How can I legally reduce my taxes?

Navigating the complexities of tax law can be daunting, but understanding legal strategies to minimize your tax burden is crucial for financial well-being. This article explores legitimate avenues for tax reduction, offering insights into deductions, credits, and smart financial planning. We'll delve into maximizing retirement contributions, utilizing tax-advantaged accounts, and understanding the nuances of itemized deductions versus the standard deduction. Learn how to legally lower your tax liability and keep more of your hard-earned money. This guide provides clear, concise information to empower you to make informed financial decisions.

Legally Lowering Your Tax Burden: Strategies and Considerations

Maximize Retirement Contributions

One of the most effective ways to legally reduce your taxes is by maximizing contributions to tax-advantaged retirement accounts. These include 401(k)s, traditional IRAs, and Roth IRAs. Contributions to these accounts are often tax-deductible, meaning the money you contribute isn't taxed immediately. This lowers your taxable income for the current year. The specific rules and contribution limits vary depending on the account type and your income, so it's crucial to understand the regulations and consult a financial advisor to determine the optimal strategy for your individual circumstances. Furthermore, the growth within these accounts often grows tax-deferred or tax-free, providing additional long-term tax advantages.

Claim Eligible Tax Deductions and Credits

The tax code offers numerous deductions and credits designed to incentivize specific behaviors or assist taxpayers in certain situations. Carefully review the IRS instructions to identify deductions you may be eligible for. Common deductions include those for charitable contributions, home mortgage interest, and state and local taxes (subject to limitations). Tax credits, unlike deductions, directly reduce your tax liability dollar-for-dollar, often providing a more significant tax benefit. Examples include the child tax credit, earned income tax credit, and certain education credits. Thoroughly researching and documenting all eligible deductions and credits is essential for minimizing your tax burden. Remember to keep accurate records of all supporting documentation.

Optimize Your Investment Strategies

Strategic investment planning can significantly influence your tax liability. Consider investing in tax-efficient instruments like municipal bonds, which often offer interest income that is exempt from federal taxes. Additionally, understanding the tax implications of capital gains and losses is crucial. You can offset capital gains with capital losses, reducing your overall tax burden. Tax-loss harvesting, a strategy involving selling losing investments to offset gains, can be a powerful tool for minimizing your tax bill, though it requires careful planning and consideration of potential short-term implications. Consulting a qualified financial advisor can help you tailor an investment strategy that optimizes both your tax efficiency and your overall financial goals.

This content may interest you! What expenses can I deduct from my taxes?

What expenses can I deduct from my taxes?| Strategy | Description | Tax Benefit |

|---|---|---|

| Maximize Retirement Contributions | Contribute the maximum allowed to 401(k)s, IRAs, etc. | Reduces taxable income, tax-deferred growth |

| Claim Eligible Deductions & Credits | Identify and claim all applicable tax deductions and credits. | Directly reduces tax liability (credits) or taxable income (deductions). |

| Optimize Investment Strategies | Invest in tax-advantaged instruments, utilize tax-loss harvesting. | Reduces capital gains tax, potentially offers tax-exempt income. |

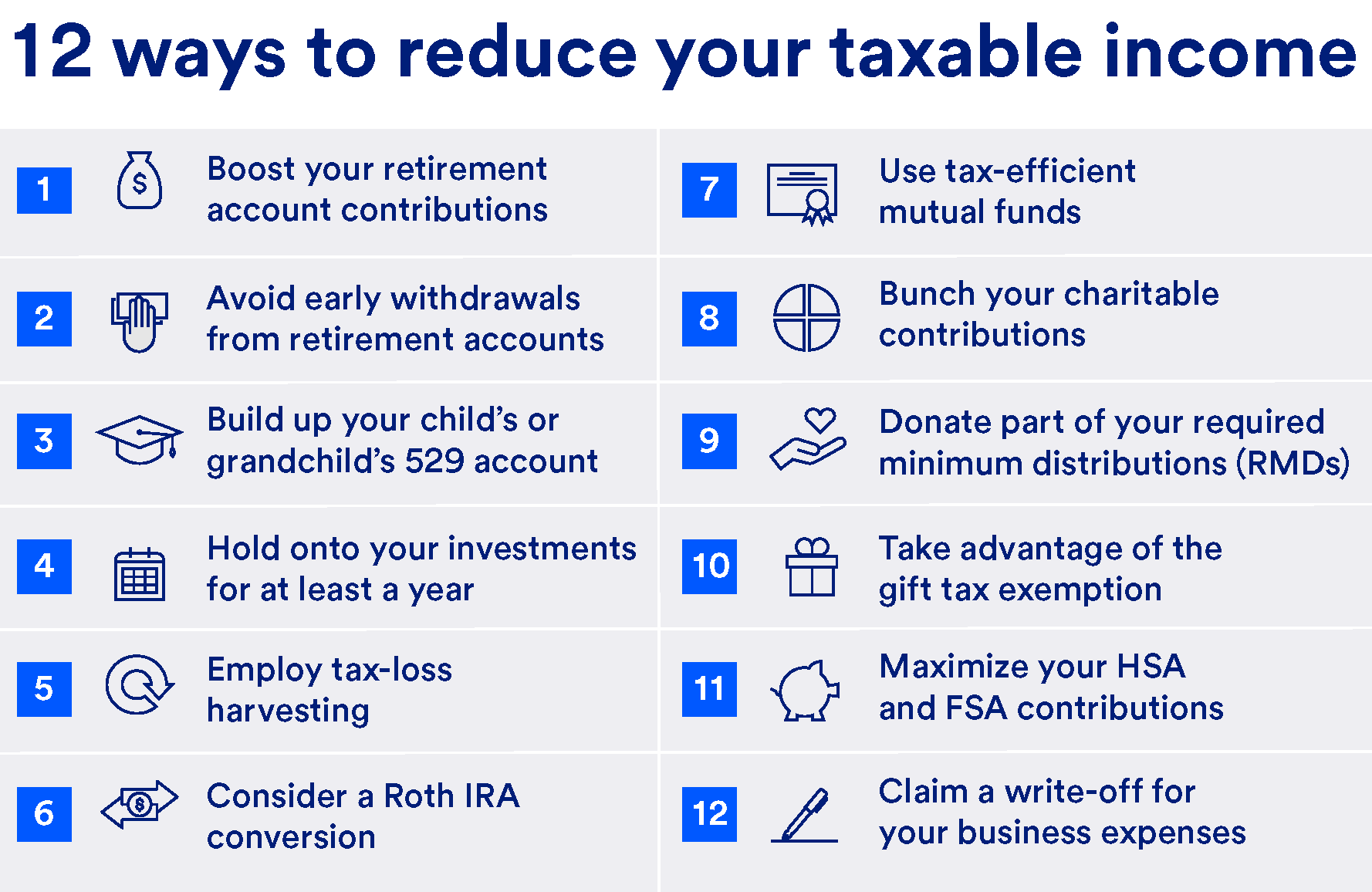

How can I reduce my taxable income legally?

Maximize Retirement Contributions

Contributing to tax-advantaged retirement accounts like 401(k)s and traditional IRAs is one of the most effective ways to reduce your taxable income. Contributions are typically deducted from your gross income before taxes are calculated, lowering your taxable income for the year. The specific contribution limits vary annually, so it's important to check the IRS website for the most up-to-date information. Remember that while you won't pay taxes on the money until retirement, you will need to pay taxes eventually when you withdraw funds in retirement. Different retirement accounts have different tax implications; a financial advisor can help you determine which is best for your situation.

- Traditional 401(k): Offers pre-tax contributions, lowering your current taxable income.

- Traditional IRA: Similar to a 401(k), but often with lower contribution limits.

- Roth IRA: Contributions are made after tax, but withdrawals in retirement are tax-free.

Claiming Tax Deductions and Credits

The tax code offers various deductions and credits that can significantly reduce your tax liability. These are essentially reductions in your taxable income (deductions) or direct reductions in the tax you owe (credits). Itemizing deductions instead of taking the standard deduction can be advantageous if you have significant deductible expenses. Tax credits, such as the child tax credit or earned income tax credit, directly reduce your tax owed and are generally more valuable than deductions. Thoroughly review the IRS publications and consult with a tax professional to identify all applicable deductions and credits you qualify for.

- Itemized Deductions: Mortgage interest, state and local taxes (SALT), charitable contributions, medical expenses exceeding a certain percentage of your income.

- Tax Credits: Child Tax Credit, Earned Income Tax Credit, American Opportunity Tax Credit (for education).

- Consult a Tax Professional: They can help you identify all eligible deductions and credits specific to your situation.

Tax Loss Harvesting

Tax loss harvesting is a strategy used to offset capital gains with capital losses. If you have investments that have decreased in value, you can sell these losing investments to generate a capital loss. This loss can then be used to offset capital gains from investments that have increased in value, thereby reducing your taxable income. There are limitations on how much loss you can deduct each year, and it's crucial to understand the rules around wash sales to avoid penalties. Careful planning is needed to ensure you're maximizing your tax benefits while maintaining your overall investment strategy.

This content may interest you! How do self-employed individuals pay taxes?

How do self-employed individuals pay taxes?- Identify Losing Investments: Review your investment portfolio to identify assets that have decreased in value.

- Offset Capital Gains: Sell the losing investments to generate a capital loss that can offset capital gains.

- Consult a Financial Advisor: A professional can help with strategic tax loss harvesting while keeping your investment goals in mind.

What are the 3 ways you can reduce your taxes deducted?

Reducing Tax Deductions

Maximize Retirement Contributions

Contributing to tax-advantaged retirement accounts like 401(k)s and traditional IRAs lowers your taxable income. These contributions are deducted from your gross income before taxes are calculated, resulting in a lower tax bill. The specific contribution limits vary annually, so it's important to check the IRS guidelines. The benefits extend beyond immediate tax savings; the money grows tax-deferred, meaning you only pay taxes when you withdraw it in retirement. Carefully consider your retirement goals and contribution limits when maximizing these accounts.

- Contribute the maximum allowed to your 401(k) plan.

- Open and contribute to a traditional IRA, even if you already have a 401(k).

- Consider a Roth IRA if your income is below the eligibility limits for tax-free withdrawals in retirement.

Claim Tax Credits

Tax credits directly reduce the amount of tax you owe, unlike deductions which reduce your taxable income. Many tax credits are available for specific situations, such as having children (Child Tax Credit), being a homeowner (Residential Energy Credits), or having significant medical expenses. Research available credits to see which ones apply to your circumstances. It's crucial to gather all necessary documentation to support your claims when filing your taxes. Be aware of eligibility requirements and income limitations for each credit.

This content may interest you! What is tax withholding and how does it affect my paycheck?

What is tax withholding and how does it affect my paycheck?- Carefully review the IRS publication 970, Tax Benefits for Education.

- Investigate the Earned Income Tax Credit (EITC) if you have low to moderate income.

- Explore the Child and Dependent Care Credit if you paid childcare expenses to allow you to work or look for work.

Itemize Deductions

Instead of taking the standard deduction, itemize if your itemized deductions exceed the standard deduction amount. Itemized deductions include things like mortgage interest, state and local taxes (up to a limit), charitable contributions, and medical expenses exceeding a certain percentage of your adjusted gross income. To determine if itemizing is beneficial, you need to carefully calculate both your standard deduction and your itemized deductions. Accurate record-keeping of all qualifying expenses is crucial. Software or a tax professional can assist in calculating and comparing.

- Maintain meticulous records of all charitable donations.

- Track medical expenses throughout the year.

- Keep detailed records of mortgage interest payments and property taxes.

Is there a legal way to pay less taxes?

Legal Ways to Pay Less Taxes

Yes, there are many legal ways to reduce your tax liability. It's important to understand that "reducing taxes" doesn't mean evading taxes, which is illegal. Legally reducing your tax burden involves taking advantage of deductions, credits, and other provisions within the tax code to lower your taxable income. The specific strategies depend heavily on your individual circumstances, including your income level, filing status, and type of income (e.g., salary, business income, investments).

This content may interest you! What happens if I don’t pay my taxes?

What happens if I don’t pay my taxes?Tax Deductions

Tax deductions reduce your taxable income, thus lowering the amount of taxes you owe. They are subtractions from your gross income, not subtractions from your tax liability itself (like tax credits). There are many types of deductions available, and some are more valuable than others. To effectively utilize deductions, meticulous record-keeping is crucial.

- Itemized Deductions vs. Standard Deduction: Choosing between itemizing deductions and taking the standard deduction is a critical decision. Itemizing requires listing individual deductions, while the standard deduction provides a fixed amount. The choice depends on which will lead to a lower taxable income.

- Common Deductions: Many deductions are available, including those for charitable contributions, mortgage interest (homeowners), state and local taxes (subject to limitations), and business expenses (for self-employed individuals).

- Home Office Deduction: If you have a dedicated workspace in your home used exclusively for business, you might be able to deduct a portion of your home-related expenses, such as rent, utilities, and depreciation.

Tax Credits

Tax credits directly reduce the amount of tax you owe, dollar for dollar. They're far more valuable than deductions because they provide a more significant tax reduction. Credits are generally targeted toward specific taxpayers or situations, such as families with children or those investing in renewable energy.

- Child Tax Credit: This is a substantial credit for families with qualifying children. The amount of the credit can depend on the child's age and the family's income.

- Earned Income Tax Credit (EITC): This credit is available to low-to-moderate-income working individuals and families. It can significantly reduce or eliminate their tax liability.

- Other Credits: Numerous other credits exist, including those for education expenses, adoption expenses, and renewable energy investments. Eligibility requirements vary.

Tax Planning Strategies

Proactive tax planning involves implementing strategies throughout the year, not just at tax time. This proactive approach aims to minimize your tax burden over the long term. This frequently includes careful consideration of investment choices, retirement planning, and business structures.

- Retirement Savings: Contributions to tax-advantaged retirement accounts, such as 401(k)s and IRAs, can reduce your taxable income in the present and defer tax liability until retirement.

- Tax-Loss Harvesting: This strategy involves selling losing investments to offset capital gains, thus reducing your capital gains tax liability.

- Choosing the Right Business Structure: The structure of your business (sole proprietorship, partnership, LLC, S corporation, C corporation) significantly impacts your tax liability. Careful consideration of the tax implications is vital when choosing a business structure.

What are the illegal ways to reduce taxes?

:max_bytes(150000):strip_icc()/tax_avoidance.asp-Final-9d7e3d82dc5c4ce293256ff9d548494d.png)

How do capital gains taxes work?

How do capital gains taxes work?Illegal Tax Reduction Methods

Tax Evasion Through Concealment of Income

Tax evasion through the concealment of income involves actively hiding or misrepresenting income to reduce the amount of tax owed. This can be done in various ways, often involving sophisticated schemes to avoid detection by tax authorities. The penalties for tax evasion are severe, including hefty fines and potential imprisonment.

- Underreporting income from various sources, such as wages, investments, or business activities.

- Using offshore accounts or shell corporations to hide assets and income from tax authorities.

- Failing to report income from illegal activities such as drug trafficking or gambling.

Inflating Deductions and Expenses

Inflating deductions and expenses is another common method of illegal tax reduction. This involves falsely claiming deductions or expenses that are not legitimate, in an attempt to lower taxable income. The act of exaggerating legitimate expenses is also considered illegal. Tax authorities scrutinize deductions closely, and inconsistencies can lead to investigations and penalties.

- Claiming personal expenses as business expenses.

- Overstating the value of charitable donations or losses.

- Fabricating or altering receipts and invoices to support false claims.

Filing False or Fraudulent Tax Returns

Filing false or fraudulent tax returns encompasses a broad range of illegal activities aimed at deceiving the tax authorities. This can include providing false information on tax forms, using false identities, or submitting entirely fabricated returns. The consequences for this are extremely serious.

This content may interest you! How do I clear my bank debt?

How do I clear my bank debt?- Providing false information regarding income, deductions, or credits.

- Using a stolen identity to file a fraudulent return.

- Submitting a return with intentionally false or misleading information to claim a refund.

What deductions can I claim to lower my taxable income?

Several deductions can significantly reduce your taxable income. Common deductions include those for charitable contributions (up to a certain percentage of your adjusted gross income), mortgage interest (if you itemize), state and local taxes (subject to limitations), and health savings account (HSA) contributions. Remember to keep meticulous records of all expenses to support your deductions. Consult a tax professional or utilize tax software to ensure you're claiming all eligible deductions and following current IRS guidelines. Incorrectly claiming deductions can lead to penalties.

Can I contribute to a retirement account to lower my tax burden?

Yes, contributing to tax-advantaged retirement accounts like a 401(k) or IRA can substantially reduce your current year's taxable income. Contributions to traditional 401(k)s and IRAs are often tax-deductible, meaning the money you contribute isn't taxed until you withdraw it in retirement. Roth IRAs offer tax-free withdrawals in retirement, but contributions aren't tax-deductible. Contribution limits exist, so check the IRS website for the most up-to-date information. Understanding the differences between traditional and Roth accounts is crucial to maximizing tax advantages.

Are there any tax credits I can claim to reduce my tax liability?

Tax credits directly reduce the amount of tax you owe, offering a more significant benefit than deductions. Several credits are available, such as the child tax credit (for qualifying children), the earned income tax credit (for low-to-moderate-income taxpayers), and the American opportunity tax credit (for qualified education expenses). Eligibility requirements vary for each credit, so carefully review the IRS guidelines to determine if you qualify. Incorrectly claiming a credit could result in penalties or a requirement to repay the credit.

How can I plan ahead to minimize my taxes in future years?

Effective tax planning involves proactive strategies throughout the year, not just during tax season. This includes regularly reviewing your tax bracket and adjusting your withholding to optimize your paycheck deductions. Consider tax-loss harvesting to offset capital gains. Consult with a financial advisor or tax professional to create a long-term tax strategy tailored to your specific financial situation and goals. Regularly reviewing your financial situation and adjusting your strategy as needed ensures you stay on top of tax planning throughout the year and minimize your tax burden.

Leave a Reply