How to budget if you have debt?

Managing debt while trying to maintain a balanced budget can feel overwhelming, but with the right strategies, it’s entirely possible to regain financial control. Budgeting with debt requires a clear understanding of your income, expenses, and debt obligations.

By prioritizing payments, cutting unnecessary expenses, and creating a realistic spending plan, you can gradually reduce your debt while still meeting your daily needs.

This article will guide you through practical steps to create a budget that works for your financial situation, helping you tackle debt effectively and build a stronger financial foundation for the future.

How to Budget Effectively When You Have Debt

Managing your finances while dealing with debt can feel overwhelming, but with a structured approach, it’s entirely possible to regain control. The key is to create a realistic budget that prioritizes debt repayment while still covering essential expenses.

Start by listing all your income sources and expenses, then identify areas where you can cut back. Allocate a portion of your income to debt payments and stick to this plan consistently. Over time, this disciplined approach will help you reduce your debt and improve your financial health.

This content may interest you! What is the 70-10-10-10 budget rule?

What is the 70-10-10-10 budget rule?1. Assess Your Financial Situation

The first step in budgeting with debt is to assess your financial situation. Gather all your financial statements, including credit card bills, loan statements, and monthly expenses. Calculate your total income and compare it to your expenses.

This will give you a clear picture of how much you can allocate toward debt repayment. If your expenses exceed your income, look for areas to cut back, such as dining out or subscription services. Understanding your financial standing is crucial for creating a realistic budget.

| Category | Amount |

|---|---|

| Monthly Income | $3,000 |

| Essential Expenses | $2,000 |

| Debt Payments | $500 |

| Discretionary Spending | $300 |

| Savings | $200 |

2. Prioritize High-Interest Debt

When budgeting with debt, it’s essential to prioritize high-interest debt first. High-interest debts, such as credit card balances, can quickly grow and become unmanageable. Focus on paying off these debts as quickly as possible while making minimum payments on lower-interest debts.

This strategy, often called the avalanche method, helps you save money on interest over time. Once the high-interest debt is paid off, redirect those payments to the next highest-interest debt.

| Debt Type | Interest Rate | Monthly Payment |

|---|---|---|

| Credit Card | 18% | $200 |

| Student Loan | 5% | $150 |

| Car Loan | 4% | $100 |

3. Build an Emergency Fund

While paying off debt is important, it’s equally crucial to build an emergency fund. Unexpected expenses, such as medical bills or car repairs, can derail your budget and force you to take on more debt.

This content may interest you! How much should you have in savings if you have debt?

How much should you have in savings if you have debt?Aim to save at least $1,000 initially, and gradually increase this amount to cover three to six months of living expenses. Having an emergency fund provides a financial cushion and prevents you from relying on credit cards or loans during emergencies.

| Emergency Fund Goal | Amount Saved |

|---|---|

| Initial Goal | $1,000 |

| Long-Term Goal | 3-6 Months of Expenses |

How to make a budget when you're in debt?

Assess Your Current Financial Situation

To create a budget while in debt, the first step is to thoroughly assess your current financial situation. This involves understanding your income, expenses, and the total amount of debt you owe. Here’s how to do it:

- List all sources of income, including salary, freelance work, or any other earnings.

- Track all monthly expenses, categorizing them into fixed (rent, utilities) and variable (entertainment, dining out).

- Compile a list of all debts, including credit cards, loans, and their respective interest rates and minimum payments.

Prioritize Debt Repayment in Your Budget

Once you have a clear picture of your finances, prioritize debt repayment in your budget. This ensures that you allocate funds effectively to reduce your debt over time. Follow these steps:

- Identify high-interest debts and focus on paying them off first to minimize interest accumulation.

- Allocate a specific portion of your income to debt repayment, ensuring it’s realistic and sustainable.

- Consider using strategies like the debt snowball or debt avalanche method to systematically pay off debts.

Cut Unnecessary Expenses and Increase Income

To free up more money for debt repayment, it’s essential to cut unnecessary expenses and explore ways to increase your income. Here’s how to approach this:

This content may interest you! How much does Dave Ramsey say to have in savings?

How much does Dave Ramsey say to have in savings?- Review your variable expenses and eliminate non-essential spending, such as subscriptions or luxury items.

- Look for ways to reduce fixed expenses, such as negotiating lower rates for utilities or refinancing loans.

- Explore additional income streams, such as part-time work, selling unused items, or freelancing, to boost your budget.

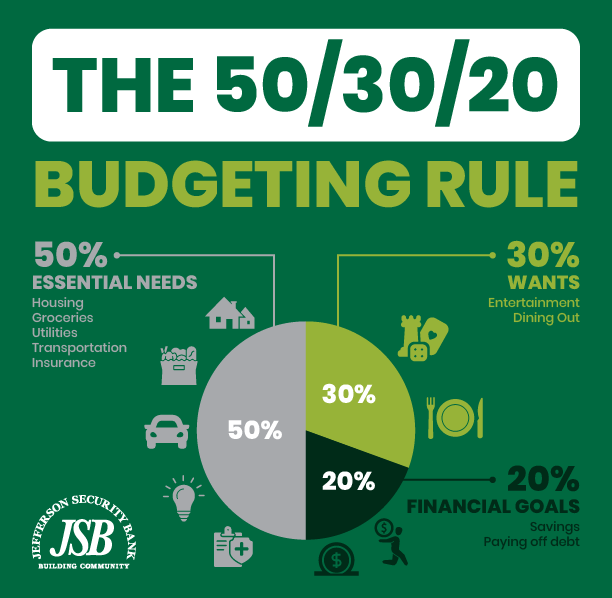

What is the 50/30/20 rule for debt?

The 50/30/20 rule for debt is a budgeting framework designed to help individuals manage their finances effectively by allocating their after-tax income into three categories: needs, wants, and savings or debt repayment.

According to this rule, 50% of income should go toward essential needs, 30% toward discretionary wants, and 20% toward savings or paying off debt. This approach ensures a balanced financial plan that prioritizes both immediate obligations and long-term financial health.

How Does the 50/30/20 Rule Work for Debt Management?

The 50/30/20 rule provides a structured way to manage debt by ensuring that a portion of income is consistently allocated toward debt repayment. Here’s how it works:

- 50% of income is allocated to needs, such as housing, utilities, groceries, and minimum debt payments.

- 30% of income is allocated to wants, such as dining out, entertainment, and non-essential purchases.

- 20% of income is allocated to savings or additional debt repayment, helping to reduce debt faster and build financial security.

Why Is the 50/30/20 Rule Effective for Debt Repayment?

The 50/30/20 rule is effective for debt repayment because it creates a clear and manageable structure for allocating income. Here’s why it works:

- It ensures that essential expenses are covered, reducing the risk of falling behind on payments.

- It allows for discretionary spending, which helps maintain a balanced lifestyle while working toward financial goals.

- It prioritizes debt repayment and savings, helping individuals make consistent progress toward becoming debt-free.

How to Apply the 50/30/20 Rule to Your Debt Situation

Applying the 50/30/20 rule to your debt situation involves careful planning and tracking of your expenses. Here’s how to do it:

This content may interest you! What is the 70 20 10 budget rule?

What is the 70 20 10 budget rule?- Calculate your after-tax income to determine the exact amounts for each category.

- List your essential needs and allocate 50% of your income to cover these expenses, including minimum debt payments.

- Use 30% of your income for discretionary wants, ensuring you have room for enjoyment without overspending.

- Direct 20% of your income toward savings or additional debt payments, focusing on high-interest debts first to reduce overall interest costs.

Is $5000 in debt a lot?

Understanding the Context of $5000 in Debt

Whether $5000 in debt is considered a lot depends on various factors, such as your financial situation, income, and the type of debt. For some, $5000 might be manageable, while for others, it could be overwhelming. Here are some key points to consider:

- Your income level: If you earn a high income, $5000 might be easier to pay off compared to someone with a lower income.

- Type of debt: Credit card debt with high interest rates can grow quickly, making $5000 more challenging to manage than a low-interest student loan.

- Existing financial obligations: If you already have other debts or high monthly expenses, $5000 could add significant stress to your finances.

Strategies to Manage $5000 in Debt

If you find yourself with $5000 in debt, there are several strategies you can use to manage and pay it off effectively. Here are some actionable steps:

- Create a budget: Track your income and expenses to identify areas where you can cut back and allocate more money toward debt repayment.

- Prioritize high-interest debt: Focus on paying off debts with the highest interest rates first to minimize the total amount you’ll pay over time.

- Consider debt consolidation: If you have multiple debts, consolidating them into a single loan with a lower interest rate can simplify payments and reduce costs.

Long-Term Implications of $5000 in Debt

Carrying $5000 in debt can have long-term effects on your financial health if not addressed properly. Here are some potential consequences and considerations:

- Impact on credit score: High levels of debt, especially if payments are missed, can lower your credit score, making it harder to secure loans or credit in the future.

- Stress and mental health: Persistent debt can lead to stress and anxiety, affecting your overall well-being and quality of life.

- Opportunity cost: Money spent on debt payments could otherwise be used for savings, investments, or other financial goals, delaying your progress toward financial stability.

How to pay off $30,000 in debt in 1 year?

Create a Detailed Budget Plan

To pay off $30,000 in debt within a year, the first step is to create a detailed budget plan. This involves tracking all income and expenses to identify areas where you can cut back and allocate more funds toward debt repayment. Here’s how to do it:

This content may interest you! What is the 50/20/30 budget rule?

What is the 50/20/30 budget rule?- List all sources of income, including salary, freelance work, or side hustles.

- Track all monthly expenses, categorizing them into essentials (rent, utilities, groceries) and non-essentials (entertainment, dining out).

- Identify areas where you can reduce spending, such as canceling subscriptions or limiting discretionary purchases.

- Allocate the saved money directly toward your debt payments.

Increase Your Income Streams

Paying off $30,000 in a year requires a significant monthly payment, which may not be feasible with your current income alone. Increasing your income can help you achieve this goal faster. Consider the following strategies:

- Take on a part-time job or freelance work to earn extra money.

- Sell unused items, such as electronics, clothing, or furniture, to generate additional cash.

- Explore gig economy opportunities like driving for a rideshare service or delivering food.

- Use your skills to offer services like tutoring, consulting, or graphic design.

Prioritize and Strategize Debt Repayment

To effectively pay off $30,000 in debt, it’s crucial to prioritize and strategize your repayment approach. This ensures you’re making the most of your resources. Follow these steps:

- List all your debts, including balances, interest rates, and minimum payments.

- Consider using the debt avalanche method, focusing on paying off high-interest debts first while making minimum payments on others.

- Alternatively, use the debt snowball method, paying off smaller debts first to build momentum.

- Negotiate with creditors for lower interest rates or better repayment terms to reduce the overall cost of your debt.

Frequently Asked Questions

How do I start budgeting when I have debt?

Begin by listing all your income sources and expenses. Prioritize essential expenses like rent, utilities, and groceries. Allocate a portion of your income to debt repayment, focusing on high-interest debts first. Use budgeting tools or apps to track spending and adjust your plan as needed. Staying consistent and disciplined is key to managing debt effectively.

Should I save money while paying off debt?

Yes, it’s important to build a small emergency fund, even while paying off debt. Aim for $500-$1,000 to cover unexpected expenses. This prevents you from relying on credit cards or loans in emergencies. Once your debt is under control, you can focus on growing your savings further.

How can I reduce expenses to pay off debt faster?

Cut non-essential spending, such as dining out, subscriptions, or entertainment. Look for ways to save on essentials, like using coupons or buying in bulk. Consider downsizing or finding cheaper alternatives for services like insurance or phone plans. Redirect the money saved toward your debt payments to accelerate repayment.

This content may interest you! What is the 70 saving rule?

What is the 70 saving rule?What’s the best strategy for prioritizing debt payments?

Use either the debt avalanche or debt snowball method. The avalanche method focuses on paying off high-interest debts first, saving you money on interest. The snowball method targets smaller debts first, providing quick wins to stay motivated. Choose the strategy that aligns with your financial goals and motivates you to stay on track.

Leave a Reply