What are 7 sources of income?

In today's economic climate, diversifying income streams is crucial for financial security. This article explores seven diverse sources of income beyond a traditional 9-to-5 job. We'll delve into options ranging from passive income generators like real estate and dividend stocks to more active pursuits such as freelancing and entrepreneurship. Whether you're aiming for financial independence or simply seeking extra cash flow, understanding these avenues can empower you to build a more resilient financial future. Let's uncover these seven powerful income streams and their potential.

7 Diverse Streams of Income: Expanding Your Financial Horizons

Salaries and Wages

A salary is a fixed regular payment, typically paid monthly, made by an employer to an employee, while wages are typically paid on an hourly, daily, or piece-rate basis. Both are common sources of income for most people, providing a predictable and reliable flow of funds. The amount received depends on factors like job title, experience, skills, and location. Many people rely heavily on salaries and wages as their primary income source, and supplemental income often is necessary to meet financial goals.

Investing and Passive Income

Investing encompasses a wide range of activities, from buying stocks and bonds to real estate or peer-to-peer lending. Passive income stems from assets you own that generate returns with minimal ongoing effort. Examples include rental income from properties, dividends from stocks, or royalties from creative works. While setting up these income streams might require initial investment and work, the subsequent income generated requires relatively little ongoing management, creating financial freedom and security. The potential for return varies depending on the investment strategy and market conditions.

Self-Employment and Entrepreneurship

Self-employment and entrepreneurship offer significant income potential but also considerable risk. This encompasses a wide array of activities, including running your own business, freelancing, consulting, or offering services independently. Income is directly tied to your efforts and success, meaning it can be highly variable. While potentially very lucrative, it demands dedication, hard work, and the willingness to assume responsibility for all aspects of your work and business operations. Building a successful self-employed career requires strategic planning, strong business acumen, and consistent effort.

| Source of Income | Description | Pros | Cons |

|---|---|---|---|

| Salaries/Wages | Fixed regular payment from an employer. | Predictable income, benefits | Limited earning potential, dependence on employer |

| Investing/Passive Income | Income generated from assets. | Long-term growth potential, passive income streams. | Risk of loss, requires initial investment. |

| Self-employment/Entrepreneurship | Income from independent work or business. | High earning potential, autonomy. | Unpredictable income, high risk, demanding workload. |

| Rental Income | Income from renting out property. | Passive income, potential for appreciation. | Property management responsibilities, vacancy risk. |

| Freelancing/Gig Work | Income from short-term projects or gigs. | Flexibility, variety of work. | Income inconsistency, lack of benefits. |

| Government Benefits | Social security, unemployment, disability. | Financial support during challenging times. | Eligibility requirements, limited amounts. |

| Business Profits | Net income after all business expenses are deducted. | Unlimited Earning Potential, ownership and control | High risk, time consuming, lots of responsibility |

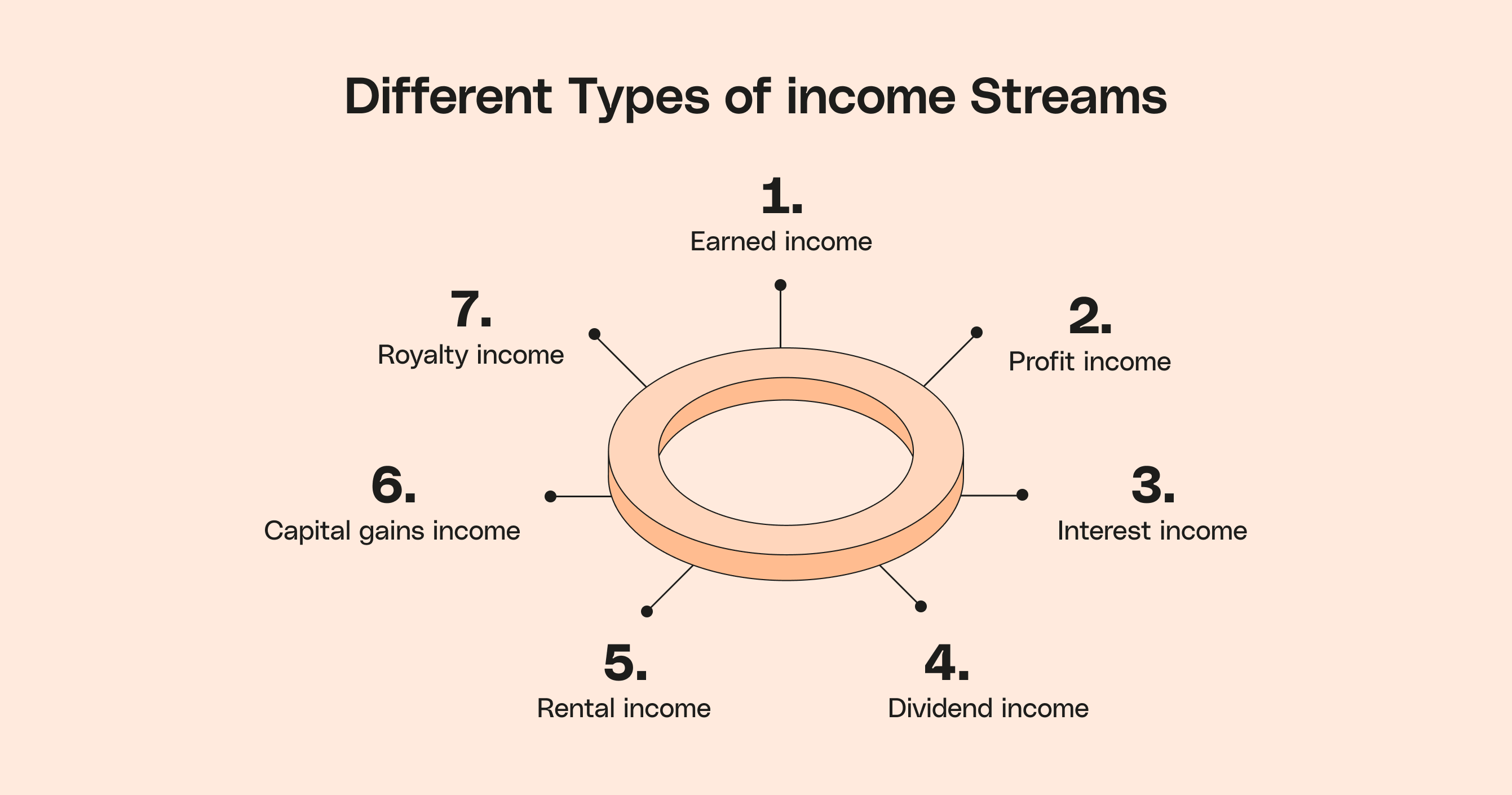

What are the 7 ways of income?

How can I make an extra $1000 a month from home?

How can I make an extra $1000 a month from home?7 Ways of Income

Earned Income

Earned income is the most common type of income. It refers to money received in exchange for work performed. This is typically a wage or salary, but it can also encompass other forms of compensation for services rendered. The amount earned often depends on factors like the number of hours worked, skill level, and position held. It's taxed and reported to the government.

- Wages: Payment for hourly work.

- Salaries: Fixed annual payment for a job.

- Bonuses: Additional payments based on performance.

- Commissions: Payment based on sales or performance metrics.

- Tips/Gratuities: Voluntary payments for services.

Investment Income

Investment income is generated from assets invested with the expectation of generating returns. This type of income can be relatively passive, requiring less direct effort than earned income, though it often requires upfront capital investment and research. The level of return varies depending on market conditions and the type of investment.

- Dividends: Payments from companies to shareholders.

- Interest: Earnings from savings accounts, bonds, or loans.

- Capital Gains: Profits from selling assets like stocks or real estate at a higher price than the purchase price.

- Rental Income: Money received from renting out property.

Passive Income

Passive income is generated from assets or systems that require minimal ongoing effort to maintain. While initial effort is often required to set up these systems, they ideally produce income with little to no daily management. Examples can range from creating and selling digital products to owning rental properties.

- Royalties: Payments for the use of intellectual property (e.g., books, music, software).

- Affiliate marketing: Earning commissions by promoting other companies' products or services.

- Rental income (as mentioned above): Renting out assets like real estate or equipment.

How can I make $1000 a month in passive income?

What is the best online job to earn money?

What is the best online job to earn money?Making $1000 a Month in Passive Income

Generating $1000 a month in passive income requires dedication, strategy, and often, a significant upfront investment of time and/or money. It's rarely something that happens overnight. There's no single "magic bullet," but rather a combination of approaches that often work best. The key is to build assets that generate income without requiring your constant active participation. This could involve creating and selling digital products, building an online course, investing in income-generating assets, or creating a successful affiliate marketing program. The level of effort required to reach $1000/month varies significantly depending on the chosen method. Some strategies may require substantial initial investment and expertise, while others might involve a longer time frame to build momentum and scale.

Creating and Selling Digital Products

Digital products offer a scalable and relatively low-cost entry point into passive income. Once created, they can be sold repeatedly without requiring further production. However, success hinges on market research, crafting high-quality products, and effective marketing. This requires initial investment in creation, design and marketing, but the potential for consistent income is high.

- Identify a niche with high demand and low competition. Research keywords and analyze competitor offerings.

- Create a high-quality digital product (e.g., eBook, online course, templates, stock photos). Prioritize excellent content and presentation.

- Market your product effectively using platforms like Etsy, Gumroad, or your own website. Utilize SEO and social media marketing strategies.

Investing in Income-Generating Assets

Investing in assets that generate passive income, such as real estate, dividend-paying stocks, or peer-to-peer lending, can provide a consistent stream of revenue. However, it typically requires a significant upfront capital investment and carries inherent risks. Careful research, diversification, and a long-term perspective are crucial for success.

- Research different investment options and assess their risk tolerance and potential returns. Consider real estate investment trusts (REITs), index funds, or individual stocks.

- Diversify your investment portfolio to mitigate risk. Don't put all your eggs in one basket.

- Continuously monitor your investments and adjust your strategy as needed. Stay informed about market trends and economic conditions.

Building an Affiliate Marketing Program

Affiliate marketing involves promoting other companies' products or services and earning a commission on each sale made through your unique referral link. Building a successful affiliate marketing program requires a strong online presence, engaging content, and a targeted audience. It takes time to build trust and attract an audience large enough to generate substantial income.

This content may interest you! How can you increase your income effectively?

How can you increase your income effectively?- Choose a niche and find affiliate programs that align with your audience's interests and your expertise.

- Build a website or social media presence with high-quality content that attracts your target audience. Focus on providing value and building trust.

- Promote affiliate products through blog posts, social media, email marketing, and other channels. Track your results and optimize your strategy over time.

What are the main sources of income?

Main Sources of Income

Main sources of income vary significantly depending on individual circumstances, such as age, employment status, and investment strategies. However, some common sources consistently represent a substantial portion of global income generation. These include wages and salaries from employment, business profits, investments, rental income, and government transfers. The relative importance of each source fluctuates based on economic conditions and individual choices. For example, in periods of economic growth, income from employment and business profits might dominate, while during recessions, government transfers and investment income may become relatively more significant. Understanding these sources is crucial for individuals in personal financial planning and for governments in formulating economic policies.

Wages and Salaries

Wages and salaries represent compensation received for work performed. This is often the primary source of income for a significant portion of the global population. The amount earned depends on factors like education level, job skills, experience, and location. In many developed economies, a significant portion of household income originates from salaries earned in various sectors, from manufacturing and technology to healthcare and finance. The nature of this income can be regular and predictable, or it might fluctuate depending on the employment type (e.g., hourly wages vs. annual salary).

- Employment in various sectors (e.g., manufacturing, services, technology).

- Negotiated salaries or hourly wages.

- Potential for bonuses, commissions, and other benefits.

Investment Income

Investment income encompasses returns earned from capital invested in various assets. This could involve dividends from stocks, interest from bonds, capital gains from selling appreciated assets, or rental income from properties. The level of risk and potential return varies depending on the type of investment. Stocks generally offer higher potential returns but come with higher risk, while bonds are considered less risky but typically offer lower returns. Real estate investment offers the possibility of rental income alongside potential appreciation in property value. This source of income often plays a more significant role for individuals with accumulated savings or wealth.

This content may interest you! How can I make $1000 a month in passive income?

How can I make $1000 a month in passive income?- Dividends from stocks.

- Interest from bonds and savings accounts.

- Capital gains from the sale of assets (stocks, bonds, real estate).

- Rental income from properties.

Business Profits

Business profits represent the income earned after deducting all expenses from the revenue generated by a business. This can range from small entrepreneurial ventures to large corporations. Profits are highly variable, depending on factors such as market demand, competition, management efficiency, and overall economic conditions. Sole proprietorships, partnerships, and limited liability companies (LLCs) all generate profits as a primary source of income for their owners. The potential for high earnings is often accompanied by significant risk and responsibility.

- Revenue generated from sales of goods or services.

- Expenses deducted to arrive at net profit.

- Variable profits depending on market conditions and business performance.

How to create seven streams of income?

Seven Streams of Income

How to Create Seven Streams of Income

Identifying Your Skills and Passions

Before diving into specific income streams, it's crucial to identify your skills and passions. What are you naturally good at? What do you enjoy doing? Matching your income streams with your strengths and interests will significantly increase your chances of success and sustained motivation. Consider taking personality tests or reflecting on past projects and activities that brought you fulfillment. This self-assessment is the foundation for building a diverse and sustainable income portfolio.

- Analyze your existing skills: List your hard skills (e.g., coding, writing, marketing) and soft skills (e.g., communication, teamwork, problem-solving).

- Identify your passions: What activities genuinely excite you? What problems do you want to solve?

- Match skills and passions: Find overlaps between your skills and passions. This is where you'll find the most fulfilling and potentially lucrative income streams.

Diversifying Your Income Streams

The key to creating multiple income streams is diversification. Don't put all your eggs in one basket. Explore a variety of income models, balancing active income (requiring ongoing effort) and passive income (requiring less ongoing effort). Consider a mix of online and offline opportunities. This resilience against economic fluctuations and market changes is essential for long-term financial security.

This content may interest you! How to come up with monthly income?

How to come up with monthly income?- Active Income: Examples include freelancing, consulting, part-time jobs, and selling services.

- Passive Income: Examples include rental income, investments, affiliate marketing, and creating and selling digital products.

- Balanced Approach: Aim for a mix of active and passive income streams to create a more stable and sustainable financial situation.

Scaling Your Income Streams

Once you've established a few income streams, focus on scaling them up. This could involve automating processes, hiring help, or leveraging technology to increase efficiency and reach a wider audience. Scaling allows you to generate more income with less time investment. Consider reinvesting profits to further grow your income streams. Continuously analyze your performance and adapt your strategies based on data and market trends.

- Automation: Use tools and software to automate repetitive tasks, freeing up time for higher-value activities.

- Delegation: Hire freelancers or virtual assistants to handle tasks you can outsource.

- Expansion: Explore new markets or expand your product/service offerings to reach a wider audience.

What are some examples of traditional sources of income?

Traditional income sources often involve exchanging your time or skills for money. A common example is a salary from employment, where you receive regular payments for your work. Self-employment, such as freelancing or running your own business, also falls into this category, allowing you more control over your earnings but requiring more self-management. Investments, like dividends from stocks or interest from bonds, represent another type, providing passive income generated from your capital. Rental income from properties you own is another established source. Finally, pensions and social security benefits provide regular income during retirement, supplementing other sources. These methods are relatively well-established and provide a stable foundation for financial security.

What are some less conventional sources of income?

Beyond traditional jobs and investments, many less conventional options exist. Creating and selling digital products, such as e-books, online courses, or stock photos, offers a scalable income stream. Affiliate marketing, where you earn commissions by promoting others' products, is another popular choice, requiring marketing skills and audience building. Renting out assets like your car or spare room through platforms provides extra income with minimal effort. Participating in the gig economy, taking on short-term tasks or projects, offers flexibility. Finally, monetizing a hobby, by selling crafts or offering services related to it, can turn passion into profit. These options provide flexibility and potential for growth but usually require more effort to establish.

How can I diversify my income streams?

Diversifying your income sources significantly reduces financial risk. Instead of relying on a single job or investment, spreading your income across several streams cushions against unexpected setbacks in any one area. For example, having a steady job alongside a side hustle provides a safety net if one income source falters. Combining different income types, such as salary, rental income, and investment returns, creates a balanced financial portfolio. This approach enhances financial stability and allows for greater financial freedom. Furthermore, exploring diverse income streams can open up new opportunities for personal and professional growth. A strategic approach to diversification ensures resilience in the face of economic fluctuations.

What factors should I consider when choosing income sources?

Selecting suitable income streams depends on various factors. Assess your skills and interests to identify opportunities aligning with your strengths. Consider the time commitment required; some options demand significant effort, while others offer more passive income. Evaluate the potential for growth and scalability: can your income source expand as your needs evolve? Risk tolerance plays a crucial role, as some methods are riskier than others. Finally, consider the tax implications of each source, ensuring compliance with relevant regulations. Careful consideration of these factors allows you to choose income sources that best align with your personal circumstances, goals, and risk profile.

This content may interest you! What 7 streams of income do millionaires have?

What 7 streams of income do millionaires have?https://youtube.com/watch?v=jRjVW16ZS3Y

Leave a Reply