What are taxes and how do they work?

Taxes are compulsory financial charges or contributions levied on individuals or corporations by a government entity. This seemingly simple concept underpins the functioning of modern states, funding essential public services like infrastructure, healthcare, and education. This article will explore the various types of taxes, examining their mechanisms, how they are collected, and their overall impact on individuals and the economy. We’ll delve into income tax, sales tax, property tax, and more, providing a clear understanding of this fundamental aspect of societal governance.

What are Taxes and How Do They Work?

What are Taxes?

Taxes are mandatory payments made by individuals and businesses to the government. These payments fund public services such as infrastructure (roads, bridges, schools), healthcare, national defense, and social welfare programs. The amount of tax owed depends on various factors, including income, type of income, and applicable tax laws. Different jurisdictions (national, state, local) levy different taxes, and tax systems vary considerably around the world, ranging from progressive systems (higher earners pay a larger percentage) to regressive systems (lower earners pay a larger percentage). Understanding the tax system in your jurisdiction is crucial for responsible financial planning and compliance with the law.

How Taxes Work: The Tax System

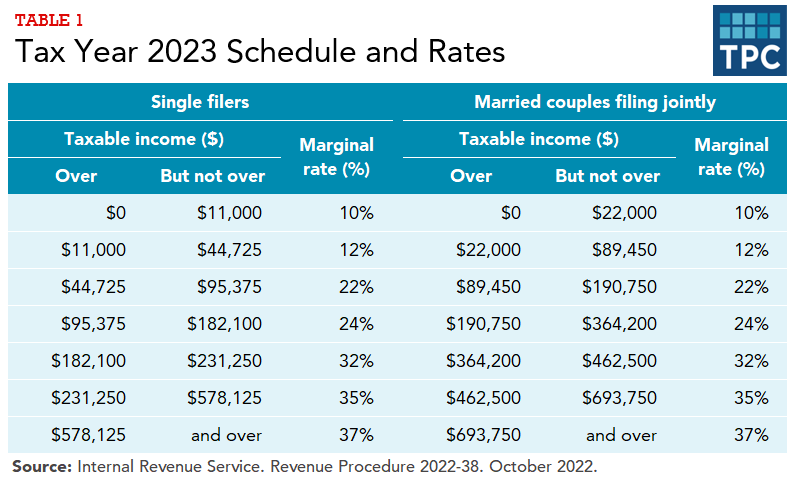

A tax system generally involves several key components. First, there's the tax base, which is the item or activity being taxed (e.g., income, property, sales). Then comes the tax rate, which determines the percentage or fixed amount to be paid. The tax rates can be progressive (increasing with income), regressive (decreasing with income), or proportional (flat rate). Taxes are usually collected by the government through various methods, such as withholding (deductions from paychecks), estimated taxes (quarterly payments), and annual tax filings. These filings require individuals and businesses to report their income and expenses and calculate their tax liability, often with the help of tax professionals or software.

Types of Taxes

Numerous types of taxes exist, each with its own characteristics and purpose. Income tax is levied on earnings from various sources like employment, investments, and business profits. Sales tax is a tax on goods and services purchased by consumers. Property tax is based on the value of real estate owned. Payroll tax funds social security and Medicare programs in many countries. Corporate income tax applies to the profits of businesses. Excise taxes target specific goods or services (e.g., gasoline, alcohol, tobacco), often to discourage consumption or generate revenue. The specific mix of taxes a country employs reflects its economic priorities and social policies.

| Tax Type | Description | Example |

|---|---|---|

| Income Tax | Tax on earnings | Federal and state income taxes in the US |

| Sales Tax | Tax on goods and services | State and local sales taxes in the US |

| Property Tax | Tax on real estate | Local property taxes |

| Payroll Tax | Tax on wages and salaries | Social Security and Medicare taxes |

| Corporate Income Tax | Tax on business profits | Federal corporate income tax |

| Excise Tax | Tax on specific goods or services | Taxes on gasoline and cigarettes |

How do the taxes work?

What are the different types of taxes?

What are the different types of taxes?How Do Taxes Work?

How Do Taxes Work?

Taxes are compulsory financial charges or contributions levied on individuals or corporations by a government entity—whether local, regional, or national—to fund various public expenditures. The process involves several key steps. First, the government defines tax laws specifying what is taxable (income, property, sales, etc.), the tax rates (percentage or fixed amount), and any deductions or exemptions. Taxpayers then calculate their tax liability based on these laws and their individual circumstances. This usually involves filing a tax return, a document detailing income, deductions, and credits. The tax authority then assesses the return, verifying the information provided and calculating the final tax owed or the amount of a refund. Finally, taxpayers remit the tax owed according to the established payment schedule, often through electronic transfers, checks, or other designated methods. Failure to comply with tax laws can result in penalties and legal repercussions. The complexity of tax systems varies widely between countries, encompassing direct and indirect taxes, progressive and regressive tax structures, and numerous specific regulations.

Types of Taxes

Various taxes exist, each targeting a different source of income or activity. These taxes fund different government functions, from infrastructure development to social welfare programs. The specific types of taxes a country employs depend heavily on its economic structure and government policies. Understanding the distinction between different tax types is crucial for accurate tax calculations and responsible financial management.

- Income tax: This is a direct tax levied on earned income (salaries, wages, business profits) and unearned income (dividends, interest). The tax rate often varies based on income levels, reflecting a progressive tax structure where higher earners pay a larger percentage. Many countries have complex income tax codes with numerous deductions and credits to consider.

- Sales tax: An indirect tax added to the price of goods and services at the point of sale. This is a consumption tax, meaning it is paid by consumers. The tax rate is typically a percentage of the sale price and varies among jurisdictions. Exemptions might be available for certain necessities or non-profit organizations.

- Property tax: A tax assessed on the value of real estate (land and buildings). This is a significant source of revenue for local governments and is often used to fund public services such as schools and infrastructure. Property tax rates depend on factors like the assessed value of the property, local tax rates, and potential exemptions.

Tax Deductions and Credits

Tax deductions and credits can significantly reduce a taxpayer’s tax liability, offering valuable financial relief. While both lower the overall tax owed, they function differently. Understanding these distinctions is important for maximizing tax savings and meeting legal obligations. Careful planning and record-keeping are necessary to effectively utilize deductions and credits.

- Deductions: These reduce the amount of income subject to tax. They are subtracted from your gross income, thus lowering your taxable income. Examples include deductions for charitable contributions or mortgage interest.

- Credits: These directly reduce the amount of tax owed. Unlike deductions, they are subtracted directly from your tax liability. Examples include child tax credits or earned income tax credits, offering more significant tax relief than comparable deductions.

- Tax forms and filing: Taxpayers are required to complete and file relevant tax forms, which vary by country and tax jurisdiction. Accurate and timely completion is essential to avoid penalties and ensure correct tax assessment. Assistance is often available from tax professionals or government resources.

Tax Compliance and Enforcement

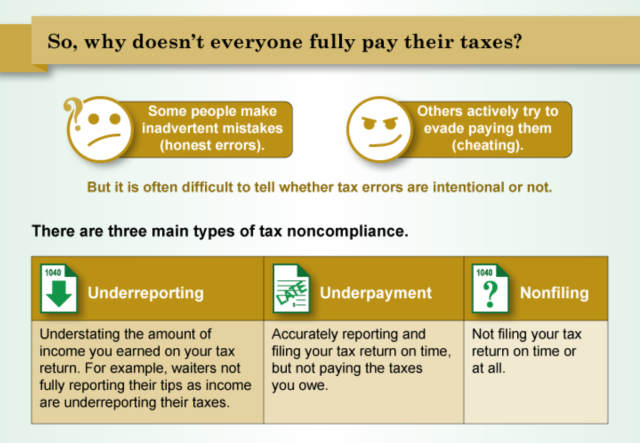

Tax compliance is essential for maintaining a functioning government and providing public services. Governments employ various mechanisms to ensure compliance, including audits, penalties for non-compliance, and assistance programs for taxpayers. Understanding these mechanisms and adhering to the tax laws is crucial for responsible citizenship.

This content may interest you! How does income tax work?

How does income tax work?- Audits: Tax authorities may select tax returns for audit to verify the accuracy of the information reported. These audits can involve extensive examination of records and potentially result in adjustments to the tax liability.

- Penalties: Non-compliance with tax laws can result in penalties, including interest charges on unpaid taxes, fines, and in severe cases, criminal prosecution.

- Tax assistance: Many governments provide assistance to taxpayers through websites, helplines, and tax preparation assistance programs to help navigate the complexities of tax laws and ensure accurate filing.

What is tax in simple terms?

:max_bytes(150000):strip_icc()/taxes-4188113-1-fb27402db4ac4638875e56eefb0ba00d.jpg)

What is Tax?

In simple terms, tax is a mandatory financial charge or some other type of levy imposed upon a taxpayer (an individual or legal entity) by a governmental organization in order to fund various public expenditures. It's the money people and businesses pay to the government to support public services.

Types of Taxes

There are many different types of taxes, each levied for a specific purpose. Governments use tax revenue to fund a wide variety of programs and services that benefit citizens. The exact types and rates of taxes vary significantly from country to country and even within different regions of the same country. Some examples include income taxes, sales taxes, property taxes, and excise taxes. The specifics of each tax are dictated by tax laws and regulations.

- Income Tax: A tax levied on an individual's or a company's earnings.

- Sales Tax: A tax added to the price of goods and services at the point of sale.

- Property Tax: A tax levied on the value of real estate (land and buildings).

Who Pays Taxes?

Tax obligations vary widely based on income, assets, and business activities. Almost everyone contributes in some way, though the amount and type of taxes paid depend largely on individual circumstances and the tax laws of their location. Tax systems are designed to allocate the tax burden in various ways, some based on ability to pay, others based on consumption or other factors.

This content may interest you! What is the difference between tax deductions and tax credits?

What is the difference between tax deductions and tax credits?- Individuals: Most individuals pay income taxes, and many also pay sales taxes and property taxes.

- Businesses: Businesses face various taxes, including income taxes on profits, sales taxes collected from customers, and payroll taxes.

- Corporations: Corporations are subject to corporate income tax on their profits, as well as other taxes.

How Taxes are Used

Tax revenue is crucial for funding public services. Governments utilize this revenue to support various essential functions and programs that benefit the overall population. The specific allocation of tax revenue can vary based on governmental priorities and societal needs. Transparency in how taxes are used is a crucial element of a well-functioning democracy.

- Public Services: Funding for essential services like education, healthcare, infrastructure (roads, bridges), and public safety.

- Social Welfare Programs: Support for programs such as unemployment benefits, social security, and welfare assistance.

- National Defense: Funding for the military and national security efforts.

What happens if you don't pay taxes?

Consequences of Tax Evasion

Financial Penalties

Failing to pay your taxes will result in significant financial penalties from the tax authority. These penalties are designed to incentivize timely payment and can be substantial, accumulating interest on the unpaid amount. The amount of the penalty can vary based on the reason for non-payment, the length of time the taxes remain unpaid, and the amount owed. In many jurisdictions, intentional tax evasion carries even harsher penalties than simple neglect. Penalties can include:

- Interest charges on the unpaid tax liability.

- Late payment penalties, often a percentage of the unpaid tax.

- Additional penalties for fraud or intentional tax evasion, potentially including significant fines.

Legal Actions

Persistent failure to pay taxes can lead to serious legal consequences. Tax authorities have the power to take legal action to recover the unpaid taxes, including filing lawsuits and obtaining court orders for wage garnishment or asset seizure. This can severely damage your credit rating, making it difficult to obtain loans, mortgages, or even rent an apartment. In extreme cases of tax evasion, especially involving large sums of money or deliberate fraud, criminal charges can be filed, resulting in jail time and a criminal record.

This content may interest you! How do tax brackets work?

How do tax brackets work?- Lawsuits to recover unpaid taxes.

- Wage garnishment – a portion of your salary is seized to pay the debt.

- Levy on assets – the tax authority can seize and sell your property (house, car, etc.) to pay the debt.

- Criminal prosecution, leading to potential jail time and a criminal record.

Impact on Credit and Future Finances

The consequences of tax evasion extend far beyond immediate financial penalties. A poor tax record will negatively impact your credit score, making it harder to secure loans, credit cards, or mortgages in the future. This can have long-term implications for your ability to purchase a home, a car, or even start a business. Furthermore, the stain of a tax lien or legal action related to unpaid taxes can affect your ability to obtain employment, particularly in certain regulated industries. Repairing your credit and reputation after tax problems can be a lengthy and challenging process.

- Lowered credit score, impacting your ability to obtain credit.

- Difficulties securing loans and mortgages.

- Challenges in renting an apartment or securing other financial services.

- Potential impact on employment opportunities.

What is the main purpose of taxes?

The Main Purpose of Taxes

The main purpose of taxes is to fund government operations and services. Taxes provide the revenue necessary for governments at all levels – local, state, and federal – to finance the public goods and services they provide to citizens. This includes everything from infrastructure projects like roads and bridges to essential services such as education, healthcare, national defense, and social welfare programs. Without sufficient tax revenue, governments would be unable to fulfill their responsibilities and provide the services that underpin a functioning society.

Funding Public Goods and Services

Taxes are the primary mechanism through which governments finance public goods and services. These are goods and services that are typically non-excludable (meaning it's difficult or impossible to prevent people from using them, even if they don't pay for them) and non-rivalrous (meaning one person's use of the good doesn't diminish another person's ability to use it). Examples include national defense, clean air and water, public parks, and street lighting. These are vital for the well-being of society but are often not efficiently provided by the private sector alone.

This content may interest you! What is a tax refund and how can I get one?

What is a tax refund and how can I get one?- National Defense: Protecting the country from external threats requires significant resources, from military personnel and equipment to intelligence gathering and cybersecurity.

- Infrastructure: Building and maintaining roads, bridges, public transportation, and other infrastructure are crucial for economic activity and daily life.

- Public Education: Providing quality education is essential for a skilled workforce and a well-informed citizenry.

Redistributing Wealth and Reducing Inequality

Tax systems can be designed to redistribute wealth from higher-income individuals and corporations to lower-income individuals and groups. Progressive tax systems, where higher earners pay a larger percentage of their income in taxes, are often used to achieve this goal. This redistribution can help reduce income inequality and fund social safety nets, such as unemployment benefits, food stamps, and affordable housing programs. The aim is to create a more equitable society by providing support to those in need.

- Progressive Taxation: Higher earners pay a larger percentage of their income in taxes.

- Social Welfare Programs: Providing assistance to the needy, such as unemployment benefits and food assistance.

- Affordable Housing Initiatives: Subsidizing affordable housing to ensure access to safe and decent living conditions.

Regulation and Behavior Modification

Taxes can also be used to influence behavior and discourage certain activities deemed harmful to society. For instance, taxes on cigarettes and alcohol are designed to reduce consumption of these products, thereby improving public health. Similarly, carbon taxes can be levied to incentivize businesses and individuals to reduce their carbon footprint and mitigate climate change. These are examples of "sin taxes" or "Pigovian taxes," which aim to internalize negative externalities – costs imposed on society by certain activities.

- Sin Taxes: Taxes on goods considered harmful to public health, such as tobacco and alcohol.

- Environmental Taxes: Taxes on activities that pollute the environment, such as carbon emissions.

- Congestion Pricing: Taxes or charges for using congested roads or public transportation during peak hours to discourage driving and promote alternative modes of transportation.

What are taxes?

Taxes are mandatory contributions levied on individuals or entities by a government to fund public expenditures. These expenditures encompass a wide range of services, including infrastructure development (roads, schools, hospitals), national defense, social welfare programs (unemployment benefits, social security), and the administration of government itself. The amount of tax owed is typically calculated based on income, sales, property value, or other specified bases. Different tax systems exist across the globe, varying in their structure, rates, and the types of taxes imposed. Understanding your tax obligations is crucial for responsible citizenship and financial planning.

How are taxes collected?

Tax collection methods vary depending on the type of tax and the country's administrative system. Income taxes are often collected through a system of withholding, where employers deduct taxes from employee paychecks. Sales taxes are typically collected by businesses at the point of sale and remitted to the government. Property taxes are assessed on the value of real estate and are usually billed directly to property owners. Governments utilize tax agencies and specialized departments to manage the collection process, employing various methods like online portals, mail-in forms, and direct debits. Penalties for non-payment or late payment are common to ensure compliance.

What are the different types of taxes?

There's a wide variety of taxes, broadly categorized into direct and indirect taxes. Direct taxes are levied directly on individuals or corporations, like income tax (on earnings), corporate tax (on company profits), and property tax (on land and buildings). Indirect taxes are levied on goods and services, impacting consumers indirectly. Examples include sales tax (added to purchases), value-added tax (VAT), excise tax (on specific goods like alcohol or tobacco), and import duties (on goods brought into a country). The specific types and rates of taxes differ significantly across jurisdictions, shaped by economic policy and societal priorities.

This content may interest you! What 7 streams of income do millionaires have?

What 7 streams of income do millionaires have?Who is responsible for paying taxes?

Tax responsibility varies depending on the type of tax and the legal structure of the entity. Individuals are typically responsible for paying income tax on their earnings, sales tax on their purchases, and property tax on any real estate they own. Businesses are responsible for paying corporate income tax on profits, sales tax on sales, and potentially other business-related taxes. In some systems, certain income levels or types of businesses may have exemptions or reduced tax rates. Understanding individual tax responsibilities is vital for avoiding penalties and fulfilling civic duties, often facilitated through tax laws and regulations.

Leave a Reply