Can I invest as little as $100?

Investing can seem daunting, especially with the perception that significant capital is required. But what if you only had $100? This article explores the possibilities of starting your investment journey with a small amount.

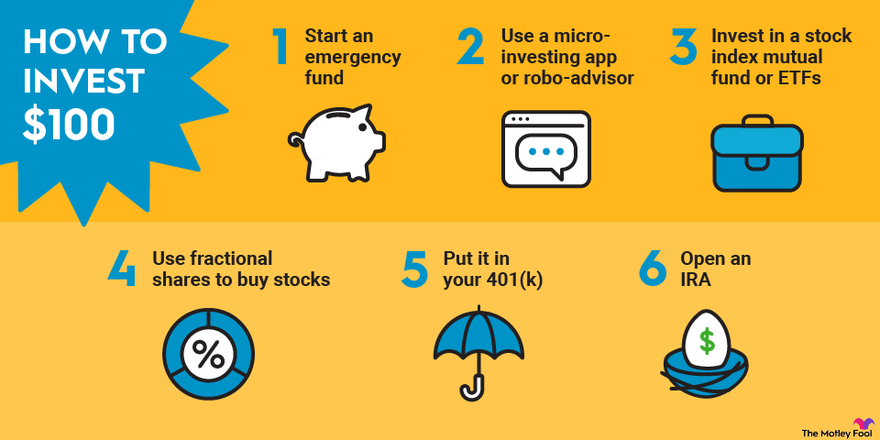

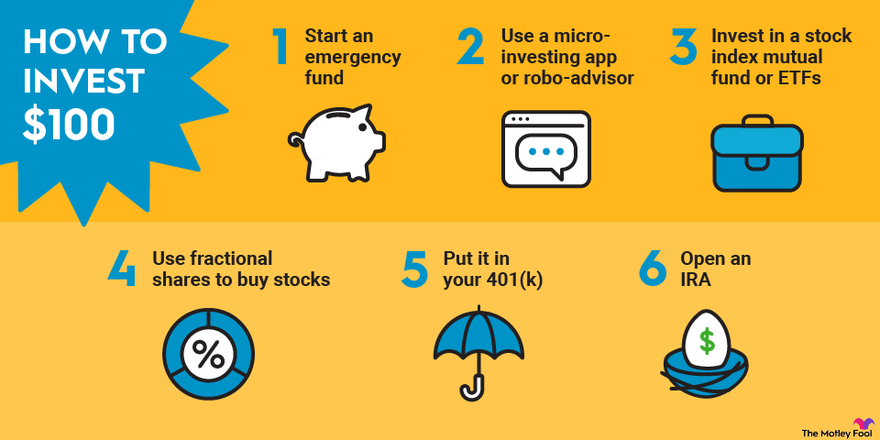

We'll examine various investment vehicles accessible to beginners with limited funds, including fractional shares, micro-investing apps, and high-yield savings accounts.

Discover whether a $100 investment can truly make a difference and how to navigate the world of finance with a modest budget. We'll also address potential risks and rewards.

Can I Start Investing with Just $100?

Yes, you absolutely can start investing with as little as $100. While it might not seem like a substantial amount, it's a great way to begin building wealth and taking advantage of the power of compound interest. Many brokerage platforms and investment vehicles now cater to smaller investors, offering fractional shares and low minimum investment requirements.

This makes investing accessible to a wider range of people, regardless of their financial background. However, it's crucial to understand your investment goals, risk tolerance, and the fees associated with your chosen platform before you begin. Remember, even small, consistent investments can yield significant returns over time. The key is to stay disciplined and patient.

What Investment Options Exist for Small Investments?

With $100, your options might be slightly more limited than with a larger sum, but several avenues are still available. Fractional shares are a game-changer, allowing you to invest in companies like Apple or Tesla even if you can't afford a whole share.

Many brokers now offer this, making it easier than ever to diversify your portfolio, even with a small amount. Another option is to invest in exchange-traded funds (ETFs) that track broad market indices like the S&P 500.

These funds offer diversification at a low cost, making them ideal for beginners with limited capital. Finally, some peer-to-peer lending platforms allow small investments, giving you the opportunity to earn returns from lending to individuals or businesses. The key is to research and choose options with low fees and align with your financial goals.

This content may interest you! How to turn $100 into $1000 investing?

How to turn $100 into $1000 investing?What Are the Risks of Investing Small Amounts?

While investing with $100 offers accessibility, it's crucial to acknowledge the risks. Lower returns are a given, simply due to the smaller investment size. The impact of fees can also be proportionally higher, potentially eating into your profits.

Furthermore, market volatility can significantly impact your small investment; a substantial market downturn could wipe out a considerable portion of your initial capital. Finally, lack of diversification is a major concern when starting with limited funds.

It can be challenging to build a well-diversified portfolio with a small amount, increasing your exposure to risk. Careful planning and research are crucial to mitigate these risks.

How Can I Maximize Returns on a Small Investment?

Even with a small amount, you can still maximize your returns through smart strategies. First, focus on low-cost investments; fees can quickly erode profits, particularly when dealing with small sums. Second, prioritize long-term investing. The power of compounding means that even small regular investments over a long period can grow significantly.

Third, reinvest dividends and profits whenever possible; this allows for faster growth by continuously adding to your initial investment. Fourth, consider dollar-cost averaging, investing a fixed amount regularly regardless of market fluctuations. Finally, educate yourself and stay informed about your investments and market trends. This allows for making informed decisions, rather than impulsive ones.

| Investment Type | Minimum Investment | Pros | Cons |

|---|---|---|---|

| Fractional Shares | Often $1 or less | Access to high-growth stocks, diversification | Brokerage fees can be significant, volatility |

| ETFs | Varies, but often low | Diversification, low cost, ease of investing | Limited control over specific holdings, market risk |

| Peer-to-Peer Lending | Varies by platform | Potentially higher returns than savings accounts | Higher risk, potential for loan defaults |

Is $100 too little to invest?

Whether $100 is too little to invest depends entirely on your perspective and goals. While it might seem insignificant compared to larger investment sums, it's crucial to consider the power of compounding and the accessibility of modern investment platforms.

Starting small allows you to learn about investing without significant risk, experiment with different strategies, and build good financial habits. Even small, consistent investments can accumulate substantial value over time, especially if you start early. However, it's important to weigh the potential returns against any associated fees, which might significantly impact smaller investments.

This content may interest you! How to turn $1000 into $5000 in a month?

How to turn $1000 into $5000 in a month?What are the advantages of starting with a small investment like $100?

Starting with a small investment like $100 offers several key advantages. It lowers the risk associated with potential losses, making it an excellent entry point for beginners.

This approach allows you to develop practical experience in the investment world and learn from your successes and mistakes without significant financial setbacks. It also builds discipline and consistency in your investment strategy, fostering long-term financial habits that can be scaled up as your financial resources grow.

- Low risk: Minimal financial impact if investments lose value.

- Learning experience: Gain practical knowledge without significant losses.

- Habit formation: Builds consistent saving and investing behaviors.

What are the limitations of investing only $100?

While $100 is a great starting point, it does have some limitations. The primary concern is the impact of fees. Many investment platforms charge fees per trade or management fees, which can eat into a small investment's returns.

Additionally, the growth potential might be slower compared to larger investments, although consistent contributions can still yield significant long-term results. The limited diversification options with such a small sum might also expose you to higher risk.

- High Fee Impact: Fees can significantly reduce returns on small investments.

- Slower Growth: Potential for smaller returns compared to larger investments.

- Limited Diversification: Difficult to diversify effectively with only $100.

What investment options are suitable for a $100 investment?

Despite the limitations, several investment options are suitable for a $100 investment. Fractional shares allow you to invest in established companies even with small amounts.

Many brokerage accounts have no minimum investment requirements, and robo-advisors can automate the process for you, often with lower fees than traditional advisors.

High-yield savings accounts are another option offering a safe and relatively easy way to grow your money, though returns may be lower than other options.

- Fractional Shares: Invest in well-established companies, despite low capital.

- Robo-advisors: Automate investment strategies with low fees.

- High-yield savings accounts: Earn interest with minimal risk.

Can I invest $100 and make money?

Should I invest while I have debt?

Should I invest while I have debt?Yes, you can potentially make money investing $100, although the amount of profit will likely be small and the risk of loss is significant. The key is to understand that with a small starting amount, your investment options are limited and your returns will be proportionally smaller.

You'll need to focus on strategies that offer high potential returns, even if they also carry higher risks. It's crucial to carefully manage expectations and understand the potential for loss. $100 isn't enough to diversify broadly, so your success will depend heavily on your investment choices and market conditions.

High-Risk, High-Reward Options

With a small capital investment like $100, your options for diversification are limited. You'll likely need to consider higher-risk investments with the potential for larger, although less certain, returns.

This approach requires a higher tolerance for risk, as a loss of your initial $100 is a real possibility. Be prepared to lose your entire investment. Careful research and understanding of the investment are paramount.

- Penny Stocks: These are shares of small companies trading at very low prices. While they offer potential for significant growth, they are extremely volatile and can easily lose value quickly. Thorough due diligence is essential before investing.

- Cryptocurrencies: The cryptocurrency market is highly speculative. While some cryptocurrencies have experienced explosive growth, others have plummeted. Investing in crypto with a small amount presents a high risk, but also the potential for significant, albeit unlikely, gains.

- Peer-to-Peer Lending: This involves lending money to individuals or businesses through online platforms. It's possible to start with small sums, but this method involves a credit risk since some borrowers may default on their loans.

Low-Risk, Low-Reward Options

While the potential for significant returns is lower with low-risk options, they offer greater security for your initial investment. The gains might be small, but consistent, small gains can add up over time, especially with the use of compounding.

This approach is suitable if you prioritize capital preservation over high returns.

- Fractional Shares: Many brokerage firms now allow you to buy fractions of shares of established companies. This lets you invest in blue-chip stocks, even with a limited budget. While the returns might be modest, the lower risk mitigates potential losses.

- High-Yield Savings Accounts: These accounts offer a relatively safe way to grow your money, though the returns are generally quite small compared to riskier investments. They offer a much lower risk of losing the principle investment.

- Micro-Investing Apps: Apps like Acorns or Stash allow you to invest small amounts of money regularly, often rounding up your purchases to the nearest dollar and investing the difference. This is a good approach for beginners to start building a portfolio over time.

Building a Foundation for Future Investments

While making substantial profits with a $100 investment is unlikely, it can serve as a valuable stepping stone. Concentrate on learning about investing, developing a financial plan, and gaining experience.

Focus on educating yourself about the markets, understanding investment strategies, and learning from your experiences – both successes and failures. Even small investments can help you build a foundation for bigger financial goals in the future.

This content may interest you! Is $20,000 a lot of debt?

Is $20,000 a lot of debt?- Learn about different asset classes: Educate yourself on stocks, bonds, real estate, and other investment vehicles to make informed decisions.

- Develop a financial plan: Create a budget and set realistic financial goals. This will help you allocate your resources effectively and make sound investment choices.

- Track your progress: Keep records of your investments, and regularly monitor their performance. This helps you understand your investment strategy’s effectiveness.

What is the smallest amount I can invest?

The smallest amount you can invest depends heavily on the investment vehicle you choose. There isn't a universal minimum. Some investments, such as certain mutual funds or exchange-traded funds (ETFs), may have no minimum initial investment, though minimums may apply for subsequent investments or withdrawals.

Others, like real estate investment trusts (REITs) or individual stocks purchased through a broker, typically have higher minimums, sometimes in the thousands of dollars, or are subject to brokerage fees that may make very small investments impractical.

Many platforms and investment products now offer fractional shares, allowing investors to purchase parts of a share, dramatically lowering the minimum investment amount for stocks and ETFs. However, you must always check the specific requirements of the individual investment you are considering.

Minimum Investment Amounts Across Different Asset Classes

There is a wide range of minimum investment amounts depending on the type of investment.

- Stocks and ETFs: While some brokers offer fractional shares, eliminating minimums for many, others may have minimum account balances or per-trade fees that effectively create a minimum investment. Direct purchase plans from some companies might have lower minimums than purchasing through a broker. It's crucial to check your chosen brokerage's fee schedule.

- Mutual Funds: Many mutual funds have no minimum initial investment, particularly index funds, but this can vary greatly. Some funds may require a large initial investment or have high minimums for subsequent contributions. You should always review the fund's prospectus for details.

- Real Estate: Investing in real estate directly requires considerably more capital than other assets. The minimum investment is in the tens or hundreds of thousands of dollars unless you consider REITs, which still often have minimum investment amounts or require purchasing multiple shares, significantly increasing the overall cost.

Micro-Investing Platforms and Apps

Several platforms specialize in making investing accessible to those with limited capital.

- These platforms often allow investments as small as a single dollar, investing your spare change, or rounding up purchases to the nearest dollar. They typically invest your money in ETFs, reducing fees and diversification risk.

- The convenience and low barrier to entry of these micro-investing apps make them attractive for beginners or those with limited financial resources. However, it's crucial to understand the fees charged, especially if you're investing small amounts.

- While these platforms make investing accessible, they may not be suitable for long-term, large-scale investing or complex strategies. This is because they are usually designed around automation and ease of use, rather than offering customized portfolio management.

Factors Affecting Minimum Investment Requirements

Various factors influence the minimum investment amount for a specific investment vehicle.

- Brokerage Fees: Brokerage commissions and fees can significantly impact the overall cost of an investment, especially when dealing with smaller amounts. These fees can eat into your returns making small investments less practical.

- Investment Type: The investment's nature directly determines the minimum investment amount. Real estate investments naturally necessitate larger capital outlays compared to stocks or bonds.

- Platform or Institution: Different brokers, financial institutions, and investment platforms have varying policies regarding minimum investments, making it crucial to check before investing.

How can I turn $100 into $1000 fast?

Do millionaires pay off debt or invest?

Do millionaires pay off debt or invest?Turning $100 into $1000 quickly requires significant risk and a lot of effort. There's no guaranteed method, and any strategy promising easy riches is likely a scam. Success depends heavily on your skills, market conditions, and a considerable amount of luck.

The faster you aim to make the money, the higher the risk of losing your initial investment.

High-Risk, High-Reward Ventures

These options offer the potential for rapid growth but also carry a substantial risk of losing your entire $100. They often involve leveraging your initial investment or relying on unpredictable market fluctuations.

- Day Trading: This involves buying and selling stocks or other assets within the same trading day, aiming to profit from small price changes. Requires significant knowledge of market analysis and risk management. High potential for losses if not done properly.

- Penny Stocks: These are shares of small companies that trade at low prices, often highly volatile. While offering the possibility of significant gains, they are extremely risky and susceptible to fraud.

- Flipping Items: Buying undervalued items (like clothes, electronics, or collectibles) and reselling them for a profit at online marketplaces or through secondhand stores can generate quick returns if you can find the right deals and market them effectively. Finding profitable items requires research, effort, and some luck.

Service-Based Businesses

Offering your skills or services can be a more reliable, albeit potentially slower, way to reach your goal. This approach requires less upfront capital but more time and effort.

- Freelancing: Offering services like writing, graphic design, web development, or virtual assistance on platforms like Upwork or Fiverr can generate income relatively quickly, depending on your skills and the demand for your services. Building a strong portfolio and positive client reviews is crucial.

- Local Gigs: Offering services directly to your community, such as yard work, house cleaning, pet sitting, or handyman services, can be a fast way to earn money. This method requires marketing yourself locally and consistently securing clients.

- Online Tutoring/Teaching: If you have expertise in a particular subject, you can offer tutoring or teaching services online. Platforms like Skooli or Chegg offer opportunities to connect with students seeking assistance.

Investing with a Longer-Term Perspective

While not offering the "fast" return you desire, this approach minimizes risk while still allowing for substantial growth over time. It requires patience and discipline. Remember, long-term gains are often more sustainable than quick profits.

- High-Yield Savings Accounts or Certificates of Deposit (CDs): These are low-risk options, but the returns are usually modest and unlikely to turn $100 into $1000 quickly. However, it's a safe way to grow your capital gradually.

- Index Funds or ETFs: Investing in index funds or exchange-traded funds provides diversified exposure to the market, reducing risk compared to individual stocks. However, significant growth takes time.

- Peer-to-Peer Lending: Lending money to individuals or businesses through platforms can offer relatively higher returns compared to traditional savings accounts, but it involves credit risk. Thoroughly vetting borrowers is crucial.

Frequently Asked Questions

Can I really invest with only $100?

Yes, you can absolutely invest with as little as $100, depending on the investment vehicle. Fractional shares allow you to buy parts of a company's stock, even if a full share costs much more. Many brokerage platforms now support this, making investing accessible to beginners with limited capital.

However, remember that returns will be proportionally smaller with a smaller initial investment. Consider your investment goals and risk tolerance before investing any amount.

What investment options are available with a $100 investment?

With $100, your options might be more limited compared to larger investments. Fractional shares of stocks or ETFs are ideal, allowing participation in the market even with a small sum. Some robo-advisors also accept smaller initial deposits, providing automated portfolio management.

This content may interest you! How do I invest with very little money?

How do I invest with very little money?Index funds and low-cost mutual funds could also be potential choices, though minimum investment requirements vary. Explore options carefully to find the best fit for your risk tolerance and financial objectives.

Are there any fees associated with investing $100?

Yes, fees can still apply even with small investments. Brokerage platforms often charge commissions on trades, though many now offer commission-free trading for certain types of investments. However, other fees may include account maintenance fees or management fees for robo-advisors.

It's crucial to understand and compare all fees across different platforms to avoid unexpected costs, especially when dealing with smaller investment amounts where fees can represent a larger percentage of your total investment.

What are the potential risks of investing only $100?

Investing $100 carries the same inherent risks as larger investments, though the potential losses are proportionally smaller. Market volatility can still significantly impact your returns, and a small investment may not be sufficient to diversify effectively and mitigate risk.

The potential for significant gains is also limited. While accessible, it's crucial to understand that investing, regardless of the amount, involves risk and shouldn't be considered a get-rich-quick scheme. Carefully research and understand the risks before committing any funds.

Leave a Reply