What is the 30 day rule?

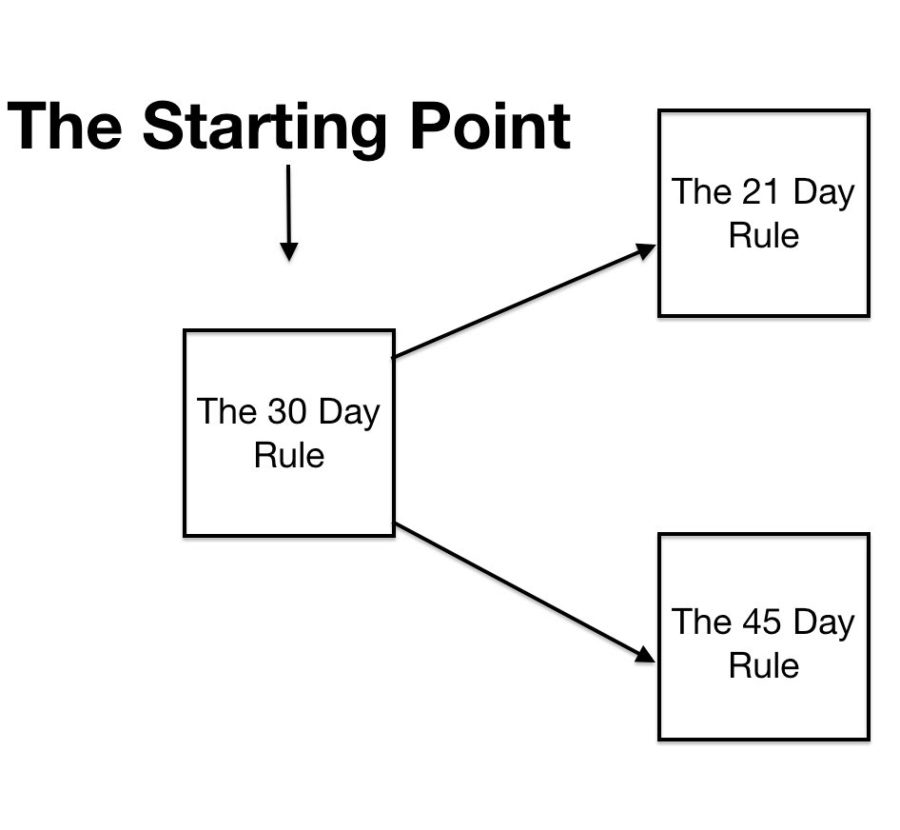

The 30-day rule, a popular productivity and decision-making technique, offers a simple yet effective approach to managing impulses and fostering thoughtful choices. This article delves into the core principles of the 30-day rule, exploring its practical applications in various aspects of life. We'll examine how delaying gratification for a month can help you avoid regrettable purchases, impulsive actions, and emotional reactions, ultimately leading to more considered decisions and a greater sense of control over your life. Discover how this powerful tool can transform your approach to spending, relationships, and personal growth.

What is the 30-Day Rule? A Comprehensive Guide

What are the origins of the 30-day rule?

The 30-day rule doesn't have a single, definitive origin like a specific law or regulation. Instead, it's a self-imposed guideline that's evolved over time within various contexts. It's often presented as a personal finance strategy, a dating tip, or even a method for handling difficult decisions. Its popularity stems from the idea that a 30-day waiting period provides sufficient time for emotional distance, rational consideration, and avoidance of impulsive actions. While not officially recognized anywhere, its practical application across different spheres makes it a recognizable concept.

How is the 30-day rule applied in different situations?

The application of the 30-day rule varies greatly depending on the specific context. In personal finance, it might involve waiting 30 days before making a significant purchase, allowing time to assess whether the item is truly needed or simply a fleeting desire. In dating, it could mean resisting the urge to contact someone immediately after a first date, thereby allowing both parties time and space for reflection. In scenarios involving difficult decisions, the 30-day rule promotes thoughtful consideration, minimizing the impact of immediate emotional responses and allowing for a more informed choice. The key is to tailor the implementation of the rule to the unique characteristics of each situation.

What are the benefits and drawbacks of using the 30-day rule?

The main benefit of the 30-day rule is its emphasis on delayed gratification and mindful decision-making. By creating a buffer period, it reduces impulsivity and fosters more rational choices. However, it also has potential drawbacks. In certain situations, a 30-day delay might lead to missed opportunities or a loss of momentum. For instance, in competitive markets, waiting 30 days to make a purchase might mean missing out on a deal. Furthermore, the rule's effectiveness hinges on self-discipline and the ability to consistently adhere to it. Successful implementation requires self-awareness and a commitment to prioritizing long-term benefits over short-term gratification.

This content may interest you! How can I save money if I have debt?

How can I save money if I have debt?| Context | Application | Benefits | Drawbacks |

|---|---|---|---|

| Personal Finance | Waiting 30 days before large purchases | Reduces impulsive spending, allows for better budgeting | May lead to missing out on limited-time offers |

| Dating | Delaying contact after a first date | Provides space for reflection, avoids appearing overly eager | Might cause the other person to lose interest |

| Decision-Making | Postponing major decisions for 30 days | Allows for more rational and less emotionally-driven choices | Can result in missed opportunities or delays |

How to save $500 in 30 days?

Saving $500 in 30 Days

Saving $500 in 30 days requires significant effort and careful planning. It's a challenging but achievable goal if you're disciplined and strategic. The key is to drastically reduce spending while simultaneously increasing income, even if temporarily. This means scrutinizing every expense, identifying areas for immediate cuts, and exploring opportunities to earn extra money. Tracking your spending is crucial; use budgeting apps or a simple spreadsheet to monitor your progress. Remember, every dollar saved contributes to your goal. Be realistic about your capabilities and set achievable daily or weekly savings targets. A successful strategy will involve a combination of both spending reduction and income generation. Don't be afraid to get creative and explore various options to reach your target.

Identify and Eliminate Unnecessary Expenses

Analyze your spending habits to identify areas where you can cut back. This involves looking at both big and small expenses. Often, small, recurring expenses add up to significant amounts over time. Focusing on eliminating these can make a considerable impact. You should prioritize needs over wants, and challenge yourself to find free or low-cost alternatives. Consider temporarily reducing or eliminating non-essential services or subscriptions.

This content may interest you! What is the best app to save your money?

What is the best app to save your money?- Review your subscriptions: Identify and cancel any unused streaming services, gym memberships, or magazine subscriptions.

- Reduce dining out: Prepare meals at home instead of eating out. Packing your lunch is a great way to save.

- Limit impulse purchases: Avoid unplanned shopping trips and stick to your shopping list. Consider using cash instead of cards to track spending more effectively.

Increase Your Income

Explore different avenues to generate extra income. Even small amounts of extra money add up quickly. Consider your skills and resources when choosing options. This might involve taking on a part-time job, selling unused items, or leveraging your skills for freelance work. Remember, the more avenues you explore, the greater your chances of success.

- Sell unused items: Declutter your home and sell clothes, electronics, or other items you no longer need on online marketplaces.

- Freelance work: Offer your skills on freelance platforms, such as writing, graphic design, or virtual assistance.

- Part-time job: Consider a part-time job in retail, food service, or customer service to supplement your income.

Create a Realistic Budget and Track Progress

A detailed budget is essential for successful saving. It allows you to monitor your income and expenses closely, helping you identify areas needing improvement. Regularly review your budget and make adjustments as needed. Using a budgeting app or a spreadsheet can help you track your progress and stay motivated. Celebrating small milestones along the way can also help maintain your momentum.

- Track your expenses: Use a budgeting app or spreadsheet to monitor all your spending.

- Set realistic daily/weekly savings goals: Break down the $500 goal into smaller, more manageable targets.

- Review and adjust your budget: Regularly review your spending and make adjustments as needed to stay on track.

Can I save $10,000 in 3 months?

Whether you can save $10,000 in 3 months depends entirely on your current financial situation and your ability to drastically reduce spending and/or increase income. It's a challenging goal, requiring significant commitment and potentially some sacrifices. Let's explore the factors involved:

This content may interest you! What is the #1 budgeting app?

What is the #1 budgeting app?Factors Affecting Your Ability to Save $10,000 in 3 Months

Saving $10,000 in three months requires saving approximately $3,333 per month. This is a substantial amount and necessitates a thorough examination of your current financial situation. Consider your monthly income, your existing debts and expenses, and your potential for additional income streams. The feasibility of this goal hinges on creating a significant gap between your income and expenses.

- Income: Your current income is the foundation upon which your savings efforts are built. A high-income individual may find this goal more achievable than someone with lower income. Consider any potential for income increases such as a raise, bonus, or taking on a side hustle. Explore options like freelancing, part-time jobs, or selling unused possessions.

- Expenses: A detailed analysis of your spending habits is crucial. Identify areas where you can significantly cut back. This may involve scrutinizing discretionary spending on entertainment, dining out, subscriptions, and impulse purchases. Consider budgeting apps or spreadsheets to track your spending effectively. Look for cost-cutting measures such as negotiating lower bills, switching to cheaper providers for utilities and other services, or finding more affordable alternatives for your daily needs.

- Existing Debt: High levels of existing debt, such as credit card debt or loans, will greatly impact your ability to save this amount. High-interest debt payments consume a significant portion of your income, limiting the amount available for savings. Explore strategies for debt reduction, such as debt consolidation or the debt snowball method, to free up funds for savings.

Strategies for Achieving Your Savings Goal

To reach your $10,000 savings target, a multi-pronged approach is generally necessary, combining both income generation and expenditure reduction strategies. This involves a disciplined approach to managing your finances, coupled with a realistic assessment of your financial capabilities. Focusing on a few key strategies is likely to yield better results than trying to tackle everything at once. Prioritize your efforts and measure your progress regularly to stay on track.

- Aggressive Budgeting: Implement a strict budget that meticulously tracks every dollar spent. Categorize your expenses, identify areas for reduction, and allocate a substantial portion of your income towards savings. The more aggressive your budget, the faster you can reach your savings goal.

- Increased Income Streams: Actively seek ways to increase your income. This could involve taking on a part-time job, freelancing, selling unused items, or investing in income-generating assets. Every additional dollar earned accelerates your progress towards your savings goal.

- Emergency Fund: While focusing on your $10,000 goal, remember the importance of maintaining an emergency fund. Unexpected expenses can derail your efforts, so having a small buffer can help avoid setbacks.

Potential Challenges and Mitigation Strategies

Reaching this savings goal will not be without its obstacles. Unexpected expenses, changes in income, or even simply maintaining the discipline required can pose significant challenges. Careful planning and a contingency plan can help mitigate these risks. The key is to be prepared for the unexpected and to adapt your strategies as necessary.

- Unexpected Expenses: Life throws curveballs. Car repairs, medical bills, or unexpected home maintenance can easily derail your savings plan. Having an emergency fund, even a small one, can help cushion the blow. Consider building this fund in parallel with your $10,000 goal.

- Maintaining Discipline: Sticking to a strict budget for three months can be challenging. Develop strategies to stay motivated, such as tracking your progress, rewarding yourself for milestones, or finding an accountability partner.

- Income Volatility: If your income is unreliable or prone to fluctuation, reaching this goal becomes much harder. Explore ways to stabilize your income, such as diversifying your income sources or seeking more secure employment.

What is the 30-day rule for breakups?

At what age should parents stop giving money?

At what age should parents stop giving money?30-Day Rule for Breakups

The "30-day rule" for breakups isn't a formally established guideline or psychological principle. It's more of a colloquialism, a self-imposed restriction often suggested as a way to manage the aftermath of a romantic relationship ending. The idea centers around avoiding contact with your ex-partner for a full 30 days following the breakup. This period of no contact is intended to facilitate healing, self-reflection, and moving on. However, its effectiveness varies greatly depending on individual circumstances, the nature of the relationship, and the personalities involved. While some find it beneficial, others may find it detrimental or even impossible to maintain. It's crucial to understand that this is not a universally applicable or guaranteed solution for overcoming heartbreak. The 30-day timeframe is arbitrary; the core principle is establishing a period of separation to allow for emotional processing and independent growth.

Reasons People Adopt the 30-Day Rule

Many people adopt the 30-day rule (or a variation thereof) for several compelling reasons. It's often seen as a tool for emotional regulation and regaining a sense of self after a significant relationship concludes. The enforced separation creates space to process emotions without the influence of the ex-partner's presence. This period can be instrumental in identifying unhealthy patterns or behaviors within the relationship that need addressing. Furthermore, it allows individuals to focus on personal growth and self-care, potentially leading to a stronger sense of identity outside the context of the previous relationship.

- Emotional Regulation: Avoiding contact minimizes emotional triggers and allows for healthier coping mechanisms to develop.

- Self-Reflection: The time apart provides space to analyze the relationship's dynamics and personal contributions to its conclusion.

- Personal Growth: The focus shifts from the relationship to self-improvement, promoting healthier habits and stronger self-esteem.

Potential Challenges and Considerations

Despite its potential benefits, the 30-day rule isn't without its challenges. Maintaining no contact can be exceptionally difficult, particularly if the breakup was unexpected or involved shared living spaces, finances, or children. There's also the risk of the no-contact period causing further resentment or unresolved issues. It's vital to approach this with realistic expectations. The rule shouldn't be viewed as a magical solution but rather as a tool, and its effectiveness depends significantly on individual circumstances and commitment. Additionally, forcing no contact when the individuals share responsibilities (such as co-parenting) can be unrealistic and even detrimental.

This content may interest you! How to convince your parents to give you $500?

How to convince your parents to give you $500?- Difficulty Maintaining No Contact: Shared resources, children, or strong emotional ties can make complete separation extremely challenging.

- Unresolved Issues: The enforced separation might prevent necessary communication and leave unresolved issues unaddressed, possibly leading to long-term resentment.

- Individual Circumstances: The success of this rule highly depends on individual coping mechanisms, support systems, and the complexity of the relationship dynamics.

Alternatives and Healthy Coping Mechanisms

While the 30-day rule might work for some, it's crucial to remember that there are various alternative approaches to healing after a breakup. Focusing on self-care activities such as exercise, healthy eating, and pursuing hobbies can be far more beneficial. Building a supportive network with friends and family is also critical. Seeking professional guidance from a therapist or counselor can provide valuable support and tools for navigating the emotional complexities of a breakup. Remember that healing is a journey, and there isn't a one-size-fits-all solution. The most effective approach will depend on your unique situation and emotional needs.

- Self-Care: Prioritize physical and mental well-being through exercise, healthy eating, and mindfulness practices.

- Social Support: Lean on trusted friends and family for emotional support and encouragement.

- Professional Help: Seek guidance from therapists or counselors specializing in relationship issues to navigate complex emotions and develop healthy coping strategies.

How can I save $1000 in 30 days?

Saving $1000 in 30 days requires aggressive cost-cutting and potentially some extra income generation. It's a challenging goal, and success depends heavily on your current financial situation and spending habits. Here's a breakdown of strategies:

Identify and Eliminate Non-Essential Spending

Saving $1000 in 30 days necessitates a thorough review of your spending. You need to ruthlessly cut out anything non-essential. This means identifying areas where you're overspending and making significant reductions. This might involve temporary sacrifices, but the goal is short-term, intense saving.

This content may interest you! How to save money if you are not working?

How to save money if you are not working?- Track your spending meticulously for a few days to identify spending patterns. Use budgeting apps or spreadsheets to monitor every expense.

- Categorize your expenses and prioritize essential needs like rent, utilities, and groceries. Identify non-essential spending like eating out, entertainment, subscriptions, and impulse purchases.

- Completely eliminate or severely reduce non-essential spending for the 30 days. This could involve cooking at home instead of eating out, cancelling subscriptions, foregoing entertainment expenses, and avoiding impulse buys.

Increase Your Income Streams

Supplementing your existing income through temporary measures can significantly boost your savings potential. While a substantial increase in income within 30 days might be difficult for some, even a small amount of extra money each day can accumulate quickly.

- Explore gig work options like driving for ride-sharing services, delivering food, or freelancing based on your skills. Many platforms offer immediate opportunities for income generation.

- Sell unused items. Declutter your home and sell clothes, electronics, or other possessions through online marketplaces or consignment shops. The quicker you can liquidate assets, the faster you can add to your savings.

- Consider a temporary part-time job. Even a few hours per week at minimum wage can significantly contribute to your savings goal. Seek opportunities that align with your availability and skills.

Negotiate Bills and Explore Financial Assistance

Lowering your existing expenses can create more room in your budget. Actively negotiating with service providers or seeking financial assistance programs can unlock unexpected savings.

- Contact your service providers (internet, phone, cable) to negotiate lower rates. Many companies are willing to offer discounts to retain customers.

- Research and apply for financial assistance programs if you qualify. Many organizations offer aid with utilities, rent, or other essential expenses.

- Explore options for lowering your grocery bill. Utilize coupons, shop sales, and compare prices between grocery stores. Consider buying in bulk for items you use regularly.

What exactly is the 30-day rule?

The 30-day rule is a personal finance strategy focusing on delaying non-essential purchases for 30 days. This period allows for reflection on the need and value of the item. By waiting, impulsive buys are often avoided, saving money and reducing buyer's remorse. It helps build mindful spending habits and encourages prioritization of needs over wants. The rule is flexible; it’s about cultivating a thoughtful approach to spending, not rigidly adhering to a calendar. It applies to everything from small impulse purchases to bigger-ticket items.

How does the 30-day rule benefit me?

The 30-day rule primarily benefits your financial well-being. By delaying purchases, you're giving yourself time to assess whether the item is truly necessary or just a fleeting desire. This leads to reduced spending, increased savings, and less debt. It also helps you develop better financial discipline and a more mindful approach to consumption. Over time, this can lead to significant savings and improved financial security. The delayed gratification fosters a healthier relationship with money and spending.

This content may interest you! How to wish on first salary?

How to wish on first salary?Are there any exceptions to the 30-day rule?

While the core principle is delaying non-essential purchases, exceptions exist for necessities like groceries, medication, or urgent home repairs. The key is to distinguish between true needs and impulsive wants. Items critical for health, safety, or well-being should not be subject to the 30-day waiting period. However, even for necessary items, the rule can encourage careful consideration of cost-effective options or alternatives. The flexibility lies in applying the principle appropriately.

How can I effectively implement the 30-day rule?

Start by identifying your spending triggers. Are you more likely to overspend online, in stores, or under specific emotional states? Keep a spending journal to track your purchases and identify impulsive buys. When tempted by a non-essential item, write it down and revisit the list after 30 days. This allows reflection and assessment of its value. Use a budgeting app or spreadsheet to monitor your finances. Combining the 30-day rule with other financial strategies will maximize its effectiveness.

Leave a Reply