What happens if I don’t pay my taxes?

Failing to pay your taxes can lead to a cascade of serious consequences. From penalties and interest accumulating on your unpaid balance to wage garnishment and the seizure of assets, the IRS takes non-payment seriously. This article will explore the potential ramifications of tax evasion, detailing the various actions the government can take, the legal repercussions involved, and steps you can take to rectify an unpaid tax bill, even if you're facing financial hardship. Understanding these consequences is crucial for responsible financial management.

What are the Consequences of Tax Evasion?

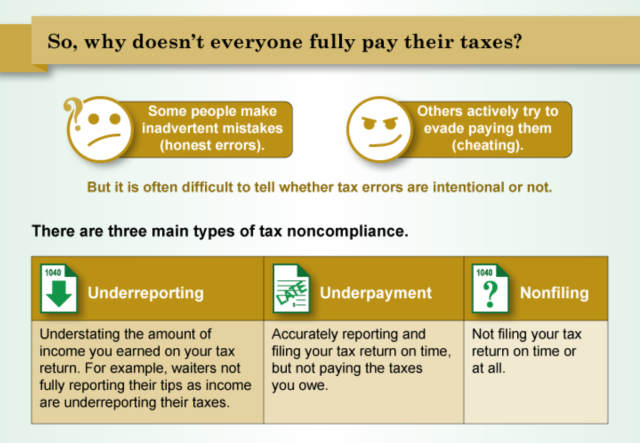

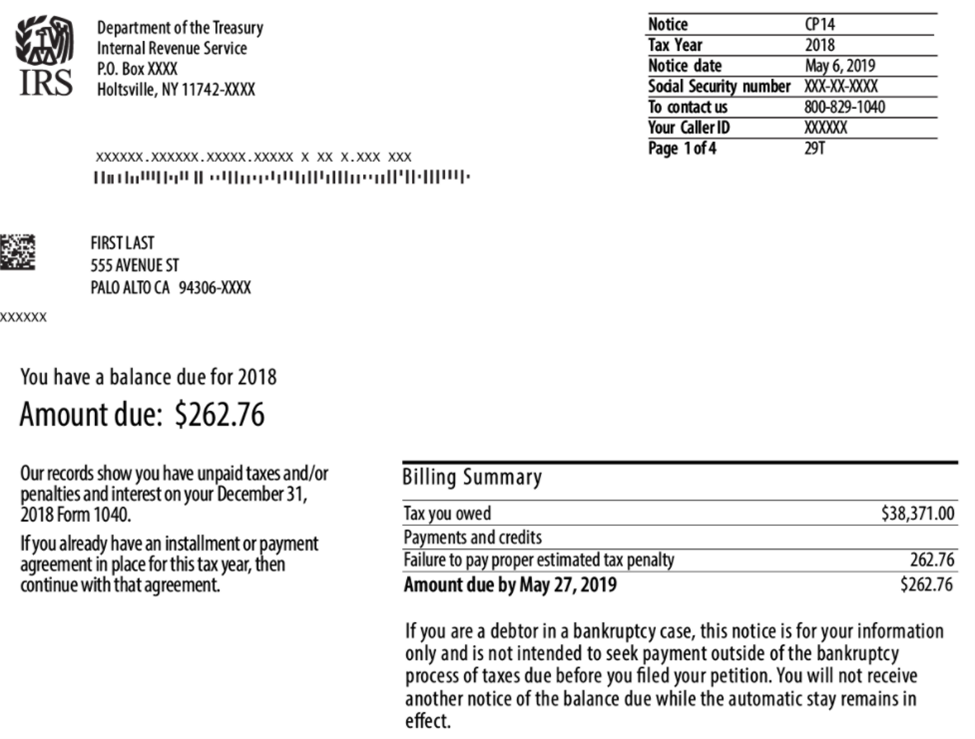

Failing to pay your taxes can lead to a range of serious consequences, impacting your financial stability and potentially your freedom. The severity of the repercussions depends on factors such as the amount of unpaid tax, the duration of non-payment, and whether the non-payment was intentional (tax evasion) or due to unintentional oversight. Penalties and interest will quickly accrue, significantly increasing the amount you owe. Beyond financial penalties, the IRS (or your equivalent tax authority) can take aggressive collection actions, including wage garnishment, bank levies, and even asset seizure. In extreme cases, criminal prosecution can result in hefty fines, imprisonment, and a severely damaged credit rating, making it extremely difficult to secure loans, rent an apartment, or even obtain employment in the future. It's crucial to understand that the IRS has considerable power and resources to pursue delinquent taxpayers.

What are the Penalties for Unpaid Taxes?

The penalties for unpaid taxes are substantial and can quickly escalate. You'll face interest charges on the unpaid amount, calculated daily, effectively compounding the debt. Beyond interest, the IRS imposes failure-to-pay penalties, typically a percentage of the unpaid tax. Additional penalties might apply for failure to file a tax return on time. The penalties themselves are not static; they can increase depending on the length of time the taxes remain unpaid. It is important to note that these penalties can accumulate rapidly, turning a relatively small initial tax debt into a significant financial burden.

How Does the IRS Collect Unpaid Taxes?

The IRS employs a variety of methods to collect unpaid taxes, starting with notices and demands for payment. If you fail to respond or make arrangements to pay, they can escalate their actions. This might include levying your bank accounts to seize funds, garnish your wages directly from your employer, or even place a lien on your property, impacting your ability to sell or refinance. In more serious cases, the IRS can seize and sell assets such as vehicles or personal property to cover the tax debt. They can also take steps to file a tax lien against your assets, harming your creditworthiness and making it harder to obtain loans or credit cards in the future. Ultimately, consistent non-payment could lead to legal action and criminal charges.

What Happens if I Can't Afford to Pay My Taxes?

If you're facing financial hardship and can't afford to pay your taxes, it’s crucial to contact the IRS immediately. Don't ignore the problem; proactive communication is key. The IRS offers various payment options, including payment plans that allow you to pay off your debt in installments over time. They may also offer offers in compromise (OICs) in certain situations, potentially reducing the total amount owed. Filing an amended tax return if you believe a mistake was made is also an important step to take. Seeking professional help from a tax advisor or enrolled agent can greatly assist you in navigating these options and finding a suitable solution to avoid more severe consequences.

This content may interest you! How do capital gains taxes work?

How do capital gains taxes work?| Action | Consequence |

|---|---|

| Failure to File | Penalties, Interest, Potential Criminal Charges |

| Failure to Pay | Interest, Penalties, Wage Garnishment, Bank Levy, Asset Seizure |

| Tax Evasion (Intentional Non-Payment) | Significant Penalties, Criminal Prosecution, Imprisonment |

| Ignoring IRS Notices | Escalation of Collection Actions, Legal Action |

What happens if you just don't pay taxes?

Financial Penalties

Failing to pay your taxes will result in significant financial penalties from the tax authority. These penalties can accrue interest, making the initial debt grow exponentially over time. The amount of the penalty will depend on several factors, including how late the payment is, the amount owed, and whether this is a first-time offense or a repeat occurrence. The tax authority will typically send numerous notices before taking more serious action, but ignoring these will only exacerbate the situation.

- Late payment penalties: A percentage of the unpaid tax, increasing the longer the payment is overdue.

- Interest charges: Accruing daily interest on the unpaid tax and penalties.

- Additional penalties for intentional disregard or fraud: Substantially higher penalties if the non-payment is deemed deliberate.

Legal Action

Persistent non-payment of taxes can lead to serious legal consequences. The tax authority may take legal action to collect the debt, which can range from wage garnishment to the seizure and sale of assets. In severe cases, criminal charges may be filed, resulting in significant fines, imprisonment, and a severely damaged credit history. The specific legal actions taken will vary depending on jurisdiction and the magnitude of the unpaid taxes. Ignoring official notices and attempts at communication will severely limit your options and may lead to more aggressive collection methods.

- Wage garnishment: A portion of your wages will be directly deducted to repay the debt.

- Bank levy: Funds in your bank accounts will be seized to satisfy the tax liability.

- Asset seizure and sale: The tax authority can seize and sell your property (e.g., house, car) to recover the debt.

- Criminal prosecution: In cases of tax evasion, you may face criminal charges leading to fines and imprisonment.

Damaged Credit Rating

Tax liens, which are public records indicating unpaid taxes, significantly damage your credit rating. This can have long-term negative consequences, making it difficult to obtain loans, rent an apartment, or even secure certain jobs. Repairing your credit after a tax lien can be a lengthy and challenging process, and the impact on your financial life can be considerable. Even after settling the tax debt, the negative mark on your credit report will remain for several years.

- Difficulty securing loans: Lenders may be unwilling to provide credit due to the poor credit rating.

- Higher interest rates: If you do manage to secure credit, you'll likely face higher interest rates.

- Rejected rental applications: Landlords often check credit reports, and a poor rating could lead to rejection.

- Employment difficulties: Some employers perform credit checks, and a poor rating can hinder your job prospects.

What happens if I owe the IRS and can't pay?

What is a tax audit and how can I avoid one?

What is a tax audit and how can I avoid one?If you owe the IRS and can't pay, the IRS will take action to collect the debt. The severity of the action depends on the amount owed and your willingness to cooperate. The IRS will first send you notices explaining the amount owed and the payment options available. Ignoring these notices will only escalate the situation. They may begin by levying your bank accounts, seizing your wages (through wage garnishment), or placing liens on your property. Eventually, they may even file a lawsuit against you and take more severe measures to recover the debt. The longer you wait to contact the IRS and work out a payment plan or other arrangement, the more aggressive their collection efforts will become. Understanding your rights and options is crucial in managing this situation. Early communication is key to potentially avoiding the more severe consequences.

IRS Collection Methods

The IRS employs various methods to collect unpaid taxes. These range from relatively mild to quite severe, depending on the amount owed and your responsiveness. It's important to understand these methods to anticipate what might happen and to proactively seek solutions. The IRS will typically begin with written notices, escalating to phone calls and finally, potentially, legal action. The goal is to encourage compliance and recover the owed tax revenue. It is advisable to contact the IRS directly to discuss your situation before collection efforts intensify.

- Notices and Demands for Payment: Initial attempts usually involve formal notices outlining the outstanding tax liability and payment deadlines. Ignoring these can lead to further action.

- Wage Garnishment and Bank Levy: If payments are not made, the IRS may garnish your wages, directly taking a portion of your paycheck to offset the debt, or levy your bank accounts, seizing funds directly.

- Tax Liens and Levies on Assets: In more serious cases, the IRS may place a lien on your property, preventing you from selling or refinancing it until the tax debt is settled. They may also seize and sell assets such as vehicles or other valuable possessions to recover the owed taxes.

Negotiating with the IRS

Even if you can't pay the full amount immediately, there are options available to negotiate with the IRS. Open communication and a willingness to cooperate are crucial. The IRS is often willing to work with taxpayers who demonstrate a genuine effort to resolve their tax debt. Various payment plans, such as installment agreements, are available, allowing you to pay off the debt in manageable installments over time. In some cases, they may even offer an Offer in Compromise (OIC), which allows you to settle the debt for a reduced amount if you meet specific financial criteria. It's important to explore all possible options and seek professional advice when needed.

- Installment Agreements: These allow you to pay your tax debt in monthly installments over a specified period, typically up to 72 months. Eligibility depends on factors like your income and ability to pay.

- Offer in Compromise (OIC): An OIC allows taxpayers to settle their tax liability for less than the full amount owed. This is typically considered only in situations of significant financial hardship and requires a comprehensive financial assessment.

- Penalty Abatement: In some cases, penalties may be abated or reduced if there is a valid reason for the non-payment, such as significant financial hardship or reasonable cause for the delay. Proper documentation is essential in these cases.

Seeking Professional Help

Navigating tax debt can be complex. If you're struggling to manage your tax liability, seeking professional help from a tax attorney or enrolled agent can be invaluable. They can help you understand your options, represent you in dealings with the IRS, and negotiate the best possible outcome. They can also help you navigate the complexities of payment plans, OICs, and other potential solutions. Professional guidance can significantly improve your chances of resolving your tax debt efficiently and effectively. Engaging a professional can alleviate stress and ensure you are protected throughout the process.

- Tax Attorneys: Attorneys specializing in tax law can provide legal representation and advice regarding your tax debt and potential legal actions.

- Enrolled Agents (EAs): EAs are federally authorized tax practitioners with expertise in representing taxpayers before the IRS. They possess a deep understanding of IRS procedures and regulations.

- Credit Counseling Agencies: While not directly tax-related, these agencies can assist with debt management strategies that may indirectly improve your ability to manage tax debt and avoid future issues.

What is the penalty for not paying taxes?

:max_bytes(150000):strip_icc()/Term-Definitions_Underpayment-penalty-Resized-7d6a14e797ad4b1584b7f659fff3a568.jpg)

How do property taxes work?

How do property taxes work?Tax Penalty Details

The penalties for not paying taxes vary depending on several factors, including the amount of unpaid tax, how long the tax has been unpaid, and whether the failure to pay was intentional or due to reasonable cause. Generally, the penalties include interest charges on the unpaid tax, a failure-to-pay penalty, and potentially additional penalties for other tax-related offenses. The interest rate is generally set by the IRS (or equivalent tax authority in your country) and is applied daily to the unpaid amount. The failure-to-pay penalty is usually a percentage of the unpaid tax. In some cases, criminal charges may be filed, resulting in severe penalties such as fines, imprisonment, and a damaged credit history. The specifics vary significantly by jurisdiction; it's crucial to consult the relevant tax authority's regulations.

Interest Charges

Interest is charged on any unpaid taxes from the due date of the return. This interest is compounded daily, meaning interest accrues not only on the original tax due but also on the accumulated interest. The rate is determined by the IRS (or equivalent) and can fluctuate. Failure to file a return also incurs interest from the due date of the return. This is in addition to any failure-to-pay penalty. Paying even a portion of your taxes will reduce the overall interest accrued, but the interest will continue to accumulate on any outstanding balance until it's fully paid.

- Interest is calculated daily on the unpaid balance.

- The interest rate is determined by the tax authority and can change.

- Interest applies to both unpaid taxes and failure to file penalties.

Failure-to-Pay Penalties

A failure-to-pay penalty is assessed for each month or part of a month that taxes remain unpaid, up to a maximum of 25% of the unpaid tax. The penalty is usually calculated after the due date has passed. This penalty is separate from any interest charges. While there might be some exceptions, if you can show that you had reasonable cause for not paying on time (e.g., serious illness, natural disaster), you might be able to avoid the penalty. However, you still need to pay the taxes owed plus interest.

- The penalty is typically a percentage of the unpaid taxes.

- It's applied monthly until the debt is settled.

- Reasonable cause may allow for penalty forgiveness, but requires documentation.

Criminal Penalties

In cases of intentional tax evasion, the penalties can extend far beyond financial sanctions. Criminal prosecution can lead to significant fines, imprisonment, and a severely damaged reputation. Tax evasion is a serious crime. The investigation and prosecution process will depend on the evidence available to the tax authority and often involves rigorous scrutiny of financial records. The severity of the punishment will be determined by the court and based on factors like the amount of tax evaded and the degree of intent.

This content may interest you! What is sales tax and why do I pay it?

What is sales tax and why do I pay it?- Significant fines can be imposed.

- Jail time is a possibility for serious offenses.

- A criminal record will negatively impact future opportunities.

How long does the IRS give you to pay owed taxes?

IRS Tax Payment Deadlines

The IRS doesn't give a universally set amount of time to pay owed taxes. The timeframe depends heavily on the circumstances. If you file on time but can't pay in full, you can request an extension to pay, usually up to 180 days from the original tax deadline. However, interest and penalties will still accrue on the unpaid amount. If you don't file on time, penalties and interest will start accruing immediately. The IRS may also pursue collection actions, including levies and liens, if the tax debt isn't paid. It's crucial to proactively contact the IRS to discuss payment options if you anticipate difficulties paying your taxes.

IRS Payment Options

The IRS offers various payment methods to make tax payments more manageable. Choosing the right option depends on your individual circumstances and financial capabilities. Understanding these options can help you avoid unnecessary penalties and interest charges. While the IRS aims to facilitate payment, failure to arrange and meet payment deadlines can result in significant consequences.

- Online payment: The IRS website provides a secure portal for online payments using debit cards, credit cards, and electronic bank transfers. This is often the fastest and most convenient method.

- IRS Direct Pay: A free service offered by the IRS that lets you make payments directly from your bank account.

- Payment by mail: Checks or money orders can be mailed to the address indicated on your tax notice. This method is slower and requires careful attention to deadlines and correct mailing addresses.

Installment Agreements

If you owe a significant amount of tax and are unable to pay it in full, you might be eligible for an installment agreement. This allows you to pay your taxes in monthly installments over an agreed-upon period. Approval depends on factors such as your ability to pay and the amount of your tax debt. An installment agreement requires a formal application and adherence to strict payment terms. Failure to uphold the agreement can lead to further penalties and collection actions.

This content may interest you! How do estate and inheritance taxes work?

How do estate and inheritance taxes work?- Application process: You need to apply for an installment agreement through the IRS website or by contacting them directly.

- Eligibility criteria: You must meet certain income and debt criteria to qualify. The IRS will review your financial situation to determine eligibility.

- Payment schedule: Once approved, you will receive a payment schedule outlining the monthly payment amount and due dates.

Penalties and Interest

Failure to pay taxes on time usually results in penalties and interest charges. These charges can significantly increase the overall tax debt. Understanding the penalty structure is critical for responsible tax management. While the IRS aims for compliance, penalties are enforced to ensure timely payment. Penalties and interest are calculated based on the unpaid amount and the length of the delay.

- Penalty for failure to pay: A penalty is assessed for each month or part of a month the tax remains unpaid, up to a maximum of 25% of the unpaid tax.

- Interest on underpayment: Interest is charged on the unpaid tax from the due date until the tax is fully paid.

- Accuracy-related penalty: If the underpayment is due to negligence or intentional disregard of tax rules, additional penalties can apply.

What happens if I don't file my taxes?

Failing to file your tax return, even if you owe no taxes, is a serious offense. The IRS will eventually notice and can levy significant penalties. These penalties can include a percentage of the unpaid tax, plus interest on the unpaid amount. The longer you delay, the higher these penalties become. You may also face difficulty obtaining loans, opening credit accounts, or even traveling internationally due to outstanding tax liabilities. It's crucial to file on time, even if you need to request an extension.

What are the penalties for late tax payments?

Late tax payments result in penalties and interest charges. The penalty for late payment is typically calculated as a percentage of the unpaid tax, accruing daily until the balance is settled. Interest also accrues on the unpaid tax, adding to the total amount you owe. The exact penalties and interest rates can vary depending on the circumstances and the tax year. Furthermore, repeated failures to pay on time can lead to more severe consequences, such as wage garnishment, bank levy, or even legal action.

Can I negotiate a payment plan if I can't afford to pay my taxes?

Yes, the IRS offers payment plans to taxpayers who can't afford to pay their taxes in full. These plans allow you to pay your taxes in installments over a period of time, often up to 72 months. You'll likely need to complete an application and demonstrate your ability to make the agreed-upon payments. There may be fees associated with setting up a payment plan. It’s crucial to act promptly and contact the IRS before penalties and interest escalate significantly. Ignoring the issue could lead to more severe consequences.

What if I owe back taxes from previous years?

Owing back taxes from previous years can lead to various serious consequences, including penalties, interest, and potential legal action. The IRS has methods to collect past-due taxes, such as wage garnishment, bank levies, and the seizure of assets. The amount owed will increase significantly due to accumulating penalties and interest. It's crucial to contact the IRS as soon as possible to discuss payment options, such as installment agreements or offers in compromise, to resolve your outstanding tax liability and avoid further complications.

This content may interest you! What to do if you are in massive debt?

What to do if you are in massive debt?

Leave a Reply