How to consolidate debt and lower interest rates?

Are you drowning in debt with high-interest rates? Consolidating your debt can significantly improve your financial health. This article explores effective strategies to combine multiple debts into a single, more manageable payment, potentially lowering your overall interest rate. We'll examine various consolidation options, including balance transfer credit cards, personal loans, and debt management programs. Discover how to choose the best method for your situation, negotiate lower rates, and create a budget to stay on track toward debt freedom. Learn how to regain control of your finances and pave the way for a brighter financial future.

How to Consolidate Debt and Secure Lower Interest Rates

Understanding Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single, more manageable payment. There are several ways to achieve this. Balance transfer credit cards offer a temporary 0% APR period, allowing you to pay down your debt without accruing interest for a specified time. However, be aware of balance transfer fees and the high interest rate that kicks in after the introductory period ends. Personal loans provide a fixed interest rate and monthly payment, making budgeting easier. Debt management programs (DMPs), offered by credit counseling agencies, negotiate lower interest rates and monthly payments with your creditors, but they typically involve fees and may negatively impact your credit score. Finally, home equity loans or lines of credit (HELOCs) use your home's equity as collateral, potentially offering lower interest rates but carrying the risk of foreclosure if you default.

Negotiating Lower Interest Rates with Creditors

Before consolidating, actively negotiate with your creditors to lower your interest rates. Many lenders are willing to work with borrowers who demonstrate a commitment to repayment. Contact each creditor individually and explain your financial situation, highlighting your history of on-time payments (if any). Request a lower interest rate or a reduced monthly payment. Document everything in writing, including any agreements reached. Consider offering to pay a lump sum or increase your payments in exchange for a lower interest rate. Be polite but firm in your negotiations, and remember that persistence often pays off. If negotiations fail, you can then explore debt consolidation options more seriously.

Improving Your Credit Score to Qualify for Better Rates

Your credit score significantly impacts the interest rates you qualify for. Before applying for any consolidation loan or credit card, take steps to improve your credit score. Pay down existing debts, ensuring you pay at least the minimum payment on time each month. Check your credit report for errors and dispute any inaccuracies. Avoid opening new lines of credit unless absolutely necessary. Maintain a low credit utilization ratio (the amount of credit you're using compared to your total credit limit), ideally under 30%. Over time, these actions will improve your creditworthiness and increase your chances of securing a lower interest rate on your consolidated debt. This will make your debt consolidation more effective and less expensive in the long run.

This content may interest you! Can I negotiate my debt to pay less?

Can I negotiate my debt to pay less?| Debt Consolidation Method | Pros | Cons |

|---|---|---|

| Balance Transfer Credit Card | Potential for 0% APR, simplified payments | High interest rate after introductory period, balance transfer fees |

| Personal Loan | Fixed interest rate and monthly payment, improved budgeting | Requires good credit score, may not offer the lowest rates |

| Debt Management Program (DMP) | Negotiated lower interest rates and payments | Fees involved, may negatively impact credit score |

| Home Equity Loan/HELOC | Potentially lower interest rates | Risk of foreclosure, uses home equity as collateral |

Does debt consolidation lower interest rates?

Debt Consolidation and Interest Rates

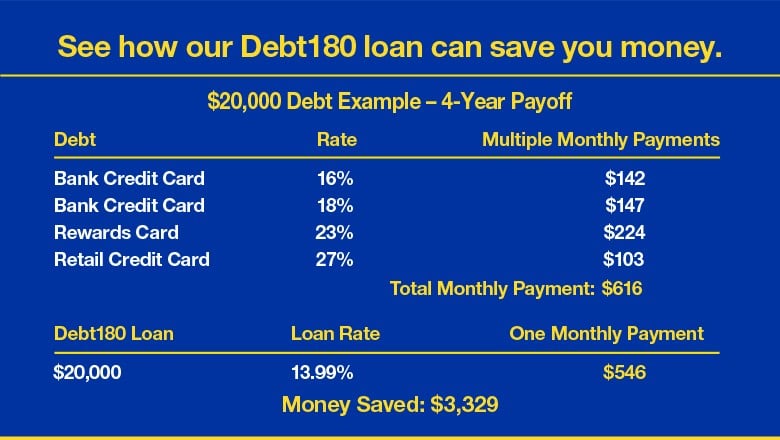

Debt consolidation does not automatically lower interest rates. Whether it lowers your overall interest rate depends heavily on several factors. If you qualify for a lower interest rate loan (like a balance transfer credit card or a personal loan) then consolidating your debt can lead to significant savings. However, if you secure a consolidation loan with a similar or higher interest rate to your existing debts, you won't save any money and may even end up paying more over time. The key is to shop around and compare interest rates from multiple lenders before making a decision. Consider factors like your credit score, the type of debt being consolidated, and the terms offered by different lenders. A lower interest rate loan is possible, but it's not guaranteed.

What Factors Influence Whether Debt Consolidation Lowers Interest Rates?

Several factors play a crucial role in determining whether debt consolidation results in a lower interest rate. Your credit score is a primary determinant; a higher score typically qualifies you for more favorable terms and lower interest rates. The type of debt you're consolidating also matters; some debt types, such as high-interest credit card debt, are often better candidates for consolidation than others. Finally, the terms of the consolidation loan itself are vital: A longer loan term might offer a lower monthly payment but will lead to higher total interest paid over the life of the loan.

This content may interest you! What are the best side hustles to pay off debt faster?

What are the best side hustles to pay off debt faster?- Credit Score: A higher credit score significantly improves your chances of securing a lower interest rate on a consolidation loan.

- Type of Debt: High-interest debt, such as credit card debt, is often a prime target for consolidation to reduce overall interest payments.

- Loan Terms: Carefully compare the interest rate, loan term, and total interest paid across different lenders to find the best deal.

How to Find the Best Interest Rate for Debt Consolidation

Actively searching for the best interest rate is essential when considering debt consolidation. Begin by checking your credit report to understand your creditworthiness. Then, compare offers from various lenders, including banks, credit unions, and online lenders. Don't hesitate to use online comparison tools to streamline this process. Pay close attention to the Annual Percentage Rate (APR), which includes all interest and fees associated with the loan. Be wary of hidden fees that can significantly increase the overall cost of the loan.

- Check Your Credit Report: Understand your current credit score to gauge your eligibility for the best interest rates.

- Compare Lenders: Explore different lenders to compare APRs, loan terms, and fees.

- Use Comparison Tools: Leverage online comparison sites to efficiently compare multiple lenders' offers.

Potential Downsides of Debt Consolidation if Interest Rates Aren't Lowered

If debt consolidation doesn't result in a lower interest rate, it might not be the most beneficial strategy. You may end up extending the repayment period, leading to a higher total interest paid over time, even if your monthly payment is lower. Furthermore, if you continue to accrue new debt during the consolidation period, you might find yourself in a worse financial position than before. Carefully weigh the pros and cons before proceeding. Consider alternatives, such as budgeting strategies and debt management plans, if debt consolidation with a comparable or higher interest rate seems likely.

- Extended Repayment Period: A longer repayment period means you'll pay more interest over the life of the loan.

- Increased Total Interest Paid: If the interest rate isn't lower, your total interest payments will likely exceed what you would have paid without consolidation.

- Potential for Further Debt Accumulation: Continuing to accrue debt while under a consolidation loan can worsen your financial situation.

How much is the payment on a $50,000 consolidation loan?

Consolidation Loan Payment Calculation

This content may interest you! How to stay debt-free after paying off what you owe?

How to stay debt-free after paying off what you owe?There's no single answer to how much the payment on a $50,000 consolidation loan will be. The monthly payment depends on several key factors:

Interest Rate

The interest rate is the most significant factor determining your monthly payment. A lower interest rate will result in a lower monthly payment. Interest rates vary depending on your credit score, the lender, and the type of loan. For example, a loan with a 5% interest rate will have a much lower monthly payment than one with a 15% interest rate. Consider these points:

- Check your credit report to understand your credit score, as this directly impacts the interest rate offered.

- Shop around with multiple lenders to compare interest rates and terms.

- Consider the type of loan. Federal student loans often have lower interest rates than private loans.

Loan Term

The loan term, or repayment period, also greatly influences your monthly payment. A shorter loan term (e.g., 3 years) will result in higher monthly payments but less interest paid over the life of the loan. Conversely, a longer loan term (e.g., 10 years) will lead to lower monthly payments but higher total interest paid. Keep the following in mind:

- Shorter loan terms mean faster debt repayment but higher monthly expenses.

- Longer loan terms offer lower monthly payments but result in a higher overall cost due to accumulated interest.

- Carefully weigh the balance between affordability and overall cost when selecting a loan term.

Loan Fees and Charges

Various fees and charges can affect your monthly payment. These include origination fees, prepayment penalties, and other administrative costs. These fees can add to the total loan amount, thus increasing your monthly payments. You should always be aware of the following:

This content may interest you! How to pay off $5000 in debt in 1 year?

How to pay off $5000 in debt in 1 year?- Inquire about all fees associated with the loan before accepting the terms.

- Compare fees charged by different lenders to find the most cost-effective option.

- Understand the implications of prepayment penalties before making extra payments.

How to pay off $60,000 in debt in 2 years?

Paying Off $60,000 in Debt in 2 Years

Creating a Realistic Budget

Paying off $60,000 in two years requires a drastic reduction in spending and a significant increase in income or debt repayment. The first step is to create a detailed budget that meticulously tracks every dollar coming in and going out. This involves categorizing expenses, identifying areas for potential savings, and realistically assessing your income. Without a firm grasp of your current financial situation, a successful debt repayment plan is impossible. A realistic budget will help you see where your money is going and identify areas where you can cut back. It will also show you how much money you have available each month to put towards your debt.

- Track all income sources: This includes your salary, any side hustles, investments, etc.

- Categorize all expenses: Group expenses by category (housing, transportation, food, entertainment, etc.) to easily identify areas of overspending.

- Identify non-essential expenses: Analyze your spending habits to pinpoint areas where you can reduce spending without significantly impacting your quality of life. Consider cutting subscriptions, dining out less frequently, or finding cheaper alternatives for entertainment.

Developing a Debt Repayment Strategy

Several strategies exist for tackling debt, each with its advantages and disadvantages. The avalanche method prioritizes paying off the debt with the highest interest rate first, minimizing overall interest paid. The snowball method focuses on paying off the smallest debt first for psychological motivation, building momentum as you eliminate each debt. Choosing the right strategy depends on your personal preferences and financial circumstances. You'll also need to determine how much extra money you can allocate each month to debt repayment. The higher the amount, the faster you'll pay off the debt. Consider taking on a side hustle or selling possessions to generate extra funds.

This content may interest you! How can I reduce my debt fast?

How can I reduce my debt fast?- Avalanche Method: Prioritize high-interest debts. This minimizes the total interest paid over time.

- Snowball Method: Pay off the smallest debt first for a quick psychological win and motivation to continue.

- Debt Consolidation: Consider consolidating multiple high-interest debts into a single loan with a lower interest rate to simplify payments and potentially lower your monthly payments.

Seeking Professional Financial Advice

Navigating significant debt can be overwhelming. Consider consulting with a financial advisor or credit counselor for personalized guidance. They can help you develop a comprehensive plan tailored to your specific situation, negotiate with creditors, and explore options such as debt management plans or bankruptcy if necessary. A professional can provide unbiased advice and help you avoid costly mistakes. They can also help you create a long-term financial plan to prevent future debt accumulation.

- Find a reputable financial advisor or credit counselor.

- Discuss your debt situation and financial goals.

- Explore different debt repayment strategies and options, such as debt consolidation or debt management plans.

Do consolidation loans hurt your credit score?

Do Consolidation Loans Hurt Your Credit Score?

Do Consolidation Loans Hurt Your Credit Score?

Whether a consolidation loan hurts your credit score is complex and depends on several factors. It's not a simple yes or no answer. While it can potentially have a negative impact, it can also be beneficial depending on your circumstances and how you manage the loan. The key is understanding how the process affects different aspects of your credit report and making informed decisions.

This content may interest you! How can I make more money a month?

How can I make more money a month?Hard Inquiries and Their Impact

Applying for a consolidation loan requires a hard inquiry on your credit report. Hard inquiries, which are checks lenders make when assessing your creditworthiness, can temporarily lower your credit score. Each inquiry has a small negative impact, but multiple inquiries within a short period can be more significant. However, the impact is usually temporary, fading over time.

- The impact of a hard inquiry typically lasts for 12 months.

- Credit scoring models weigh recent inquiries more heavily than older ones.

- Some lenders consider multiple inquiries within a short timeframe as a single inquiry, minimizing the negative impact.

Impact on Credit Utilization

Your credit utilization ratio, which is the percentage of your available credit that you're using, is a significant factor in your credit score. If you successfully consolidate high-interest debts into a lower-payment consolidation loan, and pay it down diligently, your credit utilization could improve. This is because the amount you owe is spread across a larger credit line, decreasing the percentage of credit utilized. However, if you continue to accumulate debt on other cards while consolidating, your credit utilization may increase, negatively impacting your score.

- Keeping credit utilization below 30% is generally recommended for maintaining a good credit score.

- Consolidation loans can help reduce credit utilization if managed responsibly.

- Poor management of the consolidation loan can worsen credit utilization, hurting your score.

Length of Credit History and Payment History

A longer credit history and a consistent record of on-time payments are crucial for a good credit score. A consolidation loan can positively affect these factors if you manage your payments correctly. By consolidating multiple debts into one payment, you simplify the repayment process and reduce the risk of missed payments, which will show as positive payment history. On the other hand, if you don't pay your consolidation loan on time, your credit score will likely suffer.

- On-time payments contribute significantly to a higher credit score.

- Consolidating debts can streamline payments and prevent late payments.

- Missed payments on a consolidation loan will negatively impact your credit score.

What is debt consolidation and how does it work?

Debt consolidation is the process of combining multiple debts into a single loan. This typically involves taking out a new loan (like a personal loan or balance transfer credit card) to pay off your existing debts. The new loan will have a single monthly payment, making it easier to manage your finances. Interest rates on the new loan may be lower than your current debts' rates, leading to potential savings. However, it's crucial to carefully compare interest rates and fees before consolidating to ensure it's truly beneficial. The success of debt consolidation hinges on responsible repayment of the new loan.

This content may interest you! What is the $27.40 rule?

What is the $27.40 rule?What are the benefits of consolidating debt?

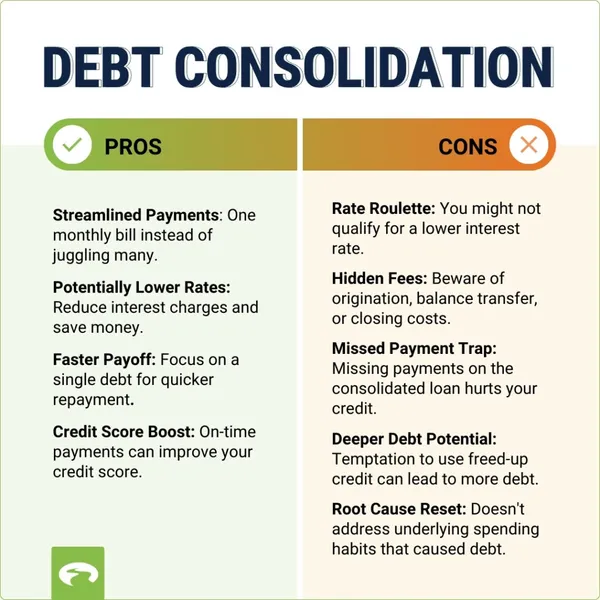

Consolidating debt simplifies your finances by reducing the number of payments you need to track. This streamlined approach lowers the risk of missed payments and improves your credit score over time, provided you consistently make your payments on the consolidated loan. A lower interest rate on the consolidated loan can translate to substantial savings on interest charges over the life of the loan, making it cheaper to pay off your debts. Further, it can provide a more manageable repayment schedule with a potentially longer repayment period.

How can I find the best debt consolidation loan?

Start by checking your credit score to understand your eligibility for different loan options. Then, compare offers from multiple lenders, paying close attention to the Annual Percentage Rate (APR), including any fees. Consider the loan term and the total cost of borrowing. Don't hesitate to utilize online comparison tools to streamline this process. Always read the loan agreement thoroughly before committing to any deal. Ensure that you understand the terms and conditions to avoid unexpected charges.

What are the risks associated with debt consolidation?

While debt consolidation offers benefits, it also carries risks. A longer repayment term, although convenient, can lead to paying more interest overall if you don’t accelerate repayment. A high APR on the consolidation loan could negate any potential savings. Moreover, failing to repay the consolidated loan can severely damage your credit score. Finally, consolidating high-interest debts onto a lower interest loan doesn't address the underlying spending habits that created the debt in the first place. Addressing those habits is crucial for long-term financial health.

Leave a Reply