How much should a young person save?

Saving money is a crucial habit for young people to develop early in life, as it lays the foundation for financial stability and future opportunities. However, determining how much to save can be challenging, given varying incomes, expenses, and goals.

While there is no one-size-fits-all answer, financial experts often recommend saving a percentage of income, such as 20%, to build an emergency fund, invest, or prepare for major life milestones. Balancing saving with enjoying the present is equally important.

This article explores practical strategies for young individuals to set realistic savings goals, prioritize spending, and create a sustainable financial plan for the future.

How Much Should a Young Person Save?

Saving money as a young person is a crucial step toward financial independence and long-term stability. While the exact amount varies depending on individual circumstances, a common recommendation is to save 20% of your income.

This percentage can be adjusted based on factors like income level, living expenses, and financial goals. Young people should prioritize building an emergency fund covering 3-6 months of living expenses, followed by saving for short-term goals (e.g., travel or a car) and long-term goals (e.g., retirement or a home).

This content may interest you! What is the 50/30/20 rule of money?

What is the 50/30/20 rule of money?Starting early allows the power of compound interest to work in your favor, making even small savings grow significantly over time.

Why Is Saving Early Important?

Saving early is essential because it leverages the power of compound interest, which allows your money to grow exponentially over time.

For example, if you start saving $200 a month at age 25 with an average annual return of 7%, you could accumulate over $500,000 by age 65. In contrast, starting at age 35 would yield significantly less.

Additionally, early saving habits help build financial discipline, making it easier to manage money and avoid debt in the future.

How to Determine Your Savings Rate?

Your savings rate depends on your income, expenses, and financial goals. A good starting point is the 50/30/20 rule: allocate 50% of your income to needs, 30% to wants, and 20% to savings. However, if your expenses are high, you may need to adjust this ratio.

This content may interest you! How much should a 25 year old save?

How much should a 25 year old save?For instance, young adults living at home might save more aggressively, while those paying rent or student loans might start with a lower percentage. The key is to prioritize consistency and gradually increase your savings rate as your income grows.

What Should Young People Save For?

Young people should focus on saving for three main categories: emergencies, short-term goals, and long-term goals. An emergency fund is the top priority, as it provides a safety net for unexpected expenses like medical bills or job loss.

Short-term goals might include saving for a vacation, a car, or further education. Long-term goals typically involve retirement savings and investments, such as contributing to a 401(k) or IRA. Diversifying your savings ensures you’re prepared for both immediate needs and future aspirations.

| Category | Recommended Savings | Purpose |

|---|---|---|

| Emergency Fund | 3-6 months of expenses | Financial safety net |

| Short-Term Goals | Varies by goal | Travel, car, education |

| Long-Term Goals | 15-20% of income | Retirement, home purchase |

How much should a 20 year old have saved?

Factors Influencing Savings for a 20-Year-Old

The amount a 20-year-old should have saved depends on several factors, including their income, expenses, and financial goals. Here are some key considerations:

- Income Level: A 20-year-old with a part-time job may save less than someone with a full-time position.

- Living Situation: Living at home versus paying rent significantly impacts how much one can save.

- Financial Goals: Saving for short-term goals like a vacation differs from long-term goals like buying a house.

Recommended Savings Benchmarks for a 20-Year-Old

While there is no one-size-fits-all answer, financial experts often suggest the following benchmarks for a 20-year-old:

This content may interest you! How much savings should I have per age?

How much savings should I have per age?- Emergency Fund: Aim to save at least $1,000 to $2,000 for unexpected expenses.

- Retirement Savings: Start contributing to a retirement account, even if it's a small percentage of your income.

- General Savings: Ideally, have 3-6 months' worth of living expenses saved by your mid-20s.

Strategies to Build Savings at 20

Building savings at a young age requires discipline and planning. Here are some effective strategies:

- Budgeting: Track your income and expenses to identify areas where you can cut back.

- Automate Savings: Set up automatic transfers to a savings account to ensure consistent contributions.

- Side Hustles: Consider taking on freelance work or part-time gigs to increase your income.

How much does the average young person have in savings?

Average Savings Among Young Adults

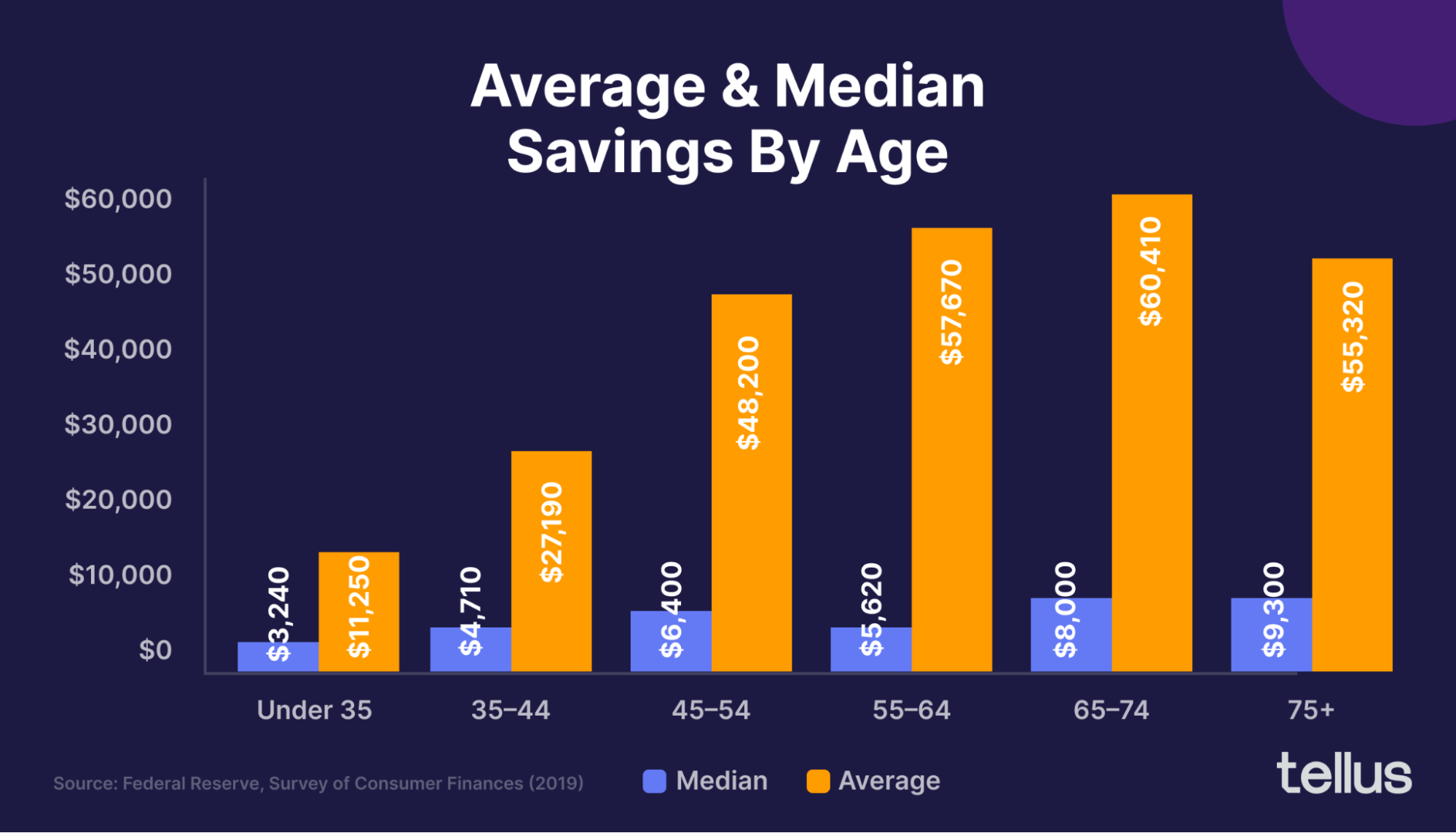

The average savings of young people can vary significantly depending on factors such as age, income, and geographic location. According to recent studies, the average young adult (aged 18-34) in the United States has approximately $5,000 to $10,000 in savings.

However, this figure can be misleading, as many young people have little to no savings due to student loan debt, high living expenses, or limited income.

- Young adults aged 18-24 often have less than $1,000 in savings due to lower earnings and early career stages.

- Those aged 25-34 tend to have higher savings, averaging around $10,000, as they progress in their careers and earn more.

- Geographic location plays a significant role, with young people in urban areas often saving less due to higher living costs.

Factors Influencing Savings Among Young People

Several factors influence how much young people are able to save. These include income levels, debt obligations, and financial literacy. For instance, young adults with student loans or credit card debt may struggle to build savings, while those with higher incomes or fewer financial obligations can save more.

This content may interest you! What is the 70 saving rule?

What is the 70 saving rule?- Student loan debt is a major barrier, with many young adults prioritizing debt repayment over savings.

- Financial literacy and education can significantly impact savings habits, as those who understand budgeting and investing are more likely to save effectively.

- Economic conditions, such as job market stability and inflation, also affect how much young people can save.

Strategies for Young People to Increase Savings

Despite challenges, there are several strategies young people can use to build their savings. These include creating a budget, reducing unnecessary expenses, and taking advantage of employer-sponsored retirement plans or savings accounts.

- Creating a detailed budget helps young adults track income and expenses, making it easier to identify areas where they can save.

- Reducing discretionary spending, such as dining out or subscription services, can free up funds for savings.

- Utilizing employer benefits, such as 401(k) matching programs, can help young people grow their savings over time.

How much should a young person save from each paycheck?

Understanding the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting guideline that can help young people allocate their income effectively. This rule suggests dividing your paycheck into three categories:

- 50% for needs: This includes essential expenses like rent, utilities, groceries, and transportation.

- 30% for wants: This covers non-essential expenses such as dining out, entertainment, and hobbies.

- 20% for savings: This portion should be directed towards savings, including emergency funds, retirement accounts, and other financial goals.

Building an Emergency Fund

An emergency fund is a crucial part of financial security. Young people should prioritize saving for unexpected expenses, such as medical bills or car repairs. Here’s how to approach it:

- Start small: Aim to save at least $500 initially, then gradually build it up to cover 3-6 months of living expenses.

- Automate savings: Set up automatic transfers from your paycheck to a dedicated savings account.

- Keep it accessible: Store your emergency fund in a high-yield savings account for easy access and growth.

Planning for Long-Term Goals

Saving for long-term goals, such as buying a home or retiring early, requires consistent effort. Here’s how young people can approach this:

- Set clear goals: Define what you’re saving for and estimate the amount needed.

- Use retirement accounts: Contribute to a 401(k) or IRA to take advantage of tax benefits and compound interest.

- Adjust as needed: Regularly review your savings plan and adjust contributions based on changes in income or priorities.

Is $1000 a month good savings?

Saving $1000 a month can be a strong starting point for building financial security, depending on your income, expenses, and financial goals. Here are some factors to consider:

This content may interest you! What is the 80/20 rule in saving money?

What is the 80/20 rule in saving money?- If your monthly income is relatively high, $1000 might represent a smaller percentage, but it still contributes significantly to long-term savings.

- For individuals with lower incomes, saving $1000 a month could be challenging but highly impactful if achieved consistently.

- It’s important to assess your budget and ensure that saving $1000 doesn’t compromise essential expenses like housing, food, or healthcare.

How Does $1000 a Month Compare to Financial Goals?

Whether $1000 a month is good savings depends on your specific financial goals. Here’s how it measures up:

- For short-term goals like building an emergency fund, $1000 a month can help you save $12,000 in a year, which is a solid safety net.

- For long-term goals like retirement, $1000 a month invested wisely could grow significantly over time due to compound interest.

- If you’re saving for a major purchase, such as a home or car, $1000 a month can help you reach your target faster, depending on the total amount needed.

What Factors Influence Whether $1000 a Month is Good Savings?

Several factors determine whether saving $1000 a month is sufficient or impressive. Consider the following:

- Your location and cost of living: In high-cost areas, $1000 might not go as far compared to regions with lower living expenses.

- Your debt obligations: If you have significant debt, saving $1000 a month might need to be balanced with debt repayment strategies.

- Your lifestyle and spending habits: If you can comfortably save $1000 without sacrificing quality of life, it’s a strong indicator of good financial health.

Frequently Asked Questions

How much should a young person save each month?

A young person should aim to save at least 20% of their monthly income. This helps build a financial cushion while balancing other expenses. If 20% isn’t feasible, start with a smaller percentage and gradually increase it as income grows. Consistency is key to building savings over time.

What percentage of income should go into savings for young adults?

Young adults should allocate 20-30% of their income to savings, including emergency funds, retirement, and short-term goals. If this seems high, start with 10% and adjust as financial stability improves. Prioritizing savings early ensures long-term financial security.

How much should a young person have in an emergency fund?

A young person should aim to save 3-6 months’ worth of living expenses in an emergency fund. This provides a safety net for unexpected events like job loss or medical emergencies. Start small and build gradually to reach this target.

This content may interest you! How much is $1000 a month for 5 years?

How much is $1000 a month for 5 years?Should young people prioritize saving or paying off debt?

Young people should balance both saving and paying off debt. Focus on high-interest debt first while saving a small amount, like 5-10% of income. Once debt is manageable, increase savings to 20% or more to secure financial stability.

Leave a Reply