How to turn $100 into $1000 investing?

Turning $100 into $1000 through investing might seem daunting, but it's achievable with the right strategy and a bit of patience. This article explores practical approaches for growing your initial capital, focusing on low-cost, accessible investment options.

We'll delve into strategies like high-yield savings accounts, fractional shares, peer-to-peer lending, and exploring niche markets.

We'll also discuss risk management and the importance of understanding your investment timeline. Learn how to navigate the world of investing and maximize your returns even with a small starting sum.

Strategic Approaches to Transforming $100 into $1000 Through Investing

High-Growth Stock Investing

Turning $100 into $1000 through stock investing requires identifying high-growth potential stocks. This means focusing on companies in emerging sectors or those experiencing rapid expansion. Thorough research is crucial; look at the company's financials, competitive landscape, and future prospects.

Consider investing in small-cap stocks, which have the potential for significant growth but also carry higher risk. Diversification is key, even with a small investment; don't put all your eggs in one basket. Remember that the potential for significant returns also carries a high risk of substantial losses. Patience and discipline are paramount, as substantial gains may not be immediate.

Leveraging Options Trading (High Risk)

Options trading offers leverage, enabling substantial returns on a small initial investment. However, it's exceptionally risky. A deep understanding of options strategies (like covered calls or cash-secured puts) is essential. Incorrect strategies can lead to significant losses exceeding the initial investment.

This content may interest you! How to turn $1000 into $5000 in a month?

How to turn $1000 into $5000 in a month?Before venturing into options trading, extensive research, practice with paper trading, and potentially professional guidance are highly recommended. Never invest more than you can afford to lose. This method is extremely speculative and unsuitable for inexperienced investors.

Peer-to-Peer Lending and Alternative Investments

Peer-to-peer (P2P) lending platforms connect borrowers and lenders, offering the potential for higher returns than traditional savings accounts. Carefully vet borrowers and diversify your investments across multiple loans to mitigate risk.

Alternative investments such as crowdfunding or real estate investment trusts (REITs) can offer opportunities, but thorough due diligence and understanding of the risks involved are crucial. These options often require a longer-term commitment and careful analysis of potential returns and associated risks before committing funds.

| Strategy | Potential Return | Risk Level | Time Horizon |

|---|---|---|---|

| High-Growth Stock Investing | High | High | Medium to Long-Term |

| Options Trading | Very High (Potentially) | Extremely High | Short to Medium-Term |

| P2P Lending & Alternative Investments | Medium to High | Medium | Medium to Long-Term |

How to flip $100 to $1000?

Reselling Items for Profit

Turning $100 into $1000 requires identifying undervalued items, purchasing them at a low cost, and reselling them at a higher price. This involves finding profitable niches and understanding market trends. Success depends heavily on your ability to source goods efficiently and market them effectively.

- Identify a niche: Focus on specific items with high demand and low competition. Examples include vintage clothing, collectibles, or specific electronics.

- Source products strategically: Use online marketplaces, thrift stores, garage sales, and auctions to find deals. Negotiating prices is crucial.

- Market effectively: Utilize online platforms like eBay, Craigslist, or social media to reach potential buyers. High-quality photos and compelling descriptions are key to attracting customers.

Investing in Stocks or Cryptocurrencies

Investing in the stock market or cryptocurrencies offers the potential for high returns, but also carries significant risk. A small investment of $100 can potentially grow to $1000, but this requires careful research, understanding of market dynamics, and risk tolerance. Diversification is crucial to mitigate potential losses.

This content may interest you! Should I invest while I have debt?

Should I invest while I have debt?- Research and due diligence: Thoroughly research potential investments before committing funds. Understand the risks involved and your investment timeline.

- Diversify your portfolio: Don't put all your eggs in one basket. Spread your investment across different assets to reduce risk.

- Consider long-term growth: Focus on long-term investment strategies rather than trying to make quick profits through speculation.

Providing Services

Offering services such as freelance writing, graphic design, virtual assistance, or pet sitting can generate income. Starting with a small investment in marketing and tools, you can leverage your skills to earn money. Building a strong reputation and positive reviews are essential for attracting repeat clients.

- Identify your skills: Determine what services you can offer based on your expertise and experience.

- Market your services: Utilize online platforms like freelance marketplaces or social media to reach potential clients.

- Deliver high-quality service: Positive reviews and word-of-mouth referrals are crucial for building a successful service-based business.

How can I invest $100 for quick return?

Investing $100 for a quick return presents significant challenges due to the limited capital. High-return investments typically involve higher risk, and with such a small amount, diversification to mitigate risk is extremely difficult.

Any strategy should prioritize minimizing potential losses. There are few genuinely "quick" and safe options, and any promises of rapid, high returns should be viewed with extreme skepticism.

Short-Term, Low-Risk Options

With only $100, focusing on preserving your capital while aiming for a small, relatively quick return is crucial. High-risk, high-reward strategies are generally inadvisable with such a small investment amount because a total loss would be devastating.

Instead, consider options that offer modest returns but minimize the risk of losing your initial investment.

This content may interest you! Is $20,000 a lot of debt?

Is $20,000 a lot of debt?- High-Yield Savings Accounts: These accounts offer a slightly higher interest rate than regular savings accounts. While the returns won't be substantial in a short timeframe, they are safe and your money is readily accessible.

- Money Market Accounts: Similar to high-yield savings accounts, money market accounts provide a higher interest rate than standard accounts, often with limited check-writing capabilities. They are generally FDIC insured, providing a level of security.

- Short-Term Certificates of Deposit (CDs): These offer a fixed interest rate over a specified period (e.g., 3 months, 6 months). While you won't be able to access your money without penalty before the maturity date, they offer a slightly higher return than savings accounts.

Higher-Risk, Potentially Higher-Return Options (Proceed with Extreme Caution)

These options offer the potentialfor quicker returns but carry significantly higher risk. The possibility of losing your entire $100 is very real, so only consider these if you're comfortable with a substantial chance of losing your investment.

- Peer-to-Peer Lending: Platforms connect borrowers with lenders. While potential returns can be higher than traditional savings accounts, there's a significant risk of borrowers defaulting on their loans.

- Short-Term Stock Trading (Extremely Risky): Trading individual stocks with only $100 is highly speculative and generally not recommended for beginners. The market's volatility makes rapid losses very likely. Commission fees can also eat into profits quickly.

- Participating in Gig Economy Platforms: Although not strictly an investment, using your $100 to purchase supplies for a gig job (e.g., cleaning supplies for house cleaning) could generate income relatively quickly. This is more of a way to leverage your funds for immediate income generation, rather than investment growth.

Building a Foundation for Future Investing

Instead of focusing solely on a quick return with a small amount, consider using your $100 to build a foundation for future investing. This approach might not yield immediate returns but will position you for better investment opportunities down the line.

- Educational Resources: Invest in books, online courses, or workshops on personal finance and investing. This knowledge will help you make smarter investment decisions in the future.

- Start a Savings Habit: Regularly saving even small amounts will build your capital over time. Treat this $100 as the start of consistent saving.

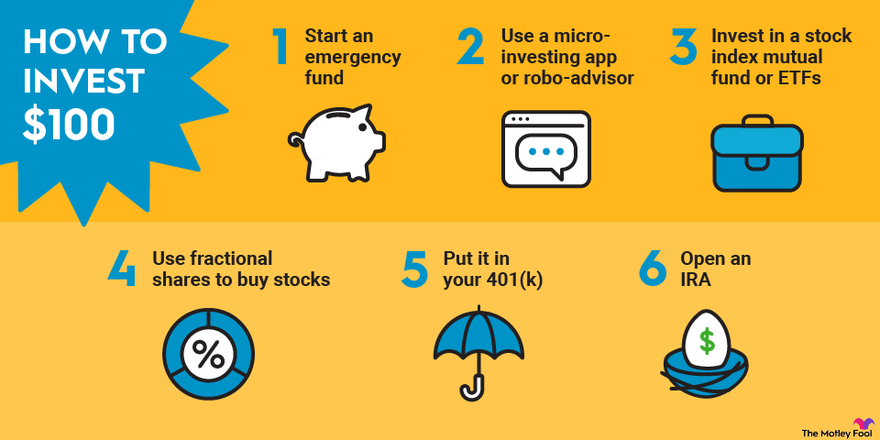

- Micro-Investing Apps: Some apps allow you to invest small amounts regularly, often with fractional shares. This allows you to gain exposure to the stock market even with limited funds and begin learning about stock investments.

How can I turn $100 into $500?

Turning $100 into $500 requires a strategy focused on leveraging your initial capital effectively. There's no guaranteed method, and the speed of achieving this goal depends heavily on the chosen approach and market conditions.

High-risk options offer faster potential returns but also carry a significantly greater chance of losing your initial investment. Lower-risk options are slower but safer.

High-Risk, High-Reward Options

Turning $100 into $500 quickly often involves high-risk ventures. These options could yield substantial returns, but the possibility of losing your initial investment is equally significant. Careful research and understanding of the inherent risks are paramount before considering any of these avenues.

This content may interest you! Do millionaires pay off debt or invest?

Do millionaires pay off debt or invest?- Day trading or short-term stock investments: This involves buying and selling stocks or other securities within a short period to profit from price fluctuations. However, it requires significant market knowledge, skill, and the ability to tolerate substantial risk. Inaccurate predictions can lead to significant losses.

- Investing in cryptocurrency: Cryptocurrencies are highly volatile, meaning their prices can fluctuate wildly in short periods. A successful investment requires careful research, understanding of market trends, and a high-risk tolerance. A small investment could potentially yield large gains, but it could just as easily vanish.

- Online gambling or high-stakes games: This is generally considered the highest-risk option. While winning large sums is possible, the odds are usually stacked against the player. This method is not recommended as it is largely based on chance and carries a very high probability of losing money.

Medium-Risk, Moderate-Reward Options

These strategies offer a balance between risk and potential reward. They typically require more time and effort than high-risk options but still carry a degree of uncertainty.

- Reselling items: Purchasing items at a discount (e.g., at thrift stores, garage sales, or online auctions) and reselling them for a profit through online marketplaces or local sales can be a viable approach. This requires market research to identify in-demand items and effective marketing skills to reach potential buyers. Profit margins vary depending on the item and market demand.

- Freelancing or gig work: Offering services like writing, graphic design, virtual assistance, or other skills online can generate income. The earning potential depends on the skills offered and the amount of time invested. Building a client base and a strong reputation is crucial for long-term success.

- Investing in low-cost index funds: While not a quick path to $500, gradually investing in diversified index funds over time can produce slow but steady returns. This approach involves less risk than individual stock picking but requires patience and consistent contributions.

Low-Risk, Low-Reward Options

These options involve less risk but typically take longer to achieve the desired financial goal. They are suitable for risk-averse individuals who prioritize capital preservation over rapid growth.

- Saving and budgeting: Meticulously saving a portion of your income and avoiding unnecessary expenses can gradually increase your savings. This approach is the least risky but requires significant discipline and patience. It’s unlikely to get you to $500 quickly.

- Part-time job or side hustle: Working a part-time job or taking on a side hustle in addition to your current income stream can generate extra money to contribute towards your $500 goal. The speed at which you reach your goal will depend on the hours worked and the hourly wage.

- Selling unused possessions: Selling items you no longer need or use (e.g., clothes, electronics, furniture) can provide a quick injection of cash. This strategy may not be sufficient to reach $500 on its own, but it can be a supplementary source of income.

How to double a $100?

Doubling $100 requires a strategy aligned with your risk tolerance and time horizon. There's no single "best" method, as different approaches offer varying levels of risk and potential return. Methods range from relatively safe, low-return options to higher-risk, potentially higher-reward ventures.

The key is understanding the potential downsides alongside the potential gains.

Investing in Stocks

Investing in the stock market offers the potential for significant growth but also carries substantial risk. Stock prices fluctuate, and there's always the possibility of losing some or all of your initial investment. However, over the long term, the stock market has historically delivered positive returns.

This content may interest you! How do I pay off 10k in debt?

How do I pay off 10k in debt?To double your $100, you'll need a substantial return, and this may take several years. Consider diversifying your portfolio to mitigate risk.

- Research individual stocks or consider index funds to spread your risk.

- Open a brokerage account with a reputable firm.

- Monitor your investment regularly, but avoid frequent trading based on short-term market fluctuations.

Starting a Small Business

Entrepreneurship offers a high-reward, high-risk path to doubling your money. With $100, your options are likely limited to very small-scale ventures requiring minimal startup costs.

Success hinges on identifying a market need, developing a solid business plan, and effectively marketing your product or service. Many small businesses fail, so thorough planning and a realistic assessment of your skills and the market are crucial.

- Identify a product or service with low startup costs that you can offer.

- Create a simple business plan outlining your target market, expenses, and revenue projections.

- Market your business effectively through social media, word-of-mouth, or other affordable channels.

High-Yield Savings Accounts or Certificates of Deposit (CDs)

While less exciting than stocks or starting a business, high-yield savings accounts and CDs offer a safe, albeit slower, path to doubling your money. These accounts typically offer a fixed interest rate, allowing you to earn interest on your initial investment over time.

The time it takes to double your money depends heavily on the interest rate offered – higher interest rates lead to faster growth. However, inflation needs to be considered.

- Research different banks and credit unions to find the highest interest rates available.

- Understand the terms and conditions of the account, including any fees or restrictions.

- Be patient; this method requires a longer timeframe compared to higher-risk options.

Frequently Asked Questions

What are some low-risk ways to turn $100 into $1000?

Turning $100 into $1000 with low risk requires patience and a long-term perspective. High-yield savings accounts or certificates of deposit (CDs) offer slow but steady growth, although reaching $1000 may take several years.

This content may interest you! What is the 70/30 rule in investing?

What is the 70/30 rule in investing?Investing in established dividend-paying stocks, although carrying some market risk, can provide consistent returns over the long term.

Index funds, which track a specific market index, offer diversification and relatively lower risk compared to individual stocks. Remember that even low-risk investments carry some level of risk, and returns are not guaranteed.

What are some higher-risk, higher-reward strategies to grow $100 to $1000?

Higher-risk strategies offer the potential for faster growth, but also come with a significantly increased chance of losing your initial investment. Options trading, while potentially lucrative, is incredibly complex and requires a deep understanding of market dynamics.

Day trading involves frequent buying and selling of assets within a single day, and demands substantial knowledge and experience to be successful.

Cryptocurrency investing is notorious for its volatility; while it offers the chance of significant gains, losses can be equally substantial. Thorough research and a solid understanding of the risks are crucial before attempting any of these strategies.

How long will it take to turn $100 into $1000 investing?

The timeframe to grow $100 to $1000 varies drastically depending on the investment strategy and market conditions. Low-risk investments like savings accounts or CDs will take significantly longer, potentially several years or even decades, due to their slower growth rates.

This content may interest you! Can I invest as little as $100?

Can I invest as little as $100?Higher-risk options like day trading or cryptocurrency might yield quicker returns, but also carry a much greater risk of substantial loss.

Consistent investment and market appreciation will influence the time needed, and there is no guaranteed timeframe. Patience and a long-term perspective are key for sustainable growth.

What are the most important factors to consider before investing $100?

Before investing any amount, understanding your risk tolerance is paramount. Determine how much potential loss you can accept without severely impacting your financial stability. Research your chosen investment thoroughly; understand its potential for growth and the associated risks.

Diversification is crucial; don't put all your eggs in one basket. Finally, consider the fees associated with your investment, as these can significantly impact your overall returns. A well-informed decision based on thorough research and a realistic assessment of your circumstances is essential.

Leave a Reply