How do capital gains taxes work?

Understanding capital gains taxes is crucial for anyone who invests or sells assets. This article demystifies the complexities of capital gains taxation. We'll explore the different types of capital gains (short-term and long-term), how they're calculated, and the applicable tax rates. We'll also examine relevant deductions and exemptions, providing a comprehensive overview to help you navigate this important aspect of personal finance. Whether you're a seasoned investor or just starting out, this guide will provide the clarity you need to effectively manage your capital gains tax liability.

Understanding Capital Gains Taxes: A Comprehensive Guide

What are Capital Gains?

Capital gains are the profits you make from selling an asset for more than you paid for it. This asset can be almost anything of value, including stocks, bonds, real estate, collectibles, or even cryptocurrency. It's crucial to understand that only the profit is taxed, not the entire sale price. For example, if you buy a stock for $100 and sell it for $150, your capital gain is $50. The amount of tax you owe depends on several factors, including the type of asset, how long you held it, and your income bracket. Different rules and tax rates apply to various assets and holding periods, influencing the final tax liability.

Short-Term vs. Long-Term Capital Gains

The length of time you own an asset before selling it significantly impacts your tax liability. Short-term capital gains are profits from assets held for one year or less. These are taxed at your ordinary income tax rate, which can be substantially higher than the rates for long-term gains. Long-term capital gains, on the other hand, are profits from assets held for more than one year. These are taxed at preferential rates that are generally lower than your ordinary income tax rate. These preferential rates vary depending on your taxable income, and understanding this distinction is vital for effective tax planning and minimizing your tax burden.

Calculating and Reporting Capital Gains

Calculating capital gains involves subtracting your basis (original cost) from the proceeds (amount received from the sale). This difference represents your capital gain. You then need to determine whether it's a short-term or long-term gain to apply the correct tax rate. For various assets like stocks, you might receive a Form 1099-B from your broker reporting the proceeds and basis. You must accurately report all capital gains and losses on your annual tax return, usually Schedule D (Form 1040). Failing to accurately report capital gains can result in penalties and interest from the tax authorities. Keeping detailed records of all your asset purchases and sales is essential for accurate tax reporting.

This content may interest you! What is a tax audit and how can I avoid one?

What is a tax audit and how can I avoid one?| Type of Capital Gain | Holding Period | Tax Rate |

|---|---|---|

| Short-Term | One year or less | Your ordinary income tax rate |

| Long-Term | More than one year | Preferential rates (vary by income bracket) |

How do I avoid capital gains on my taxes?

Avoiding Capital Gains Taxes

There's no way to completely avoid capital gains taxes legally if you sell an asset for a profit. However, you can reduceyour tax liability through various strategies. These strategies aim to minimize the taxable gain, defer the tax to a later date, or take advantage of legal deductions and exclusions. The effectiveness of each strategy depends on your individual circumstances, the type of asset sold, and the length of time you held it. It's crucial to consult with a qualified tax professional to determine the best approach for your specific situation.

Tax-Loss Harvesting

Tax-loss harvesting involves selling assets that have lost value to offset capital gains from other investments. This strategy allows you to reduce your overall taxable capital gains. For example, if you have a $10,000 capital gain from selling stock A and a $5,000 capital loss from selling stock B, you can reduce your taxable capital gain to $5,000. There are limitations on the amount of losses you can deduct annually, and the rules surrounding wash sales (rebuying a substantially identical asset shortly after selling it at a loss) must be carefully considered.

This content may interest you! How do property taxes work?

How do property taxes work?- Identify assets that have decreased in value.

- Sell these assets to realize the capital loss.

- Use the loss to offset capital gains, up to the annual limit.

Gifting Assets

Gifting appreciated assets to others can potentially reduce your capital gains tax liability. The recipient will inherit the asset's cost basis, which is the original purchase price, at the time of the gift, potentially avoiding capital gains taxes altogether. This requires careful consideration of gift tax rules and annual gift tax exclusions. There are limits to how much you can gift each year without incurring gift tax, and significant gifts could have estate tax implications down the line. The best approach needs a professional analysis.

- Understand the annual gift tax exclusion.

- Consider the recipient's future tax liability.

- Consult with a tax advisor to ensure compliance with gift tax rules.

Strategic Asset Allocation and Holding Periods

Careful planning of your investment portfolio can affect your capital gains taxes. Holding assets that qualify for long-term capital gains treatment (generally held for more than one year) can result in lower tax rates compared to short-term gains. Diversifying your portfolio can also reduce your exposure to significant gains in any one asset. This requires understanding the different types of capital gains and their associated tax rates.

- Invest in assets eligible for long-term capital gains rates.

- Diversify your portfolio to reduce risk and tax concentration in a single asset.

- Re-evaluate your portfolio regularly to adjust your asset allocation strategy based on performance and tax implications.

How do you calculate capital gains tax?

Capital Gains Tax Calculation

This content may interest you! What is sales tax and why do I pay it?

What is sales tax and why do I pay it?Calculating capital gains tax involves several steps and depends heavily on your specific circumstances and the tax laws of your jurisdiction. Generally, it involves determining the capital gain, subtracting any allowable deductions, and then applying the appropriate tax rate. The process is not always straightforward, and professional advice may be necessary for complex situations. The following steps provide a general overview:

Determining Your Capital Gain

The first step is to figure out how much profit you made from selling the asset. This is your capital gain. To calculate this, you subtract your adjusted basis from your selling price. Your adjusted basis is your original cost plus any improvements made to the asset. For example, if you bought a stock for $100 and sold it for $150, your capital gain is $50. However, there are some important considerations:

- Selling Price: This is the amount you received from the sale, less any selling fees or commissions.

- Adjusted Basis: This includes the original purchase price, plus any capital improvements (like renovations to a house), and less any depreciation (for assets used in a business). Be sure to accurately document all costs associated with the asset.

- Capital Gain: This is the difference between the selling price and your adjusted basis. A loss occurs if the adjusted basis is greater than the selling price.

Identifying the Type of Capital Gain

Capital gains are categorized differently based on how long you owned the asset. This significantly impacts the tax rate applied. The typical categories are short-term and long-term capital gains. Short-term gains are those from assets held for one year or less, while long-term gains are from assets held for more than one year. The tax rates vary widely and are dependent on your taxable income bracket. This means a higher income will lead to higher taxes on capital gains, even on long-term gains. The specific tax brackets and rates will be determined by your country’s tax legislation. It's important to confirm the exact rates applicable in your jurisdiction, as they frequently change.

- Short-Term Capital Gains: Taxed at your ordinary income tax rate.

- Long-Term Capital Gains: Taxed at preferential rates, generally lower than ordinary income tax rates.

- Tax Brackets: The tax rate applied to your long-term capital gains will depend on your overall taxable income. Higher income typically leads to higher tax rates on capital gains.

Calculating Your Tax Liability

Once you've determined your capital gain and its type (short-term or long-term), you can calculate your tax liability. This involves multiplying your capital gain by the applicable tax rate. Remember, this is simplified and doesn't account for deductions or other potential tax credits or offsets. Various deductions or credits might be available which can further reduce your tax liability. These deductions might include capital losses from other investments or specific tax breaks offered by your country's tax code. These factors could significantly affect the final tax owed and can make the process significantly more complex. Consulting a tax professional is highly recommended for accurate calculation.

This content may interest you! How do estate and inheritance taxes work?

How do estate and inheritance taxes work?- Applicable Tax Rate: Find the correct tax rate based on your income bracket and the type of capital gain (short-term or long-term).

- Tax Calculation: Multiply your capital gain by the applicable tax rate to determine your tax liability.

- Deductions and Credits: Explore any available deductions or tax credits that could reduce your overall tax burden. These can be complex and vary significantly depending on location and circumstance.

How much capital gains can I make before paying taxes?

Capital Gains Tax

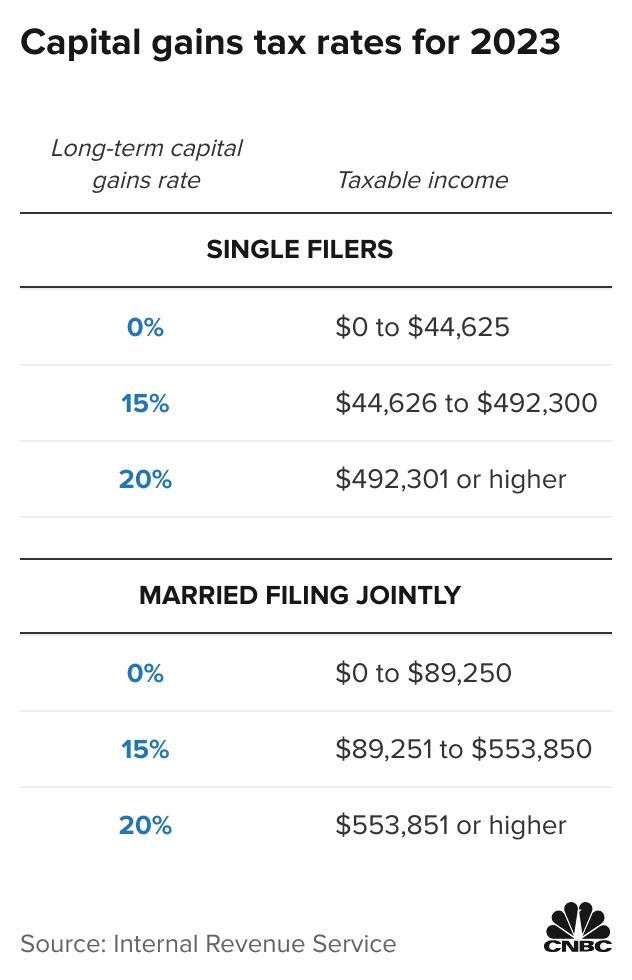

The amount of capital gains you can make before paying taxes depends entirely on your filing status, your taxable income (including the capital gains), and the applicable tax rates in your jurisdiction. There's no single dollar amount that applies universally. The US tax system, for instance, uses a progressive tax system for capital gains, meaning the tax rate increases as your income increases. Moreover, the holding period of the asset (short-term vs. long-term) significantly impacts the tax rate. Short-term capital gains are taxed at your ordinary income tax rate, while long-term capital gains have lower rates, but these rates still vary based on your income bracket. In short, you'll pay taxes on capital gains above a certain threshold, and that threshold is dependent on your personal financial situation and the tax laws where you reside.

Capital Gains Tax Rates

Capital gains tax rates in the United States are dependent on your taxable income and the length of time you held the asset. The longer you hold the asset (generally, one year or more), the lower the tax rate will be, assuming it qualifies as a long-term capital gain. However, even long-term capital gains are subject to a progressive tax system, meaning higher income brackets face higher tax rates. It's crucial to consult the current IRS tax brackets to understand your specific tax rate. It’s important to remember that tax laws change, so staying updated is critical.

This content may interest you! How can I file my taxes correctly?

How can I file my taxes correctly?- Long-term capital gains tax rates are lower than short-term rates.

- Tax rates are progressive, meaning higher income leads to higher rates.

- Taxable income includes all sources of income, not just capital gains.

The Role of Taxable Income

Your total taxable income significantly influences how much you owe in capital gains taxes. It's not just the capital gains themselves; other sources of income, such as wages, salaries, interest, and dividends, are also included in your taxable income. The higher your total taxable income from all sources, the higher your tax bracket, and therefore the higher the tax rate on your capital gains. This means that even if your capital gains are relatively low, you could still find yourself in a higher tax bracket due to your other income streams.

- Taxable income is the sum of all income, including capital gains.

- A higher taxable income results in a higher tax bracket and higher tax rates.

- Consult a tax professional to accurately calculate your taxable income.

Standard Deduction and Other Deductions

The standard deduction and other potential deductions (such as itemized deductions) can affect your taxable income and, consequently, the amount of capital gains you can make before paying taxes. The standard deduction is a flat amount that reduces your taxable income. Itemized deductions, on the other hand, allow you to deduct specific expenses from your income. By reducing your taxable income, these deductions can lower your overall tax liability, effectively increasing the amount of capital gains you can realize before entering a higher tax bracket. However, it is essential to understand the rules and limitations associated with these deductions.

- The standard deduction reduces your taxable income.

- Itemized deductions can further reduce your taxable income.

- Consult a tax professional to determine which deductions apply to your situation.

At what age do you not pay capital gains?

Capital Gains Tax and Age

This content may interest you! How can I legally reduce my taxes?

How can I legally reduce my taxes?There is no age at which you automatically do not pay capital gains taxes in the United States or most other countries. Capital gains taxes are triggered by the sale of an asset for a profit, and the tax liability depends on the amount of profit realized, your income level, and the length of time you held the asset (long-term vs. short-term capital gains). Your age has no bearing on whether or not you owe capital gains tax; only the sale of an asset at a profit does. Tax laws and regulations vary across different countries, so it is always essential to consult the specific rules of your country of residence.

Capital Gains Tax Rates and Income Brackets

Capital gains tax rates are generally progressive, meaning higher profit levels are taxed at higher rates. The specific rates depend on your taxable income and the holding period of the asset (long-term gains are usually taxed at lower rates than short-term gains). However, even if you are in a lower income bracket, any profit from selling an asset will still be subject to capital gains tax. The amount you owe, however, will depend on which tax bracket you fall into.

- Tax rates vary by income level, creating different tax brackets.

- Long-term capital gains (assets held for more than one year) usually have lower tax rates than short-term capital gains.

- It's essential to consult the IRS (or the relevant tax authority in your country) for the most up-to-date tax brackets and rates.

Exemptions and Deductions

While there's no age-based exemption from capital gains tax, several other factors can reduce your tax burden. These deductions and exemptions might decrease the amount of capital gains tax you eventually owe, but they don't eliminate it altogether. Understanding these provisions is crucial for proper tax planning.

- Certain types of assets may qualify for tax-advantaged treatment (e.g., some retirement accounts).

- There are limitations on capital losses that can be used to offset capital gains in a given year.

- Tax professionals can help determine eligibility for available deductions and exemptions.

The Importance of Tax Planning

Regardless of age, effective tax planning is essential when dealing with capital gains. This includes understanding the tax implications of different investment strategies, timing the sale of assets strategically, and potentially utilizing tax-loss harvesting to minimize your overall tax liability. Proactive planning can significantly impact the amount of capital gains tax you ultimately pay.

This content may interest you! What is the best app to save your money?

What is the best app to save your money?- Consult with a qualified tax advisor or financial planner to develop a personalized tax strategy.

- Keep detailed records of all your asset transactions for accurate tax reporting.

- Stay updated on changes in tax laws and regulations to ensure compliance.

What are capital gains?

Capital gains are the profits you make from selling an asset for more than you paid for it. These assets can include stocks, bonds, real estate, or collectibles. The tax you owe depends on several factors, including the type of asset, how long you owned it (short-term or long-term), and your overall income. Short-term gains are taxed at your ordinary income tax rate, while long-term gains have different, usually lower, tax rates. Understanding the distinction between short-term and long-term capital gains is crucial for proper tax planning.

What is the difference between short-term and long-term capital gains?

The difference lies in how long you held the asset before selling it. Short-term capital gains are profits from assets held for one year or less. These are taxed at your ordinary income tax rate, which can be significantly higher than the rates for long-term gains. Long-term capital gains are profits from assets held for more than one year. The tax rates for long-term gains are generally lower and vary depending on your taxable income bracket. Properly categorizing your gains is essential for accurate tax calculations.

How are capital gains taxes calculated?

Calculating capital gains taxes involves determining your profit (selling price minus purchase price and any relevant expenses), identifying whether it's short-term or long-term, and applying the appropriate tax rate. The tax rate depends on your income level and the holding period. You'll report these gains on Schedule D (Form 1040) of your annual tax return. Tax software or professional tax advice can be helpful in accurately calculating your capital gains tax liability, especially in complex situations involving multiple assets and transactions.

Are there any capital gains tax exemptions or deductions?

Several exemptions and deductions can reduce your capital gains tax liability. For example, the exclusion for the sale of a primary residence can protect a significant portion of your profit from taxation, subject to certain conditions. There may also be deductions for capital losses, which can offset gains. It's crucial to consult tax laws and regulations or seek professional advice to explore potential exemptions and deductions applicable to your specific situation. Tax laws are complex and change regularly, so staying informed is important.

Leave a Reply