How much money should a 14-year-old have?

The question of how much allowance a 14-year-old should receive is a complex one, varying greatly depending on individual circumstances. Factors like family income, the teen's responsibilities, and local cost of living all play a significant role.

This article explores different approaches to determining an appropriate allowance, examining the benefits of earning money, budgeting skills, and the importance of teaching financial responsibility at a young age.

We'll delve into practical strategies for setting a reasonable allowance and fostering healthy financial habits in teenagers.

- How Much Allowance is Appropriate for a 14-Year-Old?

- How much money should I have saved at 14?

- What is a reasonable allowance for a 14 year old?

- How much money should I give my 14-year-old?

- How much money should a 14 year old get on their birthday?

- Factors Influencing the Amount of Birthday Money

- Considering the Teenager's Needs and Wants

- Alternatives to Cash Gifts

- How much allowance should a 14-year-old get?

- Should a 14-year-old have a part-time job?

- What should a 14-year-old save their money for?

- How can a 14-year-old learn to manage their money?

How Much Allowance is Appropriate for a 14-Year-Old?

Determining the appropriate amount of money a 14-year-old should have depends heavily on several interconnected factors. There's no single "right" answer, as it's highly individualized. Consider the teenager's responsibilities: Do they have chores around the house?

Do they have a part-time job? Their level of responsibility should directly influence how much money they receive. Their spending habits are equally important. A child who is responsible and saves diligently might merit a higher allowance than a child who spends impulsively. The family's financial situation is the most crucial element, impacting what's realistically affordable and sustainable.

A wealthy family might provide a larger allowance for leisure activities and savings, while a family struggling financially may prioritize needs over wants and give a smaller, needs-based allowance.

Ultimately, open communication and a collaboratively agreed-upon system, where the teen understands the reasoning behind the allowance amount and its limitations, is key to fostering financial responsibility. This involves discussing budgeting, saving, and spending habits, promoting a healthy approach to money management from a young age.

Factors Influencing Allowance Amounts

Several key factors play a significant role in determining a suitable allowance. The teenager's maturity level is paramount; a more responsible teen who demonstrates good money management skills might warrant a larger allowance.

Their spending needs and desires also come into play; a teen who needs to purchase school supplies or clothing regularly will require a higher amount than one who has most essentials covered. The family's income and values are equally important; families with higher incomes might afford larger allowances while those with lower incomes might have to work with more modest amounts.

Finally, the purpose of the allowance (pocket money versus covering expenses) will dictate the amount. A purely discretionary allowance might be smaller than one designed to cover necessary expenses like lunches or transportation.

This content may interest you! Should a 12 year old save money?

Should a 12 year old save money?Connecting Allowance to Responsibilities and Chores

Tying the allowance to chores and responsibilities can be a highly effective way to teach valuable life lessons about earning and managing money. Assigning specific tasks with corresponding monetary rewards encourages responsibility and work ethic.

This approach also helps children understand the connection between work and compensation, demonstrating the value of a dollar earned. Clearly defined expectations about chores and the associated payment should be established, ideally with a written agreement to ensure transparency and avoid conflicts.

This system allows teens to earn extra money by taking on additional tasks, rewarding initiative and diligence. It also provides a framework for learning about budgeting, saving, and potentially even investing, setting them up for future financial success.

Saving and Spending: A Balanced Approach

A balanced approach to saving and spending is crucial in developing healthy financial habits. Encouraging teens to save a portion of their allowance fosters financial responsibility and encourages long-term financial planning.

This could involve setting aside money for future goals, like a new phone or college savings. While encouraging saving, it's also important to allow teens reasonable spending on things they enjoy. This could include allowing them to allocate a percentage of their allowance for entertainment or personal purchases.

A good strategy is to encourage budgeting and tracking expenses, which helps teens learn to manage their finances effectively, balancing immediate gratification with long-term financial security. The ultimate goal is to help them develop good habits and a responsible approach to money.

| Factor | Impact on Allowance |

|---|---|

| Responsibilities | Higher responsibility may justify a higher allowance. |

| Spending Habits | Responsible spending may lead to increased trust and allowance. |

| Family Income | Affects the affordability and feasibility of various allowance amounts. |

| Maturity Level | Greater maturity may warrant a higher allowance with increased freedom. |

| Chores and Tasks | Directly correlates to earnings, fostering a work ethic. |

How much money should I have saved at 14?

There's no magic number for how much money a 14-year-old should have saved. The appropriate amount depends heavily on individual circumstances, including family income, opportunities for earning money, and spending habits.

A child from a wealthy family might have significantly more saved than a child from a low-income family, and that's perfectly acceptable. The focus should be on developing good saving habits and understanding the value of money, rather than striving for a specific monetary goal. Consider the amount saved as a reflection of responsible financial behavior, not a measure of success.

What Factors Influence Savings at Age 14?

The amount a 14-year-old has saved is influenced by a number of factors. It's not simply a matter of how much allowance they receive, but also their ability to generate income and their spending habits.

This content may interest you! What age should I start budgeting?

What age should I start budgeting?A child who actively seeks out opportunities to earn money, such as babysitting, yard work, or online tasks, will likely have more savings than a child who doesn't. Similarly, a child who is mindful of their spending and avoids impulsive purchases will accumulate savings more rapidly.

Finally, family support and financial education play a crucial role; parents who encourage saving and provide financial literacy guidance will likely see their children save more effectively.

- Family income and support: Higher family incomes often allow for larger allowances and more opportunities to save.

- Earning potential: Part-time jobs, chores, or online work can significantly increase savings.

- Spending habits: Conscious spending choices and avoiding impulsive buys are key to accumulating savings.

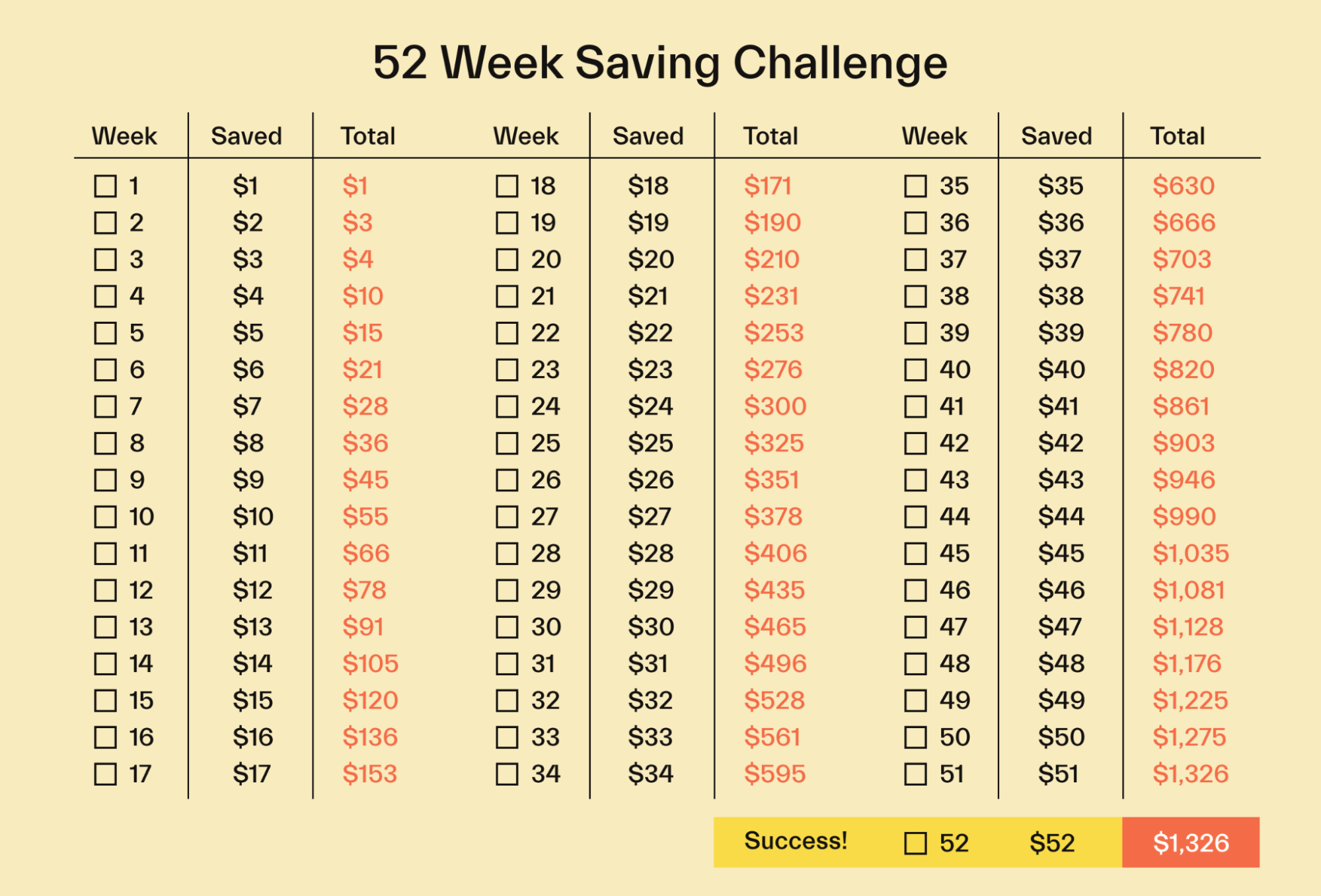

Setting Realistic Savings Goals at 14

Rather than focusing on a specific dollar amount, it's more beneficial to set achievable savings goals. These goals should be age-appropriate and reflect the 14-year-old's earning capacity and spending habits.

For example, a goal might be to save a certain percentage of their earnings each month, or to save enough money for a specific item they want to purchase. Breaking down larger goals into smaller, more manageable steps can make the process less daunting and more motivating. It's also important to involve the teenager in setting these goals to foster a sense of ownership and responsibility.

- Short-term goals: Saving for a specific item, such as a new phone or video game.

- Mid-term goals: Saving for a larger purchase, like a bicycle or a trip.

- Long-term goals: Starting a college fund or saving for a car in the future.

The Importance of Financial Literacy at Age 14

Developing good financial habits at a young age is crucial for long-term financial success. At 14, understanding basic financial concepts, such as budgeting, saving, and investing, can lay the groundwork for responsible financial management in adulthood.

Parents and guardians can play a vital role by providing financial education, helping teenagers create budgets, and encouraging them to track their spending.

Exposure to different saving and investment options, even at a small scale, can help them understand the power of compound interest and the importance of planning for the future. Learning about debt and responsible borrowing is also beneficial at this age.

- Budgeting: Learning to track income and expenses.

- Saving and Investing: Understanding different saving vehicles and investment options.

- Debt and Borrowing: Learning about responsible credit card use and loan repayment.

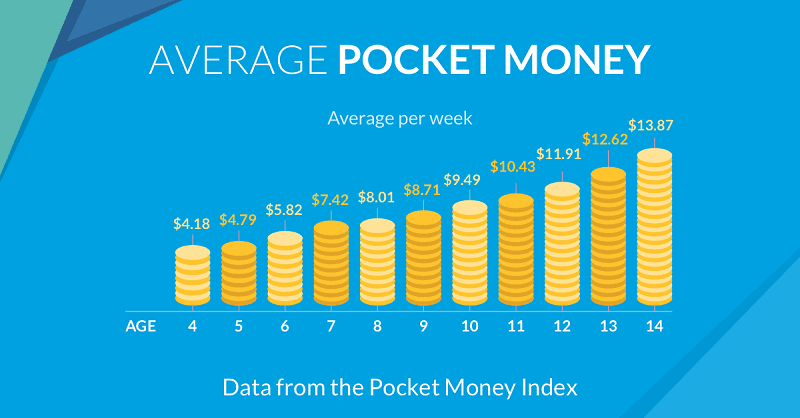

What is a reasonable allowance for a 14 year old?

What is a reasonable allowance for a 14-year-old? There's no single right answer, as a reasonable allowance depends heavily on several factors. These include the family's income, the teen's responsibilities, and the local cost of living.

A family with a higher income might give a larger allowance than a family with a lower income. Similarly, a teen with more chores or responsibilities might receive more than a teen who does less. Geographic location also plays a role; allowances in areas with higher costs of living will often be higher to reflect the increased expenses of everyday items.

This content may interest you! How to save money if you don't have a job?

How to save money if you don't have a job?A good starting point is to consider what expenses a 14-year-old typically has and build the allowance around covering those. This might include things like entertainment, snacks, personal care items, and saving for larger purchases.

It's often helpful to involve the teenager in the discussion and agree on a reasonable amount together. Open communication is crucial to ensure everyone feels fair and to prevent misunderstandings.

Factors Influencing Allowance Amount

Several key factors influence how much allowance is appropriate for a 14-year-old. Family income is paramount, with wealthier families typically providing larger allowances. The teenager's responsibilities also play a crucial role.

Doing chores around the house, such as yard work or laundry, often justifies a larger allowance than simply receiving money without contributing. The local cost of living significantly impacts the affordability of everyday items; areas with higher living costs typically require larger allowances.

Finally, the teenager's spending habits should also be considered. An allowance might need adjustment if the teen consistently spends more than what's provided.

- Family Income: Higher income families generally afford larger allowances.

- Responsibilities: More chores and responsibilities often warrant a higher allowance.

- Local Cost of Living: Higher living costs often necessitate larger allowances.

Determining a Realistic Budget

Before setting an allowance, it's beneficial to collaboratively create a realistic budget with your teenager. This involves listing all the common expenses a 14-year-old might have, such as entertainment (movies, video games, social outings), snacks and drinks, personal care items (shampoo, soap, deodorant), and clothing. You can also factor in savings goals, like saving for a phone or a future purchase.

This budgeting exercise fosters financial literacy and encourages responsible spending habits. Open communication ensures a fair and transparent system. The allowance amount should reflect the combined cost of these items, allowing for occasional splurges while also promoting responsible saving.

- List typical expenses: entertainment, snacks, personal care items, and clothing.

- Incorporate savings goals: encourage saving for future purchases.

- Promote open communication: work collaboratively to create a budget that works for everyone.

Allowance and Financial Literacy

An allowance is more than just pocket money; it's a valuable tool for teaching financial literacy. Using an allowance, teenagers can learn about budgeting, saving, and spending responsibly.

They can gain practical experience managing their finances, learning to prioritize needs versus wants, and understanding the value of money. This hands-on experience prepares them for the financial responsibilities they will face as adults.

Regular conversations about money management and financial planning can reinforce these lessons and support their development of good financial habits.

This content may interest you! What is the $27.40 rule?

What is the $27.40 rule?- Teaches budgeting and saving: practical experience managing money.

- Distinguishes needs vs. wants: learning to prioritize spending.

- Prepares for adult financial responsibility: fosters good money management skills.

How much money should I give my 14-year-old?

There's no single right answer to how much money you should give your 14-year-old. It depends heavily on several factors including your family's financial situation, your child's maturity level, their spending habits, and their responsibilities.

A good approach is to consider a system that teaches financial responsibility rather than simply providing a set amount. Consider starting with a small allowance and gradually increasing it as they demonstrate responsible financial behavior.

You might also tie allowance to chores or responsibilities around the house. The goal is to find a balance between providing enough for their needs and age-appropriate wants, while fostering good money management skills.

Factors Influencing Allowance Amount

Determining the appropriate allowance involves considering various factors. Your family's income plays a significant role, as a higher income might allow for a more generous allowance. Equally important is your child's maturity level; a responsible teen might handle a larger amount effectively, whereas a less responsible teen might benefit from a smaller, more manageable sum.

Their spending habits also come into play – are they prone to impulsive purchases or do they budget carefully? Finally, their existing responsibilities, such as chores, part-time jobs, or family commitments, might influence the amount of financial support needed or deserved.

- Family income and budget constraints

- Child's maturity level and responsible spending habits

- Existing responsibilities and contributions to the household

Tying Allowance to Responsibilities and Chores

Linking allowance to chores and responsibilities can be a powerful tool for teaching financial responsibility and reinforcing the value of work. This approach fosters a direct connection between effort and reward, helping your teen understand the concept of earning money.

It also encourages contribution to the household and instills a sense of ownership. However, it is essential to clearly define the tasks, associated pay, and expectations to avoid misunderstandings and foster transparency. This method can help your teen develop valuable life skills while earning their allowance.

- Establish a clear list of chores and their corresponding payment

- Regularly review the chore list and payment structure to ensure fairness

- Use this as an opportunity to teach negotiation and compromise skills

Considering Needs vs. Wants

Distinguishing between needs and wants is a crucial aspect of financial literacy. At 14, a teen's needs might include personal care items, school supplies, and possibly some clothing. Wants, on the other hand, would include entertainment, snacks, or social activities.

A structured allowance can help teach the difference. Perhaps a portion of their allowance is designated for needs, while the remainder is for wants.

This content may interest you! How to save money if you are not working?

How to save money if you are not working?This helps them prioritize spending and understand the implications of their choices. It also provides a valuable learning experience in budgeting and resource management.

- Create a budget with your teen outlining needs and wants

- Encourage saving a portion of their allowance for larger purchases

- Discuss responsible spending habits and the importance of saving

How much money should a 14 year old get on their birthday?

How much money a 14-year-old should receive for their birthday depends entirely on several factors. There's no single "right" amount. Consider the giver's financial situation, their relationship to the 14-year-old, and the teenager's own spending habits and responsibilities.

A grandparent might give more than a distant aunt, for instance, and a child with a part-time job might receive less than one without. A reasonable range could be anywhere from $20 to $200, but this is highly subjective. The key is the thoughtfulness behind the gift, not necessarily the monetary value.

Factors Influencing the Amount of Birthday Money

The amount of money a 14-year-old receives should depend on various factors. It's not simply about the age; it’s about the circumstances. Considering these aspects will help determine an appropriate amount.

- The giver's financial capabilities: A family struggling financially might give a smaller gift than a wealthy family.

- The relationship between the giver and the recipient: Close relatives might give more generously than acquaintances.

- The 14-year-old's existing resources: A teenager with a part-time job and savings might not need as much as a teenager who doesn't have any income.

Considering the Teenager's Needs and Wants

A thoughtful gift, whether it's cash or something else, shows you care about the recipient. When deciding on an amount, think about the teen's interests and goals.

- Their interests: Does the teenager have specific hobbies or items they've been saving up for? Cash could contribute toward that goal.

- Their responsibilities: Does the teenager have any financial responsibilities, such as contributing to household expenses or saving for college? The gift could support those responsibilities.

- Their spending habits: Are they responsible with money or do they tend to spend impulsively? This might influence the amount given.

Alternatives to Cash Gifts

While cash is convenient, consider other options that might be more valuable to the teenager. Combining cash with another gift can be a great approach.

- Experiences: Concert tickets, a day trip, or a weekend getaway can create lasting memories.

- Gift cards: These allow teenagers to choose items they truly want from their favorite stores.

- Combination gifts: A smaller amount of cash alongside a meaningful gift, such as a new book or piece of technology, can be a thoughtful and practical option.

How much allowance should a 14-year-old get?

The amount of allowance a 14-year-old receives depends heavily on their family's financial situation and the child's responsibilities. There's no magic number. Some families might offer a small, fixed amount for basic needs, while others might tie allowance to chores and responsibilities, increasing the amount as the teen takes on more tasks.

Consider the teen's needs – school lunches, entertainment, personal items – and what they can reasonably contribute to the household. Open communication between parents and child about budgeting and financial responsibility is crucial.

Should a 14-year-old have a part-time job?

Whether a 14-year-old should have a part-time job is a complex decision involving legal considerations (child labor laws vary by location), school workload, and the teen's maturity level. If a part-time job is considered, ensuring it doesn't interfere with schoolwork is vital.

The job should ideally offer valuable life skills and teach responsibility, not just provide extra spending money. Parents should closely supervise the employment situation, ensuring fair wages, safe working conditions, and a reasonable workload.

This content may interest you! Should a 15 year old save money?

Should a 15 year old save money?What should a 14-year-old save their money for?

A 14-year-old should prioritize saving for short-term and long-term goals. Short-term goals could include items like a new phone, video game, or clothes. Long-term goals might involve saving for college, a car, or travel.

Teaching the teen to budget and differentiate between needs and wants is a valuable life lesson. Encourage them to create a savings plan, setting aside a portion of their money regularly, and fostering a habit of saving early.

How can a 14-year-old learn to manage their money?

Managing money at 14 involves learning basic financial literacy. This includes understanding budgeting, saving, and responsible spending. Parents can help by creating a simple budget together, teaching the teen to track their income and expenses, and explaining the importance of saving.

Using a piggy bank, a savings account, or even a budgeting app can be helpful tools. Discussing financial concepts like interest and debt in age-appropriate ways can build a strong foundation for future financial success.

Leave a Reply