How to passively make $2000 a month?

Dreaming of generating $2000 passively each month? This isn't a get-rich-quick scheme, but a realistic goal achievable through strategic planning and consistent effort. This article explores proven methods for building passive income streams, from affiliate marketing and creating digital products to rental income and dividend investing. We'll dissect the strategies, highlight potential pitfalls, and provide actionable steps to help you reach your $2000 monthly passive income target. Let's dive into the world of financial freedom.

Unlocking Passive Income: Strategies to Earn $2000 a Month

High-Yield Savings Accounts and Bonds

While not strictly "passive" in the sense of requiring no effort, high-yield savings accounts and bonds offer a relatively hands-off approach to generating income. You'll need a substantial initial investment to reach $2000 monthly. The key is finding accounts with competitive interest rates. Regularly monitoring your accounts and reinvesting earnings is essential for maximizing returns. Diversifying your investments across several accounts and bond types mitigates risk and potentially increases your overall yield. However, it's important to be realistic about the returns. Achieving a $2000 monthly passive income from interest alone requires a significant capital investment and is usually only attainable with a very large sum already saved.

Building a Profitable Online Course or Membership Site

Creating and selling an online course or establishing a membership site is a popular method for generating passive income streams. The initial effort requires significant time and resources to create high-quality content, market your product effectively, and manage the platform. However, once established, these platforms can generate recurring revenue with minimal ongoing maintenance. Developing a strong brand and engaging your audience is vital to driving sales. Consistent marketing, leveraging social media and other online channels, is crucial for maintaining a steady flow of new subscribers and students. Remember that building a successful online course or membership site demands dedication and ongoing improvement to maintain competitiveness and user engagement.

Leveraging Affiliate Marketing and Blogging

Affiliate marketing involves promoting other companies' products or services on your blog or website and earning a commission on each sale. To reach a $2000 monthly income target, you need significant website traffic and a well-defined niche. The key is building valuable content that attracts a targeted audience and establishes credibility. Choosing the right affiliate programs and tracking your performance metrics are essential aspects of success. This requires consistent effort in creating high-quality content, optimizing your website for search engines, and actively promoting your affiliate links to drive sales. Building a loyal readership and establishing trust with your audience is crucial for long-term success in affiliate marketing.

This content may interest you! What 7 streams of income do millionaires have?

What 7 streams of income do millionaires have?| Method | Pros | Cons |

|---|---|---|

| High-Yield Savings/Bonds | Relatively low risk, consistent returns (depending on market conditions) | Requires a very large initial investment, low potential for significant growth |

| Online Course/Membership Site | Potential for high income, recurring revenue, scalable | High initial investment of time and effort, requires marketing expertise |

| Affiliate Marketing/Blogging | Relatively low startup costs, potential for high returns | Requires consistent effort, depends on website traffic and marketing skills, income can fluctuate |

How can I make $2000 a month from home?

Making $2000 a month from home requires dedication, effort, and often, a combination of income streams. There's no single guaranteed method, and success depends heavily on your skills, resources, and market demand. Here's a breakdown of potential avenues:

High-Income Skills & Freelance Platforms

Earning $2000 monthly often involves leveraging specialized skills in high demand. Freelance platforms like Upwork and Fiverr connect you with clients needing various services. Focusing on areas like web development, graphic design, writing, digital marketing, or virtual assistance can yield significant income. Building a strong portfolio showcasing your abilities is crucial for attracting high-paying clients. Consistent effort and effective marketing of your services are key to consistent income.

- Identify your strongest skills: Analyze your talents and experience to pinpoint areas where you can offer valuable services to clients. Consider what you enjoy doing and what you're good at. Focus on refining those abilities.

- Build a compelling portfolio: Showcase your best work through a professionally designed website or online portfolio. This is crucial for attracting potential clients and demonstrates your competence.

- Market yourself effectively: Utilize freelance platforms, social media, and networking to reach potential clients. Actively seek out projects and build relationships.

Online Business Ventures

Starting an online business, while requiring initial investment and effort, offers the potential for substantial income. E-commerce through platforms like Shopify or Etsy allows you to sell products directly to consumers. Affiliate marketing involves promoting other companies' products and earning a commission on sales. Creating and selling online courses or digital products (e.g., ebooks, templates, software) can also generate recurring revenue. Careful planning, market research, and a robust marketing strategy are essential for success.

This content may interest you! What are 7 sources of income?

What are 7 sources of income?- Choose a profitable niche: Conduct thorough market research to identify a niche with high demand and less competition. Understanding your target audience is vital.

- Develop a strong brand and marketing strategy: Create a memorable brand identity and develop a plan to reach your target audience through social media, paid advertising, or content marketing.

- Provide excellent customer service: Positive reviews and customer loyalty are critical for long-term success in any online business.

High-Demand Services & Consulting

Offering specialized services directly to clients can be lucrative. This might include coaching, consulting (e.g., business, marketing, finance), tutoring, or specialized technical support. Building a strong reputation and a network of referrals are crucial for acquiring clients. Marketing your expertise through online platforms, networking events, and content marketing is essential to reach your target audience.

- Network and build relationships: Networking with potential clients through online and offline channels is crucial for finding opportunities. Attend industry events and engage in relevant online communities.

- Develop a strong online presence: A professional website and social media profiles are essential for showcasing your expertise and attracting potential clients.

- Offer exceptional service and value: Providing excellent service and exceeding client expectations will lead to referrals and repeat business.

How much money do I need to invest to make $2000 a month?

Investment Calculation

There's no single answer to how much money you need to invest to make $2000 a month. The amount depends heavily on several factors, including your investment strategy, the type of investments you choose, and the rate of return you can realistically expect. It's crucial to understand that higher potential returns usually come with higher risk.

This content may interest you! How can I make an extra $1000 a month from home?

How can I make an extra $1000 a month from home?Investment Strategy and Risk Tolerance

Your investment strategy significantly impacts the capital required. A conservative strategy, focusing on low-risk investments like government bonds or high-yield savings accounts, will likely require a substantially larger initial investment to generate $2000 monthly. This is because these investments typically offer lower returns. Conversely, a more aggressive strategy involving higher-risk investments like stocks or real estate may require less initial capital but exposes you to greater potential losses.

- Conservative Strategy: Lower risk, lower return, requires a much larger principal amount. Examples include government bonds and high-yield savings accounts.

- Moderate Strategy: Balances risk and return, seeking a middle ground between safety and growth potential. May involve a mix of stocks, bonds, and real estate.

- Aggressive Strategy: Higher risk, higher potential return, potentially requiring less initial capital but with a greater chance of loss. Examples include individual stocks, options trading, and cryptocurrency.

Types of Investments and Expected Returns

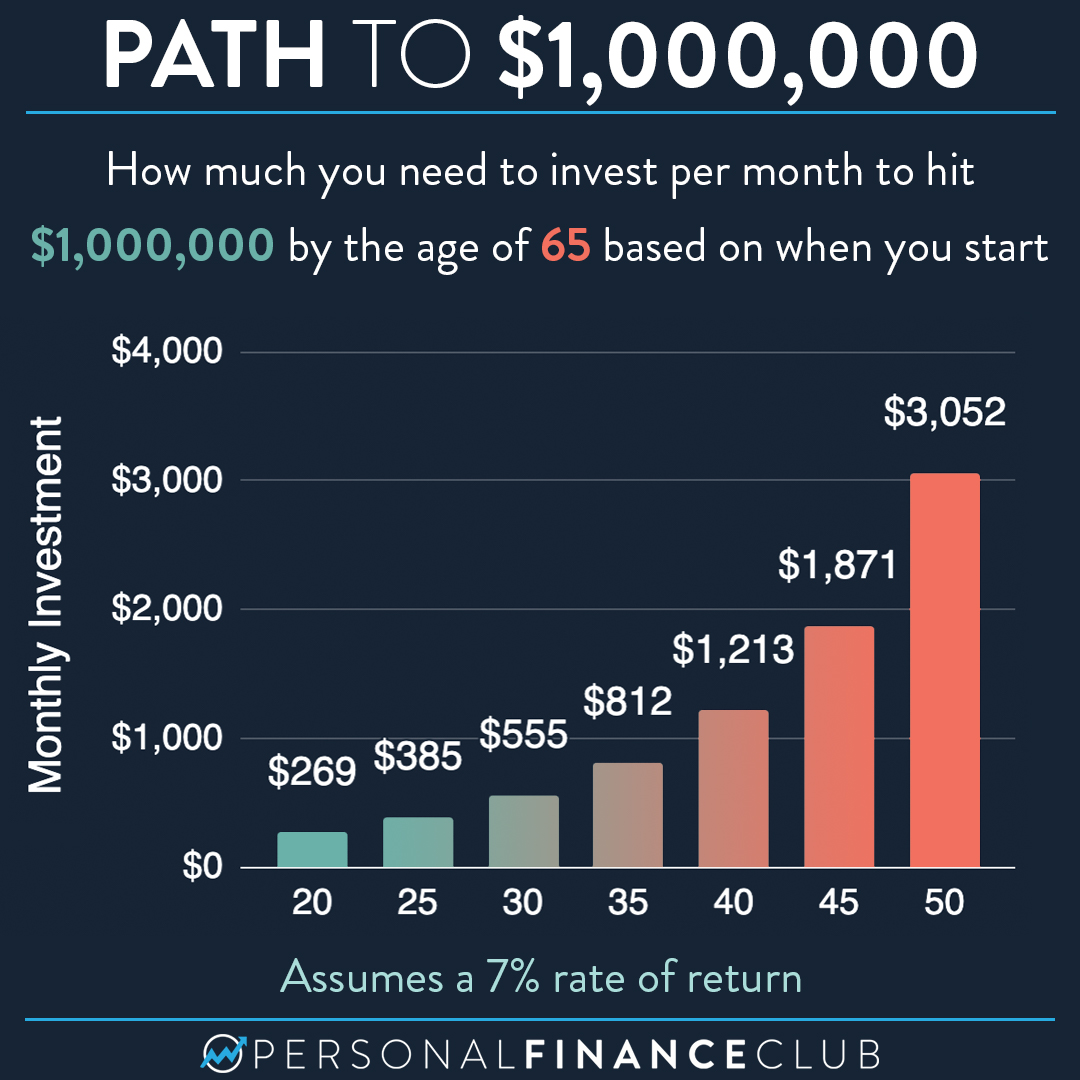

Different investment vehicles offer varying rates of return. For instance, a high-yield savings account might yield 4% annually, while a well-diversified stock portfolio could potentially yield 7-10% annually (though this is not guaranteed and fluctuates significantly). The type of investment directly influences how much you need to invest to achieve your monthly income goal. Real estate, while potentially lucrative, also requires a significant upfront investment and may involve additional expenses like property taxes and maintenance.

- High-Yield Savings Accounts: Offer low risk but very low returns, requiring a massive investment to generate $2000 monthly.

- Stocks and Bonds: Offer a wider range of returns depending on market performance and diversification. Requires careful research and understanding of market volatility.

- Real Estate: Potentially high returns but high initial investment and ongoing expenses. Requires knowledge of the property market and management skills.

The Importance of Diversification and Professional Advice

Diversifying your investments across different asset classes is crucial to mitigate risk. Putting all your eggs in one basket can be devastating if that investment underperforms. Seeking advice from a qualified financial advisor is highly recommended. They can help you develop a personalized investment plan based on your risk tolerance, financial goals, and time horizon. Remember, past performance is not indicative of future results. Any investment carries some level of risk.

- Diversification: Spreading your investments across different asset classes to reduce overall risk.

- Professional Advice: Consulting a financial advisor for personalized guidance and risk management.

- Realistic Expectations: Understanding that consistent monthly returns are not guaranteed and market fluctuations are inherent to investing.

How to generate $1000 a month in passive income?

What is the best online job to earn money?

What is the best online job to earn money?Generating $1000 a Month in Passive Income

How to Generate $1000 a Month in Passive Income?

Generating $1000 a month in passive income requires effort, planning, and often, a significant upfront investment of time or money. There's no get-rich-quick scheme, but several strategies can contribute to this goal. Success depends on choosing a path that aligns with your skills, resources, and risk tolerance. Consistency and patience are crucial; it often takes time for passive income streams to reach their full potential. You might need to combine multiple income streams to reach the $1000 target. The key is to build a system that works while you are not actively involved in day-to-day operations.

High-Ticket Affiliate Marketing

Affiliate marketing involves promoting other companies' products or services and earning a commission on each sale. Focusing on high-ticket items significantly increases your earning potential. Instead of selling many low-priced items, a few sales of expensive products can quickly add up to $1000 or more. This requires building a substantial audience, usually through a blog, YouTube channel, or social media presence, and establishing trust with your followers. You need to carefully select products that align with your audience's interests and needs to maximize your chances of success.

- Identify a niche with high-ticket products.

- Build a strong online presence through content marketing (blogging, videos, social media).

- Partner with reputable companies offering high-commission products.

Creating and Selling Online Courses

If you possess expertise in a particular area, creating and selling online courses can be a lucrative passive income stream. Platforms like Udemy, Teachable, and Thinkific allow you to easily host and sell your courses. The initial work involves creating high-quality course content, but once launched, the course can generate income continuously. Marketing your course effectively is key to driving sales. Consider offering different pricing tiers or bundles to increase revenue.

This content may interest you! How can you increase your income effectively?

How can you increase your income effectively?- Identify your area of expertise and create a valuable course.

- Choose a suitable online course platform.

- Market your course through social media, email marketing, and paid advertising.

Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate. Investing in REITs provides a relatively passive way to participate in the real estate market without directly managing properties. Dividends from REITs can provide a steady stream of passive income. Diversification is important to mitigate risk. Research different REITs to find those with a history of consistent dividend payouts and strong financial performance. You can invest in REITs through brokerage accounts.

- Research different REITs and their dividend history.

- Consider your risk tolerance and diversification strategy.

- Invest through a brokerage account and monitor your investments regularly.

How can I make $2000 asap?

Making $2000 ASAP

Selling Possessions

Quickly liquidating valuable assets is a viable option for generating a substantial amount of cash in a short period. This involves identifying items you own that hold significant monetary worth and selling them through various platforms or methods. The key lies in selecting items that are highly sought-after in the current market to maximize your return on investment. Consider the speed and ease of the sales process when choosing your items. A quick sale is crucial to meeting the ASAP goal.

This content may interest you! How should you diversify your income?

How should you diversify your income?- Online marketplaces: Utilize platforms like eBay, Craigslist, Facebook Marketplace, or OfferUp to list and sell your items to a wide audience. Consider using clear, high-quality photos and detailed descriptions to attract potential buyers.

- Pawn shops and consignment stores: For immediate cash, consider pawn shops for valuable items like jewelry or electronics. Consignment stores offer an alternative, where you receive payment after the item sells.

- Garage sale or yard sale: Organize a quick sale on your property to sell a large number of items simultaneously. Promote it widely using flyers or online advertisements.

High-Demand Gig Work

Leveraging your skills and talents through various gig-based platforms or freelance marketplaces can be a reliable method to generate quick income. Several online platforms connect individuals with diverse skill sets to short-term projects or tasks, offering opportunities to earn money within a limited timeframe. The success of this approach hinges on your ability to identify platforms that match your expertise and execute projects efficiently.

- Freelancing platforms: Explore websites like Upwork, Fiverr, or Guru, offering services in writing, graphic design, web development, virtual assistance, or other specialized skills. Prioritize projects with quick turnaround times and high pay rates.

- Delivery services: Sign up for delivery apps such as DoorDash, Uber Eats, or Grubhub to earn money by delivering food or groceries. The earning potential depends on the time dedicated and the demand in your area. Focus on peak hours for higher earnings.

- TaskRabbit or similar: These platforms connect you with people needing help with odd jobs and errands. Examples include furniture assembly, cleaning, or handyman tasks. This offers flexibility and the potential for quick earnings.

Seeking Short-Term Employment

Exploring temporary or short-term employment opportunities can be an effective way to achieve your financial goal quickly. This involves finding positions that offer immediate payment and require minimal commitment. The key lies in identifying suitable positions and adapting to various working environments and schedules. Focus on roles that offer daily or weekly pay cycles.

- Temporary staffing agencies: Partner with staffing agencies that specialize in short-term assignments, providing access to a range of jobs across different industries.

- Seasonal work: Explore seasonal job opportunities, especially during peak periods, such as holidays or harvest seasons. These often offer higher pay due to the increased demand.

- Part-time jobs: Consider taking on a part-time role at a retail store, restaurant, or other establishment that offers immediate payment. This requires flexibility and potentially work outside typical business hours.

Is it really possible to passively make $2000 a month?

While achieving a passive income stream of $2000 monthly is ambitious, it's certainly attainable for many. It requires significant upfront effort and strategic planning. This typically involves building a substantial asset, such as a successful online course, a large rental property portfolio, or a high-performing affiliate marketing website. Consistency and patience are key; it's rarely overnight success, but with dedication, building a passive income stream exceeding $2000 per month is a realistic goal.

What are some proven methods for passive income generation?

Several avenues can lead to passive income. High-yield savings accounts and dividend-paying stocks offer relatively low-effort returns, although the income may not immediately reach $2000. More active approaches include creating and selling online courses, establishing an affiliate marketing website, or building a profitable app. Rental properties, while requiring initial investment and management, offer potential for substantial passive income over time. Each method demands a different level of skill and initial capital investment.

This content may interest you! How to make $5,000 a month fast?

How to make $5,000 a month fast?How much initial investment is typically needed?

The initial investment varies drastically depending on the chosen method. Some options, like affiliate marketing or creating digital products, can start with minimal capital, focusing on time and effort. However, building a significant online following or producing high-quality digital content will usually take time and money to market. Real estate investment requires a substantial upfront capital outlay, along with ongoing property management costs. Therefore, the investment needed spans a wide spectrum, from near zero to several thousand dollars or more.

How long does it typically take to start earning passive income?

The timeframe to start earning passive income is highly variable and depends on several factors, including the chosen method, the amount of effort invested, and market conditions. Some quicker methods, like selling digital products on established marketplaces, could generate income relatively fast. However, building a sizable audience or creating highly successful, enduring content usually takes much longer. Real estate investment has a longer timeline, requiring property acquisition, tenant acquisition, and ongoing maintenance. Patience and persistence are crucial for success in any method.

Leave a Reply