How to save money from a young age?

Learning how to save money from a young age is a crucial skill that can set the foundation for financial stability and success later in life. By developing healthy saving habits early, individuals can build a safety net, achieve long-term goals, and avoid unnecessary debt. This article explores practical strategies for young people to start saving, from setting clear financial objectives to understanding the basics of budgeting. Whether it’s through part-time jobs, smart spending choices, or leveraging technology to track expenses, cultivating financial discipline early can lead to a lifetime of financial confidence and independence.

How to Save Money from a Young Age?

Saving money from a young age is a crucial habit that can set the foundation for financial stability and success in the future. By starting early, individuals can take advantage of compound interest, develop disciplined spending habits, and build a safety net for emergencies. This guide will explore practical strategies to help young people save effectively, understand the importance of budgeting, and make informed financial decisions.

1. Start with a Budget

Creating a budget is the first step toward saving money. A budget helps you track your income and expenses, ensuring that you allocate a portion of your earnings to savings. Begin by listing all sources of income, such as allowances or part-time jobs, and then categorize your expenses into needs (like school supplies) and wants (like entertainment). By prioritizing needs and limiting spending on wants, you can set aside money consistently. Tools like budgeting apps or simple spreadsheets can make this process easier and more organized.

| Category | Percentage of Income |

|---|---|

| Needs | 50% |

| Wants | 30% |

| Savings | 20% |

2. Open a Savings Account

Opening a savings account is a smart way to keep your money safe and earn interest over time. Many banks offer accounts specifically designed for young savers, with low or no fees and competitive interest rates. By depositing your savings regularly, you can watch your money grow through compound interest, which means you earn interest on both your initial deposit and the accumulated interest. Additionally, having a separate savings account helps you avoid the temptation to spend the money on unnecessary purchases.

| Account Type | Interest Rate |

|---|---|

| Youth Savings Account | 1.5% |

| Regular Savings Account | 0.5% |

3. Set Financial Goals

Setting financial goals gives you a clear purpose for saving and helps you stay motivated. Start by identifying short-term goals, such as saving for a new gadget, and long-term goals, like funding your education or buying a car. Break these goals into smaller, achievable milestones and track your progress regularly. For example, if you want to save $500 in a year, aim to save about $42 each month. Having specific goals makes it easier to resist impulsive spending and focus on what truly matters to you.

This content may interest you! How to budget as a young person?

How to budget as a young person?| Goal Type | Example | Timeframe |

|---|---|---|

| Short-Term | New Phone | 6 Months |

| Long-Term | College Fund | 5 Years |

How to start saving money at a young age?

Set Clear Financial Goals

Starting to save money at a young age begins with setting clear financial goals. Having specific objectives helps you stay focused and motivated. Here are some steps to set effective financial goals:

- Identify short-term and long-term goals, such as saving for a new gadget, college tuition, or a future vacation.

- Break down larger goals into smaller, manageable milestones to track progress easily.

- Write down your goals and review them regularly to ensure you stay on track.

Create a Budget and Track Expenses

Creating a budget is essential for managing your finances and saving money. A budget helps you understand where your money is going and how much you can save. Follow these steps to create and maintain a budget:

- List all sources of income, including allowances, part-time jobs, or gifts.

- Track your expenses by categorizing them into needs (e.g., school supplies) and wants (e.g., entertainment).

- Allocate a portion of your income to savings before spending on non-essential items.

Develop Smart Spending Habits

Developing smart spending habits is crucial for saving money at a young age. By being mindful of your purchases, you can avoid unnecessary expenses and save more. Here are some tips to cultivate smart spending habits:

- Avoid impulse buying by waiting 24 hours before making non-essential purchases.

- Compare prices and look for discounts or coupons when shopping.

- Prioritize needs over wants and focus on spending money only on what truly matters.

What is the 30 day rule?

How much should a young person save?

How much should a young person save?What is the 30-Day Rule?

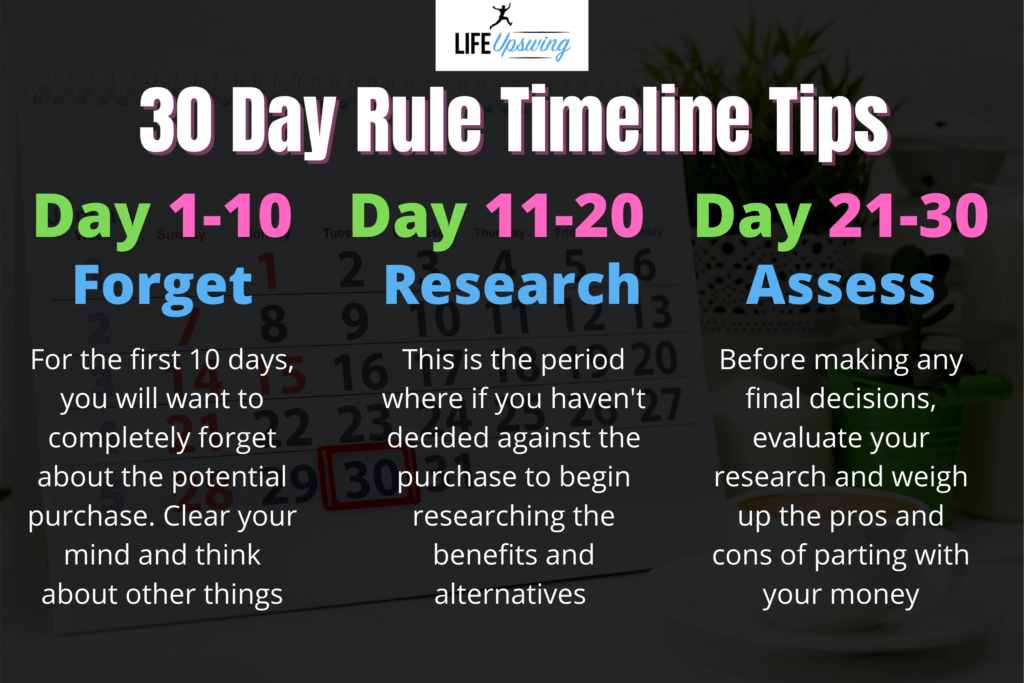

The 30-day rule is a financial strategy designed to help individuals control impulsive spending and make more thoughtful purchasing decisions. The rule suggests that when you want to buy something non-essential, you should wait 30 days before making the purchase. During this period, you evaluate whether the item is truly necessary or if it was just a fleeting desire. This approach helps reduce unnecessary expenses and encourages better money management.

How Does the 30-Day Rule Work?

The 30-day rule works by introducing a waiting period before making a purchase. Here’s how it typically functions:

- Identify the item you want to buy and note its cost.

- Wait for 30 days without purchasing the item. Use this time to reflect on whether you still want or need it.

- After the 30 days, reassess your desire for the item. If you still feel it’s necessary, you can proceed with the purchase. If not, you’ve successfully avoided an unnecessary expense.

This process helps break the cycle of impulsive buying and promotes mindful spending habits.

Benefits of the 30-Day Rule

The 30-day rule offers several advantages for personal finance and self-discipline:

- Reduces impulsive spending by encouraging thoughtful decision-making.

- Helps prioritize needs over wants, leading to better financial stability.

- Provides time to research and compare prices, ensuring you get the best deal if you decide to buy.

By implementing this rule, individuals can gain greater control over their finances and avoid accumulating debt from unnecessary purchases.

This content may interest you! What is the 50/30/20 rule of money?

What is the 50/30/20 rule of money?When to Use the 30-Day Rule

The 30-day rule is particularly useful in specific situations:

- When considering non-essential or luxury items that are not immediate needs.

- When trying to stick to a budget or save money for larger financial goals.

- When you feel tempted to make a purchase due to emotions like stress, boredom, or excitement.

This rule is a practical tool for anyone looking to improve their spending habits and achieve long-term financial health.

What is the 50/30/20 rule of money?

:max_bytes(150000):strip_icc()/50-30-20budgetingrulecustomillustration-9973713c9be846c1b25b7bf372b4818d.png)

The 50/30/20 rule of money is a simple budgeting framework designed to help individuals manage their finances effectively. It suggests dividing after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This rule provides a balanced approach to spending and saving, ensuring financial stability while allowing room for personal enjoyment.

Understanding the 50% for Needs

The first category, 50% of your income, is allocated to essential needs. These are expenses that are necessary for daily living and cannot be avoided. Examples include:

This content may interest you! How much should a 25 year old save?

How much should a 25 year old save?- Housing costs such as rent or mortgage payments.

- Utilities like electricity, water, and internet.

- Groceries and basic food supplies.

- Transportation costs, including fuel or public transit fees.

- Insurance premiums, such as health or car insurance.

This portion ensures that your basic living requirements are met without compromising your financial security.

Allocating 30% for Wants

The second category, 30% of your income, is reserved for wants. These are non-essential expenses that enhance your lifestyle but are not critical for survival. Examples include:

- Dining out at restaurants or ordering takeout.

- Entertainment, such as movies, concerts, or streaming services.

- Hobbies and recreational activities.

- Travel and vacations.

- Luxury items like designer clothing or gadgets.

This portion allows you to enjoy life and indulge in personal interests without overspending.

Dedicating 20% for Savings and Debt Repayment

The final category, 20% of your income, is focused on securing your financial future. This portion is divided into two main areas: savings and debt repayment. Examples include:

- Building an emergency fund for unexpected expenses.

- Contributing to retirement accounts like a 401(k) or IRA.

- Paying off credit card debt or student loans.

- Investing in stocks, bonds, or other financial instruments.

- Saving for long-term goals, such as buying a home or funding education.

This portion ensures financial growth and stability, helping you achieve long-term objectives.

This content may interest you! How much savings should I have per age?

How much savings should I have per age?How can I save $1000 in 30 days?

Track and Reduce Your Daily Expenses

To save $1000 in 30 days, start by tracking your daily expenses. Identify areas where you can cut back and create a strict budget. Here’s how:

- Use a budgeting app or spreadsheet to monitor every dollar spent.

- Eliminate non-essential purchases like dining out, subscriptions, or impulse buys.

- Opt for cheaper alternatives, such as cooking at home instead of ordering takeout.

Increase Your Income Through Side Hustles

Boosting your income can help you reach your $1000 goal faster. Consider these options:

- Sell unused items like clothes, electronics, or furniture online.

- Take on freelance work or gigs, such as tutoring, delivery services, or graphic design.

- Offer skills like babysitting, pet sitting, or house cleaning in your community.

Save on Utilities and Subscriptions

Cutting down on recurring expenses can free up significant funds. Follow these steps:

- Cancel unused subscriptions, such as streaming services or gym memberships.

- Reduce utility bills by conserving energy, like turning off lights and unplugging devices.

- Negotiate lower rates for services like internet, phone, or insurance.

Frequently Asked Questions

Why is it important to start saving money from a young age?

Starting to save money early helps build financial discipline, creates a safety net for emergencies, and allows your savings to grow through compound interest. It also prepares you for future expenses like education, travel, or buying a home. Developing good habits early ensures long-term financial stability and reduces reliance on debt.

This content may interest you! How to convince your parents to give you $500?

How to convince your parents to give you $500?What are some simple ways to save money as a teenager?

Teenagers can save money by setting aside a portion of their allowance or part-time earnings, avoiding unnecessary purchases, and tracking expenses. Opening a savings account, using budgeting apps, and saving for specific goals can also help. Additionally, learning to differentiate between wants and needs is crucial for building a strong saving habit.

How can parents help their children save money?

Parents can encourage saving by opening a savings account for their child, teaching them about budgeting, and matching their savings contributions. Setting a good example through responsible spending and discussing financial goals can also motivate children. Providing allowances tied to chores or achievements can further instill the value of earning and saving money.

What are the benefits of compound interest for young savers?

Compound interest allows savings to grow exponentially over time, as interest is earned on both the initial amount and accumulated interest. Starting early maximizes this effect, as even small, regular contributions can grow significantly. This makes it easier to achieve long-term financial goals, such as retirement or buying a home, with less effort later in life.

Leave a Reply