What age should I start budgeting?

Managing your finances effectively is a crucial life skill, but when is the right time to begin? The question of "What age should I start budgeting?" is a common one, and the answer isn't a single number. This article explores the benefits of budgeting at any age, from childhood allowances to managing adult income and expenses. We'll delve into age-appropriate budgeting strategies, addressing the unique financial challenges faced at different life stages. Learn how to cultivate good financial habits early and set yourself up for long-term financial success.

When Should You Start Budgeting?

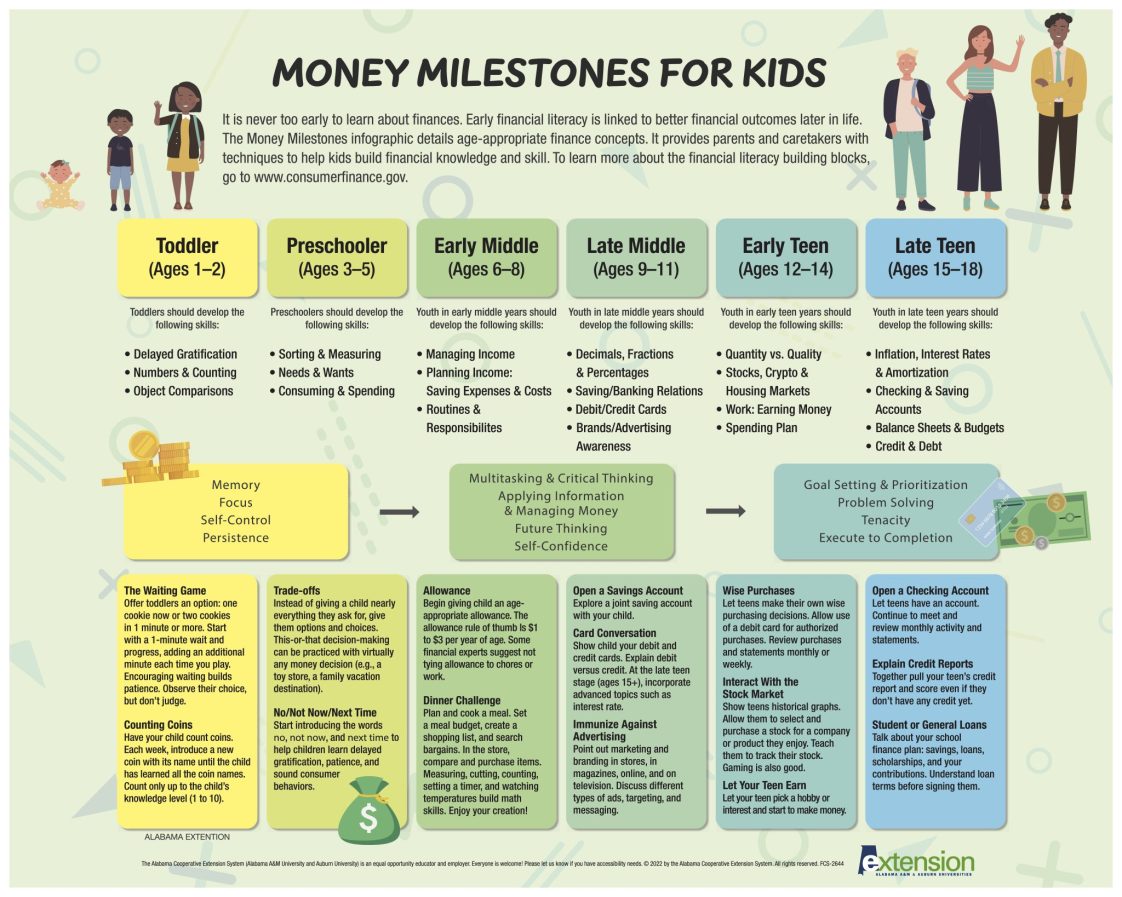

The ideal age to start budgeting is as early as possible. While many associate budgeting with adulthood and financial independence, the benefits of understanding and managing money begin long before then. The earlier you begin, the more time you have to develop good financial habits, build savings, and avoid accumulating debt. Even children can participate in simplified budgeting exercises, learning about needs versus wants and the importance of saving for specific goals (like a toy or a trip). For teenagers, budgeting can involve managing allowance, part-time job earnings, and understanding the costs of everyday expenses like entertainment and transportation. Ultimately, the sooner you start, the more prepared you’ll be for the financial complexities of adulthood.

Budgeting in Childhood (Ages 5-12): Building Foundational Understanding

For children aged 5-12, budgeting isn't about complex spreadsheets or bank accounts. Instead, it's about introducing basic financial concepts. Parents can use simple tools like piggy banks or jars labeled "saving," "spending," and "giving" to demonstrate the allocation of resources. Children can learn to track their allowance or gifts, choosing how to divide their money between saving for a desired item, spending on small treats, and donating to a cause. This early introduction fosters awareness of money's value and establishes the groundwork for responsible financial behavior in the future. It teaches the vital difference between wants and needs, a crucial element in effective budgeting regardless of age.

Budgeting in Adolescence (Ages 13-18): Managing Earned Income and Expenses

Teenagers often have access to some form of income, whether it’s an allowance, part-time job earnings, or gifts. This presents a perfect opportunity to introduce more formal budgeting techniques. This could involve using a simple budgeting app, a spreadsheet, or even a notebook to track income and expenses. Learning to manage their money responsibly, paying for things like entertainment, school supplies, or even contributing to larger purchases, provides valuable experience. This age group should also begin to understand the implications of debt, such as the interest charged on credit cards or loans, and the importance of avoiding it. Understanding the impact of saving for future goals like college or a car also becomes increasingly important.

This content may interest you! How to save money if you don't have a job?

How to save money if you don't have a job?Young adults leaving home face a whole new set of financial responsibilities. This is when a comprehensive budget becomes essential for managing rent, utilities, groceries, transportation, and loan repayments. This stage requires a more sophisticated approach to budgeting, potentially involving the use of budgeting software or apps. Understanding credit scores and their impact on future borrowing becomes crucial. The focus shifts from simple saving to long-term financial planning, including saving for retirement and investing. The ability to create and maintain a realistic budget is crucial for building financial stability and avoiding unnecessary debt in this critical phase of life.

| Age Group | Budgeting Focus | Key Skills |

|---|---|---|

| Childhood (5-12) | Basic financial concepts, needs vs. wants | Saving, spending, giving |

| Adolescence (13-18) | Managing earned income and expenses, understanding debt | Tracking income & expenses, saving for goals |

| Young Adulthood (18+) | Comprehensive budgeting, long-term financial planning | Credit management, investing, retirement planning |

What age should I start giving pocket money?

There's no single right answer to the question of when to start giving children pocket money. The ideal age depends on several factors, including the child's maturity level, understanding of money, and the family's financial situation. Some parents begin as early as age five or six, while others wait until the child is in their tweens or even teens. A good rule of thumb is to start when your child demonstrates an understanding of basic financial concepts like saving and spending. Consider if they can understand the value of money and make responsible choices about how to use it. Before starting, it's crucial to have a conversation about the purpose of pocket money and how it should be used responsibly.

Factors to Consider When Determining the Right Age

Several crucial factors should influence your decision. It's not simply about reaching a specific age; it's about your child's readiness. Observe their behaviour and assess their grasp of financial concepts. Starting too early may lead to irresponsible spending, while starting too late might hinder the development of essential financial literacy skills. Open communication and clear expectations are vital throughout the process.

This content may interest you! What is the $27.40 rule?

What is the $27.40 rule?- Child's Maturity Level: Is your child able to understand the concept of earning and spending money? Can they make responsible choices about how to use their money? A child who demonstrates maturity and responsibility may be ready for pocket money earlier than a less mature child.

- Understanding of Money: Does your child understand the value of money? Do they know the difference between needs and wants? If they don't understand the value of money, giving them pocket money may not be beneficial. You may need to teach them about saving, budgeting and the value of a dollar before giving them an allowance.

- Family Financial Situation: Your family's financial situation should also influence your decision. If money is tight, it may be difficult to provide pocket money to your children. However, even small amounts can teach valuable lessons about financial management.

Connecting Pocket Money to Chores and Responsibilities

Linking pocket money to chores or responsibilities can be a highly effective way to teach children about the value of work and earning money. This approach helps them understand that money is earned through effort and responsibility. It's important to establish clear expectations and agreements about the chores or responsibilities involved, ensuring fairness and transparency. This also teaches them valuable life skills that will benefit them in adulthood. It’s advisable to adjust the amount based on their age and the complexity of the chores.

- Age-Appropriate Chores: Assign chores that are age-appropriate and gradually increase the difficulty and responsibility as your child grows older. Younger children can handle simple tasks, while older children can take on more complex responsibilities.

- Clear Expectations: Establish clear expectations about the chores that need to be done, how often they need to be completed, and the consequences of not completing them. This promotes responsibility and accountability.

- Fair Compensation: Provide fair compensation for the chores completed. The amount of pocket money should reflect the time, effort, and responsibility required for each chore.

Teaching Financial Literacy Through Pocket Money

Pocket money provides a fantastic opportunity to teach children essential financial literacy skills. This is a practical and engaging way to impart valuable knowledge that will serve them well throughout their lives. It allows you to guide them through making sound financial decisions, while also understanding consequences of poor choices. This valuable experience will benefit them in managing their finances responsibly in adulthood.

- Saving and Budgeting: Encourage children to save a portion of their pocket money. Help them create a simple budget to track their spending and savings. This teaches them to prioritize and manage their resources effectively.

- Delayed Gratification: Teach your children the value of delayed gratification. Encourage them to save up for larger purchases instead of immediately spending their money on smaller items. This strengthens their self-control and financial discipline.

- Spending Wisely: Guide your children to make responsible spending decisions. Encourage them to think about whether they really need something before purchasing it. This fosters critical thinking and helps them avoid impulsive buying.

At what age should you start thinking about money?

Developing Good Money Habits Early On

While there's no magic age, incorporating basic financial concepts early in a child's life is crucial. Even preschoolers can begin to understand the difference between wants and needs through simple games and activities. As they get older, introducing age-appropriate concepts like saving, spending, and sharing becomes progressively more important. Starting young helps build a strong financial foundation, fostering positive attitudes towards money management and responsible decision-making in the future.

This content may interest you! How to save money if you are not working?

How to save money if you are not working?- Use age-appropriate tools: Piggy banks for younger children, simple savings accounts for older kids.

- Involve them in everyday financial discussions: Explain the need for budgeting, saving for purchases, etc.

- Use real-life examples: Show them how saving contributes to achieving goals, like buying a toy or taking a trip.

The Importance of Financial Literacy in Adolescence

The teenage years are a critical period for developing financial literacy. This is when young people start making more independent financial decisions, such as earning part-time income, making purchases, and potentially managing their own bank accounts. Understanding concepts like budgeting, saving for college or other goals, and avoiding debt becomes increasingly vital. This age group should be learning about different financial products, like debit cards, credit cards (with responsible use emphasized), and savings accounts, along with the implications of good and bad credit.

- Teach about budgeting and tracking expenses: Encourage the use of budgeting apps or spreadsheets.

- Discuss responsible credit card use: Explain interest rates, debt accumulation, and the importance of paying bills on time.

- Explore different saving and investment options: Introduce the concept of investing for long-term goals like retirement.

Entering adulthood brings a whole new set of financial responsibilities. This is when individuals often need to make significant decisions about things like renting or buying a home, managing student loans, investing for retirement, planning for a family, and insuring their possessions and health. A firm grasp of budgeting, saving, investing, and debt management is essential for long-term financial stability and well-being. Seeking professional advice when necessary (financial advisors, accountants) can help navigate the complex financial landscape of adulthood.

- Create a detailed budget: Account for all income and expenses, aiming for a surplus each month.

- Develop a savings and investment plan: Consider various options based on risk tolerance and financial goals.

- Seek professional guidance: Consult with a financial advisor to create a personalized financial plan.

Should a 12 year old save money?

Should a 12 Year Old Save Money?

This content may interest you! What is the 30 day rule?

What is the 30 day rule?Yes, a 12-year-old should absolutely start saving money. Learning about saving and managing finances at a young age is invaluable. It teaches crucial life skills that will benefit them throughout their lives. While the amounts may seem small initially, the habit itself is the most important takeaway. The earlier they develop a savings habit, the more likely they are to continue responsible financial practices into adulthood. Saving provides a sense of accomplishment and control, fostering independence and self-reliance. It also opens doors to future opportunities, from purchasing desired items to contributing towards larger goals like college education or a down payment on a car.

Teaching Financial Responsibility

Saving money at 12 is a fantastic opportunity to teach valuable financial responsibility. It's more than just putting money aside; it's about understanding the value of money, delayed gratification, and planning for the future. Involving them in the process, such as setting savings goals and tracking progress, makes it an educational and engaging experience. This early exposure helps them develop a strong foundation for making sound financial decisions as they grow older. It also instills a sense of responsibility and accountability, crucial skills that extend far beyond managing finances.

- Set achievable goals: Start with small, attainable goals, like saving for a new video game or a specific item they want.

- Use visual aids: A piggy bank, savings jar, or a simple chart to track progress can make saving more engaging and tangible.

- Discuss budgeting: Explain basic budgeting concepts – income (allowance, gifts, earnings from chores), expenses, and savings.

Building a Foundation for Future Goals

Saving at 12 years old is not just about immediate gratification; it lays a strong foundation for achieving larger, long-term goals. By establishing a savings habit early, a 12-year-old can start saving for significant future expenses such as college tuition, a car, or a down payment on a home. Even small, consistent savings add up over time, thanks to the power of compounding interest. Early saving also allows them to explore different investment options as they get older, and makes them better equipped to manage their finances in the future.

- Explore different savings accounts: Research options like savings accounts, money market accounts, or even age-appropriate investment accounts.

- Discuss long-term goals: Talk about potential future expenses and how saving can help them achieve those goals, making abstract concepts concrete.

- Encourage responsible spending: Teach them the difference between needs and wants, and how to prioritize saving over impulsive spending.

Developing Positive Financial Habits

One of the most significant benefits of saving money at age 12 is the development of positive financial habits. These habits will serve them well throughout their adult lives, fostering a sense of financial security and reducing the risk of debt. By learning to save and manage money responsibly from a young age, they'll be less prone to overspending, impulsive purchases, and financial stress. This early education equips them with the tools to navigate financial challenges and make informed decisions about their financial future.

This content may interest you! How can I save money if I have debt?

How can I save money if I have debt?- Set a regular savings schedule: Encourage consistent savings, perhaps a portion of their allowance or earnings from chores each week or month.

- Avoid debt: Emphasize the importance of avoiding debt and the long-term consequences of borrowing money.

- Teach delayed gratification: Help them understand the value of waiting for something they want rather than immediately buying it.

What is the 50 30 20 budget rule for kids?

50/30/20 Budget Rule for Kids

What is the 50/30/20 budget rule for kids?

The 50/30/20 budget rule is a simple budgeting method that can be adapted for kids to help them learn about managing money. It divides their income (allowance, gifts, earnings from chores etc.) into three categories: needs, wants, and savings. While adults typically use this rule for their after-tax income, for children it's applied to their total disposable income. The percentages represent the proportion of their money allocated to each category. 50% goes towards needs, 30% towards wants, and 20% towards savings. This simple framework provides a practical way to introduce financial literacy concepts to children in an age-appropriate manner.

Needs: 50% of income

This category covers essential expenses that are necessary for a child's well-being. It’s crucial to teach them the difference between needs and wants early on. This category helps them understand responsible spending and prioritizing necessities.

This content may interest you! At what age should parents stop giving money?

At what age should parents stop giving money?- School supplies (pens, pencils, notebooks)

- Clothing (replacements, not trendy extras)

- Personal care items (toothbrush, toothpaste)

- Transportation costs (if applicable, bus fare or gas money for a bike)

- Necessary medical expenses (if any)

Wants: 30% of income

This portion of the budget is for things kids desire but don’t necessarily need. This section is vital for teaching delayed gratification and making choices within a budget. Parents can help guide their children to make smart choices about their wants.

- Toys and games

- Snacks and treats

- Entertainment (movies, books, etc.)

- Small items they wish to purchase

- Activities with friends

Savings: 20% of income

This is arguably the most important aspect of the budget for kids, as it instills good saving habits from a young age. This teaches them the value of saving for future goals, no matter how small. It's essential to help them set realistic savings goals and track their progress.

- Short-term savings goals (a specific toy, a trip to the zoo)

- Long-term savings goals (a bicycle, a video game system)

- Educational savings (college fund)

- Emergency fund (for unexpected expenses)

- Charitable donations (to teach giving back to the community)

Is it too early to start budgeting as a teenager?

Absolutely not! Starting a budget in your teens provides invaluable life skills. You'll learn to manage your allowance, part-time job earnings, or even money from gifts. This early exposure teaches responsible spending habits, saving strategies, and the importance of financial planning. It's far better to develop these skills early and avoid accumulating debt or struggling with finances later in life. Think of it as an investment in your future financial well-being.

When is the ideal age to begin teaching children about budgeting?

The ideal time is as soon as children understand the concept of money. Even preschoolers can learn about saving for small goals like a toy. As they grow, introduce more complex concepts like needs versus wants, and the value of saving for larger purchases. Age-appropriate allowances and chores tied to earning money can make budgeting practical. The key is to start early and gradually increase the complexity of financial lessons as they mature.

This content may interest you! How to wish on first salary?

How to wish on first salary?Should I wait until I have a steady income to start budgeting?

No, waiting for a steady income is a common mistake. Budgeting isn't just about managing income; it's about managing expenses and setting financial goals. Even with limited funds, creating a budget helps you track spending, identify areas to cut back, and prioritize needs over wants. It teaches discipline and prepares you for future financial responsibilities. Start budgeting now, regardless of your income level, to develop good habits that will benefit you later.

Is there a specific age where budgeting becomes mandatory?

There's no legally mandated age to start budgeting. However, the earlier you start, the better prepared you'll be for financial independence. Budgeting isn't just about avoiding debt; it's about achieving financial goals, whether it's saving for a car, college, or a down payment on a house. The sooner you understand and implement budgeting principles, the more control you’ll have over your financial future. It’s a life skill that benefits everyone, regardless of age.

Leave a Reply