How do self-employed individuals pay taxes?

Self-employment offers flexibility and independence, but navigating the tax landscape can be daunting. Unlike employees who have taxes automatically deducted from their paychecks, the self-employed are responsible for paying estimated taxes throughout the year. This article breaks down the complexities of self-employment taxes, covering crucial topics like estimated tax payments, quarterly filings, deductions, and common pitfalls to avoid. We'll explore the various tax forms involved and provide clarity on maximizing tax efficiency for freelancers, contractors, and other self-employed individuals. Understanding these processes is key to financial health and compliance.

How Self-Employed Individuals Handle Tax Payments

Understanding Self-Employment Taxes

Unlike employees who have taxes withheld from their paychecks, self-employed individuals are responsible for paying self-employment taxes and income taxes. These taxes include Social Security and Medicare taxes, which are typically covered by both the employer and employee in traditional employment. As a self-employed individual, you pay both portions, effectively doubling the amount. This is reported on Schedule SE (Form 1040) and calculated based on your net earnings from self-employment. Accurate record-keeping is crucial to determine the correct amount owed. Failure to pay these taxes can result in significant penalties and interest charges.

Estimating and Paying Quarterly Taxes

Because taxes aren't automatically withheld, self-employed individuals must estimate their tax liability throughout the year and make quarterly payments to the IRS. This involves projecting your income and expenses to determine how much you'll owe in taxes. Using the IRS's estimated tax calculator or consulting a tax professional can be beneficial. These payments are usually made through IRS forms 1040-ES or via electronic payment systems. Underestimating your tax liability can lead to penalties, so it's essential to make accurate estimations. Failing to pay on time can also incur penalties, highlighting the importance of timely payments.

Deducting Business Expenses

One significant advantage for the self-employed is the ability to deduct various business expenses from their taxable income. These deductions can significantly reduce your overall tax burden. Eligible expenses often include home office deductions (if applicable), business supplies, professional development, travel expenses, and health insurance premiums. Careful record-keeping, including receipts and invoices, is essential to support these deductions during tax season. It’s crucial to understand the rules and limitations surrounding allowable deductions to avoid potential IRS scrutiny and to maximize tax savings. Proper documentation is key for claiming these deductions.

This content may interest you! What is tax withholding and how does it affect my paycheck?

What is tax withholding and how does it affect my paycheck?| Tax Type | Description | Payment Method | Key Considerations |

|---|---|---|---|

| Income Tax | Tax on your net profit from self-employment. | Form 1040 | Accurate income tracking is essential. |

| Self-Employment Tax (Social Security & Medicare) | Tax to fund Social Security and Medicare benefits. | Schedule SE (Form 1040) | Pay both employer and employee portions. |

| Estimated Taxes | Quarterly payments to cover income tax and self-employment tax liabilities. | Form 1040-ES or electronic payment | Accurate estimations prevent penalties. |

| Business Expenses | Deductible costs related to your business. | Schedule C (Form 1040) | Maintain thorough records for all expenses. |

How do you pay taxes if you are self-employed?

Paying Taxes as a Self-Employed Individual

Paying taxes as a self-employed individual differs significantly from the system used for employees. Instead of having taxes withheld from your paycheck, you are responsible for paying estimated taxes throughout the year and filing a tax return at the end of the year. This involves understanding various tax forms, deadlines, and potential deductions to accurately calculate and remit your tax liability. The process generally involves tracking your income and expenses meticulously, making quarterly estimated tax payments to the IRS, and filing a Schedule C with your annual 1040 tax return.

Understanding Self-Employment Tax

Self-employment tax encompasses both Social Security and Medicare taxes, which are typically split between employers and employees in traditional employment. As a self-employed individual, you are responsible for the entire amount. This tax is calculated based on your net earnings from self-employment, which is your self-employment income minus allowable deductions. The self-employment tax rate is 15.3%, but only 92.35% of your net earnings are subject to this tax. This is then used to calculate your total self-employment tax liability. Accurate record-keeping is essential for correctly determining your net earnings and subsequently your tax liability. The form used to calculate this tax is Schedule SE (Form 1040).

This content may interest you! What happens if I don’t pay my taxes?

What happens if I don’t pay my taxes?- Calculate your net earnings from self-employment by subtracting allowable business expenses from your total self-employment income.

- Multiply your net earnings by 0.9235 to arrive at the amount subject to self-employment tax.

- Multiply the result by 0.153 (the self-employment tax rate) to determine your total self-employment tax.

Making Estimated Tax Payments

Since taxes aren't withheld from your income, you must pay estimated taxes quarterly to avoid penalties. This involves projecting your income and tax liability for the year and making four payments, typically due on April 15th, June 15th, September 15th, and January 15th (of the following year). You can pay through various methods, including online, by mail, or through a tax professional. Underestimating your tax liability can result in penalties, so it's crucial to accurately project your income and expenses. You can use Form 1040-ES to calculate and pay your estimated taxes.

- Project your income and expenses for the entire tax year.

- Calculate your estimated tax liability, considering income tax, self-employment tax, and any other applicable taxes.

- Divide your total estimated tax liability by four to determine your quarterly payment amount.

Filing Your Annual Tax Return

At the end of the tax year, you must file a federal income tax return (Form 1040) along with Schedule C (Profit or Loss from Business) to report your business income and expenses. This form details your self-employment income, deductions, and other relevant financial information. You'll also need Schedule SE to calculate your self-employment tax. Accurately completing these forms is crucial for avoiding penalties and ensuring you pay the correct amount of taxes. Accurate record-keeping throughout the year significantly simplifies this process. Depending on your income and other factors, you may also need to file other tax forms.

- Gather all necessary tax documents, including bank statements, receipts, and invoices.

- Complete Schedule C to report your business income and expenses.

- Complete Schedule SE to calculate and report your self-employment tax.

- File Form 1040, including Schedules C and SE, by the tax deadline (typically April 15th).

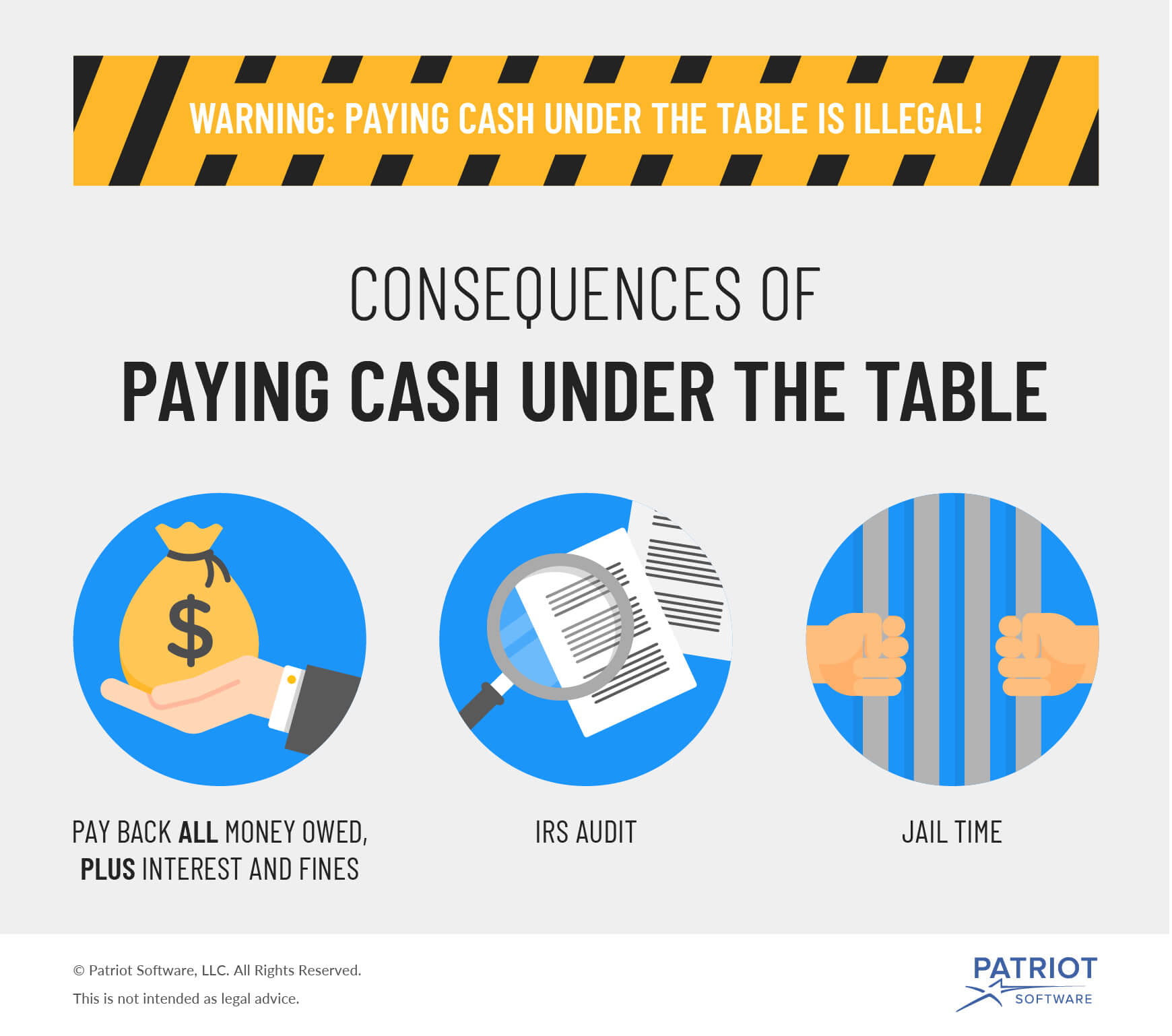

How do I pay taxes if I get paid under the table?

Paying taxes on under-the-table income is crucial, even though it's not reported to the IRS by your employer. Failing to do so can lead to significant penalties, interest charges, and even legal repercussions. The IRS has various ways of detecting unreported income, including information from banks, third parties, and even tips from others. You are legally obligated to report all income you receive, regardless of how it's paid. To pay taxes on this income, you will need to accurately track all earnings throughout the year and report them on your tax return. You will file using Form 1040, and will likely need to pay estimated taxes quarterly through Form 1040-ES.

This content may interest you! How do capital gains taxes work?

How do capital gains taxes work?Understanding Self-Employment Taxes

Since under-the-table income typically falls under self-employment, you'll need to pay self-employment taxes. These taxes cover Social Security and Medicare. The self-employment tax rate is 15.3%, but only half is deductible, meaning you effectively pay 7.65%. To calculate your self-employment tax, you'll need to subtract the deductible half from your net earnings. This amount is then used to determine your Social Security and Medicare tax liability. This will be reported on Schedule C, Profit or Loss from Business, then carried over to Form 1040.

- Calculate your net earnings from self-employment.

- Multiply your net earnings by 0.9235 (this accounts for the deductible portion of self-employment tax).

- Multiply the result by 0.153 (the combined Social Security and Medicare tax rate).

Estimating Quarterly Taxes

When you're self-employed and receiving under-the-table income, estimating and paying quarterly taxes is vital to avoid penalties. The IRS requires quarterly payments from those who expect to owe at least $1,000 in taxes. You make these payments using IRS Form 1040-ES. Failing to pay on time will lead to penalties. Accurate estimation requires keeping detailed records of your income and expenses throughout the year. It’s recommended to consult a tax professional to help accurately estimate your tax liability.

- Determine your estimated annual tax liability, factoring in income tax and self-employment tax.

- Divide your total estimated tax by four to determine your quarterly payment.

- Pay each quarterly installment by the due date (typically April 15, June 15, September 15, and January 15).

Seeking Professional Tax Advice

Given the complexities of paying taxes on unreported income, seeking professional advice from a tax advisor or accountant is highly recommended. They can provide guidance on accurately calculating your tax liability, help you fill out the necessary forms (like Schedule C and Form 1040-ES), and ensure you comply with all tax regulations. They can also help you create a strategy for future years to avoid penalties and ensure you're meeting all your obligations. A professional can help you understand penalties and interest, potentially saving you significant costs in the long run.

- Consult with a tax professional to discuss your specific circumstances.

- Request assistance in calculating your tax liability and completing the necessary forms.

- Seek advice on tax planning strategies to optimize your tax situation for future years.

How much money does a self-employed person have to make to file taxes?

What is a tax audit and how can I avoid one?

What is a tax audit and how can I avoid one?The amount of money a self-employed individual must earn to file taxes in the United States depends on several factors, primarily their filing status (single, married filing jointly, etc.) and the amount of their self-employment tax liability. There isn't a single dollar amount that triggers the requirement. Instead, the requirement is tied to whether their income exceeds the standard deduction for their filing status. If their net earnings from self-employment (after allowable deductions) exceed their standard deduction, they're generally required to file a tax return. For example, in 2023, the standard deduction for a single filer was $13,850. If a self-employed individual earned less than this amount after deductions, they likely wouldn't be required to file, although they may still choose to do so to receive a refund if they had taxes withheld or paid estimated taxes.

Self-Employment Tax Threshold

While the income threshold for filing an income tax return is based on the standard deduction, there's a separate threshold concerning self-employment taxes. Self-employment taxes (Social Security and Medicare) are applied to net earnings from self-employment. If your net earnings from self-employment are below a certain level, you may not owe self-employment taxes. However, you still might need to file a return if your income (from any source, including self-employment) exceeds the standard deduction. This means you could potentially have a filing requirement without owing self-employment taxes. Remember, the specific thresholds are adjusted annually.

- The self-employment tax threshold isn't the same as the filing threshold. It's possible to owe income taxes but not self-employment taxes, or vice versa.

- Net earnings are calculated after subtracting allowable business expenses from gross income.

- Consult the IRS website or a tax professional for the most up-to-date information on thresholds and filing requirements.

The Importance of Deductions

The deductions you can take significantly impact your taxable income. Accurate record-keeping is essential for claiming all eligible deductions. These deductions reduce your net earnings, potentially lowering your tax liability and even removing the requirement to file in some cases. There are various deductions for the self-employed, including deductions for home office expenses, health insurance premiums, and qualified business income.

- Keep meticulous records of all business expenses to maximize your deductions.

- Explore different deduction options to minimize your tax burden.

- Seek professional advice from a tax advisor to ensure you claim all applicable deductions.

Consequences of Not Filing

Failing to file a tax return when required can lead to penalties and interest charges from the IRS. These penalties can be substantial and can accumulate over time. It’s crucial to understand your obligations and file your return on time to avoid these consequences. Even if you think you owe no taxes, it is always best to file to ensure you’re compliant with tax laws.

This content may interest you! How do property taxes work?

How do property taxes work?- Late filing penalties can significantly increase your tax liability.

- Interest charges accrue on unpaid taxes.

- Failure to file can negatively impact your credit score and future financial opportunities.

How much will I owe in taxes as self-employed?

Self-Employment Taxes

Calculating your self-employment taxes involves several factors and can be complex. There's no single answer to "how much will I owe?" without knowing your specific financial situation. However, we can break down the key elements.

1. Self-Employment Tax Calculation

The biggest difference between being employed and self-employed is the tax you pay on your earnings. As an employee, your employer typically withholds income tax and Social Security/Medicare taxes. As a self-employed individual, you're responsible for paying both the employee and employer portions of these taxes. This is often referred to as "self-employment tax".

This content may interest you! How do I clear my bank debt?

How do I clear my bank debt?- First, you'll need to determine your net earnings from self-employment. This is your total income from your business minus allowable deductions.

- Next, you'll multiply your net earnings by 0.9235. This is because the Social Security tax isn't applied to the entire amount of self-employment income.

- Finally, this adjusted amount will be taxed at the combined Social Security and Medicare tax rates (15.3% for 2023). This total tax is split equally between "employee" and "employer" portions for reporting purposes. Note: There are income limits for Social Security tax. Above the income limit, only Medicare tax applies.

2. Income Tax Liability

In addition to self-employment tax, you'll also owe income tax on your net earnings. This is calculated using your applicable tax bracket based on your total income, including self-employment income and any other income sources. The complexity of determining this income tax depends on various factors, such as deductions, credits, and whether you are single, married filing jointly, etc.

- You will need to file Schedule C (Form 1040) as a sole proprietor to report your business income and expenses.

- Determine your adjusted gross income (AGI) by adding other income sources to your net self-employment income.

- Use the applicable tax brackets to figure your income tax liability based on your AGI and filing status. You may also be eligible for deductions and credits which affect this calculation.

3. Estimated Taxes

Since taxes aren't automatically withheld from your self-employment income, you must pay estimated taxes quarterly to avoid penalties. These payments cover both your income tax and self-employment tax obligations. Underestimating can result in penalties.

- Estimate your income and tax liability for the year, taking into account your previous year's tax return.

- Divide your total estimated tax liability by four to determine your quarterly payment amount.

- Make payments through the IRS's online payment system or by mail using Form 1040-ES. It's important to make these payments on time to avoid penalties.

What are the different tax forms self-employed individuals need to file?

Self-employed individuals primarily use Schedule C (Form 1040), Profit or Loss from Business, to report their business income and expenses. This form helps calculate net profit or loss, which is then transferred to Form 1040, your individual income tax return. You might also need Schedule SE (Form 1040), Self-Employment Tax, to figure your self-employment tax liability, including social security and Medicare taxes. Depending on your business structure and income, additional forms like Schedule K-1 (for partnerships or S corporations) may be necessary. Always consult the IRS instructions or a tax professional to ensure you're using the correct forms.

How often do self-employed individuals need to pay estimated taxes?

Self-employed individuals typically pay estimated taxes quarterly. This is because they don't have taxes withheld from their paychecks like employees do. The IRS requires estimated tax payments to be made on April 15, June 15, September 15, and January 15 of the following year. The amount you owe is based on your previous year's tax liability, or an estimate of your current year's liability. Failing to pay on time can result in penalties and interest. Using tax software or consulting a tax professional can help you accurately calculate and submit your estimated tax payments.

This content may interest you! How can I improve my credit score when in debt?

How can I improve my credit score when in debt?What deductions are available to self-employed individuals?

Self-employed individuals can claim several deductions to reduce their taxable income. Common deductions include home office expenses (if you meet the IRS criteria), business vehicle expenses, health insurance premiums, contributions to self-employed retirement plans (like SEP IRAs or solo 401(k)s), and various business-related supplies and services. Keep meticulous records of all business expenses to support your deductions during tax time. Remember to consult the IRS guidelines to ensure your deductions are eligible and properly documented.

What are the penalties for not paying self-employment taxes?

Failure to pay self-employment taxes on time can result in significant penalties. The IRS charges interest on underpayments, which can quickly accumulate. In addition to interest, you may face penalties for late filing or late payment. These penalties can vary depending on the amount owed and the length of the delay. The penalties can be substantial, significantly impacting your financial situation. Accurate record-keeping and timely payments are crucial to avoid these penalties; if you anticipate difficulties meeting your tax obligations, it's best to contact the IRS to explore payment options.

Leave a Reply