How to create a debt repayment plan that works?

Are you drowning in debt and feeling overwhelmed? Creating a successful debt repayment plan can feel daunting, but it's achievable with the right strategy. This article provides a step-by-step guide to help you conquer your debt and regain financial control. We'll cover essential steps like calculating your total debt, prioritizing payments, budgeting effectively, and exploring debt consolidation options. Learn how to build a realistic and sustainable plan tailored to your specific financial situation, empowering you to become debt-free and build a brighter financial future.

Crafting a Successful Debt Repayment Plan

1. Assess Your Current Financial Situation

Before you can create a plan, you need a clear understanding of your financial landscape. This involves meticulously listing all your debts, including credit cards, loans, and any other outstanding balances. For each debt, note the balance, interest rate, minimum payment, and due date. Next, calculate your monthly income and expenses. Be honest and thorough; include everything from rent and groceries to subscriptions and entertainment. The difference between your income and expenses is your disposable income – this is the money you can allocate towards debt repayment. Finally, prioritize your debts. Consider using methods like the debt snowball or avalanche methods (explained later) to strategically target your debt reduction.

2. Choose a Debt Repayment Strategy

Several strategies can help you tackle your debt effectively. The debt avalanche method prioritizes paying off debts with the highest interest rates first, saving you money on interest in the long run. The debt snowball method focuses on paying off the smallest debt first, regardless of interest rate, for a psychological boost of early wins and momentum. Another strategy is the balance transfer method, which involves transferring high-interest debt to a lower-interest credit card or loan. Carefully review the terms and fees associated with balance transfers. Select the method that best aligns with your personality and financial goals. Remember, consistency is key, regardless of the chosen strategy; sticking to your plan is crucial for success.

3. Budgeting and Sticking to Your Plan

Once you have a repayment strategy, create a detailed budget that incorporates your debt payments. This budget should allocate funds for necessities, debt repayment, and a small amount for savings (even a small amount is beneficial). To stay on track, track your spending meticulously. Use budgeting apps, spreadsheets, or even a notebook to monitor your progress. Regularly review your budget and adjust it as needed. Life throws curveballs; be prepared to adapt your plan if unforeseen circumstances arise. Celebrate your milestones along the way to maintain motivation and a positive outlook. Consider automating your payments to ensure consistency and avoid late fees.

This content may interest you! What is the snowball vs. avalanche method for paying off debt?

What is the snowball vs. avalanche method for paying off debt?| Debt | Balance | Interest Rate | Minimum Payment | Payment Strategy |

|---|---|---|---|---|

| Credit Card A | $5,000 | 18% | $100 | Avalanche Method - Higher Payment |

| Student Loan | $20,000 | 6% | $200 | Avalanche Method - Higher Payment |

| Credit Card B | $1,000 | 24% | $50 | Snowball Method - Prioritized |

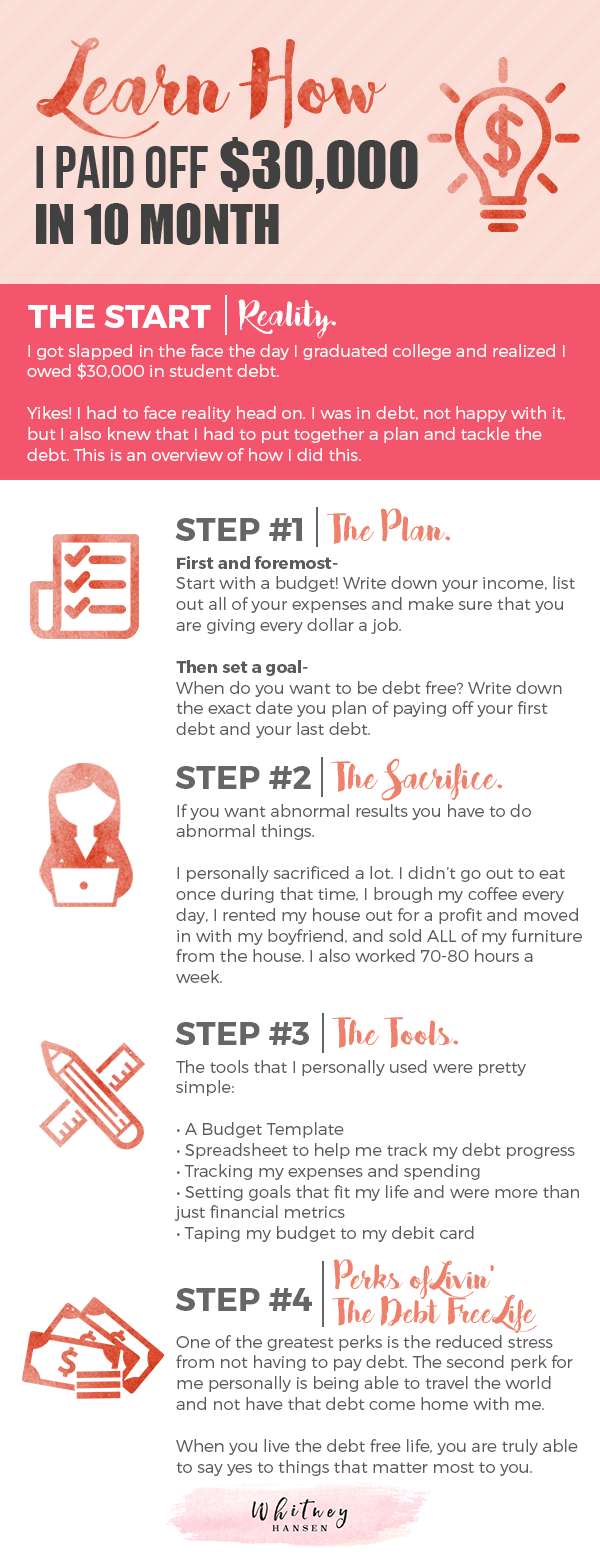

How to pay off $30,000 in debt in 1 year?

Paying off $30,000 in debt within a year is a significant undertaking requiring dedication and a strategic approach. It's highly unlikely to be achievable without substantial income and significant lifestyle changes. This plan outlines possible steps, but success depends entirely on individual circumstances and financial discipline.

Create a Detailed Budget

To effectively tackle this debt, you need a crystal-clear picture of your income and expenses. This isn't about simply tracking spending; it's about meticulously categorizing every dollar. Identify areas where you can drastically cut back to free up funds for debt repayment. This detailed analysis will reveal where your money goes and highlight areas ripe for reduction. Without a budget, paying off this much debt in such a short timeframe is nearly impossible.

- Track every expense: Use budgeting apps, spreadsheets, or even a notebook to record each transaction.

- Categorize expenses: Group expenses into necessities (housing, food, utilities), wants (entertainment, dining out), and debt payments.

- Identify areas for cuts: Analyze your spending to identify non-essential expenses that can be eliminated or reduced. This might involve cutting cable, reducing dining out, or finding cheaper alternatives for entertainment.

Explore Debt Consolidation and Refinancing Options

Consolidating high-interest debts into a lower-interest loan can significantly reduce your monthly payments, freeing up more money to allocate towards principal. Refinancing can also extend the repayment period, lowering monthly payments, although this strategy stretches the repayment timeline beyond your one-year goal. It’s crucial to weigh the pros and cons of both options carefully; extending the repayment period might seem easier monthly but will cost more in interest in the long run. Always compare interest rates and fees before making a decision.

This content may interest you! How to consolidate debt and lower interest rates?

How to consolidate debt and lower interest rates?- Research balance transfer cards: Look for cards offering 0% introductory APR periods to consolidate high-interest debts, enabling you to focus on paying down the principal during that period.

- Explore personal loans: Compare interest rates from various lenders for personal loans to consolidate your debt into a single monthly payment with a potentially lower interest rate.

- Consult a financial advisor: Seek professional guidance to assess your financial situation and determine the most suitable consolidation or refinancing strategy based on your specific circumstances.

Maximize Income and Seek Additional Funds

Aggressive debt repayment requires a multi-pronged approach. Beyond cutting expenses, explore ways to increase your income. This could involve taking on a part-time job, freelancing, selling unused assets, or even leveraging skills to generate additional income streams. Every extra dollar earned can be directly applied to your debt, accelerating the repayment process. Consider temporary sacrifices for long-term gains.

- Seek a higher-paying job: Explore job opportunities offering a higher salary or better benefits.

- Take on a side hustle: Freelancing, driving for a ride-sharing service, or selling goods online are some options for generating additional income.

- Sell unused assets: Consider selling items you no longer need to generate extra cash for debt repayment.

Which debt repayment strategy would be best?

:max_bytes(150000):strip_icc()/debt-avalanche-vs-debt-snowball-which-best-you.asp_v1-b62b7fef4c6949aa96550aa2c33b391e.png)

Debt Repayment Strategies

The best debt repayment strategy depends heavily on your individual circumstances, including the types of debt you have, the interest rates, and your overall financial situation. There's no one-size-fits-all answer. However, several popular strategies offer different approaches to tackling debt.

This content may interest you! Can I negotiate my debt to pay less?

Can I negotiate my debt to pay less?Debt Snowball Method

The debt snowball method focuses on paying off your smallest debts first, regardless of interest rate. This method provides psychological momentum by quickly generating a sense of accomplishment. Once the smallest debt is paid, you roll the payment amount into the next smallest debt, creating a snowball effect. While it might not be the most mathematically efficient, it can be highly motivating for individuals who need a quick win to stay committed to their repayment plan.

- List your debts from smallest to largest balance, regardless of interest rate.

- Make minimum payments on all debts except the smallest one.

- Throw all extra money at the smallest debt until it's paid off. Then, roll that payment amount into the next smallest debt, and repeat the process.

Debt Avalanche Method

The debt avalanche method prioritizes paying off debts with the highest interest rates first. This strategy is mathematically superior as it minimizes the total interest paid over the life of the loans. While it may take longer to see initial progress compared to the snowball method, the long-term savings in interest can be substantial. This method is particularly beneficial for high-interest debts like credit card debt.

- List your debts from highest to lowest interest rate, regardless of balance.

- Make minimum payments on all debts except the one with the highest interest rate.

- Allocate as much extra money as possible to the highest-interest debt until it is paid off. Then, move on to the next highest-interest debt, and repeat.

Balance Transfer Method

The balance transfer method involves moving high-interest debt to a new credit card or loan with a lower interest rate. This can significantly reduce the amount of interest you pay over time. However, it's important to be aware of balance transfer fees and ensure you can pay off the debt before the introductory low-interest period expires. Carefully compare offers from different lenders and read the terms and conditions before making a decision.

- Research credit cards or loans offering low or 0% introductory APRs.

- Check for balance transfer fees and any other associated charges.

- Transfer your high-interest debt to the new account and develop a repayment plan to pay it off before the introductory period ends to avoid paying high interest.

How to pay off $5000 in debt in 6 months?

What are the best side hustles to pay off debt faster?

What are the best side hustles to pay off debt faster?Paying Off $5000 in 6 Months

How to Pay Off $5000 in Debt in 6 Months?

Create a Realistic Budget

Paying off $5000 in six months requires a significant change in spending habits. The first step is to create a detailed budget that tracks all income and expenses. This will help you identify areas where you can cut back and free up funds for debt repayment. Be brutally honest with yourself – every latte, subscription service, and impulse purchase adds up. Once you have a clear picture of your financial situation, you can develop a plan to allocate extra money towards your debt.

- Track every expense for at least a month to get an accurate picture of your spending.

- Categorize your expenses (housing, food, transportation, entertainment, etc.) to see where your money goes.

- Identify areas where you can reduce spending, such as eating out less, canceling unnecessary subscriptions, or finding cheaper alternatives for utilities.

Develop a Debt Repayment Strategy

With a realistic budget in place, you can choose a debt repayment method. The most common are the debt snowball and debt avalanche methods. The debt snowball method focuses on paying off the smallest debt first for psychological motivation, while the debt avalanche method targets the debt with the highest interest rate first to save money on interest in the long run. Consider which method best suits your personality and financial goals. No matter which you choose, consistency is key.

- List all your debts, including the balance and interest rate (if applicable).

- Choose either the debt snowball or debt avalanche method.

- Allocate as much extra money as possible towards your debt repayment each month, aiming for consistent payments over the six-month period.

Explore Additional Income Streams

Paying off $5000 in six months requires significant financial discipline. In addition to cutting expenses, you might need to increase your income. Explore various options to supplement your existing income. This could involve taking on a part-time job, selling unused items, freelancing, or utilizing your skills to earn extra cash. The more money you can generate, the faster you can eliminate your debt.

This content may interest you! How to stay debt-free after paying off what you owe?

How to stay debt-free after paying off what you owe?- Identify skills or hobbies you can monetize (e.g., tutoring, crafting, writing).

- Look for part-time jobs or freelance opportunities online.

- Sell unwanted possessions through online marketplaces or consignment shops.

Can I do a debt management plan myself?

Can I Do a Debt Management Plan Myself?

Yes, you can create and implement a debt management plan yourself. However, it requires significant discipline, organization, and financial literacy. Successfully managing debt independently hinges on your ability to meticulously track expenses, prioritize payments, and stick to a strict budget. While possible, it's often more challenging than seeking professional assistance, as a professional can offer unbiased guidance and leverage their experience in negotiating with creditors.

Understanding Your Debt

Before crafting any plan, you need a comprehensive understanding of your debt. This involves gathering all relevant statements to identify the total amount owed, interest rates, minimum payments, and due dates for each debt. Categorizing your debts (credit cards, loans, etc.) can help prioritize which ones to tackle first. A clear picture of your financial landscape is crucial for effective debt management.

This content may interest you! How to pay off $50,000 in debt in 1 year?

How to pay off $50,000 in debt in 1 year?- List all your debts, including the creditor, balance, interest rate, and minimum payment.

- Categorize your debts (e.g., credit cards, student loans, medical bills).

- Calculate your total debt and monthly minimum payments.

Creating a Realistic Budget

A realistic budget is the cornerstone of any successful debt management plan. You need to track your income and expenses meticulously to identify areas where you can cut back. This might involve reducing non-essential spending, finding cheaper alternatives for necessities, or increasing your income through a side hustle. Your budget should allocate sufficient funds for debt payments while ensuring you cover essential living expenses. A surplus is ideal for accelerating debt repayment.

- Track your income and expenses for at least one month to establish a baseline.

- Identify areas where you can reduce spending without significantly impacting your quality of life.

- Allocate a specific amount each month towards debt repayment, prioritizing higher-interest debts.

Strategies for Debt Repayment

Several strategies can be employed to repay debt effectively. The avalanche method prioritizes paying off high-interest debts first to minimize overall interest paid, while the snowball method focuses on paying off the smallest debts first for psychological motivation. You can also consider contacting creditors to negotiate lower interest rates or extended payment plans. Remember to regularly review and adjust your plan as needed based on your financial circumstances.

- Consider the avalanche method (highest interest first) or snowball method (smallest debt first).

- Explore negotiating lower interest rates or extended payment terms with your creditors.

- Regularly review your progress and adjust your plan as needed.

What's the first step in creating a debt repayment plan?

The first step is to honestly assess your financial situation. List all your debts, including credit cards, loans, and other obligations. Note down the balances, interest rates, minimum payments, and due dates for each. Then, calculate your total monthly income and expenses. This clear picture of your income and outgoings is crucial for determining how much you can realistically allocate towards debt repayment each month. Don't forget to include all expenses, even seemingly small ones. Accurate figures will help you create a realistic and achievable plan.

Which debt repayment method is best for me?

The best method depends on your individual circumstances. The avalanche method prioritizes paying off the debt with the highest interest rate first, minimizing overall interest paid. The snowball method focuses on paying off the smallest debt first for motivational purposes, building momentum and confidence. Consider your personality and financial goals. If you're motivated by quick wins, the snowball method might suit you. If minimizing interest is your priority, the avalanche method is usually better. Consult a financial advisor if you're unsure which method suits you best.

This content may interest you! What is the 30 day rule?

What is the 30 day rule?How can I stick to my debt repayment plan?

Sticking to your plan requires discipline and commitment. Automate your payments whenever possible to ensure consistent repayments. Track your progress regularly using spreadsheets or budgeting apps to monitor your progress and stay motivated. Consider creating a visual representation of your debt reduction, like a chart tracking your progress. Celebrate milestones to maintain motivation. If you face unexpected expenses, adjust your budget immediately and revisit your repayment plan to ensure it remains realistic and achievable.

What if I can't afford my minimum payments?

If you can't afford minimum payments, contact your creditors immediately. Explain your situation honestly and explore options such as hardship programs, payment plans, or debt consolidation. Consider seeking professional help from a credit counselor or financial advisor. They can offer guidance and negotiate with your creditors on your behalf. Don't ignore the problem; proactive communication is vital in preventing further damage to your credit score and managing your debt effectively.

Leave a Reply