How much does Dave Ramsey say to have in savings?

Financial expert Dave Ramsey emphasizes the importance of building a solid savings foundation as a key step toward financial stability. He advocates for a structured approach, starting with an emergency fund to cover unexpected expenses.

Ramsey’s advice is rooted in practicality, aiming to help individuals avoid debt and achieve long-term financial security. His recommendations are tailored to different stages of financial health, offering clear guidelines on how much to save and when.

Understanding Ramsey’s savings principles can provide a roadmap for managing money wisely, reducing stress, and preparing for life’s uncertainties. This article explores his specific recommendations for savings targets.

This content may interest you! What is the 70 20 10 budget rule?

What is the 70 20 10 budget rule?How Much Does Dave Ramsey Recommend Having in Savings?

Dave Ramsey, a well-known financial expert, emphasizes the importance of building a solid financial foundation through savings.

He recommends following a structured approach to savings, which includes creating an emergency fund as a top priority. His advice is tailored to help individuals avoid debt and achieve financial stability.

What Is Dave Ramsey's Baby Step 1?

Dave Ramsey's Baby Step 1 focuses on saving a $1,000 starter emergency fund. This initial step is designed to provide a small financial cushion for unexpected expenses, such as car repairs or medical bills. It acts as a safety net while you work on paying off debt and building a more substantial savings account.

This content may interest you! What is the 50/20/30 budget rule?

What is the 50/20/30 budget rule?How Much Should You Save in Baby Step 3?

In Baby Step 3, Dave Ramsey advises saving 3 to 6 months' worth of living expenses in a fully funded emergency fund. This amount ensures you are prepared for significant financial setbacks, such as job loss or major medical emergencies. The exact amount depends on your income stability and personal circumstances.

Why Is an Emergency Fund Important According to Dave Ramsey?

Dave Ramsey stresses that an emergency fund is crucial because it prevents you from relying on credit cards or loans during financial crises. It provides peace of mind and helps you stay on track with your financial goals. Without an emergency fund, unexpected expenses can derail your progress and lead to debt.

| Baby Step | Savings Goal | Purpose |

|---|---|---|

| Baby Step 1 | $1,000 | Starter emergency fund for small unexpected expenses |

| Baby Step 3 | 3-6 months of living expenses | Fully funded emergency fund for major financial setbacks |

What is the 50 30 20 rule for tithing?

The 50 30 20 rule for tithing is a budgeting framework that helps individuals allocate their income in a structured manner. While traditionally used for personal finance, it can also be adapted for tithing, which is the practice of giving a portion of one's income to religious or charitable causes.

What is the 60/20/20 budget rule?

What is the 60/20/20 budget rule?The rule suggests dividing your income into three categories: 50% for needs, 30% for wants, and 20% for savings or giving. When applied to tithing, the 20% portion can be used to fulfill religious or charitable obligations.

- The 50% portion covers essential expenses like housing, utilities, and groceries.

- The 30% portion is allocated for discretionary spending, such as entertainment or dining out.

- The 20% portion is dedicated to savings, investments, or tithing, depending on personal priorities.

How to Apply the 50 30 20 Rule to Tithing

Applying the 50 30 20 rule to tithing involves setting aside a portion of your income specifically for charitable or religious contributions.

This approach ensures that tithing becomes a consistent and manageable part of your financial plan. By allocating 20% of your income to savings and giving, you can prioritize tithing without compromising your essential needs or discretionary spending.

This content may interest you! What is the 40-40-20 budget rule?

What is the 40-40-20 budget rule?- Calculate your total monthly income after taxes.

- Allocate 50% to essential needs, 30% to wants, and 20% to savings or tithing.

- Decide how much of the 20% will go toward tithing, based on your religious or personal beliefs.

Benefits of Using the 50 30 20 Rule for Tithing

The 50 30 20 rule offers several advantages when applied to tithing. It provides a clear structure for managing finances, ensures that tithing is prioritized, and helps maintain a balance between spending, saving, and giving. This method also encourages financial discipline and accountability, making it easier to fulfill tithing commitments consistently.

- It creates a balanced approach to managing income and expenses.

- It ensures that tithing is treated as a financial priority.

- It promotes long-term financial stability while supporting charitable or religious causes.

What is Dave Ramsey's 8% rule?

What is Dave Ramsey's 8% Rule?

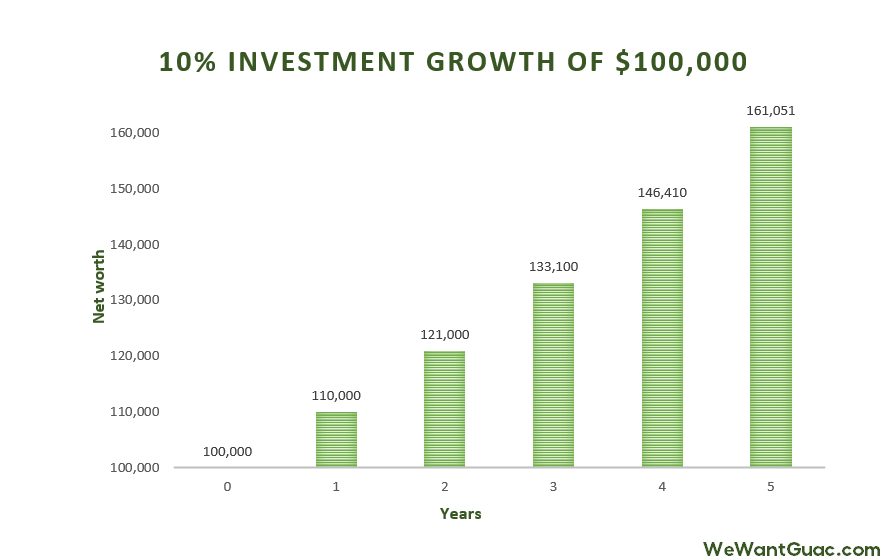

Dave Ramsey's 8% rule is a guideline he suggests for retirement planning. It is based on the idea that, over time, the stock market has historically returned an average of 8% annually. Ramsey advises individuals to use this figure as a benchmark when calculating how much they need to save for retirement. The rule helps people estimate the growth of their investments over the long term, assuming they invest in a diversified portfolio of stocks.

This content may interest you! How to save money from a young age?

How to save money from a young age?- The 8% rule assumes a long-term investment horizon, typically 10 years or more, to account for market fluctuations.

- It is not a guarantee but a historical average, meaning actual returns may vary depending on market conditions.

- Ramsey emphasizes the importance of consistent investing and avoiding emotional decisions based on short-term market changes.

How Does the 8% Rule Apply to Retirement Savings?

The 8% rule is often used to project how much money an individual will have in retirement based on their current savings and contributions. For example, if someone invests $10,000 annually and expects an 8% return, they can estimate their retirement fund's growth over decades. This projection helps individuals set realistic savings goals and adjust their contributions if necessary.

- It encourages individuals to start saving early to take advantage of compound interest over time.

- The rule assumes reinvestment of dividends and capital gains to maximize growth.

- It is important to periodically review and adjust savings plans to align with changing financial goals and market conditions.

Limitations of the 8% Rule

While the 8% rule is a useful guideline, it has limitations. Market returns are not consistent, and past performance does not guarantee future results. Factors like inflation, fees, and economic downturns can impact actual returns. Additionally, individual risk tolerance and investment choices play a significant role in determining outcomes.

- Historical averages do not account for periods of low or negative returns, which can affect long-term growth.

- Fees from investment accounts and funds can reduce the effective return, making the 8% figure less accurate.

- Personal circumstances, such as early withdrawals or changes in income, can disrupt the projected growth of retirement savings.

What is the 75 15 10 rule?

What is the 80/20 rule in saving money?

What is the 80/20 rule in saving money?Understanding the 75 15 10 Rule

The 75 15 10 rule is a budgeting guideline that helps individuals allocate their income effectively. It suggests dividing your after-tax income into three categories: 75% for living expenses, 15% for savings, and 10% for investments or debt repayment. This rule is designed to promote financial stability and growth by ensuring that essential needs are met while also prioritizing future financial security.

- 75% of your income is allocated to living expenses, including housing, utilities, groceries, transportation, and other necessities.

- 15% of your income is dedicated to savings, such as an emergency fund, retirement accounts, or other long-term financial goals.

- 10% of your income is reserved for investments or paying off debts, which can help build wealth over time or reduce financial burdens.

Benefits of the 75 15 10 Rule

The 75 15 10 rule offers several advantages for managing personal finances. By following this rule, individuals can maintain a balanced approach to spending, saving, and investing, which can lead to greater financial security and peace of mind.

- It provides a clear structure for budgeting, making it easier to track and manage expenses.

- It encourages consistent savings, helping to build an emergency fund and prepare for future financial needs.

- It promotes responsible debt management and investment, which can lead to long-term financial growth and stability.

How to Implement the 75 15 10 Rule

Implementing the 75 15 10 rule requires careful planning and discipline. To get started, assess your current income and expenses, and adjust your spending habits to align with the rule's guidelines.

This content may interest you! How much is $1000 a month for 5 years?

How much is $1000 a month for 5 years?- Calculate your after-tax income and determine the amounts to allocate to each category (75%, 15%, and 10%).

- Track your spending to ensure that you stay within the 75% limit for living expenses and adjust as needed.

- Automate your savings and investments to ensure that the 15% and 10% allocations are consistently met without requiring constant manual intervention.

Is having $100,000 in savings good?

Having $100,000 in savings is a significant financial milestone for many individuals. It represents a substantial amount of money that can provide financial security and flexibility. Here are some key points to consider:

- It offers a safety net for emergencies, such as medical expenses or job loss.

- It can be used to achieve long-term financial goals, like buying a home or funding retirement.

- It provides peace of mind, knowing you have a cushion to fall back on in uncertain times.

How Does $100,000 in Savings Compare to Average Savings?

When compared to the average savings of individuals, $100,000 is well above the norm. Here’s how it stacks up:

- According to recent studies, the median savings for Americans is significantly lower, often under $10,000.

- Having $100,000 places you in a better position to handle unexpected expenses without relying on debt.

- It also indicates disciplined saving habits, which are essential for long-term financial health.

What Can You Do with $100,000 in Savings?

With $100,000 in savings, you have several options to grow your wealth or improve your financial situation. Consider the following possibilities:

This content may interest you! How to budget if you have debt?

How to budget if you have debt?- Invest in diversified portfolios, such as stocks, bonds, or mutual funds, to potentially increase your wealth over time.

- Use a portion of the savings to pay off high-interest debt, which can save you money in the long run.

- Allocate funds for major life events, such as education, travel, or starting a business, to enhance your quality of life.

Frequently Asked Questions

How much does Dave Ramsey recommend for an emergency fund?

Dave Ramsey suggests having an emergency fund of $1,000 as a starter. This amount is meant to cover small, unexpected expenses while you work on paying off debt. Once you're debt-free, he advises building a full emergency fund of 3-6 months' worth of living expenses to provide financial security in case of job loss or major emergencies.

Why does Dave Ramsey recommend $1,000 as a starter emergency fund?

Dave Ramsey recommends $1,000 as a starter emergency fund because it’s enough to cover minor unexpected expenses without derailing your financial progress. This amount acts as a buffer while you focus on paying off debt. It’s not meant to cover major emergencies but to prevent you from relying on credit cards or loans for small, unforeseen costs.

What should you do after saving $1,000 in your emergency fund?

After saving $1,000, Dave Ramsey advises focusing on paying off all non-mortgage debt using the debt snowball method. Once you’re debt-free, you should increase your emergency fund to cover 3-6 months of living expenses. This larger fund provides a safety net for significant financial setbacks, such as job loss or major medical expenses.

How does Dave Ramsey suggest saving for 3-6 months of expenses?

Dave Ramsey recommends saving 3-6 months of expenses by budgeting carefully and prioritizing this goal after becoming debt-free. He suggests cutting unnecessary expenses, increasing income through side jobs, and automating savings to build this fund efficiently. This amount ensures you’re prepared for major financial disruptions without relying on debt.

Leave a Reply