What is the #1 budgeting app?

Finding the perfect budgeting app can feel overwhelming with so many options available. This article dives deep into the world of personal finance apps to determine the ultimate champion. We'll examine key features, user reviews, and overall effectiveness to crown the #1 budgeting app. From tracking expenses and setting budgets to providing insightful financial reports, we'll analyze the top contenders and reveal the app that consistently delivers the best user experience and helps you achieve your financial goals. Get ready to simplify your finances!

What is the Best Budgeting App? Finding the Right Fit for You

Factors to Consider When Choosing a Budgeting App

There's no single "best" budgeting app, as the ideal choice depends heavily on individual needs and preferences. Key factors to consider include the app's ease of use, its features (such as goal setting, bill reminders, investment tracking, and debt management tools), its compatibility with your financial institutions, its security measures, and, of course, its cost (many offer free plans with limited features, while others charge a subscription fee for premium access). Consider whether you need a simple app for basic tracking or a more complex one with advanced features. User reviews can also provide valuable insights into the user experience.

Popular Budgeting App Options and Their Strengths

Several budgeting apps consistently rank highly. Mint, for example, is known for its user-friendly interface and comprehensive features, including credit score monitoring and investment tracking. YNAB (You Need A Budget) is popular for its zero-based budgeting methodology, helping users allocate every dollar to a specific purpose. Personal Capital caters to more sophisticated users, offering advanced features like retirement planning and investment management. Ultimately, the "best" app will be the one that best aligns with your budgeting style and financial goals. Comparing features and trying out free trials (if available) is crucial before committing to a paid subscription.

Understanding the Limitations of Budgeting Apps

While budgeting apps can be extremely helpful, it's important to understand their limitations. They rely on you to input your data accurately; incorrect information will lead to inaccurate budget projections. Additionally, security is a concern; choose reputable apps with robust security measures to protect your financial information. Finally, remember that a budgeting app is just a tool; successful budgeting requires discipline and consistent effort. The app can help you organize your finances, but it can't magically solve financial problems; you must actively use the app and make informed financial decisions.

This content may interest you! At what age should parents stop giving money?

At what age should parents stop giving money?| App Name | Key Features | Pricing | Pros | Cons |

|---|---|---|---|---|

| Mint | Budgeting, bill tracking, credit score monitoring, investment tracking | Free (with ads) | Easy to use, comprehensive features | Can be overwhelming for simple needs, relies on accurate data input |

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, debt management | Paid subscription | Effective budgeting methodology, strong community support | Steeper learning curve, requires consistent effort |

| Personal Capital | Budgeting, investment management, retirement planning | Free (with premium options) | Advanced features, suitable for sophisticated users | Complex interface, primarily focuses on investment management |

What is the number one budget app?

There is no single "number one" budgeting app as the best app depends heavily on individual needs and preferences. However, several apps consistently rank highly and receive significant praise. Mint, YNAB (You Need A Budget), and Personal Capital are frequently cited as top contenders. The "best" app is subjective and requires individual assessment.

Factors to Consider When Choosing a Budget App

Choosing the right budgeting app involves considering several crucial factors. You need to evaluate how well the app integrates with your existing financial accounts, its ease of use, and the features offered. A user-friendly interface is paramount for consistent use, while robust features like financial goals setting and reporting capabilities are also highly desirable.

- Ease of Use: The app should be intuitive and simple to navigate, regardless of your technological proficiency. A clean layout and clear instructions are essential for painless budgeting. Look for apps with tutorials or helpful support resources.

- Account Linking and Data Aggregation: The ability to automatically import data from your bank accounts, credit cards, and investment accounts is a major time-saver. This helps to create a comprehensive view of your finances without manual input.

- Feature Set: Consider essential features like budgeting tools, expense tracking, financial goal setting (saving, debt reduction), reporting and visualization, and spending analysis. More advanced features, such as bill payment reminders and investment tracking, can also prove beneficial.

Popular Budgeting Apps and Their Strengths

Numerous budgeting apps cater to diverse needs. While Mint is widely praised for its free features and ease of use for beginners, YNAB distinguishes itself with its unique zero-based budgeting methodology. Personal Capital, on the other hand, caters to users with more complex financial situations, offering advanced features focused on investment tracking and financial planning.

This content may interest you! How to convince your parents to give you $500?

How to convince your parents to give you $500?- Mint: Known for its free, user-friendly interface and extensive account aggregation capabilities. It's an excellent option for those new to budgeting.

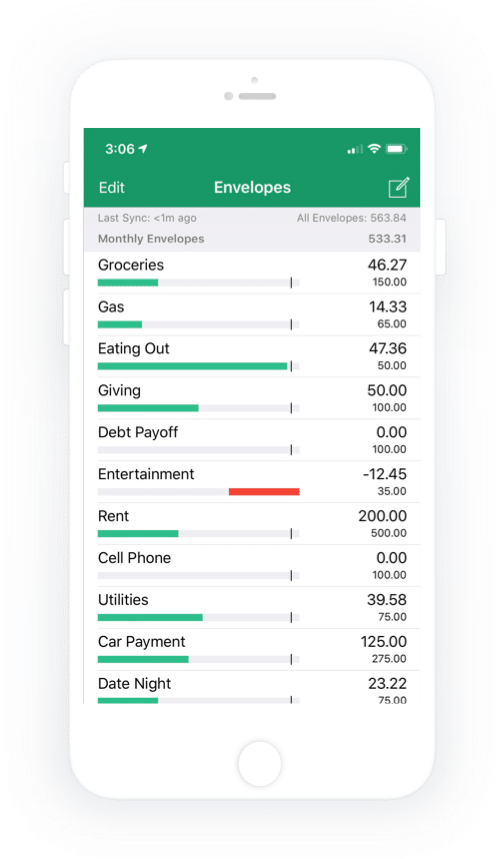

- YNAB (You Need A Budget): Employs a zero-based budgeting method, encouraging users to assign every dollar a purpose. It's popular for its powerful features and community support but comes with a subscription fee.

- Personal Capital: Provides comprehensive financial management tools, including investment tracking, retirement planning, and fee analysis. It's ideal for individuals with more advanced financial needs but also carries a subscription fee.

Choosing the Right App for Your Financial Situation

Your choice of budgeting app should align with your financial goals, technological comfort level, and the complexity of your financial life. Consider whether you need basic expense tracking or advanced features like investment portfolio analysis. Also, evaluate the app's pricing model; while many apps offer free versions, others might require a subscription fee for their full functionality. Free trials can be invaluable before committing to a paid service.

- Assess Your Financial Goals: Are you primarily focused on tracking expenses, paying off debt, or building wealth? This will influence your app choice.

- Consider Your Tech Savviness: Choose an app with an interface that's easy for you to understand and use. Look for apps with helpful tutorials and customer support.

- Evaluate Pricing and Features: Compare the features offered by different apps, and determine if the cost is justified by the benefits you'll receive.

What app does Dave Ramsey recommend for budgeting?

Dave Ramsey recommends EveryDollar for budgeting. It's a zero-based budgeting app designed to align with his financial principles.

EveryDollar's Features and Functionality

EveryDollar is a budgeting app designed to help users track their income and expenses, ensuring they allocate every dollar they earn. Its straightforward interface makes it easy to use, even for those unfamiliar with budgeting apps. A key feature is its emphasis on zero-based budgeting, a method where every dollar is assigned a specific purpose, eliminating overspending and promoting financial awareness. The app allows users to categorize spending, track progress towards financial goals, and visualize their financial situation through charts and graphs.

This content may interest you! How can you make your parents give you money?

How can you make your parents give you money?- Zero-based budgeting: Assigns every dollar a purpose, preventing overspending.

- Easy-to-use interface: Intuitive design makes it accessible for all users, regardless of financial experience.

- Goal tracking: Helps users monitor progress toward financial objectives such as debt repayment or saving for a down payment.

EveryDollar vs. Other Budgeting Apps

While numerous budgeting apps exist, EveryDollar stands out by focusing specifically on the principles of Dave Ramsey's financial peace plan. Unlike some apps that focus solely on transaction tracking, EveryDollar prioritizes planning and intentional spending. This distinction aligns with Ramsey's emphasis on discipline and proactive financial management. Other apps may offer more sophisticated features like automatic categorization or investment tracking, but EveryDollar prioritizes simplicity and aligns with a specific financial philosophy.

- Focus on Zero-Based Budgeting: Unlike apps that simply track spending, EveryDollar emphasizes proactive budgeting and planning.

- Alignment with Dave Ramsey's Principles: The app directly supports his financial philosophy, making it a natural choice for his followers.

- Simplicity over Complexity: The app's straightforward design avoids overwhelming users with advanced features.

Limitations of EveryDollar

While EveryDollar offers a strong foundation for budgeting, it has some limitations. The free version has restricted features, requiring a subscription for full functionality. It lacks some advanced features found in other budgeting apps, such as automatic transaction categorization or integration with multiple bank accounts. Its reliance on manual data entry can be time-consuming for users with numerous transactions.

- Subscription Requirement: Full functionality requires a paid subscription.

- Limited Features: Lacks advanced features like automatic categorization and multi-account linking.

- Manual Data Entry: Requires users to manually input transactions, which can be tedious.

What budgeting app was suggested to use?

Budgeting App Suggestions

This content may interest you! What is it called when your parents give you money weekly?

What is it called when your parents give you money weekly?No specific budgeting app was suggested in the prompt. Therefore, I cannot provide a detailed answer to . To answer your question fully, a previous context or a specific suggestion is required. However, I can offer information on popular budgeting apps in general to help you make an informed decision.

Popular Budgeting Apps: A Comparison

Many budgeting apps are available, each with strengths and weaknesses depending on individual needs and preferences. Some focus on simplicity and ease of use, while others offer more advanced features like financial goal setting, investment tracking, and debt management tools. Choosing the right app depends on your financial habits and tech savviness. Consider factors like the app's interface, features, security, and cost (some are free, others offer premium subscriptions).

- Mint: A well-known free app offering features such as account aggregation, spending tracking, and budgeting tools. It's user-friendly and integrates with numerous financial institutions.

- Personal Capital: This app provides more sophisticated features, including investment tracking and retirement planning tools. It's suitable for users who want to manage investments alongside their budget.

- YNAB (You Need A Budget): While not free, YNAB emphasizes a zero-based budgeting approach, guiding users to allocate every dollar of their income. It's known for its robust features and strong community support.

Factors to Consider When Choosing a Budgeting App

Selecting the right budgeting app requires careful consideration of several factors. It is crucial to find an application that aligns with your financial goals and your personal style of budgeting. Different apps offer various approaches to budgeting, some emphasizing simplicity, while others offer a more complex and feature-rich experience. Understanding your needs will help to narrow down the options and make the selection process easier.

- Ease of use: The interface should be intuitive and easy to navigate, even for users who are not tech-savvy.

- Features: Consider what features are most important to you, such as account aggregation, spending categorization, goal setting, and report generation.

- Security: Choose an app with robust security measures to protect your sensitive financial information.

Alternatives to Dedicated Budgeting Apps

While dedicated budgeting apps offer convenience and features, other methods can effectively manage personal finances. These alternatives may be suitable for users who prefer a more hands-on approach or who have simpler financial needs. The use of spreadsheets or even pen and paper can provide adequate budgeting functionality for those who require a less technology-intensive solution.

This content may interest you! How to wish on first salary?

How to wish on first salary?- Spreadsheet software (like Excel or Google Sheets): Offers customizable budgeting templates and allows for detailed tracking and analysis.

- Personal finance software (like Quicken): Provides more comprehensive features than basic budgeting apps, including investment tracking and tax preparation assistance.

- Manual budgeting (using pen and paper): A simple yet effective method for those who prefer a non-digital approach.

Is Mint or YNAB better?

Mint vs. YNAB

Is Mint or YNAB Better?

Choosing between Mint and YNAB (You Need A Budget) depends heavily on your financial goals and personality. Mint is a free, automated budgeting and finance tracking app that excels at providing a comprehensive overview of your finances. YNAB, on the other hand, is a paid, more hands-on budgeting app that emphasizes mindful spending and achieving specific financial goals. Neither is inherently "better"; the superior choice hinges on your individual needs and preferences.

Ease of Use and Setup

Mint boasts a remarkably simple setup process. Connecting your accounts is straightforward, and the app automatically categorizes transactions. This ease of use makes it an attractive option for beginners or those who prefer a less involved approach to budgeting. YNAB, while having a more intuitive interface than in the past, requires more initial effort. You need to manually categorize transactions initially and set up a budget, but this process fosters a deeper understanding of your finances.

This content may interest you! How much should a 16 year old save?

How much should a 16 year old save?- Mint: Quick and easy setup, automated categorization.

- YNAB: Requires more manual input initially, leading to a more thorough understanding of your spending habits.

- Mint's ease of use can lead to less engagement with financial details.

Features and Functionality

Mint shines in its breadth of features. It offers credit score monitoring, investment tracking, and bill payment reminders, among other things. YNAB focuses laser-like on budgeting. Its core strength lies in its zero-based budgeting methodology and tools that help you allocate your money intentionally. While YNAB lacks the wide array of features found in Mint, its budgeting tools are considered by many to be more robust and effective.

- Mint: Offers a wide range of features beyond budgeting, such as credit score monitoring and investment tracking.

- YNAB: Concentrates on budgeting, offering sophisticated tools for zero-based budgeting and goal setting.

- Mint's broad feature set can be overwhelming for some users; YNAB's focused approach can be more manageable and effective for goal-oriented budgeting.

Cost and Value

Mint is completely free to use, making it an accessible option for everyone. YNAB, however, is a subscription-based service. While the cost is a significant factor, many users find the value in YNAB's superior budgeting tools and the resulting improved financial control to be worth the price. Ultimately, the value proposition depends on individual priorities and willingness to invest in financial management tools.

- Mint: Free to use, making it a budget-friendly option.

- YNAB: Subscription-based, requiring a recurring payment.

- The value of YNAB's features needs to be weighed against its cost.

What criteria should I use to determine the best budgeting app for me?

Choosing the "best" budgeting app depends entirely on your individual needs and preferences. Consider factors like your comfort level with technology, the specific features you require (e.g., bill tracking, investment tracking, debt management tools), and the level of customization you desire. Read reviews from other users to understand their experiences. Finally, think about the app's user interface; a clean, intuitive design can significantly impact your engagement and success with budgeting.

Are there free budgeting apps that offer robust features?

Yes, several free budgeting apps provide surprisingly robust features. Many offer core functionalities like expense tracking, budgeting tools, and financial reporting, often with no limitations on the number of accounts or transactions you can track. However, free versions might include ads or limit access to advanced features like financial analysis tools or premium support. Carefully compare the free and paid versions to determine if the added cost justifies the extra functionality for your needs.

This content may interest you! How much should a young person save?

How much should a young person save?What are some key features to look for in a top-rated budgeting app?

Essential features include easy account linking (bank accounts, credit cards), intuitive expense categorization, clear visual representations of your spending habits (charts, graphs), goal setting capabilities (saving, debt reduction), and secure data storage. Advanced features, such as automated transaction categorization, bill payment reminders, and integration with investment accounts, can further enhance your budgeting experience. Consider whether these additional features are important to you and align with your financial goals.

How can I ensure the security of my financial data when using a budgeting app?

Prioritize apps from reputable developers with a proven track record of data security. Look for apps that utilize encryption to protect your financial information and adhere to industry best practices for data privacy. Read user reviews to gauge the app's reputation for security. Avoid apps that request unnecessary personal information. Remember that no system is entirely foolproof, so practice good security habits like strong passwords and monitoring your accounts regularly for suspicious activity.

https://youtube.com/watch?v=siW9K2yDFNw%26t%3D644

This content may interest you! What are proper words to ask for a raise?

What are proper words to ask for a raise?

Leave a Reply