How do property taxes work?

Property taxes, a significant source of revenue for local governments, can seem confusing. This article demystifies the process, explaining how these taxes are assessed, calculated, and collected. We'll cover key terms like assessed value, tax rate, and mill rate, exploring how they interact to determine your annual property tax bill. Understanding these mechanisms is crucial for homeowners and prospective buyers alike, allowing for informed budgeting and property investment decisions. We'll also delve into potential exemptions and appeals processes, empowering you to navigate the system effectively.

How Property Taxes are Assessed and Calculated

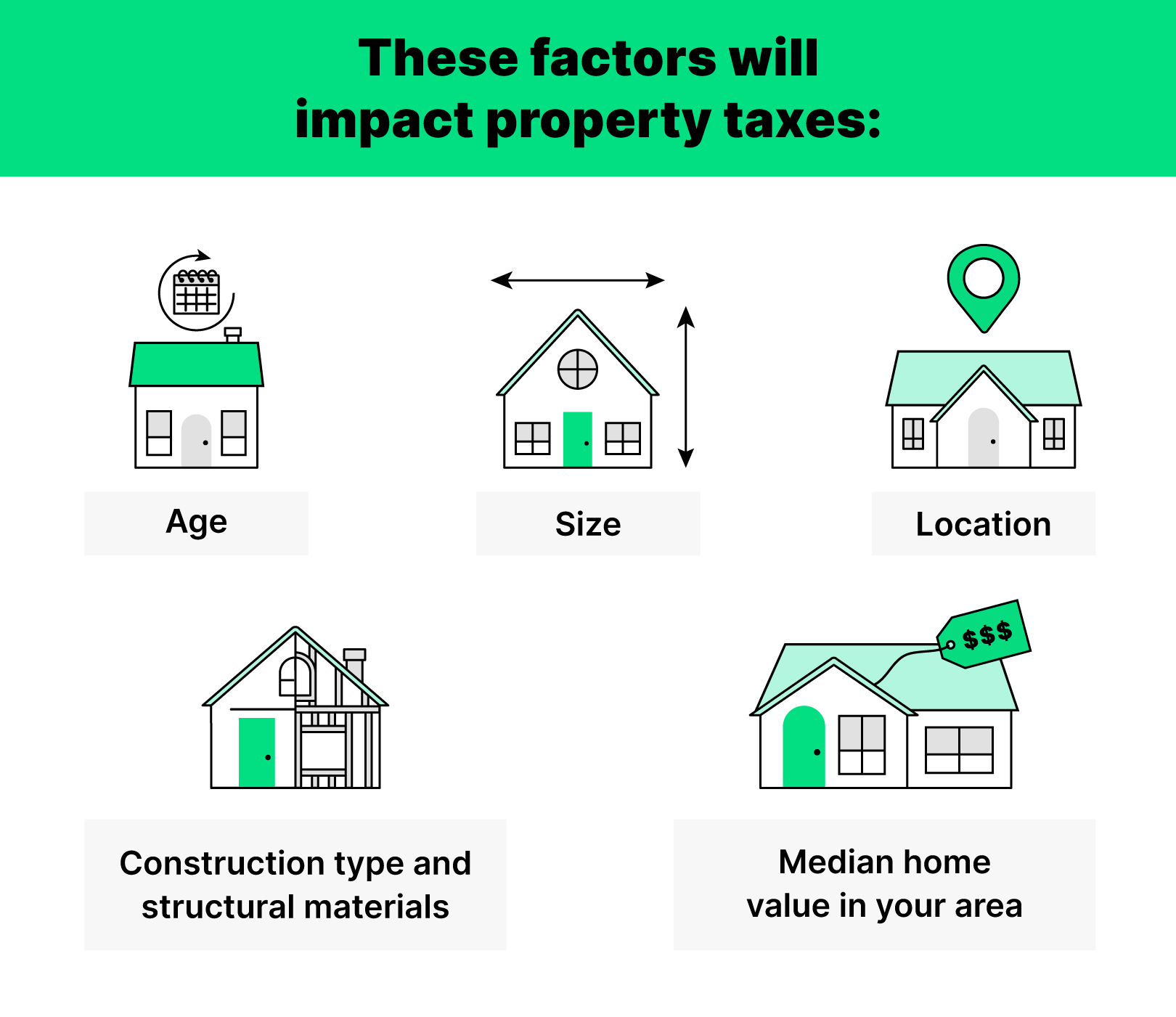

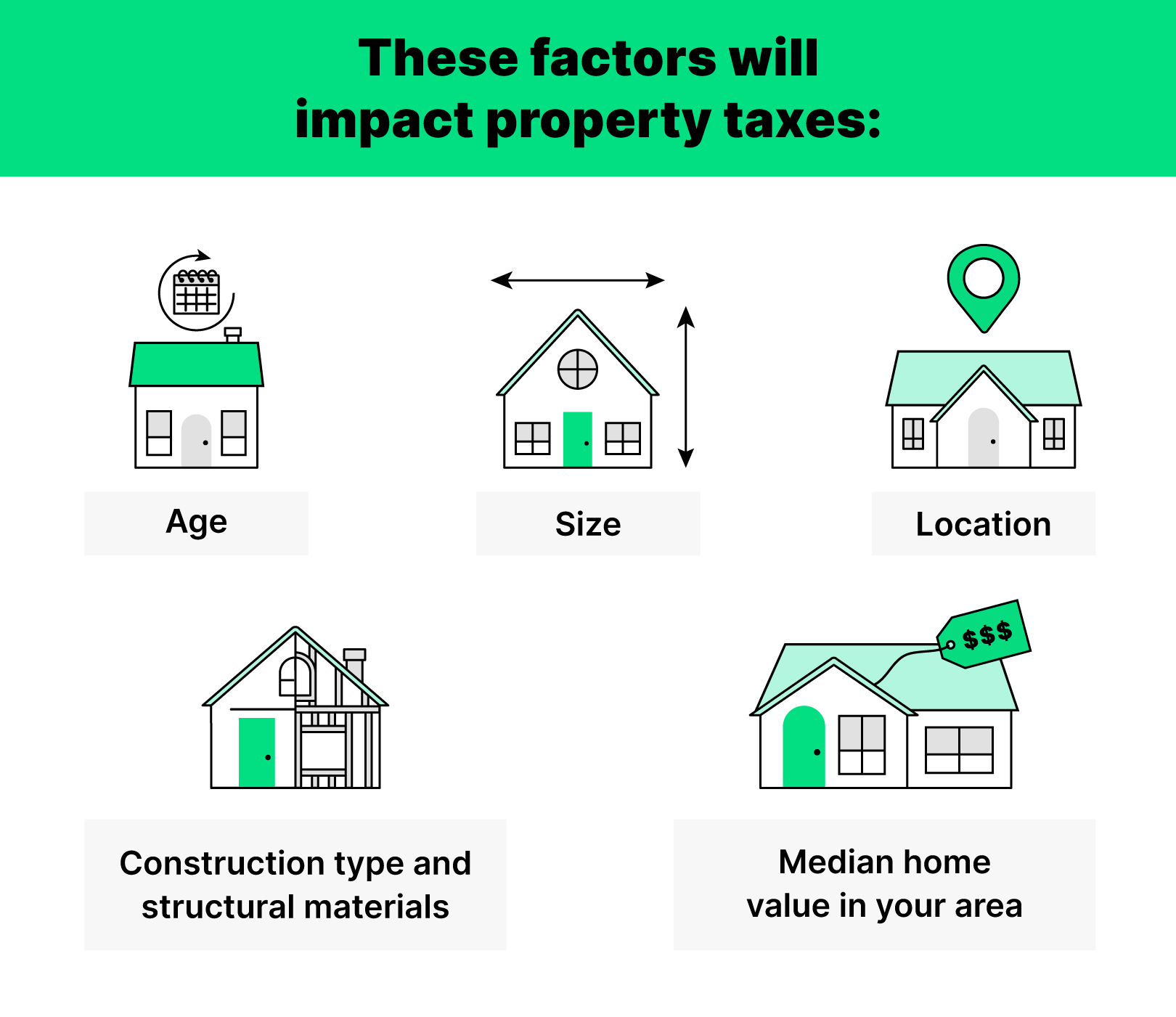

Property taxes are a significant source of revenue for local governments, funding essential services like schools, public safety, and infrastructure. The process of determining your property tax bill involves several key steps. First, your property is assessed by the local government. This assessment involves determining the fair market value of your property, which is essentially what someone would realistically pay for it in the current market. This value is often based on recent comparable sales of similar properties in your area, taking into account factors like size, location, condition, and amenities. The assessed value is then multiplied by the mill rate (also known as the tax rate), which is a figure set by the local government and varies based on budgetary needs. This calculation results in your annual property tax liability. It’s important to note that the assessed value is not necessarily the same as your property's purchase price, and you may have the right to appeal the assessment if you believe it's inaccurate.

What Factors Influence Property Tax Rates?

Property tax rates are influenced by a variety of factors, primarily the budgetary needs of local governments. If a municipality needs to increase spending on schools, public services, or infrastructure improvements, it will likely raise the tax rate to cover the increased costs. Additionally, the overall economic health of the region plays a role. Areas experiencing rapid economic growth might see property values increase, thus increasing the tax base and potentially allowing for lower tax rates, even with increased spending. Conversely, areas experiencing economic downturns might face higher rates to maintain services, even with stagnant or declining property values. The tax structure itself can also impact rates; some jurisdictions use a progressive system where higher-valued properties are taxed at a higher rate, while others use a flat rate system. Finally, state laws and regulations often impose limits or requirements on local governments' ability to raise property taxes.

How are Property Taxes Paid and What Happens if I Don't Pay?

Property taxes are typically paid annually or semi-annually, depending on the local jurisdiction’s requirements. Payment methods vary, but common options include mailing a check, paying online, or paying in person at the tax collector's office. Failure to pay property taxes can have serious consequences. The most immediate consequence is typically a lien placed on your property, meaning the government has a legal claim to it until the taxes are paid. Delinquent taxes can accumulate penalties and interest, significantly increasing the amount owed. In severe cases of non-payment, the government may initiate foreclosure proceedings, leading to the sale of your property to recover the outstanding taxes. It's crucial to understand your local payment deadlines and make arrangements to pay on time to avoid these penalties.

Who Pays Property Taxes?

Property taxes are typically paid by the owner of the property, whether that's an individual homeowner, a business, or a landlord. However, in some cases, the responsibility for paying property taxes might be shared or passed on. For example, in a rental agreement, the lease agreement may specify whether the landlord or tenant is responsible for paying property taxes. Furthermore, property tax deductions can affect who bears the actual burden, as these deductions allow homeowners to reduce their taxable income and potentially lower their income tax liability. Understanding who bears the responsibility for property taxes is crucial for both property owners and tenants.

This content may interest you! What is sales tax and why do I pay it?

What is sales tax and why do I pay it?| Term | Definition |

|---|---|

| Assessed Value | The value placed on a property by the local government for tax purposes. |

| Fair Market Value | The price a property would likely sell for in a competitive market. |

| Mill Rate | The tax rate expressed as dollars per $1,000 of assessed value. |

| Property Tax Liability | The total amount of property taxes owed. |

| Lien | A legal claim on a property to secure payment of a debt. |

How do taxes work on a house?

Property Taxes

Property taxes are levied annually on the assessed value of your house by your local government (county or municipality). The assessed value is generally lower than the market value, but it's still a significant amount. The tax rate varies widely based on your location and the services provided by your local government (schools, fire departments, police, etc.). These taxes are a major source of revenue for local governments and are used to fund essential public services.

- Assessed Value: This is the value your local government assigns to your property for tax purposes. It's usually determined by a tax assessor, who may consider recent sales of comparable properties in your area.

- Tax Rate (Millage Rate): This is expressed as a rate per $1,000 of assessed value. A higher millage rate means higher taxes.

- Payment Schedule: Property taxes are typically due annually, or sometimes semi-annually, according to a schedule set by your local government. Failure to pay can result in penalties and even foreclosure.

Capital Gains Tax

Capital gains tax applies when you sell your house for a profit. The profit is the difference between the sale price and your adjusted basis (the original purchase price plus any capital improvements). However, the US offers a significant exclusion for capital gains from the sale of a primary residence. This exclusion allows you to exclude a certain amount of profit from being taxed, which can be substantial, depending on the filing status and other factors. This is designed to help homeowners avoid a large tax burden when selling a home they've lived in for an extended period.

- Exclusion Amount: The amount of profit you can exclude depends on your filing status and the length of time you owned and lived in the house. For example, married couples may be able to exclude up to $500,000 of profit, while single filers might be able to exclude up to $250,000.

- Holding Period: To qualify for the full capital gains exclusion, you must have owned and lived in the house for at least two of the five years preceding the sale.

- Improvements: Costs of substantial improvements to the house (like adding a room or replacing a roof) increase your basis and thus reduce the amount of profit that is taxable.

Property Transfer Taxes

Some jurisdictions impose a property transfer tax, also known as a conveyance tax or deed tax, upon the sale of a house. This tax is typically a one-time payment made when the ownership of the property changes hands. The amount due is calculated as a percentage of the sale price, and the rate can vary significantly across states and even within counties. This tax is paid by either the buyer or the seller, depending on the local laws and the agreement between the parties involved in the transaction.

- Tax Rate: The tax rate varies depending on location. It could be a fixed amount or a percentage of the sale price.

- Who Pays: Whether the buyer or seller pays the transfer tax is generally specified in local laws and the purchase agreement.

- Exemptions: Some jurisdictions may offer exemptions for certain types of transactions, such as transfers between family members.

How is Texas property tax calculated?

How do estate and inheritance taxes work?

How do estate and inheritance taxes work?Texas Property Tax Calculation

How is Texas Property Tax Calculated?

Texas property taxes are calculated based on the appraised value of your property and the tax rates set by various taxing entities within your jurisdiction. The process involves several steps, starting with the appraisal of your property by the local appraisal district. This appraisal determines the market value of your property as of January 1st of the tax year. This appraised value is then used to calculate your taxable value, which might be different depending on exemptions and limitations. This taxable value is then multiplied by the combined tax rates of all the taxing entities that have jurisdiction over your property (this usually includes the county, city, school district, and potentially others). The result is your total property tax bill. It's important to note that tax rates are expressed as dollars per $100 of assessed value, allowing for straightforward calculations. Late payment penalties and interest are added if the taxes are not paid by the deadline.

Market Value Appraisal

The foundation of Texas property tax calculation lies in the market value appraisal conducted by the local appraisal district. Appraisers use various methods, including comparable sales analysis, income approaches, and cost approaches, to determine the most probable price your property would sell for on the open market. This is a crucial step as it directly impacts the amount of property taxes you will owe. The appraisal district provides you with a notice of appraised value, allowing you to contest the valuation if you believe it’s inaccurate. This process ensures a fair and transparent determination of your property's worth.

- Comparable Sales Analysis: This method compares your property to recently sold similar properties in your area, considering factors such as size, location, features, and condition.

- Income Approach: This is most commonly used for income-producing properties and estimates value based on the potential rental income the property generates.

- Cost Approach: This method estimates the value by calculating the cost of replacing the property minus depreciation.

Taxable Value and Exemptions

Once the market value is determined, it's used to calculate the taxable value. However, Texas offers various exemptions that can reduce your taxable value, and therefore your tax bill. These exemptions vary depending on factors like age, disability, and veteran status. The homestead exemption, for example, provides significant tax savings for owners who use the property as their primary residence. Understanding and claiming available exemptions is vital for minimizing your tax liability. The taxable value is the assessed value of the property after all eligible exemptions have been applied. This is the amount that will be used in calculating the final property taxes due.

- Homestead Exemptions: This reduces the taxable value of your primary residence, providing substantial tax savings.

- Over 65 and Disabled Exemptions: These exemptions provide further reductions for eligible homeowners.

- Veteran Exemptions: Veterans may qualify for additional tax reductions based on their service history.

Tax Rates and Calculation

The final step in calculating your Texas property tax is multiplying your taxable value by the combined tax rate. This combined rate is determined by adding up the tax rates set by all the applicable taxing entities, including the county, city, school districts, and any other special districts in your area. Each entity sets its own tax rate, and these rates can change annually. The tax rate is typically expressed in dollars per $100 of assessed value, simplifying the calculation process. To calculate your tax bill, you'll multiply your taxable value by the combined tax rate, and that is the total taxes you are required to pay on your property.

This content may interest you! How can I file my taxes correctly?

How can I file my taxes correctly?- Combined Tax Rate: This is the sum of the rates imposed by all applicable governmental entities.

- Tax Rate Calculation: The tax rate is usually expressed as dollars per $100 of assessed value, meaning you need to divide your assessed value by 100 and then multiply this value by the tax rate.

- Total Tax Bill: The product of the taxable value and the combined tax rate equals your total property tax liability.

How much are property taxes on a $200,000 house in Texas?

Property taxes on a $200,000 house in Texas vary significantly depending on the location. There's no single answer. The tax rate is determined by the county and specific taxing entities within that county (like school districts, cities, and special districts). These rates are expressed as dollars per $100 of assessed value, not as a percentage of the home's market value. The assessed value itself is also typically a fraction of the market value, further complicating the calculation. A house with a $200,000 market value might have an assessed value of $150,000 or even less, depending on the appraisal district's assessment practices. Therefore, to calculate the exact property tax, you need the specific tax rate for the location of the property. You can find this information on the county appraisal district's website for the relevant county.

Factors Influencing Property Tax Rates in Texas

Property tax rates in Texas are influenced by a variety of factors, making it difficult to provide a single answer for a $200,000 house. The assessed value, which is usually lower than the market value, is a key component. The tax rate is the other key variable, and it's determined by the combined rates of all the taxing entities that serve the property. These rates vary widely across Texas.

- Assessed Value: The county appraisal district determines the assessed value of your property. This value is usually a percentage of the market value, and it's the figure used to calculate your property tax liability. The percentage can vary from county to county and depends on factors including the property's characteristics and the overall property values in the area.

- Taxing Entities: Multiple entities levy taxes on your property, including the county, city, school district, and potentially other special districts such as hospital districts or water districts. Each entity sets its own tax rate, and the combined rate is what determines your total property tax.

- Property Characteristics: Certain features of your property can affect its assessed value, which in turn can impact your property taxes. For instance, a larger house on a larger lot will generally have a higher assessed value than a smaller house on a smaller lot. The quality of the property's construction and amenities can also play a role.

How to Find Your Property Tax Rate

Determining the precise property tax for a specific property in Texas requires accessing information directly from the relevant county appraisal district. This is the official source for property valuations and tax rate information.

- Identify the County: Determine the county in Texas where the $200,000 house is located. This is the crucial first step, as tax rates differ significantly across counties.

- Visit the County Appraisal District Website: Each county in Texas has its own appraisal district website. These websites typically provide online tools that allow you to search for property information by address or property identification number (PIN). You should find the assessed value and the tax rate for the property there.

- Calculate Your Taxes: Once you have the assessed value and the combined tax rate (this will be expressed in dollars per $100 of assessed value), you can easily calculate your estimated annual property tax. For example, if the assessed value is $150,000 and the combined tax rate is $2.50 per $100, the annual tax would be ($150,000 / $100) $2.50 = $3750.

Variations in Property Taxes Across Texas

The significant variations in property tax rates across Texas stem from several factors, making generalizations unreliable. Understanding these variations is crucial for prospective homeowners.

This content may interest you! What tax benefits do families and parents get?

What tax benefits do families and parents get?- Local Services: Higher property tax rates often reflect a greater level of local services provided. Areas with high-performing school districts, extensive infrastructure, and numerous amenities may have correspondingly higher tax rates to fund these services.

- Economic Conditions: Property values and tax rates can be influenced by local economic conditions. Areas experiencing rapid growth might see higher property values and, consequently, higher tax bills.

- Political Factors: Local government budgets and spending priorities influence tax rates. Different municipalities and counties may have different levels of spending, resulting in varying tax burdens on property owners.

What is property tax and how is it paid?

Property Tax

What is Property Tax and How is it Paid?

Property tax is a tax levied on the value of a property, typically real estate (land and buildings). It's a significant source of revenue for local governments, funding essential services such as schools, police and fire departments, public works projects (roads, bridges, etc.), and libraries. The amount of property tax owed depends on the assessed value of the property and the local tax rate. The assessed value is an estimate of the property's market value, determined by the local government's assessor. The tax rate is set by the local government and varies depending on the community's budget needs and spending priorities. It's usually expressed as a mill rate (dollars per $1000 of assessed value) or a percentage of the assessed value.

How Property Tax is Assessed

The assessment process involves several steps. First, the local government's assessor reviews various factors to determine the property's market value. This may involve analyzing comparable sales of similar properties in the area, considering the property's size, condition, features, and location. The assessed value is then multiplied by the tax rate to calculate the annual property tax amount. Property owners typically receive a notice of assessment, outlining the calculated value and the tax amount due. This assessment can be appealed if the property owner believes the valuation is inaccurate. The appeal process usually involves presenting evidence to support a different assessment.

- Comparable sales analysis: Comparing the subject property to recently sold similar properties in the area.

- Physical inspection of the property: Assessing the property's condition, size, and features.

- Review of property records: Examining historical data about the property and any improvements made.

How Property Tax is Paid

Property taxes are typically paid annually, semi-annually, or quarterly, depending on the local government's requirements. Payment can usually be made through various methods, including online payment portals, mail, or in person at the tax collector's office. Failure to pay property taxes on time can result in penalties and interest charges, and in some cases, even foreclosure. Some jurisdictions offer payment plans for those who are unable to pay the full amount at once. It is crucial to understand the payment schedule and deadlines established by the local government to avoid any late payment consequences.

This content may interest you! What are common tax mistakes and how to avoid them?

What are common tax mistakes and how to avoid them?- Online payment: Convenient and often available 24/7.

- Mail-in payment: Sending a check or money order to the designated address.

- In-person payment: Visiting the tax collector's office to pay in person.

Exemptions and Reductions in Property Tax

Many jurisdictions offer exemptions or reductions in property taxes for certain groups of people or under specific circumstances. These exemptions are designed to provide tax relief to individuals or groups who may be particularly vulnerable to high property tax burdens. These exemptions can vary widely by jurisdiction and often require specific documentation to qualify. Examples of common exemptions include those for seniors, veterans, disabled individuals, and those who own agricultural land. It's important to check with the local government to determine what exemptions may apply.

- Senior citizen exemptions: Tax breaks for individuals over a certain age.

- Veteran exemptions: Reductions for veterans of military service.

- Disability exemptions: Reduced taxes for individuals with qualifying disabilities.

What are property taxes?

Property taxes are levied by local governments on the assessed value of real estate, including land and buildings. The tax revenue is crucial for funding essential public services within the community, such as schools, fire departments, police, libraries, and road maintenance. Assessment values are usually determined by government assessors who consider factors like property size, location, and recent sales of comparable properties. Property taxes are typically paid annually, although payment schedules can vary depending on the local jurisdiction. Failure to pay property taxes can lead to penalties and, eventually, foreclosure.

How is my property tax amount calculated?

Your property tax bill is calculated by multiplying your property's assessed value by the local tax rate (also known as the millage rate). The assessed value is not necessarily the market value of your property. The tax rate is determined by the local government's budget and is expressed as a percentage or a dollar amount per $1,000 of assessed value. For example, a tax rate of 2% on a property assessed at $200,000 would result in a $4,000 annual property tax bill. Some jurisdictions may offer exemptions or deductions that reduce the taxable value, potentially lowering the overall property tax amount.

When are property taxes due?

The due dates for property taxes vary significantly based on location. They are usually set by your local tax assessor's office or county government. Most jurisdictions have specific deadlines, often split into two installments, to allow for semi-annual payments. These deadlines are typically published well in advance, often appearing on your property tax notice. Late payments often incur penalties and interest charges, potentially increasing the overall amount owed. It's important to contact your local tax office to determine the precise due dates for your property.

What happens if I don't pay my property taxes?

Failure to pay property taxes can have serious consequences. The local government may initiate collection procedures, starting with late payment penalties and interest. If the taxes remain unpaid, the government may place a lien on your property, which essentially makes it collateral for the debt. The lien can impact your ability to sell or refinance your property. Eventually, prolonged non-payment could lead to a tax sale, where the government auctions your property to recover the outstanding taxes and penalties. It's crucial to contact your local tax office immediately if you encounter difficulties paying your property taxes to explore possible payment plans or solutions.

This content may interest you! How can I improve my credit score when in debt?

How can I improve my credit score when in debt?

Leave a Reply