How can I file my taxes correctly?

Filing taxes can be daunting, but understanding the process is key to avoiding costly mistakes. This article provides a comprehensive guide to accurately filing your taxes, covering essential forms, deductions, and credits. We'll walk you through gathering necessary documents, choosing the right filing method (e-filing versus paper), and navigating common pitfalls. Whether you're a first-time filer or a seasoned taxpayer, this guide will empower you to confidently and correctly file your taxes, ensuring a smooth and successful tax season.

How to Ensure Accurate Tax Filing

Filing your taxes correctly is crucial to avoid penalties and ensure you receive all the deductions and credits you're entitled to. The process can seem daunting, but breaking it down into manageable steps can make it significantly easier. Accuracy is paramount; even small errors can lead to delays or audits. Start by gathering all necessary documents, including W-2s, 1099s, and any other tax forms received from employers, banks, and investment institutions. Carefully review each form to verify the accuracy of the reported income and deductions. Utilize tax software or seek professional help if needed. Understanding your filing status (single, married filing jointly, etc.) is also critical as it impacts your tax bracket and deductions. Finally, double-check your return before submitting it to catch any potential mistakes. Remember, taking your time and being thorough is key to accurate tax filing.

Gathering Necessary Documents

Before you even begin filling out your tax forms, make sure you have all the necessary documentation in hand. This includes W-2 forms from your employer(s), which report your wages and the amount of taxes withheld. You'll also need any 1099 forms reporting income from freelance work, interest, dividends, or other sources. Don't forget about any receipts or documentation for deductions you plan to claim, such as charitable donations, medical expenses, or business expenses. Organize all these documents neatly, either physically or digitally, to make the process smoother and less stressful. Having everything readily accessible will significantly reduce the time and frustration involved in preparing your taxes.

This content may interest you! What tax benefits do families and parents get?

What tax benefits do families and parents get?Choosing the Right Filing Method

There are several ways to file your taxes, each with its own advantages and disadvantages. You can file electronically using tax software, which often provides guidance and error checks. This is generally the fastest and most efficient method. Alternatively, you can file by mail using paper forms, but this is a more time-consuming process and increases the risk of errors. Another option is to use a tax professional, who can assist with complex tax situations or help maximize your deductions. Consider your comfort level with taxes and the complexity of your financial situation when deciding which method is best for you. The IRS website offers detailed information on all available filing methods and resources to help you choose.

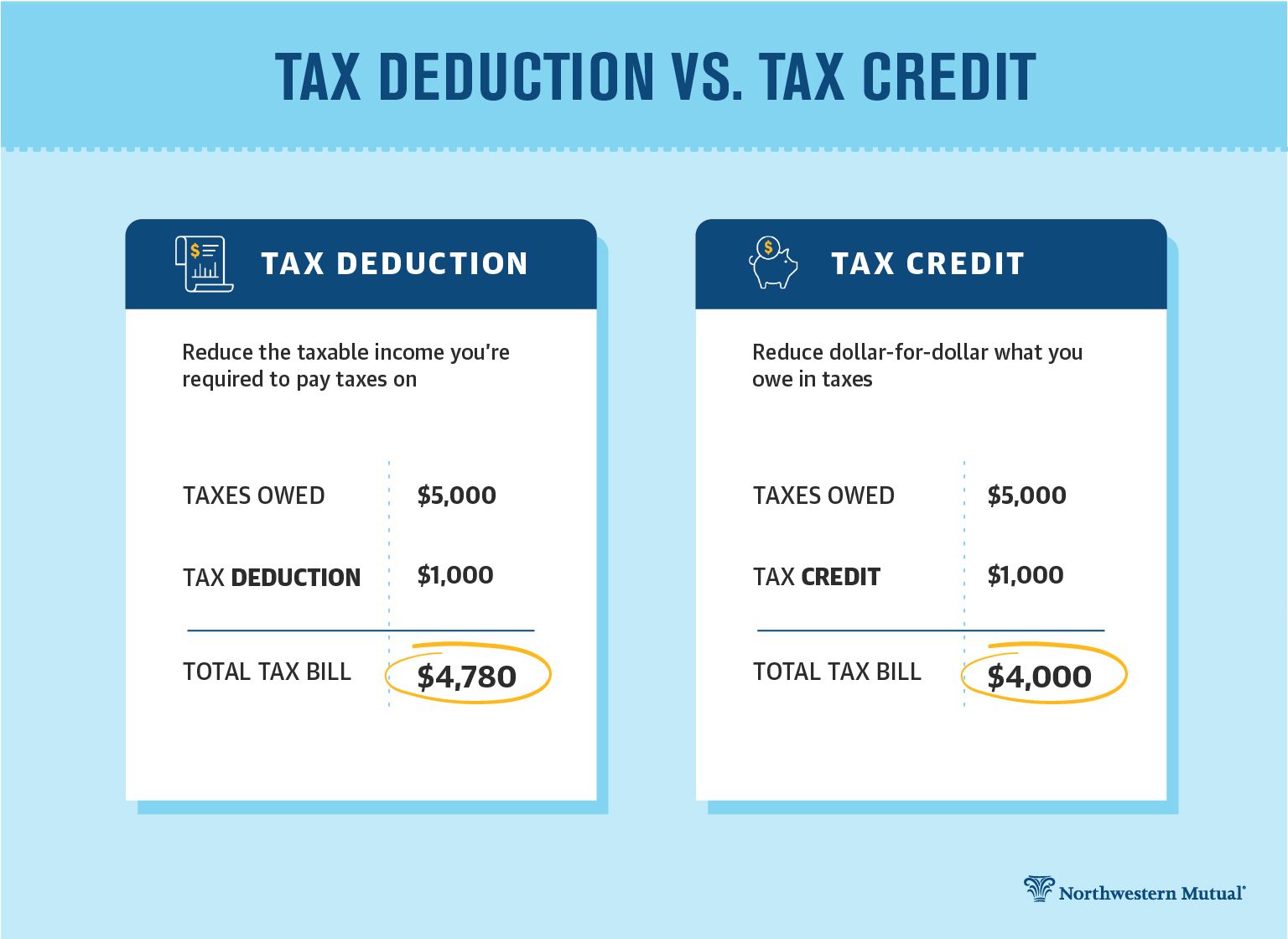

Understanding Deductions and Credits

Familiarize yourself with various tax deductions and credits available to you. Tax deductions reduce your taxable income, while tax credits directly reduce the amount of tax you owe. Common deductions include those for charitable contributions, mortgage interest, and state and local taxes (depending on your location and the tax year). Credits often target specific groups or circumstances, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit. Researching available deductions and credits relevant to your situation can significantly impact your tax liability. Tax software and professional tax preparers can help you identify and claim all eligible deductions and credits, ensuring you receive the maximum tax benefits you are entitled to.

| Step | Action | Importance |

|---|---|---|

| 1 | Gather all necessary documents (W-2s, 1099s, etc.) | Ensures accurate reporting of income |

| 2 | Choose a filing method (electronic, mail, or professional) | Impacts efficiency and accuracy |

| 3 | Accurately complete all tax forms | Avoids penalties and ensures correct tax calculation |

| 4 | Review and double-check your return before filing | Catches potential errors and minimizes risks |

How do I make sure my tax return is correct?

What are common tax mistakes and how to avoid them?

What are common tax mistakes and how to avoid them?Ensuring your tax return's accuracy is crucial to avoid potential audits and penalties. This involves meticulous record-keeping, careful calculation, and a thorough review process. Start by gathering all relevant tax documents, including W-2s, 1099s, and any other forms reflecting income, deductions, or credits. Use reputable tax software or consult a qualified tax professional to assist in the preparation process. Tax software often includes built-in error checks, and professionals possess expertise in navigating complex tax laws. Double-checking all entries for accuracy, comparing them to supporting documentation, and verifying that all necessary forms are included are crucial steps. Finally, review the completed return thoroughly before filing, paying particular attention to the accuracy of reported income, deductions, and credits. If you're unsure about any aspect of the process, seeking professional advice is always recommended.

Gathering and Organizing Your Documents

The foundation of an accurate tax return is a well-organized collection of documents. Failing to properly gather and organize your documents can lead to errors and omissions on your return. Systematic organization is key to accuracy and efficiency. Start early in the year to avoid last-minute rushes. Maintain a dedicated file or folder for all your tax-related documents. This will significantly simplify the process of preparing your return.

- Compile all W-2s (Wage and Tax Statements) from your employers.

- Gather all 1099 forms reporting various types of income (e.g., 1099-INT for interest, 1099-DIV for dividends, 1099-NEC for non-employee compensation).

- Collect receipts and other documentation for any itemized deductions (e.g., charitable donations, medical expenses, state and local taxes).

Utilizing Tax Software or Professional Assistance

While you can prepare your taxes manually, utilizing tax software or seeking professional help significantly reduces the risk of errors. Tax software programs offer built-in checks and balances, guiding you through the process and flagging potential inconsistencies. Tax professionals, such as CPAs or enrolled agents, possess the expertise to navigate complex tax laws and optimize your tax return to ensure you claim all eligible deductions and credits. Their knowledge can save you time and potential financial penalties.

This content may interest you! How do international taxes work for digital nomads?

How do international taxes work for digital nomads?- Explore reputable tax software programs that offer comprehensive features and error-checking capabilities.

- If you have a complex tax situation (e.g., self-employment, significant investments, business income), consider consulting a qualified tax professional.

- Compare the services and fees offered by different tax professionals before making a decision.

Reviewing and Double-Checking Your Return

Before submitting your tax return, a thorough review is paramount. Rushing through this step can lead to costly mistakes. Take your time and carefully examine every detail of your return. Comparing the information on your return to your supporting documents is crucial to verify accuracy. Pay close attention to calculations and ensure all numbers match the original documentation. Consider using a second set of eyes, either a friend, family member, or a tax professional, to review your return for any potential oversights.

- Carefully review all income reported on your tax return, comparing it to your W-2s, 1099s, and other income statements.

- Double-check all deductions and credits claimed, ensuring you meet all eligibility requirements and have proper documentation.

- Verify the accuracy of all mathematical calculations and ensure they are consistent with the supporting documents.

Is it better to claim 1 or 0 on your taxes?

Claiming 1 or 0 on Taxes

This content may interest you! What are taxes and how do they work?

What are taxes and how do they work?The choice between claiming 1 or 0 on your taxes refers to the number of allowances you claim for withholding purposes. This affects how much federal income tax is withheld from your paycheck throughout the year. It's not about claiming a deduction or credit; it's about adjusting your withholding to potentially avoid underpaying or overpaying your taxes. Claiming fewer allowances (like 0) results in more tax withheld, while claiming more allowances (like 1) results in less tax withheld. The optimal number depends entirely on your individual circumstances, including your income, filing status, deductions, and credits. There's no universally "better" choice; it's about finding the right balance to minimize adjustments at tax time. Incorrectly choosing a number can lead to owing a significant amount or receiving a smaller refund than anticipated.

Understanding Withholding Allowances

Withholding allowances are based on the number of dependents you have, as well as other factors like filing status and estimated deductions. The more allowances you claim, the less tax your employer will withhold. This system is designed to provide a fairly accurate estimate of your tax liability. However, using the wrong number of allowances can lead to either a large tax bill at the end of the year, or a smaller-than-expected refund. Accurately calculating the appropriate number of allowances requires careful consideration of your financial situation. An incorrect number can result in financial difficulties later on, such as owing the IRS a large sum of money or not receiving the full benefits of a potential refund.

- Higher income earners might find it more beneficial to claim fewer allowances to avoid a large tax bill at the end of the year.

- Individuals with multiple dependents and significant deductions might find that claiming more allowances is appropriate.

- Using the IRS withholding calculator is recommended for making an informed decision about the number of allowances to claim.

The Impact on Your Tax Refund

The number of allowances claimed directly impacts the size of your tax refund (or the amount you owe). Claiming zero allowances means your employer withholds the maximum amount of tax from your paycheck. This often leads to a larger refund (or a smaller tax bill) at the end of the year. However, it also means you have less disposable income throughout the year. Conversely, claiming one or more allowances means less tax withheld, resulting in more money in your paycheck each pay period. This can be beneficial for budgeting and cash flow, but it might lead to owing more taxes at tax time. The best choice depends on your personal financial goals and risk tolerance.

This content may interest you! What are the different types of taxes?

What are the different types of taxes?- A larger refund can provide a financial cushion, but it represents a tax-free loan to the government throughout the year.

- Having more disposable income throughout the year can alleviate financial stress and improve budgeting capabilities.

- Carefully weighing the pros and cons of each approach is vital for making an informed decision that aligns with personal financial objectives.

Using the IRS Withholding Calculator

The IRS provides a helpful withholding calculator that can assist you in determining the appropriate number of allowances to claim. This online tool takes into account various factors, such as your income, filing status, deductions, and credits, providing a more accurate estimate of your tax liability. Using this calculator can minimize the risk of underpaying or overpaying your taxes, potentially saving you time and money. It's strongly recommended to utilize this resource before making a decision about how many allowances to claim. Regular review of your withholding, perhaps annually, ensures it remains aligned with your circumstances. Changes in your income, family status, or deductions should prompt a recalculation.

- The IRS withholding calculator is a free and readily accessible online tool.

- Accurate input of personal information is crucial for reliable results from the calculator.

- Periodically reviewing and updating your withholding information can ensure optimal tax planning throughout the year.

What is the 90% rule for taxes?

The 90% Rule for Taxes

This content may interest you! How do I recover from so much debt?

How do I recover from so much debt?There is no formally established "90% rule" in tax law. The term is often used informally to describe a general guideline or heuristic, not a legal requirement. It suggests that taxpayers should aim to have approximately 90% of their anticipated tax liability withheld or paid through estimated taxes throughout the year to avoid penalties for underpayment. This isn't a hard and fast rule, and the actual percentage that triggers penalties can vary depending on several factors, such as income level and filing status. Failure to meet this informal threshold may result in penalties, though the exact penalty amount and applicability depend on the specifics of the taxpayer's situation. The IRS provides detailed instructions and calculations to help taxpayers determine the appropriate amount to pay throughout the year to avoid penalties.

What are the factors influencing the "90% rule"?

Several factors can influence whether a taxpayer needs to pay 90% of their tax liability to avoid penalties. These factors are crucial to understanding the nuances involved and avoiding potential penalties.

- Income Level: Higher-income taxpayers generally have higher tax liabilities, so they need to pay a larger portion of their anticipated liability in advance to avoid underpayment penalties.

- Filing Status: A taxpayer's filing status (single, married filing jointly, etc.) impacts their tax bracket and ultimately how much they owe, influencing the amount they need to withhold or pay quarterly.

- Significant Tax Changes: If a taxpayer anticipates substantial changes in their income or deductions throughout the year, they need to adjust their withholding or estimated tax payments to ensure they are paying enough to avoid penalties. This may involve recalculating estimates and adjusting future payments.

What are the potential penalties for underpayment?

The IRS imposes penalties for underpayment of estimated taxes. These penalties are calculated based on the shortfall compared to what should have been paid and may include interest charges. Understanding these penalties is vital for responsible tax planning.

This content may interest you! What is a tax audit and how can I avoid one?

What is a tax audit and how can I avoid one?- Interest Charges: Interest is charged on underpaid tax amounts, increasing the overall cost of non-compliance.

- Penalty Rate: The penalty rate for underpayment is typically determined by the IRS based on prevailing interest rates.

- Exceptions and Waivers: There are certain circumstances that may exempt taxpayers from underpayment penalties, such as unforeseen events or significant life changes. These exceptions must be appropriately documented and reported to the IRS.

How to calculate and avoid underpayment penalties?

Accurately calculating estimated tax payments is essential to avoid penalties. Taxpayers can use various methods for calculation and should always keep accurate records of their payments. The IRS offers resources to assist in these calculations.

- IRS Form 1040-ES: This form is used for calculating estimated tax payments and helps determine the necessary quarterly payments throughout the tax year.

- Tax Professionals: Consulting a tax professional can provide guidance on accurate estimation and help avoid potential penalties by ensuring compliance with tax laws.

- IRS Publication 505: This publication offers detailed instructions on the calculation of estimated tax payments for various situations and tax brackets.

How do I get the biggest refund on my taxes?

Maximize Your Tax Deductions

The most significant way to increase your tax refund is to maximize your deductions. Deductions reduce your taxable income, leading to a lower tax bill and a larger refund. It's crucial to understand the different types of deductions available to you and meticulously gather all necessary documentation. Remember, the IRS only gives you what you claim, so thoroughness is paramount. Failing to claim eligible deductions leaves money on the table.

This content may interest you! What to do if you are in massive debt?

What to do if you are in massive debt?- Itemized deductions: If your itemized deductions (such as medical expenses, charitable contributions, state and local taxes, mortgage interest) exceed the standard deduction, itemizing will result in a lower taxable income.

- Above-the-line deductions: These deductions are subtracted directly from your gross income before calculating your adjusted gross income (AGI). Examples include contributions to a traditional IRA or student loan interest payments.

- Tax credits: While not directly deductions, tax credits reduce your tax liability dollar-for-dollar, resulting in a larger refund than deductions. Explore tax credits such as the Earned Income Tax Credit (EITC), child tax credit, or education credits.

Accurate Record Keeping and Documentation

Accurate record keeping is the cornerstone of a successful tax return. The IRS requires supporting documentation for all claimed deductions and credits. Without proper documentation, your claims might be rejected, leading to a smaller refund or even an audit. Maintaining organized records throughout the year is essential for a smooth and efficient tax filing process. This meticulousness ensures you don't miss out on any eligible deductions or credits.

- Keep receipts for all eligible expenses: This includes medical bills, charitable donations, business expenses (if self-employed), and home office expenses.

- Maintain a detailed log of income and expenses: Especially important for self-employed individuals or those with significant investment income.

- Use tax software or consult a tax professional: Software can help track expenses and ensure accuracy, while a professional can guide you through complex tax situations and maximize your deductions.

Understanding Tax Laws and Credits

Tax laws are complex and constantly evolving. Staying informed about changes and utilizing all available credits and deductions is crucial for obtaining the largest possible refund. This may involve researching new tax laws, staying updated on IRS announcements, or seeking professional tax advice. Many resources are available to help you navigate the tax system effectively and ensure you are maximizing your deductions and claiming all eligible credits. Misunderstanding tax laws can lead to missed opportunities for significant refunds.

- Review the IRS website regularly for updates and changes to tax laws and credits.

- Consult with a qualified tax professional to ensure you are claiming all eligible deductions and credits.

- Utilize online tax preparation software to ensure compliance and identify potential deductions or credits you may have overlooked.

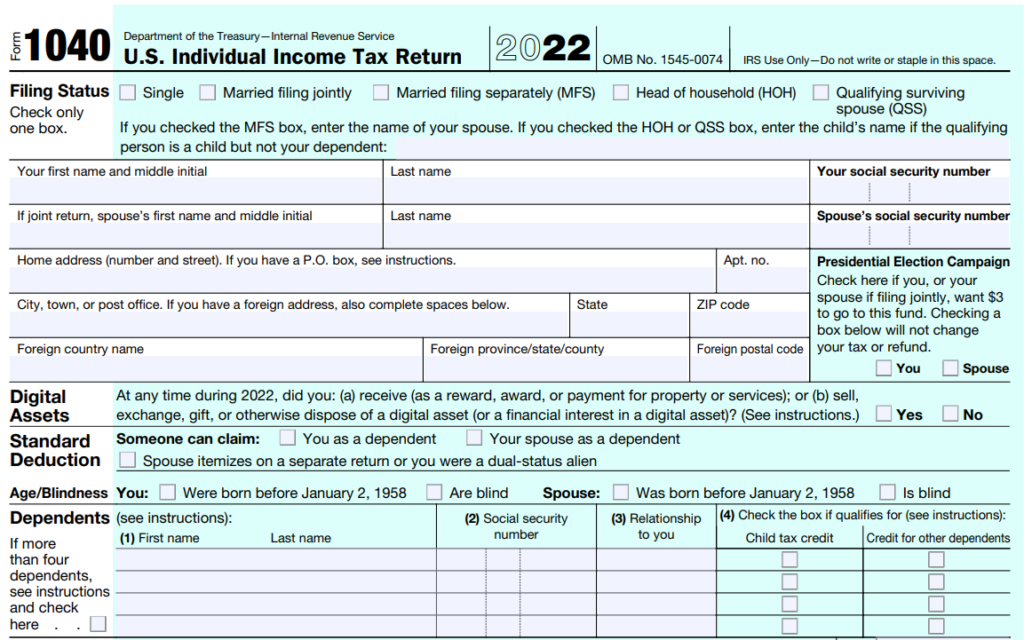

What forms do I need to file my taxes?

The specific forms you need depend on your individual circumstances. Common forms include Form 1040 (U.S. Individual Income Tax Return), W-2 (Wage and Tax Statement), and 1099 forms (for various types of income). You might also need schedules for itemized deductions (Schedule A), capital gains or losses (Schedule D), or self-employment income (Schedule C). The IRS website offers a comprehensive list of forms and instructions, and using tax software often guides you to the correct forms based on your entered information. It's crucial to gather all relevant documents before starting to ensure accuracy.

What if I made a mistake on my tax return?

Mistakes happen, but don't panic. The IRS provides options for correcting errors. For simple mistakes, you can typically file an amended return using Form 1040-X. This form allows you to correct information and recalculate your tax liability. If you significantly underpaid and owe additional taxes, penalties and interest may apply. For more complex situations, or if you're unsure how to proceed, consulting a tax professional is recommended. They can guide you through the amendment process and help prevent future errors.

What are my options if I can't afford to pay my taxes?

If you can't afford to pay your taxes in full, several options are available. You can explore payment plans, which allow you to pay your taxes in installments. Applying for an offer in compromise (OIC) might be possible if you can demonstrate you're unable to pay your tax liability. This involves negotiating a lower amount. You should carefully consider all options and explore the IRS resources dedicated to payment assistance. Early action is crucial, as penalties and interest can accrue quickly. Contacting the IRS directly is also essential to discuss your situation and explore suitable solutions.

Where can I get help filing my taxes?

Several resources are available to assist with tax filing. The IRS website offers extensive information, publications, and forms. Free tax preparation assistance is available through programs like the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) for qualifying taxpayers. Many commercial tax preparation software options provide guidance and support, though some charge a fee. Finally, you can always consult a tax professional, such as a Certified Public Accountant (CPA) or enrolled agent, for personalized guidance and assistance with complex tax situations.

Leave a Reply