How to budget as a young person?

Budgeting as a young person can feel overwhelming, especially when balancing education, work, and social life. However, mastering this skill early can set the foundation for long-term financial stability.

Whether you’re saving for future goals, paying off student loans, or simply managing day-to-day expenses, creating a budget is a crucial step. This guide will walk you through practical strategies to track your income, prioritize spending, and build healthy financial habits.

By understanding where your money goes and setting realistic goals, you can take control of your finances and make informed decisions. Start your journey toward financial independence today with these essential budgeting tips.

How to Budget as a Young Person

Budgeting as a young person is a crucial skill that sets the foundation for financial stability and independence. It involves understanding your income, tracking expenses, and making informed decisions about saving and spending.

By creating a budget, you can avoid unnecessary debt, build savings, and achieve your financial goals. Below, we break down the key steps to help you get started.

1. Track Your Income and Expenses

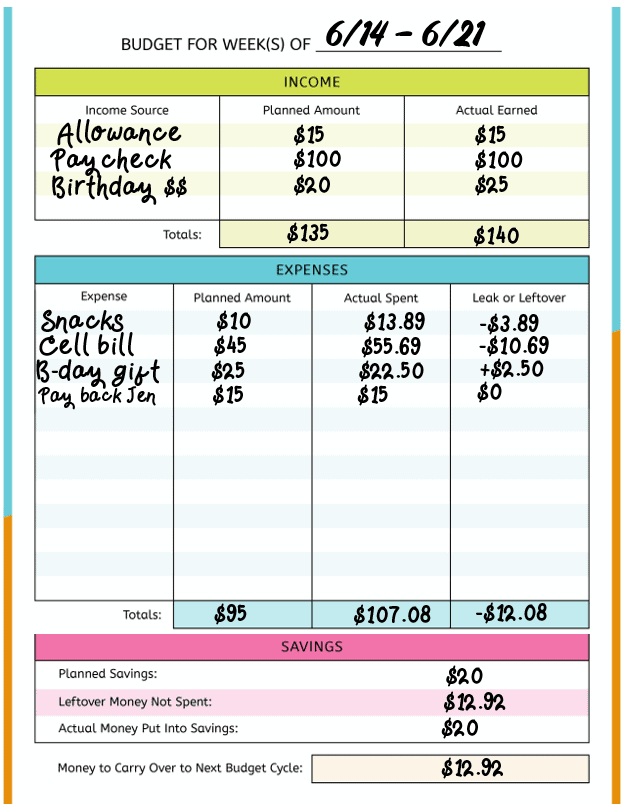

The first step in budgeting is to track your income and expenses. Start by listing all sources of income, such as your salary, freelance work, or allowances. Then, categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out). Use budgeting apps or spreadsheets to monitor where your money goes.

This content may interest you! How much should a young person save?

How much should a young person save?This will help you identify areas where you can cut back and allocate funds more effectively.

| Category | Amount |

|---|---|

| Income | $2,000 |

| Fixed Expenses | $1,200 |

| Variable Expenses | $500 |

| Savings | $300 |

2. Set Financial Goals

Setting financial goals is essential for staying motivated and focused. Whether it’s saving for a car, paying off student loans, or building an emergency fund, having clear objectives helps you prioritize your spending.

Break down your goals into short-term (1-2 years) and long-term (5+ years) categories. Allocate a portion of your income toward these goals each month to ensure steady progress.

| Goal | Timeline | Monthly Contribution |

|---|---|---|

| Emergency Fund | 1 Year | $200 |

| Travel Fund | 2 Years | $100 |

| Retirement Savings | Long-Term | $150 |

3. Use the 50/30/20 Rule

The 50/30/20 rule is a simple and effective budgeting method. Allocate 50% of your income to needs (rent, groceries, utilities), 30% to wants (entertainment, hobbies), and 20% to savings and debt repayment.

This approach ensures a balanced distribution of your income, helping you maintain financial discipline while still enjoying life. Adjust the percentages based on your personal circumstances and priorities.

| Category | Percentage | Amount |

|---|---|---|

| Needs | 50% | $1,000 |

| Wants | 30% | $600 |

| Savings/Debt | 20% | $400 |

How to budget for young people?

What is the 50/30/20 rule of money?

What is the 50/30/20 rule of money?Understanding Your Income and Expenses

To budget effectively, young people must first understand their income and expenses. Start by listing all sources of income, such as part-time jobs, allowances, or freelance work. Then, track all expenses, including fixed costs like rent or subscriptions and variable costs like entertainment or dining out.

This helps identify spending patterns and areas where adjustments can be made.

- List all income sources, including irregular ones like bonuses or gifts.

- Categorize expenses into fixed and variable to see where money is going.

- Use budgeting apps or spreadsheets to simplify tracking and analysis.

Setting Financial Goals

Setting clear financial goals is crucial for young people to stay motivated and focused. Goals can be short-term, like saving for a new gadget, or long-term, such as building an emergency fund or saving for higher education.

Prioritize goals based on importance and feasibility, and allocate a portion of income toward achieving them.

- Define short-term and long-term financial goals.

- Prioritize goals based on urgency and personal values.

- Create a savings plan by allocating a percentage of income to each goal.

Adopting Smart Spending Habits

Smart spending habits are essential for staying within a budget. Young people should differentiate between needs and wants, avoid impulse purchases, and look for discounts or alternatives.

Additionally, learning to cook at home, using public transportation, and limiting subscription services can significantly reduce expenses.

This content may interest you! How much should a 25 year old save?

How much should a 25 year old save?- Distinguish between needs and wants to avoid unnecessary spending.

- Plan purchases in advance and compare prices to find the best deals.

- Limit discretionary spending by setting monthly caps on non-essential items.

How should I budget in my 20s?

Understanding Your Income and Expenses

To create an effective budget in your 20s, start by understanding your income and expenses. Track all sources of income, including your salary, freelance work, or any side hustles.

Then, list out your monthly expenses, categorizing them into fixed (rent, utilities, subscriptions) and variable (entertainment, dining out, shopping). This will help you identify where your money is going and where you can make adjustments.

- Calculate your total monthly income after taxes.

- List all fixed expenses and prioritize them.

- Track variable expenses to identify spending patterns.

Setting Financial Goals

Setting clear financial goals is crucial for budgeting in your 20s. Whether it's saving for an emergency fund, paying off student loans, or planning for a big purchase, having specific goals will guide your spending and saving habits.

Break down your goals into short-term (1 year), medium-term (1-5 years), and long-term (5+ years) to stay motivated and organized.

- Define short-term goals like building a $1,000 emergency fund.

- Set medium-term goals such as paying off credit card debt.

- Plan long-term goals like saving for a down payment on a house.

Creating and Sticking to a Budget Plan

Once you understand your income, expenses, and goals, create a budget plan that aligns with your priorities. Use the 50/30/20 rule as a guideline: allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

Regularly review and adjust your budget to ensure it remains realistic and effective.

This content may interest you! How much savings should I have per age?

How much savings should I have per age?- Use budgeting tools or apps to track your spending.

- Adjust your budget monthly based on changing needs.

- Avoid unnecessary expenses by sticking to your plan.

What is a good budget for an 18 year old?

Understanding the Basics of Budgeting at 18

Creating a budget as an 18-year-old is essential for managing finances effectively. At this age, income sources might include part-time jobs, allowances, or scholarships.

A good budget should cover essential expenses while allowing for savings and discretionary spending. Here are some key points to consider:

- Identify all sources of income, such as wages, gifts, or financial aid.

- List fixed expenses like phone bills, transportation, or subscriptions.

- Allocate a portion of income to savings, ideally 20% of earnings.

Essential Expenses to Include in Your Budget

When budgeting at 18, it's important to prioritize essential expenses to ensure financial stability. These expenses are necessary for daily living and should be accounted for first. Here’s what to include:

- Housing or rent, if living independently or contributing to household expenses.

- Transportation costs, such as gas, public transit, or car maintenance.

- Food, including groceries and occasional dining out.

Balancing Savings and Discretionary Spending

A good budget for an 18-year-old should strike a balance between saving for the future and enjoying the present. Discretionary spending includes non-essential items like entertainment, hobbies, or shopping. Here’s how to manage both:

- Set a monthly savings goal, such as building an emergency fund or saving for college.

- Limit discretionary spending to a specific percentage of income, like 10-15%.

- Track spending habits to avoid overspending on non-essential items.

What is the 50/30/20 rule of money?

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

Understanding the 50/30/20 Rule

The 50/30/20 rule is a simple budgeting framework designed to help individuals manage their finances effectively. It divides after-tax income into three categories:

This content may interest you! What is the 70 saving rule?

What is the 70 saving rule?- 50% for Needs: This portion covers essential expenses such as housing, utilities, groceries, transportation, and insurance.

- 30% for Wants: This category includes discretionary spending like dining out, entertainment, hobbies, and non-essential shopping.

- 20% for Savings and Debt Repayment: This segment is allocated for building savings, investing, or paying off debt, such as student loans or credit card balances.

How to Apply the 50/30/20 Rule

To implement the 50/30/20 rule, follow these steps:

- Calculate your after-tax income: Determine your monthly take-home pay after taxes and deductions.

- Categorize your expenses: Separate your spending into needs, wants, and savings/debt repayment.

- Adjust your budget: Ensure that your spending aligns with the 50/30/20 percentages. If not, identify areas to cut back or reallocate funds.

Benefits of the 50/30/20 Rule

The 50/30/20 rule offers several advantages for financial management:

- Simplicity: It provides a straightforward and easy-to-follow structure for budgeting.

- Flexibility: It allows for personalization based on individual financial goals and priorities.

- Balance: It ensures a healthy distribution of income across essential needs, lifestyle choices, and future financial security.

Frequently Asked Questions

How can I start budgeting as a young person?

To start budgeting, track your income and expenses for a month. Use apps or spreadsheets to categorize spending. Set realistic goals, like saving 20% of your income. Prioritize needs over wants and allocate funds accordingly. Review and adjust your budget regularly to stay on track.

What are the best budgeting methods for young adults?

Popular methods include the 50/30/20 rule (50% needs, 30% wants, 20% savings), zero-based budgeting (every dollar has a purpose), and envelope system (cash for categories). Choose one that aligns with your lifestyle and financial goals. Experiment to find what works best for you.

How do I save money while budgeting on a low income?

Focus on cutting non-essential expenses, like dining out or subscriptions. Look for free or low-cost alternatives for entertainment. Automate small savings transfers to build an emergency fund. Take advantage of discounts, coupons, and student deals. Even small savings add up over time.

How can I stick to my budget as a young person?

Set clear financial goals, like saving for a trip or paying off debt. Use budgeting tools to monitor spending. Avoid impulse purchases by creating a want list and waiting before buying. Share your goals with friends for accountability. Celebrate small wins to stay motivated.

This content may interest you! How to budget if you have debt?

How to budget if you have debt?

Leave a Reply