How much should a 50 year old have in savings UK?

Turning 50 is a significant milestone, prompting many to reassess their financial standing. This article explores the crucial question: how much savings should a 50-year-old in the UK realistically aim for? We'll delve into factors influencing savings goals, including lifestyle, mortgage status, retirement plans, and desired future lifestyle.

We'll provide practical guidance and benchmarks, helping you determine your own personal savings target and develop a robust financial strategy for the years ahead. Remember, this is a personal journey, and the right amount is relative to your individual circumstances.

How Much Savings Should a 50-Year-Old in the UK Aim For?

There's no single magic number for how much savings a 50-year-old in the UK should have. The ideal amount depends heavily on individual circumstances, including retirement goals, lifestyle aspirations, current income, existing debts, and health.

A comfortable retirement often requires significant savings, considerably more than simply having enough for essential living expenses. Factors like mortgage payments, potential healthcare costs, and desired travel plans all contribute to the overall savings needed. While some might be content with a modest retirement, others may envision a lavish lifestyle requiring substantially larger savings.

It's crucial to consider your personal circumstances and aspirations when determining a suitable savings target. Financial advisors can offer personalized guidance based on your specific situation, helping you create a retirement plan tailored to your needs and financial capabilities. Using online retirement calculators can also provide a general estimate, but professional advice is strongly recommended.

Factors Influencing Savings Goals for 50-Year-Olds in the UK

Several key factors influence the appropriate savings target for a 50-year-old in the UK. Lifestyle expectations play a significant role; someone aiming for a luxurious retirement will need a much larger nest egg than someone planning a simpler lifestyle.

Outstanding debts, such as mortgages or loans, substantially impact available savings, requiring individuals to prioritize debt reduction before significantly increasing savings. Health considerations are also crucial; anticipated healthcare expenses in later life can dramatically alter savings requirements.

Finally, pension contributions are vital. Understanding current pension pot value and projected income at retirement is crucial in determining the additional savings needed to achieve desired retirement goals. Careful consideration of these factors is essential for accurate savings planning.

Retirement Income Planning and Savings at 50

Effective retirement planning is crucial for 50-year-olds in the UK. Understanding the state pension entitlement is a critical first step. This will form a significant base of retirement income, informing the additional savings needed to achieve a desired standard of living.

This content may interest you! Is saving $1000 a month good in the UK?

Is saving $1000 a month good in the UK?It's important to regularly review investment strategies, adjusting portfolios based on market conditions and risk tolerance. Diversification is key to managing risk effectively. Seeking advice from a financial advisor can significantly enhance the effectiveness of retirement planning, enabling individuals to make informed decisions tailored to their unique situations and circumstances.

Proactive and well-informed planning at this stage significantly improves the chances of a comfortable and secure retirement.

Strategies for Increasing Savings at Age 50

Boosting savings at 50 requires a strategic approach. Reviewing spending habits and identifying areas for potential reductions is a crucial first step. This could involve cutting back on non-essential expenses or finding more cost-effective alternatives.

Increasing income, if possible, through a side hustle or seeking higher-paying employment, can significantly boost savings potential. Exploring additional pension contributions, even small incremental amounts, can generate substantial long-term benefits through compound interest.

Finally, considering downsizing the home can free up significant capital that can be reinvested to accelerate savings growth. Combining these strategies provides a holistic approach to improving financial security in later years.

| Factor | Impact on Savings Goal |

|---|---|

| Desired Lifestyle | Higher lifestyle expectations require significantly larger savings. |

| Outstanding Debts | Significant debts reduce available funds for savings, necessitating prioritized debt reduction. |

| Health Concerns | Potential healthcare costs can substantially increase savings requirements. |

| Pension Contributions | Existing pension pot value and projected income influence additional savings needed. |

How much money should a 50 year old have in the bank?

There's no single answer to how much money a 50-year-old should have in the bank. It depends heavily on individual circumstances, including income, expenses, debt, retirement goals, and risk tolerance. A 50-year-old's savings should reflect their unique financial picture, not a generalized average.

Focusing on a target net worth, rather than a specific bank balance, is often more helpful. This net worth should encompass all assets (including investments, property, retirement accounts) less all liabilities (including mortgages, loans, and credit card debt).

Factors Influencing Savings at Age 50

Several key factors determine the appropriate level of savings for a 50-year-old. High earners with substantial assets and low debt will naturally have a significantly larger bank balance than someone with a lower income, high debt, and fewer assets.

Lifestyle choices also play a crucial role; someone planning an early retirement will need a larger nest egg compared to someone intending to work until a later age. The amount of money in the bank itself can be less important than overall financial health.

This content may interest you! What should your net worth be at 50 UK?

What should your net worth be at 50 UK?- Income: Higher income generally allows for greater savings and investment.

- Expenses: A higher level of expenses reduces the amount available for saving and investing.

- Debt: Significant debt (mortgages, loans) reduces the net worth and may necessitate a larger emergency fund.

Emergency Fund and Short-Term Goals

A 50-year-old should ideally have a well-established emergency fund, typically covering 3-6 months of living expenses. This fund acts as a safety net against unexpected job loss, medical emergencies, or home repairs.

Beyond the emergency fund, the amount in the bank will depend on upcoming short-term goals. For example, someone saving for a down payment on a vacation home or funding a child's education will likely have more in readily accessible savings.

- Emergency Fund: Covers unexpected expenses, providing financial security.

- Short-Term Goals: Savings dedicated to specific, near-future objectives (e.g., home improvements, travel).

- Liquidity Needs: The amount kept in readily accessible accounts depends on anticipated cash flow needs.

Retirement Planning and Long-Term Goals

Retirement planning is a significant factor at age 50. A substantial portion of a 50-year-old's savings should ideally be directed toward retirement accounts (401(k)s, IRAs). The specific amount needed will vary depending on retirement goals, expected longevity, and desired lifestyle in retirement.

While some money should be easily accessible, a significant portion might be invested in longer-term assets with potentially higher returns.

- Retirement Savings: A crucial element, considering future financial needs.

- Investment Strategy: The allocation of retirement savings across various assets (stocks, bonds, etc.).

- Long-Term Goals: Defining retirement lifestyle and associated financial requirements.

Is 100k in savings good?

Whether $100,000 in savings is "good" is entirely relative and depends on several factors. It's not a universally applicable yes or no answer. Several key considerations influence the assessment.

Factors Affecting the Value of $100,000 in Savings

The perceived value of $100,000 in savings is heavily dependent on individual circumstances. A single person might view this amount very differently than a family of four. Geographic location also plays a crucial role, as the cost of living varies drastically across regions and countries.

Furthermore, the age of the saver and their financial goals are critical factors to consider. A younger individual might see this sum as a strong foundation for future investments, whereas someone nearing retirement might consider it insufficient for their long-term needs.

- Cost of Living: High cost of living areas significantly diminish the perceived value of $100,000. A sum that might feel substantial in one location could be barely enough to cover a down payment on a home in another.

- Age and Financial Goals: The same amount of savings holds different significance at different life stages. Early in one's career, $100,000 might represent a significant achievement and a solid foundation for future investments. For someone closer to retirement, it could represent a significant shortfall.

- Debt and Liabilities: Existing debts, like mortgages or student loans, significantly impact the overall financial picture. $100,000 might seem substantial, but if burdened by significant debt, the actual financial security is lessened.

Considering $100,000 in the Context of Investing

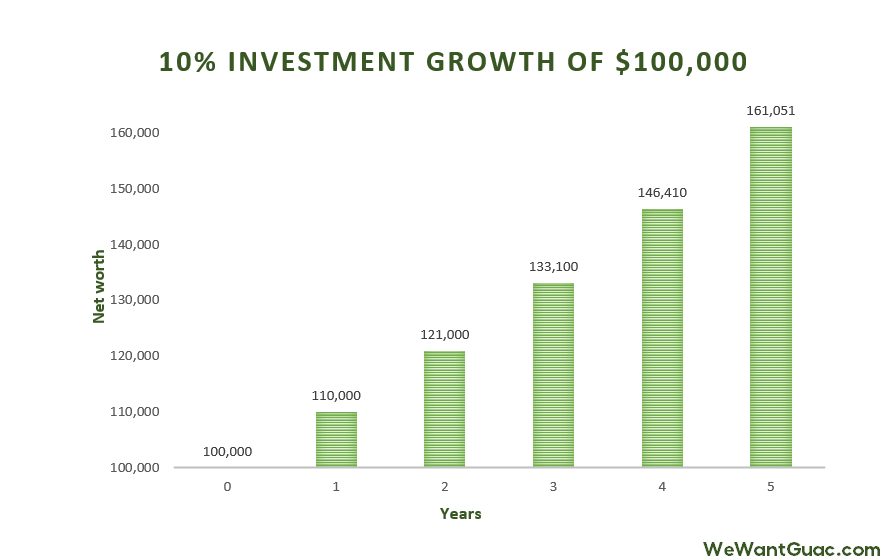

While $100,000 is a considerable amount, its long-term value can be significantly amplified through strategic investing. Holding this money solely in a savings account might not be the most prudent approach, considering inflation and potential returns from investment opportunities.

This content may interest you! How do I invest with very little money?

How do I invest with very little money?Diversification is key to mitigate risk and maximize potential growth. Different investment vehicles, each with varying levels of risk and potential return, offer various paths to enhance the initial $100,000.

- Investment Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk and enhance the potential for growth. This reduces the impact of poor performance in a single sector.

- Risk Tolerance: Individuals' risk tolerance dictates the appropriate investment strategy. A more conservative investor might favor lower-risk investments such as bonds, while a more aggressive investor might pursue higher-risk, higher-reward options like stocks.

- Long-Term Growth: Strategic investing aims to outperform inflation and generate long-term growth. Compounding interest plays a vital role in accumulating wealth over time. Starting with a substantial base like $100,000 provides a stronger foundation for this process.

Comparing $100,000 to National Averages

Benchmarking $100,000 against national savings averages provides context. Comparing the amount to the median or average savings of households in a specific country reveals whether it exceeds or falls short of the typical savings level.

This comparison should consider factors like household size, age, and income level. Contextualizing the savings amount against national averages gives a clearer picture of its relative value.

- National Averages: Comparing $100,000 to national average savings data offers valuable context. Data on average household savings can help determine whether this sum is above or below the norm, providing a relative measure of financial standing.

- Household Size and Income: National averages should be considered in relation to household size and income. $100,000 might be exceptionally high for a single-person household with modest income, but average for a two-income household with higher income.

- Regional Variations: Average savings vary significantly by region. Cost of living heavily influences savings levels, making it vital to compare against the average for the specific geographic area.

Is 50k in savings good?

Whether $50,000 in savings is "good" is entirely relative and depends on several factors. It's a significant amount, but its value is contextual. Consider your age, expenses, debts, income, financial goals, and cost of living.

For someone early in their career with minimal debt, it might be excellent progress. For someone nearing retirement with substantial debts and high living costs, it might be insufficient. The key isn't the absolute number, but rather how it aligns with your personal financial situation and aspirations.

Factors Influencing the Value of $50,000 in Savings

Several factors determine whether $50,000 is a good amount of savings for you. Your individual circumstances and financial goals significantly affect the interpretation of this sum. It's crucial to analyze these factors before making a judgment about the adequacy of your savings.

- Your age: A younger person might find $50,000 a strong foundation for future investments and financial security, while an older individual might view it as a relatively modest sum for retirement planning.

- Your income and expenses: If you have a high income and low expenses, $50,000 might represent a smaller portion of your financial picture compared to someone with a lower income and higher expenses.

- Your debts: The presence of significant debts, such as student loans or credit card balances, drastically alters the perception of $50,000. If you're burdened by debt, $50,000 might be a crucial step towards financial freedom, whereas someone debt-free might find it less impactful.

Comparing $50,000 Savings to National Averages

Comparing your savings to national averages provides a broader perspective on the significance of $50,000. However, relying solely on averages can be misleading, as individual circumstances can vary greatly.

It's crucial to analyze your personal financial situation rather than comparing yourself to others.

- National Savings Averages: Comparing your $50,000 savings to the average savings across your country will give context. If the average is significantly lower, you're in a stronger position. If the average is higher, you may want to re-evaluate your savings strategy.

- Average Household Income: Your savings should also be assessed against your household income. A higher income typically allows for greater savings. A lower income might necessitate a more conservative approach to spending and investment.

- Cost of Living: The cost of living in your area greatly influences the value of $50,000. In high-cost areas, $50,000 might be considered a modest amount, while in more affordable regions, it could represent a larger proportion of your overall financial security.

Long-Term Financial Goals and $50,000 Savings

The significance of $50,000 in savings heavily relies on your long-term financial objectives. Retirement, buying a home, or starting a business will each require different savings targets. Your financial goals shape how you perceive the current value of your accumulated funds.

This content may interest you! What is the best investment for a small amount?

What is the best investment for a small amount?- Retirement Planning: $50,000 is a good start for retirement, but it's likely insufficient to cover all retirement needs unless it's coupled with a solid retirement plan and continued contributions.

- Homeownership: For a down payment on a home, $50,000 can be a significant contribution, especially in areas with lower housing costs. In expensive markets, it might be just a portion of the required down payment.

- Emergency Fund: $50,000 is a substantial emergency fund and provides considerable financial security in case of unexpected expenses or job loss.

How much money does an average 50 year old have?

There's no single answer to how much money an average 50-year-old has. The amount varies dramatically based on numerous factors, including geographic location, career choices, education level, spending habits, investment strategies, and inheritance. Instead of a specific number, it's more accurate to discuss ranges and influencing factors.

Some 50-year-olds may be millionaires, others may struggle financially. Average net worth figures can be misleading, as they are often skewed by high earners. Data often represents median net worth, which better reflects the middle ground but still hides a vast range of individual circumstances. Reliable sources for data on household net worth by age group include government statistical agencies and financial research firms. However, even these sources use broad averages, and individuals will deviate significantly.

Factors Affecting a 50-Year-Old's Net Worth

A multitude of variables contribute to a 50-year-old's financial standing. These factors can interact in complex ways, making generalizations unreliable. Consider a person's career path: high-earning professions naturally lead to higher accumulation of assets.

Conversely, those in lower-paying jobs or facing career interruptions might have significantly less. Savings and investment choices are critical; consistent saving and strategic investing over the years will substantially boost net worth.

Unexpected life events such as health issues or job loss can heavily impact savings and overall wealth. Finally, inheritance plays a considerable role for some, greatly altering their financial picture compared to others who receive no such windfall.

- Career choice and income level: High-income professions like medicine, law, and finance typically lead to greater wealth accumulation compared to lower-paying jobs.

- Savings and investment strategies: Consistent saving and wise investment choices, such as investing in stocks, bonds, and real estate, significantly impact long-term wealth.

- Unexpected life events: Major medical expenses, job loss, or unforeseen economic downturns can drastically affect a person's financial situation.

Data Limitations and Interpretations

Interpreting data on average wealth for 50-year-olds needs careful consideration. Published statistics often represent averages or medians, obscuring significant variations. Averages can be misleading as they are easily skewed by high earners, masking the financial reality of the majority.

Moreover, data usually reflects household net worth, which includes assets like homes and retirement accounts, but doesn't always capture individual financial pictures clearly. It's vital to acknowledge the limitations and consider the broader context of socio-economic factors when interpreting such figures.

Regional differences are also substantial; a 50-year-old in a high cost-of-living area might have less disposable income and savings than someone in a more affordable region, even with similar earnings.

This content may interest you! Can I invest as little as $100?

Can I invest as little as $100?- Averages versus medians: The median (the middle value) is often a more accurate representation than the average (mean) when dealing with income or wealth data, as averages can be distorted by outliers.

- Household net worth versus individual wealth: Data often focuses on household net worth, which may not accurately reflect an individual's financial situation, especially in cases of dual-income households or unequal asset distribution.

- Regional variations: Cost of living significantly impacts financial stability; a 50-year-old in a high-cost area might have accumulated less despite similar income compared to someone in a lower-cost region.

Debt and its Impact

Debt significantly affects a 50-year-old's overall financial picture. Mortgage debt, student loans, and credit card debt can substantially reduce net worth and financial flexibility. The level of debt relative to income and assets is a critical factor in determining financial health.

High debt levels can hinder retirement planning and limit the ability to enjoy life after 50. Effective debt management strategies, such as paying down high-interest debt and budgeting effectively, are crucial to improving financial well-being.

A 50-year-old with significant debt might have fewer savings and assets than a similar individual with less debt, despite having the same income.

- Mortgage debt: A significant portion of a 50-year-old's assets might be tied up in home equity, which is not readily accessible unless the home is sold.

- Student loan debt: Outstanding student loans can stretch into middle age for many, impacting savings and other financial goals.

- Credit card debt: High-interest credit card debt can quickly consume a significant portion of income and reduce financial stability.

Frequently Asked Questions

How much savings should I ideally have at 50 in the UK?

There's no single "right" amount, as savings goals depend heavily on individual circumstances. Factors like your desired retirement lifestyle, mortgage status (paid off or not), existing pension contributions, and health all play a significant role.

However, a general guideline might suggest aiming for at least 1-2 times your annual salary saved by age 50. This is a starting point; you may need more if you plan a lavish retirement or less if you anticipate inheriting assets or have other financial support lined up. Professional financial advice tailored to your situation is highly recommended.

What if I'm behind on my savings goals at 50?

Don't panic! It's never too late to start saving or to boost your efforts. First, honestly assess your current financial situation, including debts and income. Then, create a realistic budget, identifying areas where you can cut back.

Explore ways to increase your income, such as taking on extra work or investing wisely. Consider consulting a financial advisor to develop a catch-up plan.

They can help create a strategy focusing on maximizing your savings potential for the years you have left until retirement. Prioritize paying off high-interest debts before aggressively saving.

What types of savings accounts are best for someone nearing retirement?

As you approach retirement, preserving your capital becomes crucial. Consider lower-risk, lower-return options like Cash ISAs, which offer tax advantages, or Premium Bonds, for a small chance of winning prizes.

This content may interest you! How much should a 25 year old save?

How much should a 25 year old save?While these may not yield the highest returns, they minimize the risk of losing your savings. You can maintain a portion of your savings in higher-risk investments like stocks and shares ISAs for potentially higher returns, but always balance this with your risk tolerance and time horizon. Diversification is key to mitigating risk.

How can I ensure I have enough for retirement at 50?

Regularly reviewing and adjusting your financial plan is vital. Factor in inflation, which can erode the value of savings over time.

Consider increasing your pension contributions if possible; even small increases can make a significant difference in the long run. Maximize tax-efficient savings schemes like ISAs to reduce your tax burden.

Regularly speak to a financial advisor to receive personalized advice and make sure your savings strategy aligns with your retirement goals. Remember, unforeseen circumstances can impact your plans, so having a financial buffer for emergencies is also essential.

Leave a Reply