a well-defined plan for how you'll use the money. Avoid vague requests like "for spending money." Instead, propose a specific project or goal. This could be saving for a specific item (like a laptop for school or a used car), investing in a skill-building opportunity (a course, software, or tools), or contributing towards a larger financial goal (like a down payment for a future purchase). The more concrete and realistic your plan, the more likely your parents will be to see the value in your request. A detailed budget outlining exactly how the money will be allocated further strengthens your case.

Negotiate and Offer Alternatives

Approaching your parents with a flexible attitude and a willingness to negotiate significantly improves your chances of success. Instead of demanding the full $500 upfront, consider proposing a payment plan, perhaps earning a portion through extra chores or offering a matching contribution from your savings. Show that you’re willing to work towards your goal and aren’t just expecting a handout. If they are hesitant about the full amount, perhaps propose a smaller initial sum, demonstrating your ability to manage smaller amounts responsibly before asking for more. Being open to compromise demonstrates maturity and increases the probability of a positive outcome.

This content may interest you! How can you make your parents give you money?

How can you make your parents give you money?| Factor | Impact on Success |

|---|---|

| Responsibility Demonstrated | High - Shows trustworthiness and capability |

| Clear Plan & Purpose | High - Provides justification and reduces risk |

| Negotiation & Compromise | High - Shows maturity and willingness to work together |

| Vague Request | Low - Lacks justification and increases skepticism |

| Unrealistic Expectations | Low - Damages credibility and reduces likelihood of success |

How to convince parents to give money?

Show Responsibility and Maturity

Demonstrating responsibility and maturity is key to convincing your parents to give you money. Parents are more likely to trust you with their money if they see you handling your own affairs well. This means consistently completing chores, managing your time effectively, and showing that you understand the value of money. If you have a history of being irresponsible with money or possessions, it's time to turn that around. Actions speak louder than words, so focusing on responsible behavior will significantly improve your chances.

- Maintain a clean and organized space. This showcases your ability to manage your belongings and environment responsibly.

- Complete all your chores and responsibilities without being asked. This demonstrates initiative and self-reliance.

- Save a portion of any money you already earn, even if it's a small amount. This shows that you understand the importance of saving and budgeting.

Clearly Outline Your Needs and Wants

When asking for money, avoid vague requests. Instead, prepare a clear and well-thought-out presentation of exactly what you need the money for, and why it’s important. If you have a specific goal in mind (like saving for a college fund or a specific item), explain that goal, how much money you need, and how you plan to use it responsibly. Make sure you consider whether this is a need or a want, and tailor your approach accordingly. Emphasize the benefits and positive outcomes of receiving the money. Parents often respond better to a reasoned and practical argument, rather than an emotional plea.

- Create a detailed budget outlining how you will spend the money. Show your parents that you've considered the costs and have a plan.

- Research the cost of your desired item or experience. This demonstrates that you are serious and have put in the effort to be prepared.

- If it's for a need, explain the consequences of not receiving the money. For example, if you need new shoes for school, explain how worn-out shoes affect your comfort and participation in activities.

Offer a Plan for Repayment (if applicable)

If you're asking for a loan rather than a gift, outlining a clear repayment plan is crucial. Show your parents that you understand the responsibility of borrowing money and that you intend to pay them back. Propose a realistic repayment schedule, specifying how much you can afford to pay each week or month and when you anticipate the debt will be fully repaid. Be prepared to discuss how you will earn the money to repay the loan. This demonstrates responsibility and reduces the risk from your parents’ point of view. Transparency and a well-defined plan build trust and increase your chances of success.

This content may interest you! What is it called when your parents give you money weekly?

What is it called when your parents give you money weekly?- Suggest a specific repayment schedule with concrete dates and amounts.

- Identify potential sources of income you can use to repay the loan, such as a part-time job or allowance.

- Consider offering collateral if appropriate, to show your commitment to repayment.

What is a good excuse to ask parents for money?

Good Excuses to Ask Parents for Money

Unexpected Expenses

Unexpected expenses are a common and often believable reason to ask your parents for money. These are situations where a necessary cost arises suddenly and wasn't accounted for in your budget. It's crucial to be honest and transparent about the situation, providing as much detail as possible to show you're not trying to manipulate them. Be prepared to explain why you couldn't have foreseen the expense and what steps you've already taken to address it.

- Clearly explain the nature of the unexpected expense (e.g., a broken appliance, a medical bill, an urgent car repair).

- Show them proof, if possible (e.g., a repair quote, a medical bill, a bank statement showing the unexpected withdrawal).

- Demonstrate your attempts to solve the problem yourself (e.g., calling around for cheaper repairs, exploring alternative solutions).

Educational or Self-Improvement Needs

Investing in your future is always a strong argument when asking for financial assistance. This could involve expenses related to your education, professional development, or personal growth. Frame your request as an investment in your long-term success and emphasize how this expense will benefit you and, potentially, your family in the future. Be specific about how this expense will help you achieve your goals.

This content may interest you! How to wish on first salary?

How to wish on first salary?- Clearly articulate your educational or self-improvement goals and how this expense directly supports them (e.g., a course to improve your job skills, textbooks for a crucial class, materials for a personal project).

- Provide a detailed breakdown of the costs involved, showing you've researched options and are making responsible financial choices.

- Explain how acquiring this skill or knowledge will benefit your family in the long run (e.g., increased earning potential, ability to contribute more to household expenses).

If there's a family goal or project that requires financial contribution, asking for help in reaching that shared objective can be a compelling reason. This approach positions your request not as a personal need, but as a collaborative effort towards a common goal that benefits everyone. This works best when you have already contributed what you can and need a final push to complete the project or reach the goal.

- Clearly define the shared family goal (e.g., a family vacation, a home improvement project, a charitable donation).

- Demonstrate your commitment by showing how much you've already contributed towards the goal (e.g., time, effort, savings).

- Clearly state the remaining cost and how your requested contribution will make a significant difference in achieving the shared goal.

What to do if your parents don't give you money?

The reasons why your parents might not give you money are varied, ranging from financial difficulties to differing views on financial responsibility. Understanding their perspective is crucial before taking action. However, there are several proactive steps you can take to address your financial needs regardless of their contributions. This involves a combination of seeking alternative income streams, managing your expenses effectively, and fostering open communication with your parents.

Understand Your Parents' Perspective

Before jumping to conclusions or feeling resentment, try to understand why your parents may not be providing you with financial support. Are they facing financial hardship themselves? Do they believe you should learn to be financially independent? Open and honest communication is key. Avoid accusatory language and instead focus on expressing your needs and concerns respectfully. This understanding will help you tailor your approach to finding a solution.

This content may interest you! How important is your first salary?

How important is your first salary?- Have a calm and respectful conversation with your parents about your financial needs.

- Listen to their perspective and try to understand their reasoning.

- Work together to find a compromise or solution that works for everyone.

Explore Alternative Income Streams

If your parents are unable or unwilling to provide financial assistance, you will need to explore other ways to earn money. This could involve finding a part-time job, starting a small business, or utilizing your skills to offer services to others. Consider your talents, interests, and available time when choosing an income source. The key is to be resourceful and creative in generating income.

- Look for part-time jobs in your local area, such as retail, food service, or tutoring.

- Explore online opportunities like freelancing, online surveys, or selling goods online.

- Consider starting a small business based on your skills and interests (e.g., baking, crafting, pet sitting).

Budgeting and Expense Management

Regardless of whether you receive money from your parents, effective budgeting and expense management are essential. Tracking your income and expenses will allow you to identify areas where you can cut back and prioritize your spending. Creating a realistic budget will help you make informed decisions about your finances and ensure you're spending your money wisely. This skill is crucial for long-term financial health.

- Track your income and expenses to identify areas where you can save money.

- Create a realistic budget that aligns with your income and financial goals.

- Prioritize your essential expenses (food, housing, transportation) and limit non-essential spending.

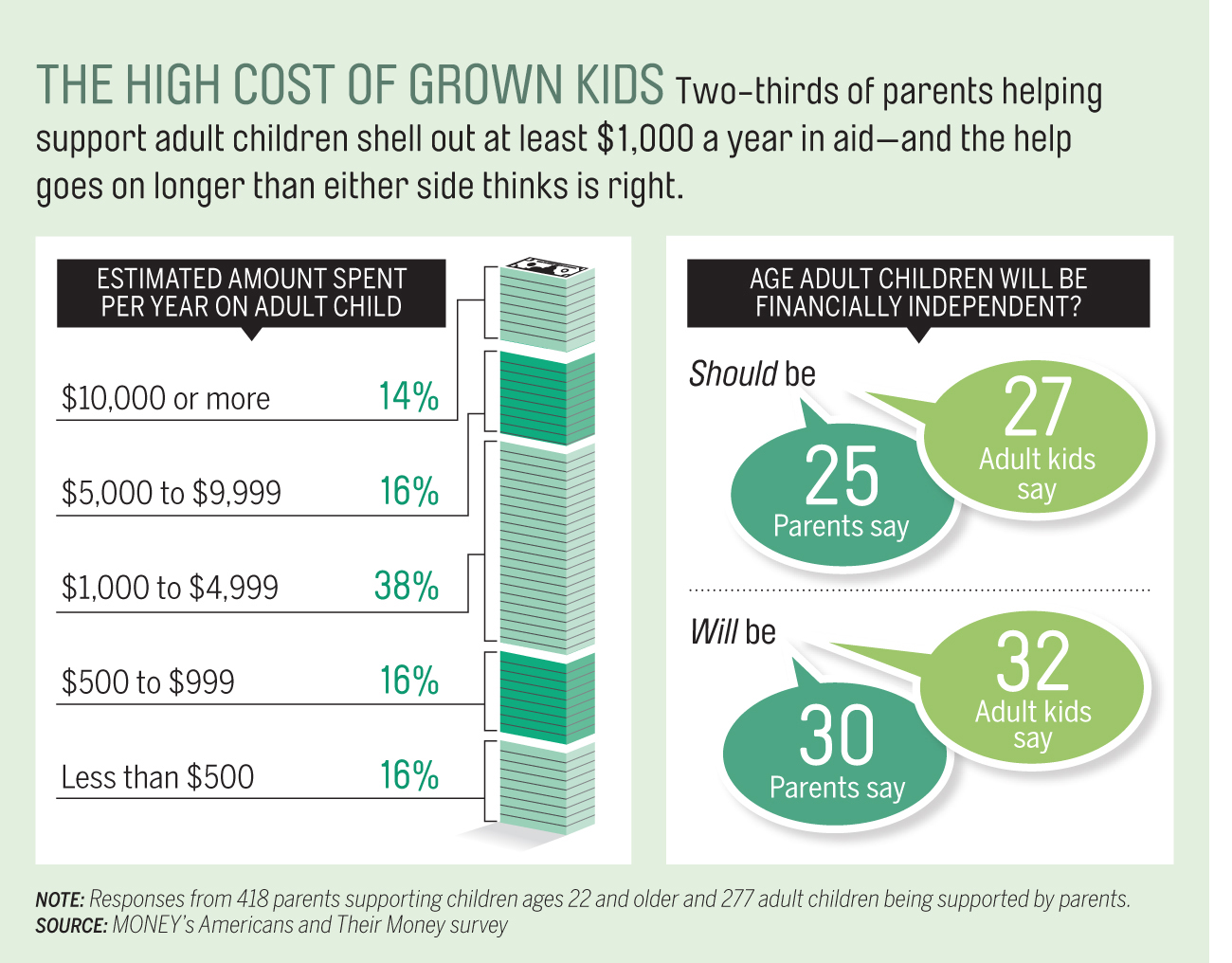

At what age should parents stop giving money?

At What Age Should Parents Stop Giving Money?

This content may interest you! What saves you the most money in college?

What saves you the most money in college?At What Age Should Parents Stop Giving Money?

There's no single answer to the question of when parents should stop giving their children financial support. The appropriate age depends heavily on individual circumstances, including the child's maturity level, financial independence, educational pursuits, career trajectory, and the parents' financial situation. Some children become self-sufficient earlier than others, while others may require ongoing support due to unforeseen circumstances like illness or disability. A gradual reduction in financial assistance, rather than a sudden cutoff, often proves more effective and less stressful for both parents and children. Open communication and a jointly developed plan are crucial for a smooth transition to financial independence.

Factors Influencing the Timing of Financial Independence

Several key factors influence the decision of when to stop providing financial assistance. The child's level of financial literacy and responsibility is paramount. Can they manage a budget, handle debt responsibly, and save for the future? Their career path also plays a significant role. High-paying professions may allow for earlier independence, while those requiring extended education or training might require longer-term parental support. Finally, unforeseen life events can impact the timeline. Unexpected illness, job loss, or family emergencies can necessitate ongoing parental assistance. A flexible approach that adapts to changing circumstances is often necessary.

- Financial Literacy and Responsibility: Assessing the child's ability to manage their finances independently is crucial. This includes budgeting, saving, and responsible debt management.

- Career Path and Earning Potential: A stable, high-paying job will naturally lead to quicker financial independence, whereas careers requiring extensive education or training may necessitate extended support.

- Unforeseen Circumstances: Unexpected events like illness, job loss, or major life changes can delay financial independence and require ongoing parental assistance.

Establishing a Plan for Gradual Financial Independence

Instead of abruptly cutting off financial support, a phased approach often yields better results. This involves setting clear expectations and milestones with the child. It might involve gradually reducing the amount of financial assistance over time, perhaps tied to the achievement of specific goals, like completing education or securing a stable job. This collaborative approach fosters responsibility and teaches the child valuable financial management skills. Regular open communication between parent and child ensures mutual understanding and prevents potential conflicts.

- Set Clear Expectations: Define specific goals and milestones that mark progress toward financial independence.

- Gradual Reduction of Support: Slowly decrease the amount of financial aid provided over a set timeframe.

- Open Communication: Maintain open dialogue to discuss progress, challenges, and adjust the plan as needed.

The Importance of Open Communication and Mutual Respect

Open and honest conversations between parents and children about financial expectations are essential. It's crucial to discuss the reasons behind the financial support, the planned timeline for its reduction, and the child's role in achieving financial independence. Mutual respect and understanding are paramount throughout this process. Parents should recognize the child's journey to self-sufficiency and avoid overly controlling behaviors. The child, in turn, needs to acknowledge their parents' contributions and strive for responsible financial management.

This content may interest you! How do you politely ask for a salary increase?

How do you politely ask for a salary increase?- Honest Discussions: Openly communicate financial expectations, timelines, and the reasons behind the support.

- Mutual Respect: Both parents and children should approach the process with respect for each other's perspectives and limitations.

- Shared Responsibility: Foster a sense of shared responsibility for the child's financial well-being and the transition to independence.

What's the best way to approach my parents about asking for a large sum of money?

Avoid ambushing them; choose a calm moment when they're relaxed and receptive. Clearly articulate why you need the money, presenting it as a responsible request, not a demand. Highlight the benefits – for example, if it's for a course, emphasize the career prospects. A well-structured, prepared approach shows maturity and increases your chances of success. Don't expect immediate approval; be prepared to discuss it further and answer their questions thoughtfully. Be respectful of their financial situation, and showing appreciation for any amount they're willing to contribute is crucial.

What if my parents say no the first time I ask?

Don't get discouraged. Consider their reasons for refusal. Maybe they need more convincing, or perhaps your request is too large. Politely ask for clarification on their concerns. If the reason is financial, perhaps you can propose a compromise, like a payment plan or contributing some of your own savings. Reiterate the benefits and show them how serious you are about using the money responsibly. Persistence and a willingness to negotiate can be very effective, demonstrating your maturity and commitment.

How can I prove to my parents I'll use the money responsibly?

Demonstrate your financial maturity. Present a detailed budget outlining exactly how the $500 will be spent. If it's for a purchase, research comparable options and justify your choice. If it's for an investment, show your research and explain the potential return. Offer a repayment plan if appropriate. Highlight any previous instances where you've handled money responsibly, like saving diligently or managing a part-time job effectively. Concrete evidence of your responsible behavior significantly enhances your credibility.

Should I offer to do extra chores or work to earn part of the money?

Offering to contribute in some way strengthens your case. It demonstrates your commitment and willingness to work towards your goal. This shows initiative and responsibility, appealing to your parents' sense of fairness. Even if they refuse your offer to work for a portion, the gesture itself speaks volumes about your character. Be specific about the extra chores or tasks you are willing to undertake and agree on a reasonable compensation or timeframe for completing them. This shows proactive problem-solving skills.

This content may interest you! What are proper words to ask for a raise?

What are proper words to ask for a raise?

Leave a Reply