Is $20,000 a lot of debt?

The question, "Is $20,000 a lot of debt?", doesn't have a simple yes or no answer. Its significance hinges entirely on your individual financial circumstances. This article explores the factors determining whether $20,000 represents a manageable burden or a crippling weight.

We'll delve into income, expenses, debt-to-income ratio, interest rates, and available resources, helping you assess your personal situation and determine the best course of action for tackling your debt. Ultimately, the answer depends on you.

Is $20,000 a Lot of Debt? A Deeper Look

Whether $20,000 is a lot of debt depends entirely on your individual financial circumstances. It's not a simple yes or no answer. A debt of this size could be manageable for someone with a high income and low living expenses, while it could be crippling for someone with a low income and high expenses.

The key factors to consider include your income, your expenses, the type of debt, and your overall financial goals. A high-interest debt, like credit card debt, will accumulate faster than a low-interest debt, like a student loan.

Therefore, understanding your debt's interest rate and repayment terms is crucial. Ultimately, the question isn't just about the amount of debt, but also about your ability to comfortably manage and repay it without jeopardizing your financial well-being. This involves creating a budget, tracking your spending, and exploring options for debt consolidation or repayment strategies if needed.

What Type of Debt is It?

The type of debt significantly impacts whether $20,000 is manageable. High-interest debt, such as credit card debt, can quickly snowball due to compounding interest, making it harder to pay off. Low-interest debt, like a federal student loan, may offer more manageable monthly payments and repayment options.

Furthermore, secured debt (backed by collateral, like a car loan) carries different risks and implications than unsecured debt (like credit card debt).

This content may interest you! What to do if you are in massive debt?

What to do if you are in massive debt?Understanding the terms of your debt, including the interest rate, repayment period, and any associated fees, is crucial in determining its impact on your financial stability. Considering these factors will provide a clearer picture of the long-term implications of this debt.

What is Your Income and Expenses?

Your income and expenses play a crucial role in determining whether $20,000 in debt is a significant burden. If your income is significantly higher than your expenses, leaving you with a substantial amount of disposable income, then $20,000 might be manageable.

However, if your expenses are already close to or exceeding your income, adding a $20,000 debt repayment to your budget could put you in a difficult financial position. A detailed budget outlining all income and expenses is essential to assess your debt-to-income ratio and determine your ability to make timely payments without compromising your essential needs.

Analyzing your cash flow and creating a realistic repayment plan are critical steps to managing this debt effectively.

What are Your Financial Goals?

Your long-term financial goals significantly influence how you should perceive $20,000 in debt. If your goal is to buy a house in the near future, this debt could substantially impact your ability to qualify for a mortgage.

Similarly, if you're aiming for early retirement, this debt could delay your timeline. However, if your goals are less immediate, like building an emergency fund, this debt might be manageable as long as you have a solid plan in place for repayment.

Understanding your financial priorities and how this debt affects your ability to achieve your goals is vital for making informed decisions about debt management strategies and prioritizing your financial well-being.

This content may interest you! What to do when you are heavily in debt?

What to do when you are heavily in debt?| Factor | Impact on $20,000 Debt Assessment |

|---|---|

| Income | High income = potentially manageable; Low income = potentially significant burden |

| Expenses | High expenses = increased difficulty; Low expenses = increased manageability |

| Debt Type | High-interest debt = more challenging; Low-interest debt = easier to manage |

| Financial Goals | Short-term goals may be impacted more severely than long-term goals |

How bad is 20k in debt?

The severity of $20,000 in debt depends heavily on several factors. It's not simply a matter of the raw number. Consider your income, the type of debt, the interest rate, and your overall financial situation. $20,000 could be manageable for someone with a high income and low interest rates, but crippling for someone with a low income and high-interest debt.

The impact is also significantly different if this debt is secured (like a car loan or mortgage) versus unsecured (like credit card debt or personal loans). High-interest debt, especially, can quickly snowball, making repayment difficult and potentially leading to financial distress.

What Type of Debt is it?

The type of debt significantly influences how problematic $20,000 is. Secured debt, backed by an asset (like a car or house), presents different risks than unsecured debt.

While defaulting on secured debt can lead to asset repossession, unsecured debt like credit card debt can severely damage your credit score, impacting future borrowing opportunities. Understanding the specific type of debt is crucial for determining the best repayment strategy.

- Secured debt (e.g., auto loan, mortgage): Losing the asset is a significant risk if you default.

- Unsecured debt (e.g., credit cards, personal loans): Damage to credit score and potential collection efforts are major concerns.

- Student loan debt: Government programs and income-driven repayment plans might be available, but the debt can still significantly impact financial freedom for years.

What is Your Income and Interest Rate?

Your income level directly affects your ability to repay the debt. A high income allows for larger monthly payments, accelerating debt reduction. Conversely, a low income makes repayment more challenging, potentially leading to further debt accumulation through missed payments and added fees.

The interest rate also plays a critical role; higher interest rates mean more money goes towards interest payments, making it harder to pay down the principal balance. A high-interest loan can quickly become an unsustainable burden.

- High income: Easier to manage and pay off quickly.

- Low income: More difficult to manage, potentially requiring debt consolidation or financial counseling.

- High interest rates: Accelerate debt growth and make repayment more challenging.

What are Your Other Financial Obligations?

Your overall financial picture significantly impacts the severity of $20,000 in debt. Existing debts, like rent, utilities, and other loans, reduce your available funds for debt repayment. Furthermore, substantial monthly expenses can make even a seemingly manageable debt load feel overwhelming.

This content may interest you! How do I recover from so much debt?

How do I recover from so much debt?A comprehensive assessment of your financial situation, including all income and expenses, is crucial before determining the severity of this debt.

- Other significant debts: Increases overall financial stress and makes repayment more challenging.

- High monthly expenses: Reduces the amount available for debt repayment.

- Emergency fund availability: Having an emergency fund helps to mitigate financial shocks that could exacerbate the debt problem.

How long does it take to pay off $20,000 in debt?

Factors Affecting Payoff Time

The time it takes to pay off $20,000 in debt is highly variable and depends on several key factors. The most significant is the interest rate. A higher interest rate means more of your payments go towards interest, leaving less to reduce the principal balance, thus extending the repayment period.

Other crucial factors include the amount of your monthly payment, whether you make extra payments, and the type of debt (credit cards typically have higher interest rates than personal loans).

Finally, unexpected life events, like job loss or medical emergencies, can significantly impact your ability to stick to a repayment plan and potentially lengthen the payoff period.

- Interest Rate: A higher interest rate dramatically increases the total amount paid and lengthens the repayment timeline.

- Monthly Payment Amount: Larger monthly payments reduce the principal faster, resulting in a shorter repayment period.

- Extra Payments: Making even small extra payments each month can substantially shorten the overall repayment time and reduce the total interest paid.

Calculating Payoff Time

To accurately determine how long it will take to pay off $20,000, you need to use a debt payoff calculator. These calculators are readily available online and require you to input the principal balance ($20,000), the annual interest rate, and your monthly payment amount. The calculator will then estimate the total number of months it will take to eliminate the debt.

Keep in mind that these calculations are based on consistent payments and don't account for potential changes in interest rates or additional charges. Many calculators also allow you to explore different scenarios, such as increasing your monthly payment to see how that impacts the payoff timeline.

- Principal Balance: The initial amount of debt owed ($20,000).

- Annual Interest Rate: The percentage of interest charged on the outstanding balance.

- Monthly Payment: The fixed amount paid each month towards the debt.

Debt Consolidation and Strategies

If you're struggling to manage multiple debts, debt consolidation can be a helpful strategy. This involves combining multiple debts into a single loan, often with a lower interest rate, simplifying your repayment process.

This content may interest you! How can I improve my credit score when in debt?

How can I improve my credit score when in debt?Alternatively, the debt snowball method focuses on paying off the smallest debt first to build momentum and motivation, while the debt avalanche method prioritizes paying off the debt with the highest interest rate first to minimize total interest paid. Both strategies require discipline and a clear repayment plan.

Seeking advice from a financial advisor can also provide personalized guidance based on your specific circumstances.

- Debt Consolidation: Combining multiple debts into one loan, potentially with a lower interest rate.

- Debt Snowball Method: Paying off the smallest debt first for motivational purposes.

- Debt Avalanche Method: Paying off the highest-interest debt first to minimize total interest.

How much debt is considered a lot?

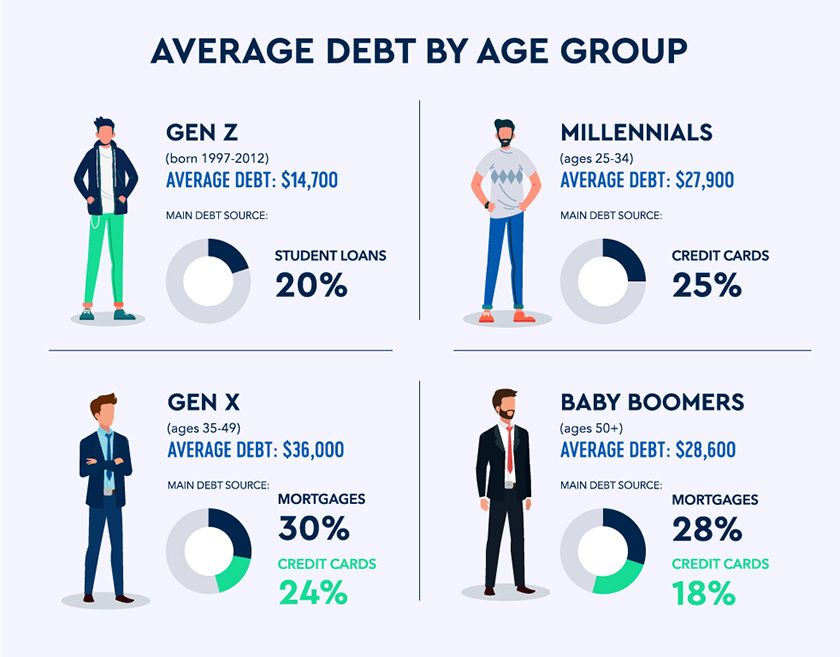

There's no single answer to how much debt is considered "a lot." It's highly dependent on several individual factors, making it a relative rather than an absolute measure. The key is to assess your debt burden in relation to your income and assets.

A small debt might be manageable for a high earner with substantial savings, while a seemingly modest debt could be crippling for someone with a low income and limited resources. Factors such as the type of debt (e.g., mortgage, student loans, credit card debt), interest rates, and the length of the repayment period all play significant roles in determining the overall impact of debt.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is a crucial indicator of your debt burden. It represents the percentage of your gross monthly income that goes towards paying your debts. Lenders typically use this ratio to assess your creditworthiness.

A high DTI can signal financial strain and increase the risk of default. Ideally, your DTI should be below 36%, with some experts recommending a target of below 28% for optimal financial health.

This content may interest you! How to create a debt repayment plan that works?

How to create a debt repayment plan that works?A higher DTI significantly impacts your ability to manage your finances effectively and can lead to a cycle of accumulating further debt.

- Calculate your DTI by adding up all your monthly debt payments (excluding mortgage) and dividing by your gross monthly income.

- Compare your DTI to industry benchmarks to get a sense of whether your debt load is manageable.

- Work to lower your DTI by paying down high-interest debt and increasing your income, if possible.

Types of Debt and Interest Rates

The type of debt significantly impacts its overall effect on your financial well-being. While a mortgage is generally considered good debt (as it represents an investment in an asset), high-interest debts such as credit card debt can quickly spiral out of control.

The interest rates charged on different types of debt vary substantially. High interest rates accelerate debt accumulation, making it more difficult to pay off, even with consistent repayments. Understanding the interest rates associated with your debts is essential for effective debt management.

- Prioritize paying down high-interest debts first to minimize the overall cost of borrowing.

- Explore options for debt consolidation or refinancing to potentially secure lower interest rates.

- Understand the terms and conditions of your loan agreements to avoid unexpected fees or interest rate increases.

Emergency Fund and Future Financial Goals

The amount of debt that is considered "a lot" also depends on your financial security net and your future financial aspirations. Having an emergency fund that covers 3-6 months of living expenses is crucial for managing unexpected events without falling further into debt.

If you have a robust emergency fund, you might be able to handle a higher debt load than someone without one. Moreover, your financial goals, such as buying a house, investing, or retirement planning, significantly influence the amount of debt you can comfortably manage.

Balancing current debt with future financial aspirations is critical for long-term financial success.

- Build an emergency fund to mitigate the impact of unexpected expenses.

- Align your debt management strategy with your long-term financial goals.

- Prioritize financial planning to ensure that your debt doesn't hinder your ability to achieve your aspirations.

How can I get out of $20000 debt fast?

Getting out of $20,000 debt quickly requires a multifaceted approach combining aggressive debt reduction strategies with lifestyle adjustments. There's no magic bullet, but a determined and organized effort can significantly shorten the repayment timeline.

This content may interest you! Is $20,000 a lot of debt?

Is $20,000 a lot of debt?The key is to maximize your income, minimize your expenses, and strategically tackle your debts.

Create a Realistic Budget and Track Your Spending

Before you can effectively tackle your debt, you need a clear picture of your financial situation. Creating a detailed budget involves meticulously listing all your income sources and expenses. Categorize your spending to identify areas where you can cut back.

Tracking your spending for at least a month will reveal spending habits you may not be aware of. Consider using budgeting apps or spreadsheets to simplify the process. Once you have a clear understanding of your cash flow, you can start making informed decisions about debt repayment.

- List all income sources: salary, side hustles, investments.

- Categorize expenses: housing, transportation, food, entertainment, debt payments.

- Identify areas for reduction: unnecessary subscriptions, dining out, impulse purchases.

Develop a Debt Reduction Strategy

Several strategies can accelerate debt repayment. The avalanche method prioritizes paying off the debt with the highest interest rate first, saving money on interest in the long run. The snowball method focuses on paying off the smallest debt first for psychological motivation, building momentum.

Debt consolidation involves combining multiple debts into a single loan with a potentially lower interest rate. Balance transfers to credit cards with 0% introductory APR can provide temporary relief, but be mindful of fees and the interest rate after the introductory period ends.

Carefully weigh the pros and cons of each strategy based on your specific debts and financial situation.

- Avalanche Method: Prioritize high-interest debts.

- Snowball Method: Prioritize small debts for motivation.

- Debt Consolidation: Combine multiple debts into one loan.

Increase Your Income

Reducing expenses is crucial, but increasing income significantly accelerates debt repayment. Explore opportunities for a raise at your current job, look for a higher-paying position, take on a part-time job, or start a side hustle.

This content may interest you! How can I save money if I have debt?

How can I save money if I have debt?Freelancing platforms, online tutoring, and gig work offer flexibility. Selling unused possessions can generate extra cash. Every extra dollar earned can be directly applied to your debt, shortening the repayment period. Be creative and persistent in exploring income-generating avenues.

- Negotiate a raise at your current job.

- Seek a higher-paying position.

- Explore side hustles: freelancing, gig work, selling possessions.

Is $20,000 a lot of debt in general?

$20,000 is a significant amount of debt, but whether it's "a lot" depends heavily on your individual financial situation. Consider your income, expenses, and existing assets. If your income comfortably covers your expenses and you have substantial savings, $20,000 might be manageable.

However, if you struggle to meet your monthly obligations or have limited savings, it could represent a considerable burden, potentially impacting your credit score and financial stability. A good rule of thumb is to examine your debt-to-income ratio to gain perspective.

How does $20,000 of debt impact my credit score?

The impact of $20,000 in debt on your credit score depends on several factors including your credit utilization ratio (the amount of credit you're using versus your total available credit), your payment history, and the types of debt you have.

A high credit utilization ratio, coupled with late or missed payments, can significantly lower your score. While $20,000 might not automatically tank your score, it increases your risk of negative impacts. Responsible management, including on-time payments and keeping your utilization low, is key to mitigating potential damage.

What are the consequences of having $20,000 in debt?

The consequences of $20,000 in debt can range from minor inconveniences to major financial hardship. You might face challenges saving for large purchases, such as a house or car, and experience stress related to financial obligations.

High-interest rates can quickly make the debt grow, creating a vicious cycle. In severe cases, it could lead to difficulty meeting essential living expenses, negatively impact your credit rating, and potentially result in collection actions if payments are consistently missed.

This content may interest you! Is $30,000 in debt a lot?

Is $30,000 in debt a lot?Can I get rid of $20,000 in debt quickly?

Eliminating $20,000 in debt quickly requires a dedicated and aggressive approach. Strategies include creating a detailed budget, identifying areas to cut expenses, and exploring debt consolidation or debt management plans.

Consider negotiating lower interest rates with creditors and prioritizing high-interest debts. While quick solutions exist, it's important to remember that sustainable debt reduction involves long-term commitment and careful planning. A realistic timeline and unwavering discipline are essential for success.

Leave a Reply