How to pay off $5000 in debt in 1 year?

Drowning in $5000 of debt? Feeling overwhelmed and unsure where to start? This article provides a practical, step-by-step guide to conquering your debt within a year. We’ll explore effective strategies, including budgeting techniques, debt snowball and avalanche methods, and negotiating with creditors. Learn how to create a realistic repayment plan tailored to your specific financial situation, track your progress, and stay motivated throughout the journey to financial freedom. Get ready to reclaim your financial future and eliminate that $5000 debt once and for all.

Creating a Realistic Debt Payoff Plan for $5000 in One Year

Assess Your Current Financial Situation and Debt

Before you can even think about tackling your $5000 debt, you need a clear understanding of your current financial situation. This involves meticulously tracking all your income and expenses for at least a month. Use budgeting apps or spreadsheets to categorize your spending (housing, food, transportation, entertainment, etc.). Identify areas where you can cut back. Then, list all your debts, including the interest rates, minimum payments, and balances. This comprehensive overview allows you to create a realistic and effective plan, ensuring you’re not overly optimistic or setting yourself up for failure. Knowing exactly where your money goes and how much you owe is the crucial first step to successfully paying off $5000 in debt within a year.

Develop a Strategic Debt Repayment Strategy

With a clear picture of your finances, you can choose a debt repayment strategy. The most common are the debt snowball and the debt avalanche methods. The debt snowball prioritizes paying off the smallest debt first for motivational purposes, regardless of interest rate. The debt avalanche focuses on the debt with the highest interest rate first to save money on interest in the long run. Choose the method that best suits your personality and financial goals. Alongside this, explore options like balance transfers to lower interest rates or negotiating with creditors for lower monthly payments. Remember to meticulously track your progress and adjust your strategy as needed. Flexibility is key to successfully navigating the debt repayment journey.

Increase Your Income and Explore Additional Savings Opportunities

Paying off $5000 in a year requires a significant commitment, often necessitating both increased income and reduced expenses. Explore opportunities to boost your income – this could involve taking on a part-time job, selling unused possessions, freelancing, or asking for a raise. Simultaneously, look for ways to reduce your spending further beyond your initial budget cuts. Identify non-essential expenses that you can eliminate or significantly reduce, such as subscriptions, eating out, or entertainment. Consider using cash envelopes for budgeting and tracking expenses. The more you can increase your income and reduce your expenses, the faster you will achieve your debt-free goal.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Debt Snowball | Pay off smallest debts first, regardless of interest rate. | Motivational, quick wins build momentum. | May cost more in interest overall. |

| Debt Avalanche | Pay off highest interest rate debts first. | Saves money on interest in the long run. | Can be less motivating initially. |

| Balance Transfer | Transfer high-interest debt to a lower-interest card. | Reduces interest payments. | May involve fees and requires good credit. |

How fast can you pay off $5000 in debt?

How can I reduce my debt fast?

How can I reduce my debt fast?Paying Off $5000 in Debt

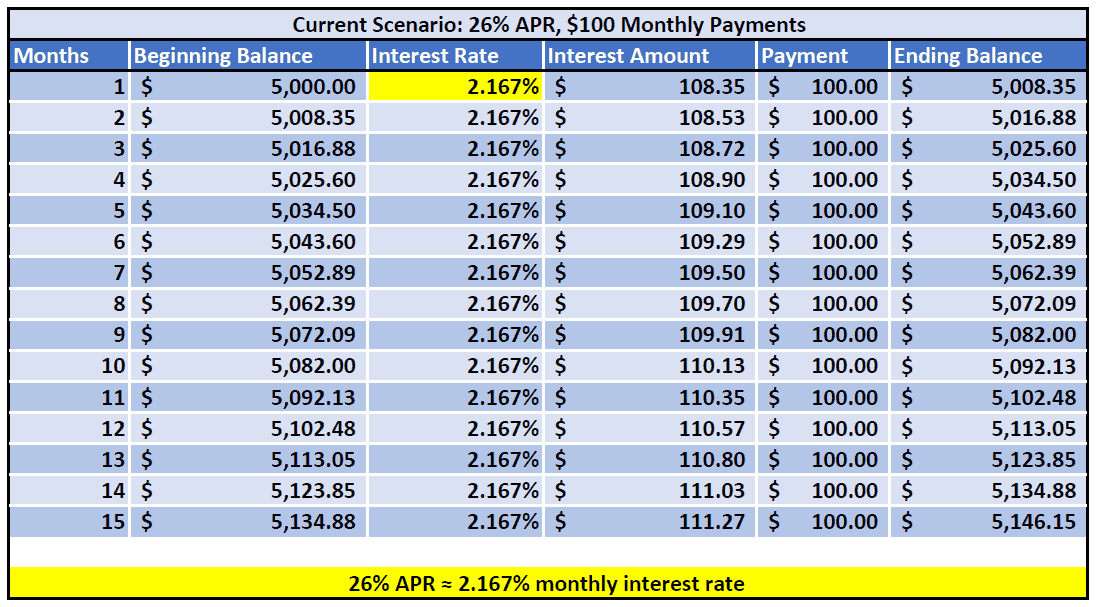

How fast you can pay off $5000 in debt depends entirely on your individual financial situation and the strategies you employ. There's no single answer. The speed of repayment hinges on factors like your available disposable income, interest rates on the debt, and your chosen repayment method. A high-income earner with a low-interest debt might pay it off within a few months, while someone with a lower income and high-interest debt might take years.

Factors Affecting Repayment Speed

Several factors influence how quickly you can eliminate $5000 in debt. Understanding these is crucial for developing a realistic repayment plan. A disciplined approach focusing on maximizing income and minimizing expenses is key.

- Income: Your monthly income directly dictates how much you can allocate towards debt repayment. Higher income allows for larger payments and faster payoff.

- Interest Rates: High-interest debts, such as credit cards, can significantly slow down repayment. Prioritizing high-interest debts is crucial to minimizing overall interest paid.

- Existing Expenses: Essential living costs such as housing, food, and transportation must be considered. Budgeting effectively to free up more money for debt repayment is vital.

Debt Repayment Strategies

Different strategies can accelerate debt repayment. Choosing the right approach depends on your debt types and financial goals. Some strategies are more aggressive than others.

- Debt Snowball Method: This involves paying off the smallest debt first, regardless of interest rate, for a psychological boost. Once the smallest debt is paid off, the funds are then allocated to the next smallest debt, and so on.

- Debt Avalanche Method: This focuses on paying off the debt with the highest interest rate first, regardless of the balance. This method minimizes total interest paid over the long run.

- Balance Transfers: Transferring high-interest debt to a lower-interest credit card or loan can significantly reduce interest costs and accelerate repayment. Be aware of any balance transfer fees.

Creating a Realistic Repayment Plan

A well-structured plan is essential for successful debt repayment. Consider your income, expenses, and debt characteristics when creating your plan. Regular monitoring and adjustments may be needed to stay on track.

This content may interest you! How to pay off $20k in debt fast?

How to pay off $20k in debt fast?- Budgeting: Track your income and expenses meticulously to identify areas where you can cut back and allocate more funds towards debt repayment.

- Prioritization: Decide which debt repayment strategy (snowball or avalanche) aligns best with your financial personality and goals.

- Regular Monitoring: Track your progress regularly, and adjust your plan as needed to account for unexpected expenses or changes in your income.

How to pay off a $5000 loan fast?

How to Pay Off a $5000 Loan Fast?

Create a Realistic Budget and Stick to It

Paying off debt quickly requires a disciplined approach to your finances. Start by creating a detailed budget that outlines all your income and expenses. Identify areas where you can cut back on spending to free up extra cash for loan repayment. This may involve reducing discretionary spending such as eating out, entertainment, or subscriptions. Tracking your spending meticulously will help you stay accountable and on track. Consider using budgeting apps or spreadsheets to monitor your progress.

- Track every expense, no matter how small.

- Identify non-essential expenses that can be reduced or eliminated.

- Automate savings and loan payments to ensure consistency.

Explore Debt Repayment Strategies

Several debt repayment methods can accelerate your progress. The avalanche method prioritizes paying off the loan with the highest interest rate first, minimizing the total interest paid over time. Alternatively, the snowball method focuses on paying off the smallest debt first, providing a sense of accomplishment and motivation to continue. Consider a combination of both, targeting the highest-interest debt while making minimum payments on others. Understanding your loan terms, including interest rates and fees, is crucial to choosing the most effective strategy.

- Calculate the total interest paid under different repayment strategies.

- Assess your personal motivation and choose a method that aligns with your goals.

- Regularly review and adjust your strategy as needed.

Increase Your Income

Supplementing your existing income can significantly accelerate loan repayment. Explore opportunities for additional income streams, such as a part-time job, freelance work, or selling unused items. Consider utilizing your skills and talents to generate extra cash. Even small increases in income can make a big difference when consistently applied towards your loan. Be realistic about the time commitment required for any additional income source and ensure it aligns with your overall financial goals.

- Identify skills and talents that can be monetized.

- Explore flexible work arrangements that fit your schedule.

- Negotiate a raise or promotion at your current job.

How to get out of 5k debt fast?

How do I clear my debts quickly?

How do I clear my debts quickly?How to Get Out of 5k Debt Fast

How to Get Out of 5k Debt Fast?

Getting out of $5,000 in debt quickly requires a multifaceted approach combining aggressive debt reduction strategies with careful budgeting and lifestyle adjustments. There's no one-size-fits-all solution, and the best approach depends on your individual circumstances, including the type of debt (credit cards, loans, etc.), interest rates, and your income. However, some key strategies consistently prove effective. Prioritizing high-interest debt is crucial to minimize long-term costs. Creating a realistic budget, identifying areas to cut expenses, and increasing income through additional work or side hustles are all vital components of a successful debt repayment plan. Remember to maintain discipline and track your progress regularly to stay motivated and on track.

Create a Realistic Budget and Track Your Spending

A detailed budget is the cornerstone of any successful debt repayment plan. You need to understand where your money is going before you can effectively redirect it towards debt reduction. Start by tracking your spending for at least a month to identify areas where you can cut back. This will give you a clear picture of your income and expenses, revealing any unnecessary spending habits. Once you have a clear view, create a budget that prioritizes debt repayment and ensures you're living within your means. This might involve making some tough choices, but it's essential for rapid debt reduction.

- Use budgeting apps or spreadsheets to track income and expenses.

- Categorize your spending (housing, food, transportation, entertainment, etc.) to identify areas for potential savings.

- Set realistic spending limits for each category and stick to them.

Aggressively Tackle High-Interest Debt

High-interest debt, like credit card debt, accumulates interest rapidly, making it more expensive in the long run. Prioritizing these debts is vital for minimizing the total amount you pay back. Consider strategies like the debt snowball method (paying off the smallest debt first for motivational purposes) or the debt avalanche method (paying off the highest-interest debt first for financial efficiency). Both methods can be effective, and the choice depends on your personal preference and financial situation. Remember to always make at least the minimum payments on all your debts to avoid late fees and further damage to your credit score.

- Identify all debts with their corresponding interest rates.

- Choose a debt repayment method (snowball or avalanche).

- Allocate extra funds towards the prioritized debt until it's paid off, then move to the next highest-interest debt.

Increase Your Income Through Additional Work or Side Hustles

While reducing expenses is crucial, increasing your income can significantly accelerate your debt repayment journey. Explore opportunities to earn extra money, such as a part-time job, freelance work, or a side hustle. The extra income can be directly applied towards your debt, significantly shortening the time it takes to become debt-free. Even small amounts of extra income can make a substantial difference over time, especially when consistently applied to your debt.

This content may interest you! How to pay $30,000 debt in one year?

How to pay $30,000 debt in one year?- Identify your skills and talents that can be monetized.

- Explore freelance platforms or gig economy apps for potential income streams.

- Consider a part-time job or side hustle that aligns with your schedule and interests.

Is $5000 dollars a lot of credit card debt?

Is $5000 in Credit Card Debt a Lot?

Whether $5,000 in credit card debt is a lot depends entirely on your individual financial circumstances. There's no single answer. It's relative to your income, expenses, and other debts. For someone with a high income and low expenses, it might be manageable. For someone with a low income and high expenses, it could be crippling.

Factors Influencing the Significance of $5000 in Credit Card Debt

Several factors determine if $5,000 in credit card debt is substantial. Your income is crucial: can you comfortably make minimum payments without impacting other essential expenses? The interest rate plays a significant role; a high interest rate accelerates debt growth, making repayment more difficult. Your existing debt obligations also matter; if you already carry substantial loans or other debts, adding $5,000 might strain your budget severely. Finally, your overall financial goals, such as saving for a house or retirement, will be affected by this debt burden.

- Income: A higher income provides more financial flexibility to manage the debt.

- Interest Rate: High interest rates drastically increase the total repayment cost.

- Other Debts: Pre-existing debts reduce your ability to handle additional financial burdens.

The Impact of $5000 Credit Card Debt on Your Credit Score

A $5,000 credit card debt can negatively impact your credit score. Credit utilization ratio (the percentage of available credit you're using) is a critical factor in credit scoring. A high utilization ratio, resulting from a large balance relative to your credit limit, lowers your score. This can affect your ability to obtain loans, rent an apartment, or even secure certain jobs. Late or missed payments, a common consequence of struggling with debt, further damage your credit score. Repaying the debt promptly and maintaining a low credit utilization ratio are essential for protecting your creditworthiness.

This content may interest you! What debt Cannot be erased?

What debt Cannot be erased?- Credit Utilization Ratio: A high utilization ratio (e.g., using a large portion of available credit) harms credit scores.

- Late Payments: Missed payments significantly decrease credit scores.

- Loan Applications: A lower credit score makes it harder to qualify for loans or other credit.

Strategies for Managing $5000 in Credit Card Debt

Several strategies can help manage $5,000 in credit card debt. Creating a realistic budget is fundamental: track expenses, identify areas for savings, and allocate funds towards debt repayment. Debt consolidation, combining multiple debts into a single loan with a potentially lower interest rate, can simplify repayment and potentially lower monthly payments. Negotiating with creditors for a lower interest rate or a payment plan might also alleviate financial pressure. Finally, seeking professional financial guidance from a credit counselor or debt management agency can provide personalized strategies and support for navigating your debt situation.

- Budgeting: Creating and sticking to a budget helps control spending and prioritize debt repayment.

- Debt Consolidation: Combining debts into a single loan with a lower interest rate can ease repayment.

- Negotiation: Contacting creditors to negotiate lower interest rates or payment plans.

What's the best way to pay off $5000 in debt in one year?

There's no single "best" way, as it depends on your individual financial situation. However, strategies like the debt snowball (paying off smallest debts first for motivation) or the debt avalanche (paying off highest-interest debts first for cost savings) are popular. Crucially, you need a detailed budget to identify areas for spending cuts, and explore options like increasing income through a side hustle or negotiating lower interest rates. Consistent, disciplined saving and repayment is paramount.

Can I realistically pay off $5000 in debt in a year?

Yes, it's absolutely achievable with dedication and a sound plan. Your success hinges on creating a realistic budget that allows for sufficient debt repayment while covering essential living expenses. This might involve significant lifestyle adjustments, such as cutting back on non-essential spending, but the reward of becoming debt-free within a year is significant. Seek professional financial advice if you're struggling to create a manageable plan.

What if I don't have enough disposable income to pay off $5000 in a year?

Explore ways to increase your income. A side hustle, freelance work, or even selling unused items can generate extra funds for debt repayment. Simultaneously, meticulously review your budget to identify areas for significant spending reductions. Consider consolidating your debt into a lower-interest loan to potentially lower your monthly payments, freeing up more disposable income. Don't be afraid to ask for help from family or friends, or consider seeking debt counseling services.

What are the potential consequences of failing to repay the debt?

Failure to repay your debt can lead to serious financial consequences, including damaged credit score, late payment fees, collection agency involvement, wage garnishment, and even legal action. These repercussions can severely impact your future financial opportunities, making it harder to obtain loans, rent an apartment, or even secure certain jobs. Proactive debt management is essential to avoid these potentially devastating outcomes. Seek help immediately if you anticipate difficulties meeting your repayment obligations.

This content may interest you! How do I recover from so much debt?

How do I recover from so much debt?

Leave a Reply