Is investing in your 20s a good idea?

Investing in your twenties might seem daunting, especially with student loans and building a career. However, the power of compounding returns makes early investing incredibly advantageous. This article explores the benefits of starting your investment journey early, addressing common concerns like risk tolerance, investment choices, and the psychological hurdles.

We'll examine different investment strategies suitable for twenty-somethings, and dispel myths surrounding investing for beginners. Ultimately, we'll show why prioritizing investment in your twenties can significantly impact your long-term financial well-being.

Is Investing in Your 20s Really Worth It?

Yes, investing in your 20s is an excellent idea, and arguably the best time to start. The key benefit is the power of compound interest. The longer your money has to grow, the more significant the returns become.

Starting early allows your investments to benefit from this exponential growth for a much longer period. While your income might be lower in your 20s, even small, consistent contributions can make a huge difference over time. Don't let the fear of making mistakes stop you; learning and adjusting your strategy along the way is part of the process.

It's better to start early and learn as you go, rather than waiting and potentially missing out on decades of potential growth. Early investing also instills financial discipline and establishes healthy savings habits that will benefit you throughout your life. It’s about building a long-term financial foundation, not about immediate riches.

The Power of Compounding: Your Biggest Ally

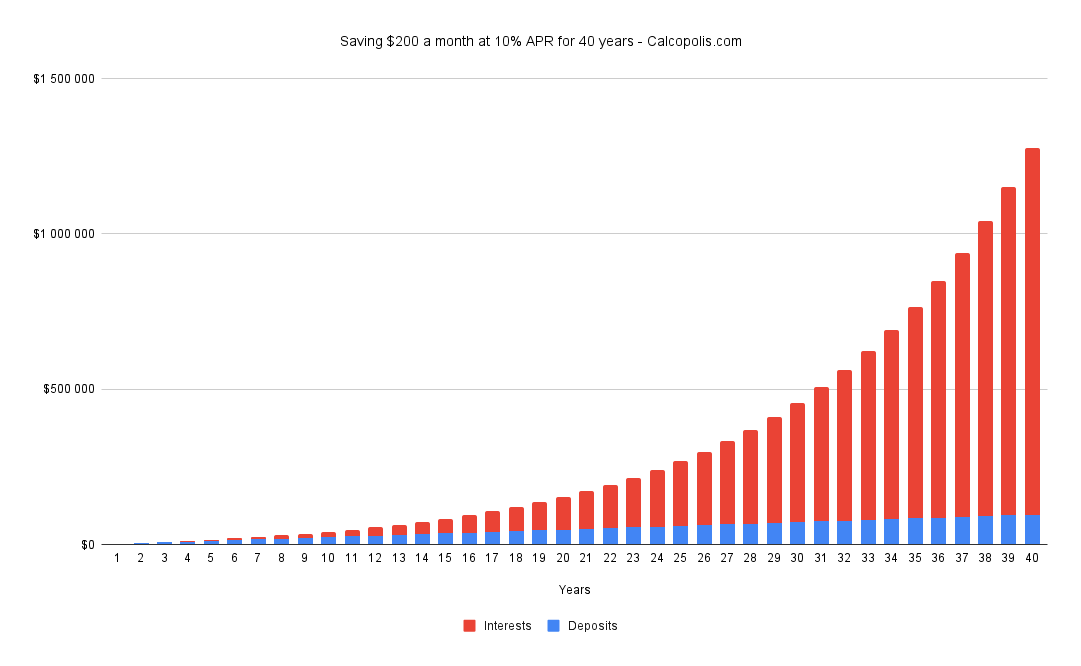

The magic of compound interest is the reason why investing in your 20s is so crucial. It's the snowball effect of earning interest on your initial investment, plus the accumulated interest. Each year, your returns grow larger, building on themselves exponentially.

This effect is most powerful over longer periods, meaning the earlier you start, the more dramatically compound interest will boost your investment growth. Imagine starting with a small sum and letting it grow for 30 or 40 years; the end result far surpasses what you'd achieve if you began investing later in life.

This means even small regular contributions can lead to a substantial nest egg for retirement or other long-term goals. The key is consistency and patience; allowing the compounding power to work its magic requires time and discipline.

Time Horizon: Your Greatest Asset

Your youth is your greatest asset when it comes to investing. A longer time horizon allows you to weather market fluctuations and recover from setbacks more easily. In your 20s, you likely have many years until retirement or other major financial goals, providing more flexibility to adjust your strategy and ride out market downturns.

Short-term volatility becomes less significant when viewed through the lens of a 30 or 40-year timeframe. This isn't to say you shouldn't pay attention to market trends, but it does mean that you can afford to be more patient and strategic in your approach.

This longer timeframe also allows you to take on slightly more risk, potentially leading to higher returns over the long haul. This isn't a reason to be reckless, however – responsible investment practices remain essential.

Overcoming Fear and Getting Started

The most significant hurdle to investing in your 20s is often fear. Fear of losing money, fear of making the wrong decisions, fear of not knowing enough – these feelings are common, and completely understandable.

However, inaction is often far more costly than taking measured risks. Start small. Begin with a manageable amount that you’re comfortable with. Educate yourself gradually through reliable sources, understand investment basics, and consider seeking professional advice if needed.

There are many resources available, from online courses to financial advisors, to help you navigate the investment world. Remember, investing is a journey, not a race. The goal isn't to become a millionaire overnight; it’s about gradually building wealth over time and creating a secure financial future for yourself.

This content may interest you! What is the 70/30 rule in investing?

What is the 70/30 rule in investing?The sooner you start, the more time you have to learn, adapt, and benefit from the power of compounding.

| Advantage | Explanation |

|---|---|

| Time Horizon | Longer time horizon allows for greater risk tolerance and recovery from market downturns. |

| Compounding | Interest earned on interest, resulting in exponential growth over time. |

| Habit Formation | Early investing establishes good financial habits for life. |

| Long-Term Growth | Significant wealth accumulation potential over decades. |

Should you invest in your 20s?

Yes, investing in your 20s is generally considered a very good idea. This is primarily due to the power of compounding. Compounding is the snowball effect of earning returns on your initial investment, and then earning returns on those returns.

The earlier you start, the more time your money has to grow exponentially. While there's inherent risk involved in any investment, the longer time horizon available in your 20s allows for greater risk tolerance and the potential to recover from market downturns.

Furthermore, your 20s are often a time of relatively lower financial responsibilities, allowing for more disposable income to allocate towards investments. However, it's crucial to understand your risk tolerance and invest responsibly, perhaps starting with smaller amounts and gradually increasing your investment as your knowledge and financial stability grow.

The Power of Compounding

The magic of compounding is most effectively harnessed when you start early. Even small, consistent investments made in your twenties can accumulate significantly over time. This is because your returns earn returns, creating a snowball effect.

The earlier you begin, the greater the snowball will become by the time you reach retirement. This contrasts sharply with starting later, where you have less time for your investments to compound and reach their full potential.

- Early investing allows for more time to recover from market downturns.

- Smaller, regular contributions can accumulate substantially over decades.

- Compounding's effects become increasingly dramatic over longer periods.

Understanding Risk Tolerance

While investing in your twenties offers significant advantages, it’s crucial to understand your personal risk tolerance. Younger investors often have a higher risk tolerance than older investors due to a longer time horizon.

This means they can afford to take on more risk in their investment strategies, potentially aiming for higher returns, even if it involves greater volatility. However, it's important to diversify your investments to mitigate risk and avoid putting all your eggs in one basket. Start with research, consider low-cost index funds, and maybe consult a financial advisor.

- A longer time horizon allows for greater risk taking and potential recovery from losses.

- Diversification is key to mitigating the risk associated with higher-return investments.

- Understanding your own financial goals is essential before selecting investment strategies.

Different Investment Options

The investment landscape offers many choices, each with varying levels of risk and potential reward. For those in their 20s, options like index funds, which track a market index, provide diversified exposure with relatively low fees.

Individual stocks might offer higher potential returns but also involve greater risk. Retirement accounts like 401(k)s and Roth IRAs offer tax advantages and are designed specifically for long-term saving and investing.

It's important to educate yourself on the various options and choose those aligning with your goals, risk tolerance, and financial knowledge.

- Index funds provide diversification and relatively low fees, ideal for beginners.

- Individual stocks can potentially offer higher returns but carry significant risk.

- Retirement accounts like 401(k)s and Roth IRAs offer tax benefits for long-term investment.

What if I invest $$200 a month for 20 years?

Investing $200 a month for 20 years can lead to significant growth, but the final amount will heavily depend on the investment's rate of return. This rate of return is influenced by various factors including the type of investment (stocks, bonds, real estate, etc.), the market's overall performance, and the level of risk involved.

This content may interest you! Can you start investing at a young age?

Can you start investing at a young age?A higher-risk investment generally has the potential for a higher return but also carries a greater chance of losses.

A lower-risk investment will likely yield a more modest return. To illustrate, let's consider a few scenarios with different average annual returns. Remember that past performance is not indicative of future results, and these are simply examples.

Potential Returns Based on Different Investment Strategies

The potential return on your investment over 20 years will dramatically change based on your investment strategy. Conservative investments like high-yield savings accounts or government bonds will offer lower returns, but with significantly less risk.

More aggressive investments like individual stocks or stock mutual funds could offer potentially higher returns but come with higher risk. Diversification across asset classes is key to managing risk. Let's imagine three distinct scenarios:

- Low-Risk Investment (4% average annual return): This could result in a total investment of $48,000 ($200/month 12 months/year 20 years), and you might see a final balance around $66,000 to $70,000 after 20 years, depending on compounding frequency. This is a modest gain, but it represents consistent, steady growth with low risk.

- Moderate-Risk Investment (7% average annual return): With a 7% average annual return, the total investment of $48,000 could grow to approximately $85,000 to $95,000 after 20 years. This illustrates how a slightly higher return can make a considerable difference over the long term.

- High-Risk Investment (10% average annual return): This scenario is more speculative. While the potential is higher, the possibility of losses is also greater. A 10% average annual return could result in a final balance of around $120,000 to $140,000, but bear in mind this scenario is significantly more volatile.

The Power of Compounding

Compounding is a crucial aspect of long-term investing. It refers to earning returns not only on your initial investment but also on the accumulated interest or returns. The earlier you start investing, the more time your money has to compound, leading to exponential growth.

Over 20 years, the effect of compounding becomes significant, particularly at higher rates of return. Consider the difference between simple interest (interest only earned on the principal) and compound interest (interest earned on both the principal and accumulated interest).

The power of compounding means even small regular investments can yield surprisingly large amounts over a long period.

- Understanding Compound Interest: Compound interest calculations consider the reinvested earnings from previous periods. It's the interest on interest that fuels significant long-term growth.

- The Time Value of Money: Investing early allows your money to grow exponentially for a longer time. This is due to the compounding effect.

- Regular Contributions: Consistent monthly contributions of $200 significantly enhance the power of compounding as you continuously add to the principal.

Factors Affecting Your Investment Growth

Several factors can influence the growth of your investment over 20 years, and these factors are interconnected. The rate of return isn't just a matter of selecting a specific investment but depends on many external forces.

The choices you make before and during the process play a crucial role in the outcome. Understanding these variables is crucial to realistic expectations.

- Market Volatility: Stock markets can experience periods of significant ups and downs. A diversified portfolio can help mitigate this risk.

- Inflation: Inflation erodes the purchasing power of money over time. It's essential to aim for investment returns that exceed the inflation rate.

- Investment Fees: High fees can significantly eat into your returns. Be mindful of expense ratios associated with mutual funds or other investment vehicles.

Is 25 a good age to start investing?

Yes, 25 is an excellent age to start investing. The power of compounding returns means that even relatively small, consistent contributions made early in life can yield significant results over time. Starting at 25 gives you several decades to benefit from the growth potential of your investments, allowing your money to work for you and build wealth steadily.

While there's always risk involved, the longer your investment horizon, the more time you have to recover from potential market downturns.

This longer timeframe also offers more opportunities to adjust your investment strategy as needed, based on changing life circumstances and financial goals. The earlier you begin, the less you'll need to invest each month to achieve your target financial goals.

The Benefits of Early Investing

Starting to invest at 25 provides several significant advantages. The most notable benefit is the extended time horizon available for your investments to grow. This allows the magic of compounding to work in your favor, turning relatively small contributions into a substantial sum over many years.

Furthermore, starting early allows you to potentially recover from market fluctuations more easily because you have a longer timeframe to potentially make up for losses. Finally, early investment allows you to build healthy financial habits that will benefit you throughout your life.

This content may interest you! Is investing young smart?

Is investing young smart?This approach also instills a sense of financial security and encourages prudent decision-making related to money.

- Longer time horizon to benefit from compounding interest and long-term growth.

- More opportunities to adjust investment strategy based on changing life circumstances.

- Development of valuable long-term financial habits and discipline.

Investment Options for 25-Year-Olds

A 25-year-old has a wide range of investment options available, offering flexibility to suit different risk tolerances and financial goals. Index funds and ETFs provide broad market diversification at low cost.

Investing in individual stocks allows for targeted growth potential but requires more research and understanding of individual company performance and risk factors. Real estate investment trusts (REITs) offer exposure to the real estate market without requiring direct property ownership.

Furthermore, bonds can provide stability and income, while alternative investments, such as cryptocurrency, may be considered depending on risk appetite and financial knowledge.

It's crucial to carefully consider your financial goals, risk tolerance, and time horizon when choosing appropriate investments.

- Index funds and ETFs: Diversified, low-cost options.

- Individual stocks: Higher risk, higher potential return.

- Real estate investment trusts (REITs): Exposure to real estate market.

- Bonds: Relatively low risk, steady income.

Managing Risk at a Younger Age

While starting early is beneficial, it's essential to manage investment risk effectively. Younger investors generally have a higher risk tolerance due to their longer time horizons; however, this doesn't mean taking unnecessary or excessive risks.

Diversification is key to mitigating risk, spreading investments across various asset classes to balance potential gains and losses. Regularly reviewing and rebalancing your portfolio ensures your investments continue to align with your risk tolerance and financial goals.

Also, it’s wise to take advantage of employer-sponsored retirement plans like 401(k)s, which often offer matching contributions.

- Diversification across multiple asset classes to minimize risk.

- Regular portfolio review and rebalancing to adapt to changing circumstances.

- Utilizing employer-sponsored retirement plans to maximize benefits.

Is 20 too late to start investing?

No, 20 is absolutely not too late to start investing. In fact, starting at 20 offers a significant advantage: the power of compounding. The longer your money has to grow, the more it will accumulate due to the interest earned on both your principal and accumulated interest.

While starting earlier is always beneficial, the key is to begin now. The earlier you start, the more time your investments have to grow, but even starting at 20 gives you many years to benefit from the markets. Don't let the fear of missing out on earlier gains prevent you from starting your investment journey.

Every year you delay reduces your potential returns significantly. Begin investing now, even with small amounts, and consistently contribute to build a strong financial future.

The Power of Compounding at 20

The beauty of investing lies in compounding. This is the snowball effect where your investment earnings generate even more earnings over time. The earlier you start, the more times this effect compounds, leading to exponential growth.

At 20, you have decades ahead of you to reap the benefits of this exponential growth. Even small, consistent investments made early in your life can lead to a surprisingly substantial amount by the time you reach retirement.

This is why starting as soon as possible is so crucial for long-term financial success. Don't underestimate the power of consistent contributions and long-term growth.

This content may interest you! How to invest in your 50s in the UK?

How to invest in your 50s in the UK?- Longer time horizon maximizes the benefits of compounding.

- Even small contributions accumulate significantly over decades.

- The earlier you start, the less risk you need to take to achieve your goals.

Investment Strategies for 20-Year-Olds

At 20, you typically have a longer time horizon, allowing you to embrace a more aggressive investment strategy. This doesn't mean taking reckless risks, but rather taking advantage of higher-growth potential investments.

Consider a diversified portfolio that balances risk and reward. It's important to educate yourself about various investment options before committing. Seek professional advice if needed.

Understanding the different levels of risk associated with different asset classes is vital for constructing a suitable investment plan. Remember, consistency and patience are key.

- Diversify your portfolio across stocks, bonds, and potentially other asset classes.

- Consider index funds or ETFs for low-cost, diversified exposure to the market.

- Allocate a higher percentage of your portfolio to growth-oriented investments.

Overcoming the Fear of Investing at 20

Many young adults feel overwhelmed or intimidated by the idea of investing. They might lack experience, feel they don’t have enough money, or worry about market volatility. However, these are common feelings, and shouldn't prevent you from starting.

Begin with small, manageable steps, perhaps by learning about different investment vehicles, setting up a brokerage account, and investing a small portion of your income each month.

Remember that even small contributions made consistently over time add up significantly. Start small, learn as you go, and don't be afraid to seek guidance.

- Start with a small amount of money; you don't need a large sum to begin.

- Educate yourself gradually about investment principles and different asset classes.

- Don't be discouraged by market fluctuations; long-term investing is about the overall trend.

Frequently Asked Questions

Is it too early to start investing in my 20s?

No, it's not too early! In fact, starting in your 20s offers a significant advantage: the power of compounding. The longer your money grows, the more it will earn through interest and returns. Even small, regular investments can accumulate substantially over several decades.

Your younger years offer more time to recover from market downturns and ride out volatility, making early investment a very smart decision. Don't wait for a "perfect" time, start now and benefit from the years ahead.

What if I don't have a lot of money to invest in my 20s?

Even small amounts can make a big difference. Many investment platforms allow you to invest as little as a few dollars per month. Consistency is key; regular contributions, even if modest, contribute significantly over time.

Consider automating your investments through direct debit from your bank account to ensure consistent contributions. Focus on low-cost investment options, such as index funds or ETFs, to minimize fees and maximize your returns. Your contributions don't need to be large to see considerable growth over the long term.

What are the best investment options for someone in their 20s?

Your 20s offer the flexibility to take on more risk, allowing you to potentially achieve higher returns. Consider investing in diversified index funds or exchange-traded funds (ETFs) that track the overall market performance.

These provide broad exposure and relatively low fees. You could also explore individual stocks, but make sure you understand the risks involved and do your research. It's crucial to maintain a diversified portfolio to mitigate risk and align with your long-term financial goals.

How can I start investing in my 20s if I don't know anything about investing?

There are plenty of resources available to educate yourself. Start by reading books and articles on investing basics. Many online courses and workshops offer introductory material on investing.

Consider speaking to a financial advisor who can provide personalized guidance and create an investment strategy suited to your financial situation and risk tolerance. Don't be intimidated; learning about investing is a process, and there are many resources to help you begin your journey.

This content may interest you! What should a 55 year old invest in?

What should a 55 year old invest in?

Leave a Reply