How should you diversify your income?

In today's volatile economic climate, relying on a single income stream is increasingly risky. Diversifying your income is crucial for financial stability and achieving long-term financial goals. This article explores effective strategies for building multiple income streams, considering your skills, resources, and risk tolerance. We'll examine various options, from side hustles and investments to starting a business or leveraging your existing expertise. Learn how to mitigate financial risks, increase your earning potential, and build a more secure financial future through smart income diversification.

How to Strategically Diversify Your Income Streams

Identify Your Skills and Passions

Diversifying your income effectively starts with a thorough self-assessment. Identify your existing skills and talents – what are you naturally good at? What do you enjoy doing? This is crucial because choosing income streams aligned with your passions will make the process more sustainable and enjoyable. Consider your professional experience and any unique knowledge you possess. Think broadly – it could be anything from writing and coding to baking, crafting, or offering consulting services in a specific field. The key is to leverage what you already have to create multiple revenue streams. Don't be afraid to brainstorm; the more ideas you generate, the better your chances of finding a viable path.

Explore Various Income Generation Methods

Once you've identified your strengths, research different income generation methods. This could include the gig economy (freelancing platforms like Upwork or Fiverr), creating and selling digital products (eBooks, online courses, templates), investing (stocks, bonds, real estate), starting a side hustle (e.g., online store, blog, service-based business), or even renting out assets you own (car, property). It’s important to research the pros and cons of each option and choose methods that align with your skills, time commitment, and risk tolerance. Start small and gradually expand as you gain experience and confidence. Don't try to do everything at once – focus on building one or two streams effectively before adding more.

Manage and Monitor Your Income Streams

Successful income diversification requires active management and monitoring. Keep track of your income and expenses for each stream to understand its profitability. Regularly evaluate your performance and make adjustments as needed. Are some streams performing better than others? Are there areas where you can improve efficiency or increase revenue? This ongoing process is critical for maximizing your overall financial success and adapting to changes in the market. Don't be afraid to cut your losses on underperforming streams and reallocate your efforts to more profitable ventures. Consistent tracking will provide valuable insights and inform future decisions.

This content may interest you! How to passively make $2000 a month?

How to passively make $2000 a month?| Income Stream | Description | Pros | Cons |

|---|---|---|---|

| Freelancing | Offering services on platforms like Upwork or Fiverr. | Flexible hours, potential for high income. | Inconsistent income, requires self-discipline. |

| Investing | Putting money into assets like stocks or real estate. | Potential for long-term growth, passive income. | Requires knowledge and carries risk. |

| Online Store | Selling products online through platforms like Etsy or Shopify. | Potential for high income, reach a wider audience. | Requires marketing efforts, inventory management. |

| Rental Income | Renting out a property or asset. | Passive income stream, relatively stable. | Requires property management, potential for vacancy. |

How can I make $1000 a month in passive income?

Making $1000 a Month in Passive Income

Generating $1000 a month in passive income requires dedication, strategic planning, and often, upfront investment of time and/or money. There's no get-rich-quick scheme, but several avenues can lead to this goal. The key is to build assets that generate income consistently with minimal ongoing effort. The amount of time and effort required to initially set up these income streams varies widely, so choose options that align with your skills and resources. Remember that "passive" doesn't mean "no work," it means minimal ongoing effort once the initial setup is complete. Consistent maintenance and monitoring will still be necessary. The speed at which you achieve your $1000 goal depends on the chosen method and the level of effort invested initially.

High-Ticket Affiliate Marketing

Affiliate marketing involves promoting other companies' products or services and earning a commission on each sale. Focusing on high-ticket items—products or services priced at $1000 or more—allows you to earn significant commissions with fewer sales. This approach requires building a substantial audience through a blog, YouTube channel, or social media presence. You need to establish trust and credibility to persuade people to purchase through your affiliate links.

This content may interest you! What 7 streams of income do millionaires have?

What 7 streams of income do millionaires have?- Identify high-ticket products or services in a niche you're passionate about.

- Build a strong online presence that attracts your target audience.

- Create high-quality content (blog posts, videos, social media updates) that provides value and subtly promotes affiliate products.

Creating and Selling Digital Products

Digital products like ebooks, online courses, templates, or stock photos can generate significant passive income. Once created, they can be sold repeatedly without requiring additional effort for each sale. This approach demands upfront work in creating a high-quality product and setting up a sales platform (like Etsy or your own website). Marketing your product is crucial for driving sales and building a sustainable income stream.

- Identify a topic or skill you're knowledgeable in and can create a valuable digital product around.

- Develop a high-quality product that meets the needs and expectations of your target audience.

- Establish an online store and marketing strategy to reach potential customers.

Real Estate Investment (Rental Properties)

Investing in rental properties can offer substantial passive income, but it usually involves a significant upfront investment. This strategy requires careful research and due diligence to identify profitable properties in good locations. You'll need to manage property maintenance, tenant relations, and legal aspects, although property management companies can handle much of this for a fee.

- Research potential rental properties in desirable locations with high rental yields.

- Secure financing (mortgage) and manage the purchase process.

- Find reliable tenants and establish clear rental agreements. Consider using a property management company to handle day-to-day operations.

What 7 streams of income do millionaires have?

Seven Streams of Income for Millionaires

This content may interest you! What are 7 sources of income?

What are 7 sources of income?Real Estate Investments

Real estate is a cornerstone of wealth building for many millionaires. It offers several avenues for generating income, often appreciating in value over time while providing consistent cash flow. This isn't limited to solely owning and renting out properties; it encompasses a broader spectrum of investment strategies.

- Rental income from residential or commercial properties.

- Profit from property flipping (buying, renovating, and selling).

- Real Estate Investment Trusts (REITs) for diversified exposure.

Business Ownership and Entrepreneurship

Owning and operating a successful business, whether it's a large corporation or a smaller, more specialized enterprise, is a significant income stream for many high-net-worth individuals. The income can be diverse, including profits, salaries, and investments within the company itself. Building a brand and systems that operate with or without their direct involvement allows for scalability and growth.

- Profits from the sale of goods or services.

- Salaries or draw from the business.

- Capital appreciation of the business's value.

Stock Market Investments and Dividends

The stock market, while involving inherent risk, provides a powerful avenue for long-term wealth creation. Millionaires often employ diversified investment strategies within the stock market to minimize risk and maximize potential returns. This includes both actively managed and passively managed portfolios.

- Dividends from stocks held in a portfolio.

- Capital gains from selling appreciated assets.

- Income from options trading (for more sophisticated investors).

Interest and Lending

Generating income through interest on savings, bonds, and other lending activities is a crucial aspect of wealth management for many millionaires. It provides a relatively stable and predictable income stream, supplementing other, potentially more volatile, sources of income. The strategy is often focused on diversification across various types of debt instruments.

This content may interest you! How can I make an extra $1000 a month from home?

How can I make an extra $1000 a month from home?- Interest from high-yield savings accounts.

- Interest from bonds (government or corporate).

- Returns from peer-to-peer lending platforms.

Intellectual Property

For those who create or own valuable intellectual property, this can become a substantial source of recurring income. This covers various forms of creative work and technological advancements, providing ongoing royalties and licensing fees.

- Royalties from books, music, or software.

- Licensing fees for patents or trademarks.

- Income from franchising a business model.

Passive Income Streams (e.g., Affiliate Marketing, Online Courses)

Passive income streams, while often requiring initial effort to establish, represent a significant income source for many wealthy individuals. They represent the automation of income generation, leveraging technology and strategic planning to create multiple streams of revenue without necessarily requiring their constant active involvement.

- Affiliate marketing commissions.

- Online course sales and subscriptions.

- Income from digital products (e.g., ebooks, templates).

Other Investments (e.g., Private Equity, Hedge Funds)

Many millionaires diversify their investment portfolios into alternative asset classes, such as private equity or hedge funds. These investments often require a higher minimum investment and are usually associated with higher risk but also higher potential returns. This is generally considered a more advanced strategy for wealth preservation and growth.

- Returns from private equity investments.

- Profits from hedge fund participation.

- Income from commodities trading (e.g., precious metals).

How to passively make $2000 a month?

What is the best online job to earn money?

What is the best online job to earn money?High-Yield Savings Accounts and Certificates of Deposit (CDs)

While not strictly "passive" in the sense of requiring zero effort, maintaining high-yield savings accounts and CDs demands minimal ongoing management. The key is to strategically allocate a substantial sum of money initially. Interest earned will compound over time. While achieving $2000 monthly passive income from interest alone requires a significant initial investment, it's a viable option for those with substantial capital. This strategy prioritizes security and stability over high growth potential.

- Research high-yield savings accounts and CDs from different banks and credit unions to compare interest rates and terms.

- Consider laddering your CDs to diversify risk and access funds as needed.

- Monitor your accounts periodically to ensure they are performing as expected and to track interest earned.

Affiliate Marketing and Selling Digital Products

Creating and marketing digital products or promoting other people's products through affiliate marketing can generate substantial passive income. The upfront effort is significant: it involves creating high-quality content, building a website or online presence, and employing effective marketing strategies. Once established, however, these platforms can generate income with minimal ongoing maintenance, requiring only updates to content and marketing campaigns to maintain engagement and relevance.

- Identify a niche market with high demand and low competition.

- Create valuable digital products like ebooks, online courses, or templates, or find suitable affiliate products to promote.

- Implement effective marketing strategies such as SEO, social media marketing, and email marketing to drive traffic and sales.

Real Estate Investment Trusts (REITs) and Dividend-Paying Stocks

Investing in REITs and dividend-paying stocks offers a relatively passive way to generate monthly income. REITs invest in income-generating real estate, while dividend-paying stocks distribute a portion of their profits to shareholders. While the initial investment is crucial, and market fluctuations can impact returns, these investment vehicles provide a relatively hands-off approach to building passive income streams compared to actively trading stocks.

- Research and select REITs and dividend-paying stocks with a history of consistent dividend payments.

- Diversify your portfolio to reduce risk and mitigate losses from any individual investment underperforming.

- Monitor your investments regularly, but avoid frequent trading, as this can negate the passive income nature of this strategy.

How should your money be diversified?

How to save money if you don't have a job?

How to save money if you don't have a job?Money Diversification

How your money should be diversified depends heavily on your individual circumstances, risk tolerance, and financial goals. There's no one-size-fits-all answer, but a well-diversified portfolio generally aims to spread your investments across different asset classes to minimize risk and maximize potential returns. This typically involves balancing higher-risk, higher-reward investments with lower-risk, lower-reward options. Your time horizon is also a crucial factor; younger investors with longer time horizons can generally tolerate more risk than those closer to retirement.

Asset Allocation Strategies

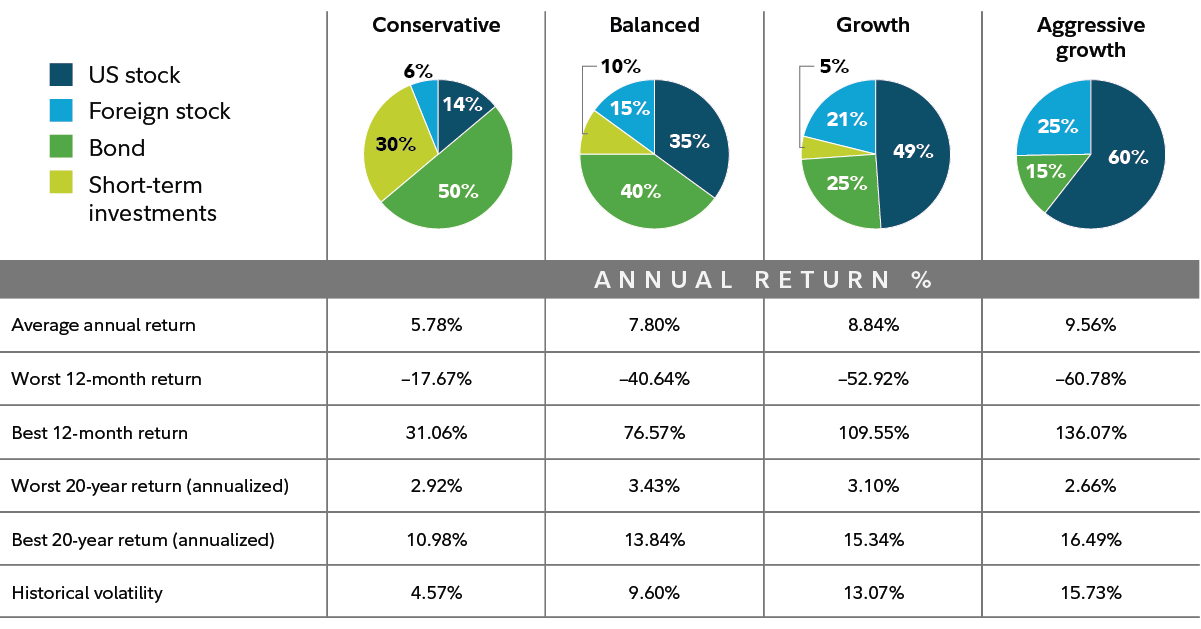

Asset allocation is the cornerstone of diversification. It involves determining the proportion of your portfolio that will be invested in various asset classes such as stocks, bonds, real estate, and cash. A common approach is to use a target-date fund, which automatically adjusts the asset allocation over time to become more conservative as you approach your target retirement date. However, you can also create a custom asset allocation strategy based on your own risk profile and goals. Remember, careful consideration of the potential risks and rewards associated with each asset class is essential.

- Stocks (Equities): Offer the potential for high growth but also carry higher risk. Consider diversifying within stocks by investing in different sectors (technology, healthcare, etc.) and market capitalizations (large-cap, mid-cap, small-cap).

- Bonds (Fixed Income): Generally less volatile than stocks, providing stability and income. Diversification within bonds can be achieved by investing in government bonds, corporate bonds, and municipal bonds with varying maturities.

- Real Estate: Can provide diversification benefits and potential for rental income. This could include direct property ownership or investment in REITs (Real Estate Investment Trusts).

Risk Tolerance and Time Horizon

Your risk tolerance and investment time horizon significantly influence your diversification strategy. Investors with a higher risk tolerance and a longer time horizon can typically allocate a larger portion of their portfolio to growth-oriented assets like stocks. Conversely, those with a lower risk tolerance and a shorter time horizon might prefer a more conservative approach with a larger allocation to bonds and cash. Understanding your personal risk profile is crucial before making any investment decisions. Don't invest in anything you don't fully understand.

This content may interest you! What is the 70 20 10 budget rule?

What is the 70 20 10 budget rule?- High Risk Tolerance (Longer Time Horizon): Greater allocation to stocks (e.g., 70% stocks, 30% bonds).

- Moderate Risk Tolerance (Medium Time Horizon): Balanced approach (e.g., 50% stocks, 50% bonds).

- Low Risk Tolerance (Shorter Time Horizon): Greater allocation to bonds and cash (e.g., 30% stocks, 70% bonds and cash).

Diversification Beyond Asset Classes

True diversification extends beyond simply investing in different asset classes. Geographic diversification, spreading investments across different countries and regions, can reduce risk exposure to specific economic or political events. Sector diversification within asset classes also plays a crucial role, ensuring that your portfolio isn’t heavily concentrated in a single industry or company. Consider diversifying across different investment vehicles, such as mutual funds, ETFs, and individual stocks, to further minimize risk.

- Geographic Diversification: Invest in international stocks and bonds to reduce reliance on a single country's economy.

- Sector Diversification: Avoid over-concentration in a single industry. Spread investments across various sectors (e.g., technology, healthcare, consumer goods).

- Investment Vehicle Diversification: Utilize a mix of investment tools such as mutual funds, ETFs, and individual stocks to create a well-rounded portfolio.

What are some low-risk ways to diversify my income?

Low-risk income diversification often involves strategies with lower potential returns but also reduced chances of significant losses. Consider starting a side hustle offering a service like freelance writing, virtual assistance, or tutoring, leveraging existing skills. Investing in high-yield savings accounts or certificates of deposit (CDs) provides a steady, albeit modest, return on your capital. Participating in the gig economy through platforms connecting you with short-term projects can offer flexible income streams. Remember that while these options are relatively safe, growth may be slower compared to higher-risk ventures.

How can I diversify my income streams without quitting my job?

Maintaining your current employment while diversifying income is achievable through various part-time or side-hustle options. Explore freelance work in your field or a complementary area, utilizing evenings or weekends. Rent out unused assets like a spare room on Airbnb or a parking space. Consider investing small amounts regularly in index funds or ETFs, building wealth over time. Online surveys or tasks can generate small but consistent supplemental income. The key is choosing options that fit your skillset, available time, and risk tolerance without overwhelming your primary employment.

What are some high-growth, but higher-risk, income diversification strategies?

High-growth income diversification involves greater risk, but the potential rewards are significantly larger. Starting your own business offers substantial growth potential but requires substantial time, effort, and carries a higher failure rate. Investing in stocks, cryptocurrencies, or real estate can yield high returns, but these markets are volatile and prone to fluctuations. Developing and selling intellectual property like software or e-books can be extremely lucrative if successful, but requires significant upfront investment and market validation. Thorough research and risk assessment are crucial before pursuing these avenues.

How do I determine the best income diversification strategy for me?

Choosing the right income diversification strategy requires a self-assessment of your skills, risk tolerance, time commitment, and financial goals. Consider your strengths and passions; what can you do well that others are willing to pay for? Assess your comfort level with risk; higher-risk strategies offer greater potential returns but also greater chances of losses. Evaluate how much time you can realistically dedicate to additional income streams. Finally, define your financial goals – are you aiming for quick returns or long-term wealth building? This assessment will guide you towards the most suitable approach for your individual circumstances.

Leave a Reply