How do I get out of owing money?

Being in debt can feel overwhelming, but escaping it is possible with a strategic plan. This article provides a comprehensive guide to navigating your financial obligations and developing a path towards financial freedom. We'll explore various debt reduction strategies, from creating a realistic budget and identifying your highest-interest debts to negotiating with creditors and considering debt consolidation or management programs. Learn practical steps to regain control of your finances and finally become debt-free.

Tackling Debt: Strategies for Financial Freedom

Understanding Your Debt

The first step to getting out of debt is understanding the nature and extent of your financial obligations. Carefully review all your outstanding debts, including credit card balances, loans (personal, student, auto), medical bills, and any other outstanding payments. List each debt, its current balance, interest rate, and minimum payment. This will give you a clear picture of your overall debt situation and allow you to prioritize repayment strategies. Knowing exactly what you owe is crucial for developing an effective debt reduction plan, as it allows you to assess the total amount you need to repay and identify the debts that are causing the most financial strain. Ignoring the problem will only make it worse. Organize your debts by interest rate, the higher the interest the higher the priority.

Creating a Realistic Debt Repayment Plan

Once you understand your debt, you need to create a realistic and manageable repayment plan. Consider several methods: the debt snowball method (paying off the smallest debts first for motivation), the debt avalanche method (paying off the highest-interest debts first to save money on interest), or a combination of both. Regardless of your chosen method, creating a budget is essential. Track your income and expenses meticulously to identify areas where you can cut back. This might involve reducing discretionary spending, negotiating lower bills, or finding additional income streams. Consistency and discipline are key to sticking to your plan. Remember to factor in unexpected expenses and build an emergency fund to avoid accumulating more debt in the future. The plan should be realistic and attainable to maintain motivation and avoid burnout.

Seeking Professional Help

If you're struggling to manage your debt on your own, don't hesitate to seek professional help. Credit counseling agencies can provide guidance on creating a debt management plan and negotiating with creditors. They can also help you understand your rights and options under the law. In some cases, debt consolidation might be a viable option, combining multiple debts into a single loan with a potentially lower interest rate. Bankruptcy should be considered as a last resort, but it's an option for those facing insurmountable debt. It's important to understand the implications of bankruptcy before pursuing this path. Consulting with a financial advisor or a bankruptcy attorney can provide valuable insights and support in navigating these complex financial situations.

| Debt Management Strategy | Description | Pros | Cons |

|---|---|---|---|

| Debt Snowball | Pay off smallest debts first for motivation. | Builds momentum and provides psychological benefits. | May cost more in interest overall. |

| Debt Avalanche | Pay off highest-interest debts first to minimize interest charges. | Saves money on interest in the long run. | Can be demotivating initially if largest debts are large. |

| Debt Consolidation | Combine multiple debts into one loan. | Simplifies payments and potentially lowers interest rate. | Requires good credit and careful consideration of terms. |

Is there really a debt forgiveness program?

:max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg)

How do I clear my bank debt?

How do I clear my bank debt?Debt Forgiveness Programs

The existence of debt forgiveness programs depends heavily on the type of debt and the specific circumstances. There isn't one single, overarching program that wipes away all debt for everyone. Instead, various programs exist targeting specific types of debt, often with eligibility requirements and limitations. These programs are usually government-sponsored or offered by specific lenders. Some programs might offer partial forgiveness, while others may provide complete debt relief, but only under very specific conditions. It's crucial to understand that claiming a debt forgiveness program exists without specifying the debt type is misleading.

Types of Debt Forgiveness Programs

Several government and private programs offer debt forgiveness, but they cater to different types of debt. For instance, federal student loan forgiveness programs exist, but their eligibility often hinges on factors like income, employment type, and the type of loan. Similarly, certain debt relief programs target individuals facing specific financial hardships, such as those affected by natural disasters. These programs usually have strict income limits and application processes. It's imperative to research the specific program to understand its eligibility criteria.

- Federal Student Loan Forgiveness: These programs typically require borrowers to meet specific income and employment criteria (e.g., working in public service). Some may require a certain number of years of qualifying payments.

- Debt Relief for Victims of Natural Disasters: Following declared natural disasters, some government programs may offer debt forgiveness or relief to affected individuals. Eligibility varies depending on the specific event and location.

- Medical Debt Forgiveness: Some non-profit organizations and hospitals may offer programs to forgive medical debt under specific circumstances, such as financial hardship. The requirements are often strict.

Eligibility Requirements and Limitations

Eligibility criteria for debt forgiveness programs vary significantly. They often involve strict income limits, specific types of debt, and proof of hardship. Meeting these criteria can be challenging, requiring extensive documentation and careful attention to detail. Furthermore, programs often have limitations on the amount of debt forgiven, and they might not cover all types of debt incurred. In some cases, even if approved, there might be tax implications associated with the forgiven debt.

- Income Restrictions: Many programs limit eligibility to individuals or households below a certain income threshold.

- Debt Type Restrictions: Programs may only cover specific types of debt, such as student loans or mortgages, excluding credit card debt or personal loans.

- Documentation Requirements: Applicants usually need to provide substantial documentation to prove their eligibility, often including income statements, tax returns, and other financial records.

Scams and Misleading Information

Unfortunately, the prevalence of debt forgiveness programs has also led to an increase in scams targeting vulnerable individuals. Many fraudulent companies promise quick and easy debt relief, often charging high upfront fees for services that they never deliver. Legitimate debt forgiveness programs are rarely associated with significant upfront costs. It is crucial to carefully research any debt forgiveness opportunity before committing to it, verifying the legitimacy of the organization and understanding the terms and conditions clearly. Always be wary of companies promising guaranteed debt relief without proper documentation or verification.

This content may interest you! Is $20,000 a lot of debt?

Is $20,000 a lot of debt?- High Upfront Fees: Legitimate programs rarely require large upfront payments.

- Guaranteed Results: Be wary of promises of guaranteed debt forgiveness without clear conditions.

- Lack of Transparency: A reputable program will be transparent about its terms, conditions, and fees.

What happens if you owe money and can't pay?

What Happens if You Owe Money and Can't Pay?

What Happens if You Owe Money and Can't Pay?

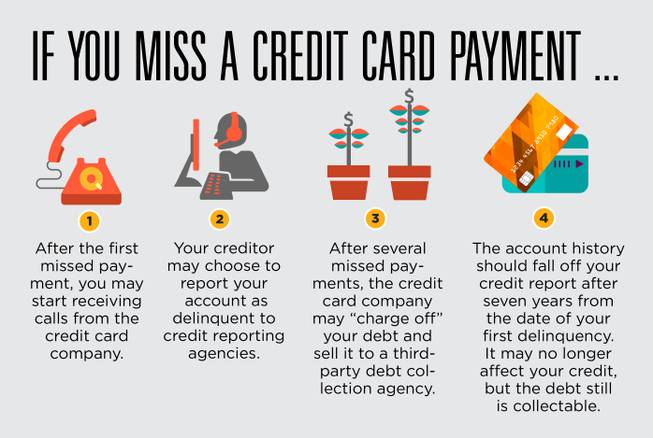

When you owe money and cannot pay, several things can happen, depending on the type of debt, the amount owed, and the creditor. The consequences can range from minor inconveniences to severe legal actions. Initially, you'll likely receive numerous communications from the creditor, including phone calls, letters, and emails, demanding payment. These communications will become increasingly insistent over time. If you ignore these attempts to collect the debt, the creditor may take further action, such as employing a collection agency or initiating legal proceedings. Legal action could involve wage garnishment, bank levy, or even the seizure of assets to satisfy the debt. The specific actions taken will depend on the laws of your jurisdiction and the terms of the original agreement. Credit bureaus will also be notified of your missed payments, negatively impacting your credit score, making it difficult to obtain loans or credit in the future. The best course of action is to contact the creditor immediately and attempt to negotiate a payment plan or other resolution, even if you can only afford small payments.

What Legal Actions Can Creditors Take?

Creditors have various legal avenues to pursue when a debtor fails to pay. These actions can significantly impact your financial life and personal well-being. The severity of the actions taken often depends on the size of the debt and the creditor's willingness to negotiate. Some creditors may be more lenient and willing to work with you, while others might pursue aggressive collection tactics. It's crucial to understand your rights and responsibilities as a debtor to protect yourself from unfair or illegal practices.

- Wage Garnishment: A court order directing your employer to withhold a portion of your wages to pay off the debt.

- Bank Levy: The creditor seizing funds directly from your bank account to satisfy the debt.

- Asset Seizure: In severe cases, the creditor can seize and sell your assets, such as a car or house, to recover the debt.

How Does This Affect Your Credit Score?

Failing to pay your debts has a severe negative impact on your credit score. This score is a crucial factor in determining your creditworthiness, influencing your ability to obtain loans, rent an apartment, or even get a job in some fields. Late payments, defaults, and collections are all reported to credit bureaus and remain on your credit report for several years, hindering your financial prospects. The longer the debt remains unpaid, the more severely your credit score will be affected. Rebuilding your credit after such damage can be a lengthy and challenging process, requiring careful financial management and responsible debt repayment.

This content may interest you! What to do if you are in massive debt?

What to do if you are in massive debt?- Lower Credit Score: Missed payments lead to a significant drop in your credit score.

- Difficulty Obtaining Credit: Lenders may be hesitant to offer loans or credit cards with favorable terms.

- Higher Interest Rates: You may be charged higher interest rates on future loans to compensate for the increased risk.

What Options Are Available to Debtors?

If you find yourself unable to pay your debts, several options can help mitigate the negative consequences. It's essential to act proactively and explore these possibilities as soon as you realize you're facing financial difficulty. Ignoring the problem only worsens the situation and limits your options. Seeking professional guidance from a credit counselor or debt management specialist can also provide valuable support and strategies for navigating this challenging situation. Open communication with your creditors is also crucial, as many are willing to work with debtors who demonstrate a genuine effort to resolve the issue.

- Debt Consolidation: Combining multiple debts into a single loan with potentially lower interest rates.

- Debt Management Plan: Working with a credit counselor to create a manageable repayment plan with creditors.

- Negotiating with Creditors: Attempting to reach an agreement with creditors for reduced payments or a settlement.

How can I get out of debt asap?

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Getting Out of Debt ASAP

How Can I Get Out of Debt ASAP?

Create a Realistic Budget

The foundation of escaping debt lies in understanding where your money goes. A detailed budget illuminates your spending habits, revealing areas for potential savings. This isn't about deprivation; it's about making conscious choices. By tracking every expense – from groceries to entertainment – you gain control over your finances. Once you see the clear picture, you can identify non-essential spending that can be redirected towards debt repayment.

- Use budgeting apps or spreadsheets to meticulously track income and expenses.

- Categorize expenses (housing, transportation, food, entertainment, etc.) to pinpoint spending patterns.

- Identify areas where you can reduce spending without significantly impacting your quality of life.

Prioritize and Strategize Debt Repayment

There are various debt repayment strategies, and the best one depends on your specific circumstances. The avalanche method prioritizes paying off high-interest debts first, minimizing the total interest paid. Conversely, the snowball method targets the smallest debts first for a quicker sense of accomplishment, which can be psychologically motivating. Regardless of the chosen method, consistent, focused repayment is key. Consider consolidating high-interest debts into a lower-interest loan to simplify payments and potentially save money on interest.

This content may interest you! What to do when you are heavily in debt?

What to do when you are heavily in debt?- List all your debts, including balances, interest rates, and minimum payments.

- Choose a debt repayment strategy (avalanche or snowball method).

- Allocate as much extra money as possible towards debt repayment, while maintaining a realistic budget.

Seek Professional Financial Advice

Navigating debt can be overwhelming, and seeking professional help can significantly improve your chances of success. A certified financial planner (CFP) can provide personalized guidance, helping you create a tailored debt repayment plan, explore options like debt consolidation or management programs, and address any underlying financial issues contributing to your debt. Credit counseling agencies can also offer valuable resources and support, including negotiation with creditors to reduce interest rates or monthly payments.

- Research and choose a reputable financial advisor or credit counseling agency.

- Schedule a consultation to discuss your financial situation and explore available options.

- Follow their advice diligently and communicate openly about any challenges or changes in your circumstances.

How do I pay off debt if I live paycheck to paycheck?

Paying Off Debt While Living Paycheck to Paycheck

Paying off debt while living paycheck to paycheck is challenging, but achievable with careful planning and discipline. It requires a multi-pronged approach focusing on increasing income, decreasing expenses, and strategically managing debt repayment. The first step is creating a realistic budget that tracks all income and expenses. This allows you to identify areas where you can cut back and prioritize debt repayment. Consider using budgeting apps or spreadsheets to simplify this process. Next, develop a debt repayment plan. The most common strategies are the debt snowball (paying off the smallest debt first for motivation) and the debt avalanche (paying off the highest-interest debt first to save money). Finally, explore options to increase your income, such as taking on a side hustle, negotiating a raise, or selling unused items. Remember, consistency and perseverance are key. Small changes over time can significantly impact your debt situation.

Creating a Realistic Budget

A realistic budget is the foundation of any successful debt repayment plan. It involves honestly assessing your income and expenses, identifying areas where you can reduce spending, and allocating funds specifically for debt payments. It's essential to be thorough and track every expense, no matter how small. This might require using budgeting apps or spreadsheets to monitor your spending habits. Regularly reviewing and adjusting your budget is important as circumstances change. Remember, the goal is to create a surplus, even if it's small, to allocate towards debt repayment.

This content may interest you! How do I recover from so much debt?

How do I recover from so much debt?- Track all income and expenses for at least one month to understand your spending patterns.

- Categorize your expenses (housing, food, transportation, entertainment, etc.) to pinpoint areas for potential reductions.

- Allocate a specific amount each month for debt repayment, even if it's a small amount initially. This demonstrates commitment and builds momentum.

Developing a Debt Repayment Strategy

Once you have a clear picture of your finances, choose a debt repayment strategy that suits your personality and financial situation. Two popular methods are the debt snowball and the debt avalanche. The debt snowball involves focusing on paying off the smallest debt first, regardless of interest rates, to build momentum and motivation. The debt avalanche prioritizes paying off the debt with the highest interest rate first, which saves money in the long run. Either method requires discipline and commitment to stick to the repayment plan. Consider consulting a financial advisor to determine the best strategy for your specific circumstances.

- List all your debts, including the balance, interest rate, and minimum payment.

- Choose either the debt snowball or debt avalanche method, depending on your preference and financial goals.

- Make extra payments whenever possible, focusing your extra funds on the prioritized debt. Even small extra payments can significantly reduce the time it takes to pay off your debt.

Increasing Income and Exploring Additional Resources

While cutting expenses is crucial, increasing your income can significantly accelerate debt repayment. Explore various options to boost your income, such as taking on a part-time job, freelance work, or selling unused possessions. Negotiating a raise at your current job is another possibility. Additionally, consider seeking assistance from credit counseling agencies or non-profit organizations that provide financial guidance and support. These organizations can help you create a personalized debt management plan and negotiate with creditors.

- Identify potential sources of additional income, such as side hustles, freelance work, or selling unwanted items.

- Explore opportunities to negotiate a raise at your current job or seek employment with a higher salary.

- Research and consider credit counseling agencies or non-profit organizations that offer debt management services and financial guidance.

How can I negotiate with my creditors to reduce my debt?

Negotiating with creditors can significantly reduce your debt. Start by contacting each creditor individually and explaining your financial situation honestly. Be prepared to propose a written repayment plan offering a lower monthly payment or a lump-sum payment if feasible. Demonstrate your commitment by providing details of your income and expenses. Be polite and persistent; many creditors are willing to work with struggling borrowers to avoid default. Consider seeking professional debt negotiation services if you're struggling to navigate the process alone.

What are my options if I can't afford my debt payments?

Several options exist if you're unable to meet your debt obligations. Debt consolidation combines multiple debts into a single, lower-interest loan, simplifying payments. Debt management plans (DMPs) involve a credit counseling agency negotiating lower interest rates and payments with your creditors. Bankruptcy, a legal process, can discharge certain debts but has significant long-term financial consequences. Careful consideration of your individual circumstances and long-term financial goals is crucial when choosing the most suitable option. Consult a financial advisor or credit counselor for personalized guidance.

Can I use a debt consolidation loan to get out of owing money?

Debt consolidation loans can be a helpful tool, but they aren't a guaranteed solution for eliminating debt. They combine multiple debts into a single loan with potentially lower interest rates, making payments more manageable. However, the total amount owed remains the same, and you'll still need to repay the entire loan. To successfully use a debt consolidation loan, you need to commit to a disciplined repayment schedule and avoid accumulating new debt. It's essential to carefully compare interest rates and fees before choosing a consolidation loan.

This content may interest you! How to pay $30,000 debt in one year?

How to pay $30,000 debt in one year?What legal protections are available to those struggling with debt?

Several legal protections exist for individuals facing financial hardship. The Fair Debt Collection Practices Act (FDCPA) limits how debt collectors can contact and treat you. Bankruptcy laws provide a legal framework for managing and potentially discharging unmanageable debts. State laws may offer additional protections, such as exemptions for certain assets. It's crucial to understand your rights and explore all available legal options before making any decisions. Consulting with a legal professional specializing in debt relief can provide invaluable guidance and ensure you're protected throughout the process.

Leave a Reply