Should a 12 year old save money?

Twelve is a pivotal age, marking a transition from childhood to adolescence, and financial literacy plays a crucial role in this journey. Should a 12-year-old start saving money? This question sparks debate among parents and financial experts alike.

While some believe it's too early to introduce complex financial concepts, others advocate for early financial education to foster responsible spending habits and future financial security.

This article explores the benefits and challenges of teaching a 12-year-old about saving, offering practical advice and strategies for parents and guardians to navigate this important phase.

- The Importance of Saving for Tweens: Why a 12-Year-Old Should Start Saving Money

- How much money should a 12 year old have?

- What should I save up for as a 12 year old?

- How much should a 12 year old get in pocket money?

- What age should kids start saving money?

- Introducing the Concept of Saving: Early Childhood (Ages 3-5)

- Developing Saving Habits: Middle Childhood (Ages 6-12)

- Building Financial Responsibility: Adolescence (Ages 13-18)

- How much money should a 12-year-old save?

- What are some good ways for a 12-year-old to save money?

- What if my 12-year-old doesn't want to save money?

- How can I help my 12-year-old learn about money management?

The Importance of Saving for Tweens: Why a 12-Year-Old Should Start Saving Money

Absolutely! A 12-year-old should absolutely start saving money. This is a crucial life skill that will benefit them immensely in the future. While they may not have a large income, even small amounts saved consistently can add up.

Saving teaches valuable lessons about financial responsibility, delayed gratification, and goal setting. It allows them to understand the value of money and empowers them to make informed financial decisions later in life. It's never too early to instill good financial habits.

Starting young allows them to develop a positive relationship with money and avoid potential future financial struggles. Learning to save at this age can also build confidence and self-reliance, fostering a sense of accomplishment when they achieve their savings goals.

Moreover, saving can open up opportunities for them to purchase items they desire, participate in activities they enjoy, or even contribute to a larger, more significant goal in the future.

Building Good Financial Habits Early

Introducing a 12-year-old to saving is an excellent way to build strong financial habits that will serve them well throughout their lives. This isn't just about accumulating money; it’s about teaching them the value of budgeting, planning, and making responsible choices.

By setting small savings goals, such as saving for a new video game or a desired item, they can learn the satisfaction of working towards and achieving a financial objective. This process reinforces the importance of delayed gratification and shows them the power of consistent effort.

Furthermore, it provides a valuable opportunity to discuss concepts like interest and compound interest, laying the groundwork for more complex financial understanding later on.

Teaching Financial Responsibility and Goal Setting

Saving money empowers a 12-year-old to become more financially responsible. It encourages them to think about their spending habits and make conscious decisions about how to allocate their resources.

This content may interest you! What age should I start budgeting?

What age should I start budgeting?They can learn to distinguish between needs and wants and prioritize their spending accordingly. Setting savings goals, whether big or small, helps them develop goal-setting skills which are transferable to other aspects of their lives.

Achieving these goals, even small ones, boosts their self-esteem and reinforces the idea that hard work and patience pay off. This sense of accomplishment fosters a positive relationship with money and motivates them to continue saving and managing their finances responsibly.

Opportunities and Future Benefits of Saving

Saving early can open doors to exciting opportunities in the future. Even modest savings can contribute to larger goals like college education, driving lessons, or a down payment on a first car or apartment. Having savings also provides a safety net for unexpected expenses, reducing stress and anxiety associated with financial emergencies.

The earlier they begin saving, the more time their money has to grow through interest, enhancing the long-term value of their savings. This early exposure to savings and financial planning prepares them for the responsibilities of adulthood, making them more confident and secure in their financial future.

Moreover, it allows for earlier access to opportunities that may not be feasible without sufficient savings.

| Benefit | Description |

|---|---|

| Financial Literacy | Understanding of budgeting, saving, and spending. |

| Delayed Gratification | Learning to wait for desired items, fostering self-control. |

| Goal Setting | Developing skills in setting and achieving financial targets. |

| Financial Independence | Gaining control over personal finances and reducing reliance on others. |

| Future Opportunities | Access to education, experiences, and purchases otherwise unavailable. |

How much money should a 12 year old have?

How much money a 12-year-old should have is highly dependent on several factors and there's no single right answer. It's more about responsible money management than a specific amount. Consider their maturity level, earning ability (allowance, chores, part-time jobs), spending habits, and saving goals.

A child who earns money from chores might have more disposable income than one who doesn't. Similarly, a child with a strong saving ethic might have a significant savings account, while another may prefer spending their money immediately.

The key is teaching financial literacy and responsible spending, regardless of the exact amount. A well-structured allowance tied to chores can be an excellent way to teach this. Parents should tailor the amount to their child's situation and their family's financial situation as well.

Allowance and Earning Opportunities

A structured allowance can be a valuable tool for teaching financial responsibility to a 12-year-old. The amount should be appropriate for the child's age and responsibilities, and should be clearly defined and consistently provided.

This can be linked to chores, promoting a valuable work ethic and a connection between effort and reward. Earning additional money through small jobs or part-time employment (if permitted by law) can provide even more valuable life lessons.

This content may interest you! How to save money if you don't have a job?

How to save money if you don't have a job?It’s crucial for parents to establish clear expectations, monitoring the child's spending and assisting with saving habits.

- Consider linking allowance to completed chores; this teaches the value of work.

- Explore age-appropriate part-time jobs or freelance work to expand financial skills and independence.

- Regularly discuss finances with your child to provide guidance and feedback on spending decisions.

Savings Goals and Financial Literacy

It's important to guide the 12-year-old towards setting achievable saving goals. This could involve saving for a specific item, such as a video game or a new bike, or for a long-term goal, such as college.

By establishing savings goals, children learn the importance of delaying gratification and planning for future purchases. Financial literacy education is crucial; teaching them about budgeting, saving, and the difference between needs and wants will provide invaluable skills.

Consider opening a savings account to help them visualize their progress.

- Help your child set both short-term and long-term savings goals to teach delayed gratification.

- Introduce basic budgeting concepts, such as tracking income and expenses.

- Use age-appropriate resources and games to teach financial literacy and responsible money management.

Spending Habits and Responsible Consumption

A 12-year-old is at an age where peer pressure and marketing heavily influence spending habits. It's essential to engage in conversations about responsible spending, encouraging them to differentiate between needs and wants. Setting spending limits for certain categories, such as entertainment, can help them make informed decisions and avoid impulse purchases.

By involving them in planning purchases and understanding the value of money, they will begin to develop responsible spending patterns.

- Discuss the difference between needs and wants, helping them prioritize spending on essentials.

- Set spending limits for specific categories (e.g., entertainment, snacks) to encourage budgeting.

- Encourage saving for larger purchases rather than impulsive spending on smaller items.

What should I save up for as a 12 year old?

Saving for short-term goals allows you to experience the satisfaction of achieving something relatively quickly. This can help build good saving habits and teach you the value of delayed gratification.

It’s also a great way to learn about budgeting and planning your spending.

- A video game or a new game console: Many 12-year-olds have gaming as a major interest. Saving for a particular game or a console upgrade is a tangible and motivating goal.

- Tickets to a concert or movie: Seeing your favorite band or catching a new movie release can be an exciting experience. Saving up for these events teaches financial planning and the importance of budgeting for entertainment.

- A new bike or other sporting equipment: Investing in a new bike or sports equipment can encourage a healthy and active lifestyle. This shows that saving can lead to positive changes beyond immediate gratification.

Mid-Term Goals: Investments in Your Future

Mid-term goals focus on items or experiences that will benefit you over a longer period. These goals might involve a significant purchase or contribute to personal growth. Saving for these goals helps cultivate a sense of long-term planning and responsibility.

- A new phone or tech device: While it might seem like a luxury, a new phone or tech device could be essential for communication, schoolwork, or staying connected with friends. Saving for these helps you learn about responsible tech use and management.

- A class or workshop: Learning a new skill, whether it's coding, music, or art, can be invaluable. Saving for a class or workshop shows the value of investing in yourself and your future development.

- A contribution towards a future trip: Saving for a family vacation or a trip with friends teaches planning, budgeting and the importance of saving for larger expenditures. It also provides a powerful motivation to save consistently.

Long-Term Goals: Building a Strong Financial Foundation

Long-term savings build a strong financial base for the future. While it can be harder to visualize the payoff immediately, these habits are crucial for long-term financial security and responsible money management. Starting early provides a huge advantage.

- College or higher education fund: Even small amounts saved regularly contribute significantly over time to fund college tuition or other educational expenses. Starting early can significantly reduce the financial burden later.

- A savings account for emergencies: Building an emergency fund, even a small one, teaches the importance of financial security and preparedness for unexpected situations. This sets a strong foundation for responsible money handling.

- Investing in your own business: Although it may seem far off, some entrepreneurial 12-year-olds might be interested in saving for a future small business venture. This teaches valuable skills in business planning and financial management.

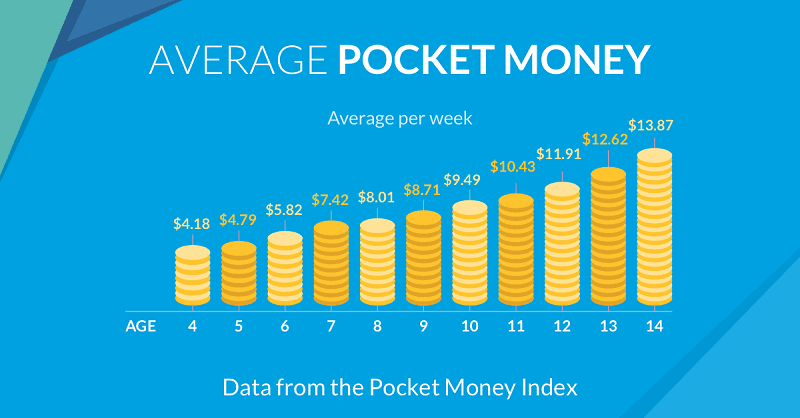

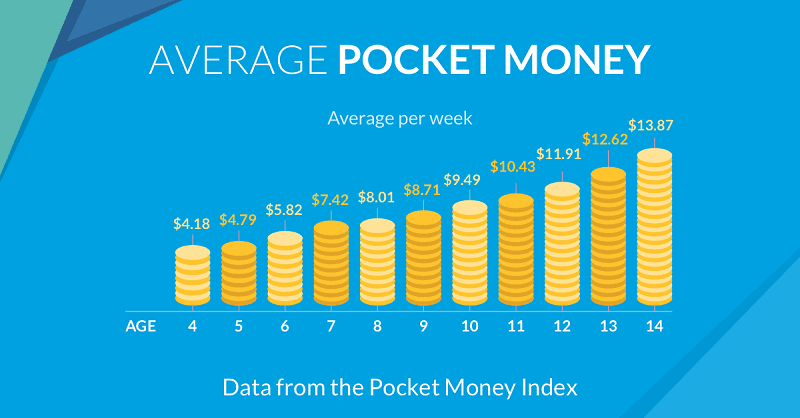

How much should a 12 year old get in pocket money?

What is the $27.40 rule?

What is the $27.40 rule?There's no single right answer to how much pocket money a 12-year-old should receive. The appropriate amount depends on several factors, including the child's responsibilities, the family's income, the cost of living in their area, and the child's spending habits.

Some families opt for a fixed weekly or monthly allowance, while others tie the amount to chores completed.

A reasonable approach is to consider what the child needs for small purchases like snacks, entertainment, or small personal items, and then set an allowance that covers these expenses without overly burdening the family budget.

It's also helpful to discuss the allowance with the child, explaining the reasoning behind the amount and encouraging them to manage their money wisely. Open communication and financial education are key to helping a 12-year-old learn about responsible spending and saving.

Factors Influencing Allowance Amounts

The amount of pocket money a 12-year-old receives should be tailored to their individual circumstances and family situation. Several key factors play a significant role in determining the appropriate amount.

- Family Income: Families with higher incomes may be able to afford a larger allowance, while those with lower incomes may need to provide a smaller amount. This ensures that the allowance is fair and doesn't create undue financial strain on the family.

- Local Cost of Living: The cost of everyday items, like snacks and entertainment, varies widely depending on location. A 12-year-old in a high-cost area might need a larger allowance to cover the same expenses as a child in a lower-cost area.

- Child's Responsibilities: If the 12-year-old takes on additional chores or responsibilities around the house, their allowance might be adjusted to reflect their contribution. This teaches valuable lessons about earning and responsibility.

Teaching Financial Responsibility Through Allowance

Providing a child with pocket money is a great opportunity to teach valuable lessons about money management and financial responsibility. A well-structured allowance program can help a child develop crucial life skills.

- Budgeting: An allowance allows a 12-year-old to practice creating and sticking to a budget. They can learn to prioritize spending and saving for larger purchases, fostering a sense of financial planning.

- Saving: Encouraging saving can be easily incorporated into an allowance system. Setting savings goals, whether for a new video game or a larger item, helps children learn patience and the value of delayed gratification.

- Spending Wisely: Through experience with their own money, a 12-year-old can learn to differentiate between needs and wants and make informed decisions about their spending. This is a crucial skill for adult life.

Alternative Approaches to Pocket Money

Beyond a fixed weekly or monthly allowance, families can explore other approaches that can be equally effective in teaching financial responsibility.

- Chore-Based System: Linking allowance to the completion of specific chores teaches a direct connection between work and earning. This method motivates the child to contribute to the household and understand the value of their labor.

- Project-Based Earnings: Offering payment for completing larger projects or tasks around the house allows for greater flexibility and the opportunity to earn a larger sum. This fosters a sense of accomplishment and the understanding of earning through more significant contributions.

- Combined Approaches: A flexible system that blends aspects of a fixed allowance with chore-based or project-based earnings can provide a balanced approach to managing money while learning responsibility.

What age should kids start saving money?

There's no single magic age at which children should begin saving money. The ideal starting point depends on a child's developmental stage and understanding of money. While very young children may not grasp the concept of long-term savings, introducing the idea early can lay a strong foundation for financial literacy.

Even preschoolers can begin to understand the basic principle of saving up for something they want, creating a tangible connection between effort and reward. As they grow older, the complexity of their savings goals and understanding of financial concepts can be increased, gradually building their financial skills and responsibility.

It's less about a specific age and more about tailoring the approach to their individual comprehension and maturity.

Introducing the Concept of Saving: Early Childhood (Ages 3-5)

At this age, the focus should be on building a foundational understanding of saving. Avoid complex financial terms; instead, use simple, relatable examples and visuals. The goal is to nurture a positive association with saving, not to instill strict financial discipline.

This content may interest you! How to save money if you are not working?

How to save money if you are not working?Learning through play is particularly effective. Using a piggy bank or visual aid helps children see their progress tangibly.

- Use a piggy bank or clear jar so they can visually track their savings.

- Connect saving to short-term goals like a small toy or a special treat.

- Make saving a fun, positive experience, not a chore.

Developing Saving Habits: Middle Childhood (Ages 6-12)

As children mature, they start understanding the concept of delayed gratification. This is the ideal time to introduce more sophisticated saving methods, such as opening a savings account. Involving them in the process of choosing a bank or managing their account fosters a sense of ownership and responsibility.

This age group also benefits from learning about different types of savings, such as a piggy bank for immediate goals and a savings account for long-term goals. Encourage them to set larger savings goals and discuss how saving can help them achieve their dreams, reinforcing the link between patience and accomplishment.

- Open a savings account in their name and involve them in the process.

- Introduce them to the idea of interest and how their savings grow over time.

- Help them set both short-term and long-term savings goals.

Building Financial Responsibility: Adolescence (Ages 13-18)

Teenagers are ready for more complex financial discussions. This is the perfect opportunity to discuss budgeting, earning money, investing, and the importance of managing debt. Encourage them to explore various ways to earn money, such as part-time jobs or online gigs.

Teaching them how to manage their earnings, distinguishing between needs and wants, and understanding the impact of spending and saving habits are crucial skills to develop at this stage. Start introducing more complex financial concepts like investing, budgeting, and managing credit cards responsibly.

- Discuss budgeting and the difference between needs and wants.

- Explore ways to earn money, such as part-time jobs or online opportunities.

- Introduce concepts like investing and responsible credit card usage (if applicable).

How much money should a 12-year-old save?

There's no magic number! It depends on their allowance, earnings from chores or jobs, and spending habits. A good starting point is to aim for saving at least 10-20% of their income. Encourage them to set realistic savings goals, perhaps for a specific item they want or a future experience.

Tracking their progress visually, like using a savings chart, can boost motivation. The key is to establish the habit of saving early and consistently.

What are some good ways for a 12-year-old to save money?

A savings account is ideal for larger goals, offering interest and security. A piggy bank or jar can work for smaller, immediate goals. Teaching them about budgeting helps them understand where their money goes.

Involving them in family financial discussions, age-appropriately, helps them grasp the value of saving. Consider a chore chart with payment linked to savings. Encouraging them to delay gratification for larger purchases teaches valuable patience and financial responsibility.

What if my 12-year-old doesn't want to save money?

Start by understanding their reluctance. Are they focused on immediate gratification? Explain the long-term benefits of saving – independence, future purchases, and financial security. Make saving fun by involving them in choosing their savings goals.

Consider a visual savings tracker, or reward system for consistent saving. Positive reinforcement and open communication are crucial. Connect saving to their interests; saving for a video game or concert can be highly motivating.

This content may interest you! What is the 30 day rule?

What is the 30 day rule?How can I help my 12-year-old learn about money management?

Lead by example, showcasing responsible financial habits. Involve them in age-appropriate family financial discussions, like grocery shopping and bill paying. Use board games or apps to simulate real-world financial situations.

Open a joint savings account to demonstrate responsible banking. Discuss different saving and spending options and let them make small financial decisions. Emphasize the importance of budgeting, saving, and responsible spending habits to build a strong financial foundation.

Leave a Reply