What is the 60 saving rule?

The 60 saving rule is a straightforward yet effective budgeting strategy designed to help individuals manage their finances more efficiently. This rule suggests allocating 60% of your income towards essential expenses, such as housing, utilities, and groceries, while the remaining 40% is divided between savings and discretionary spending.

By prioritizing needs over wants, this approach encourages financial discipline and long-term stability. Whether you're aiming to build an emergency fund, pay off debt, or save for future goals, the 60 saving rule provides a clear framework to achieve financial balance. This article explores how to implement this rule and its potential benefits for your financial health.

What is the 60 Saving Rule?

The 60 Saving Rule is a straightforward budgeting strategy designed to help individuals manage their finances effectively. It suggests allocating 60% of your income to cover essential expenses, such as housing, utilities, groceries, and transportation.

The remaining 40% is divided into savings, investments, and discretionary spending. This rule aims to create a balanced financial plan, ensuring that you prioritize both your immediate needs and long-term financial goals.

How Does the 60 Saving Rule Work?

The 60 Saving Rule works by dividing your income into three main categories. First, 60% is allocated to essential expenses, which include necessities like rent, bills, and food.

This content may interest you! Can I retire at 60 with 300k?

Can I retire at 60 with 300k?The remaining 40% is split into two parts: 20% goes toward savings and investments, such as emergency funds, retirement accounts, or stocks, while the other 20% is reserved for discretionary spending, like entertainment, dining out, or hobbies. This structure ensures a balanced approach to managing your money.

Benefits of the 60 Saving Rule

One of the primary benefits of the 60 Saving Rule is its simplicity, making it easy for anyone to implement. By dedicating 60% of your income to essentials, you ensure that your basic needs are always covered.

The 20% savings portion helps build financial security, while the 20% discretionary spending allows for personal enjoyment without overspending. This rule also encourages disciplined spending habits, reducing the risk of debt and promoting long-term financial stability.

Who Should Use the 60 Saving Rule?

The 60 Saving Rule is ideal for individuals who want a clear and structured approach to budgeting. It is particularly useful for those with a steady income who struggle to balance their spending and saving habits.

Whether you're a young professional, a family, or someone planning for retirement, this rule can be adapted to fit various financial situations. However, it may require adjustments for those with irregular incomes or high debt levels.

This content may interest you! How many people have $1,000,000 in retirement savings?

How many people have $1,000,000 in retirement savings?| Category | Percentage | Purpose |

|---|---|---|

| Essential Expenses | 60% | Housing, utilities, groceries, transportation |

| Savings & Investments | 20% | Emergency funds, retirement, stocks |

| Discretionary Spending | 20% | Entertainment, dining out, hobbies |

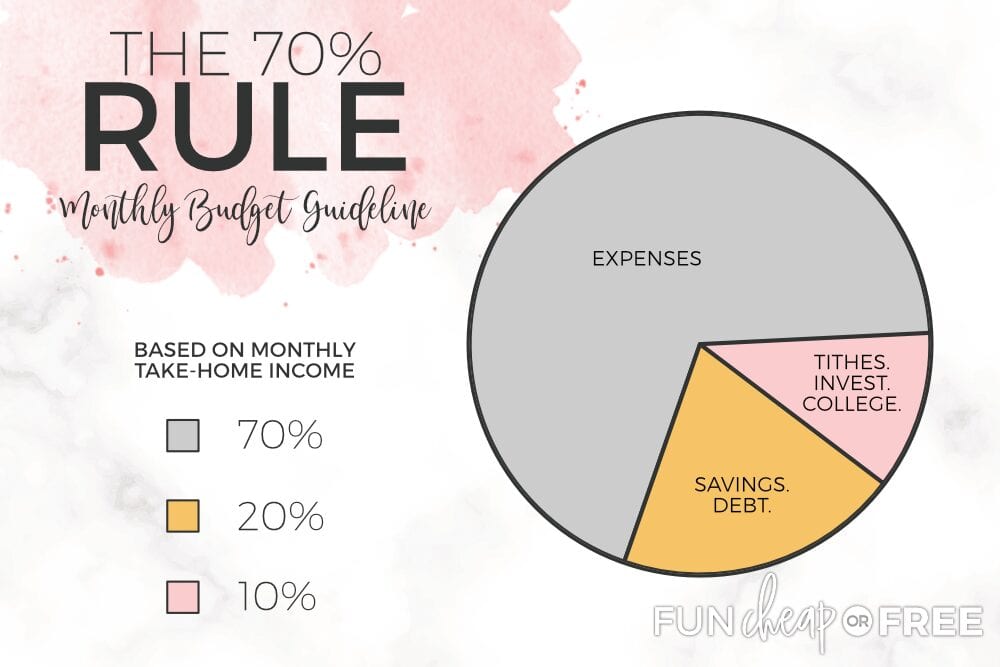

What is the 70/30/10 rule money?

Understanding the 70/30/10 Rule

The 70/30/10 rule is a budgeting framework designed to help individuals manage their finances effectively. It divides income into three categories: living expenses, savings, and discretionary spending. This rule provides a simple yet structured approach to ensure financial stability while allowing room for personal enjoyment.

- 70% of income is allocated to living expenses, including rent, utilities, groceries, and transportation.

- 30% of income is dedicated to savings, investments, and debt repayment.

- 10% of income is reserved for discretionary spending, such as entertainment, dining out, or hobbies.

Benefits of the 70/30/10 Rule

This budgeting method offers several advantages for individuals seeking to balance their financial responsibilities and personal desires. It promotes disciplined spending while ensuring that essential needs are met and future financial goals are prioritized.

- It simplifies budgeting by providing clear percentages for different financial categories.

- It encourages saving and investing, which are crucial for long-term financial security.

- It allows for guilt-free discretionary spending, ensuring a balanced lifestyle.

How to Implement the 70/30/10 Rule

To successfully apply the 70/30/10 rule, individuals need to assess their income, categorize their expenses, and adjust their spending habits accordingly. This process requires consistency and regular review to ensure alignment with financial goals.

- Calculate your total monthly income after taxes.

- Divide your income into the 70%, 30%, and 10% categories based on the rule.

- Track your spending regularly to ensure you stay within the allocated percentages.

What is the 40 30 20 10 rule?

Can you have savings if you have debt?

Can you have savings if you have debt?The 40 30 20 10 rule is a budgeting and prioritization strategy often used in personal finance, business, and time management. It suggests allocating resources, such as income, effort, or time, into specific percentages to achieve balance and efficiency. The rule divides resources into four categories: 40%, 30%, 20%, and 10%, each representing a different priority or focus area.

Understanding the 40% Allocation

The 40% allocation typically represents the largest portion of resources and is often dedicated to the most critical or high-priority areas. For example:

- In personal finance, 40% of income might be allocated to essential expenses like housing, utilities, and groceries.

- In business, 40% of a budget could be directed toward core operations or product development.

- In time management, 40% of your day might be reserved for high-impact tasks or responsibilities.

Exploring the 30% Allocation

The 30% allocation is usually reserved for secondary priorities that still hold significant importance. Examples include:

- In personal finance, 30% of income might go toward discretionary spending, such as entertainment or dining out.

- In business, 30% of a budget could be allocated to marketing or customer acquisition efforts.

- In time management, 30% of your day might be spent on tasks that contribute to long-term goals or personal development.

Breaking Down the 20% and 10% Allocations

The remaining 20% and 10% allocations are often focused on savings, investments, or low-priority tasks. For instance:

- In personal finance, 20% of income might be saved for emergencies or future goals, while 10% could be invested or donated.

- In business, 20% of a budget might be set aside for innovation or research, and 10% could be used for unexpected expenses.

- In time management, 20% of your day might be dedicated to administrative tasks, and 10% could be reserved for relaxation or leisure activities.

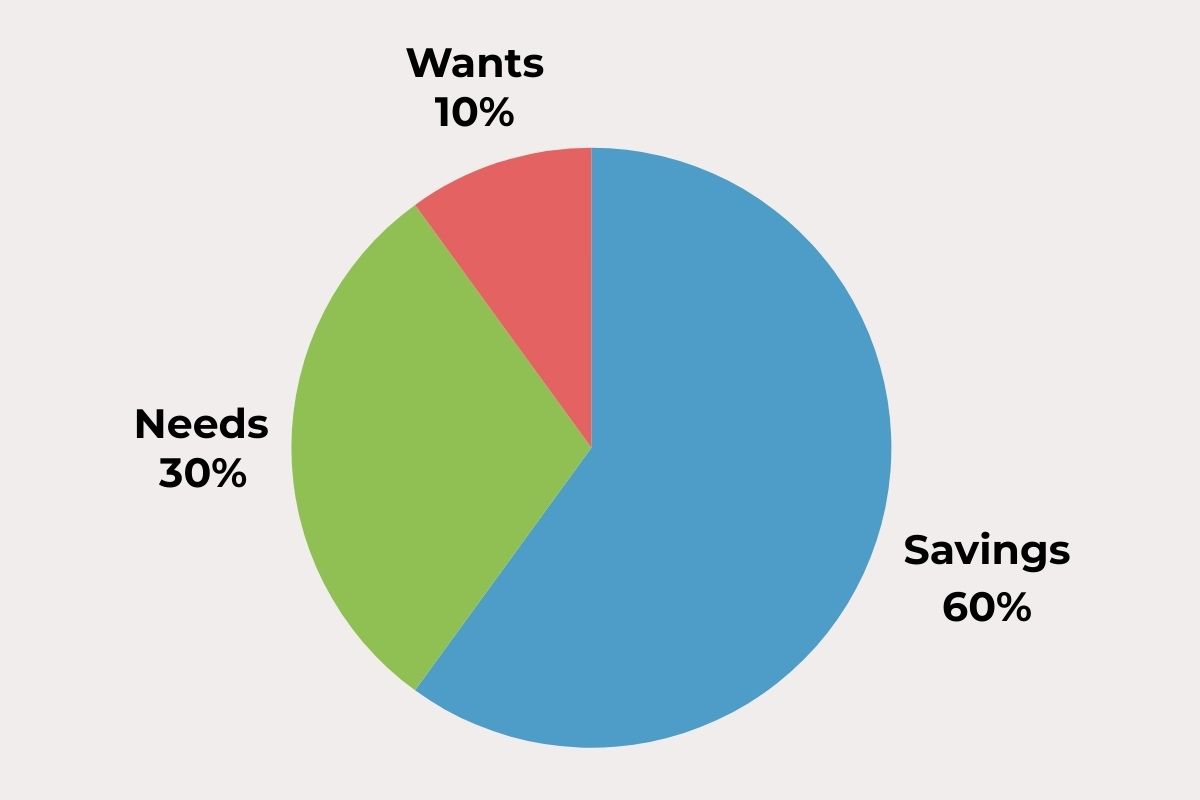

What is the 60 30 10 rule for savings?

How to budget if you have debt?

How to budget if you have debt?The 60 30 10 rule for savings is a budgeting guideline that helps individuals allocate their income into three main categories: 60% for essential expenses, 30% for discretionary spending, and 10% for savings and investments. This rule provides a simple framework to manage finances effectively while ensuring a balance between immediate needs, personal enjoyment, and future financial security.

Understanding the 60% for Essential Expenses

The largest portion of the 60 30 10 rule is dedicated to essential expenses, which are necessary for daily living. These expenses typically include:

- Housing costs such as rent or mortgage payments.

- Utilities like electricity, water, and internet services.

- Groceries and other basic necessities required for sustenance.

By allocating 60% of your income to these essentials, you ensure that your basic needs are met without overspending.

Exploring the 30% for Discretionary Spending

The 30% portion of the rule is reserved for discretionary spending, which covers non-essential but enjoyable activities and purchases. This category includes:

- Entertainment such as dining out, movies, or hobbies.

- Travel and vacations to relax and explore new places.

- Personal indulgences like shopping for clothes or gadgets.

This allocation allows for flexibility and enjoyment while maintaining financial discipline.

This content may interest you! What is the 70-10-10-10 budget rule?

What is the 70-10-10-10 budget rule?Focusing on the 10% for Savings and Investments

The final 10% of the 60 30 10 rule is dedicated to building financial security through savings and investments. This portion can be used for:

- Building an emergency fund to cover unexpected expenses.

- Contributing to retirement accounts like a 401(k) or IRA.

- Investing in stocks, bonds, or other assets to grow wealth over time.

By consistently saving and investing 10% of your income, you create a foundation for long-term financial stability and growth.

How much should I have in savings by 60?

General Savings Guidelines by Age 60

By the time you reach 60, financial experts often recommend having saved a specific multiple of your annual income. This amount can vary depending on your lifestyle, retirement goals, and expected expenses. Here are some general guidelines:

- Aim to have saved 8 to 10 times your annual salary by age 60.

- Consider your expected retirement age and adjust savings accordingly if you plan to retire early or work longer.

- Factor in additional savings if you anticipate higher healthcare costs or other significant expenses.

Factors Influencing Savings Needs at 60

Several factors can influence how much you should have saved by age 60. These include your retirement goals, lifestyle preferences, and financial obligations. Below are key considerations:

This content may interest you! How much does Dave Ramsey say to have in savings?

How much does Dave Ramsey say to have in savings?- Your desired retirement lifestyle: A more luxurious lifestyle will require more savings.

- Healthcare costs: As you age, medical expenses tend to increase, so plan for higher out-of-pocket costs.

- Debt obligations: Paying off mortgages, loans, or credit card debt before retirement can reduce the amount you need to save.

Strategies to Build Savings by Age 60

If you haven’t reached your savings goal by age 60, there are still strategies to help you catch up. These include maximizing contributions, reducing expenses, and exploring additional income sources. Here are some actionable steps:

- Maximize retirement account contributions, such as 401(k) or IRA, especially if you’re eligible for catch-up contributions.

- Cut discretionary spending and redirect those funds into savings or investments.

- Consider part-time work or freelance opportunities to supplement your income and boost savings.

Frequently Asked Questions

What is the 60 saving rule?

The 60 saving rule is a budgeting strategy where you allocate 60% of your income to essential expenses like housing, utilities, and groceries. The remaining 40% is divided into savings (20%), investments (10%), and discretionary spending (10%). This rule helps maintain financial balance by prioritizing necessities while ensuring consistent savings and investments for future goals.

How does the 60 saving rule work?

The 60 saving rule works by dividing your income into specific percentages: 60% for essential needs, 20% for savings, 10% for investments, and 10% for discretionary spending. By following this structure, you ensure that your basic needs are met while building savings and investments for long-term financial security. It’s a simple yet effective way to manage your finances responsibly.

Who should use the 60 saving rule?

The 60 saving rule is ideal for individuals seeking a straightforward budgeting method. It works well for those with stable incomes who want to balance essential expenses, savings, and discretionary spending. However, it may require adjustments for people with irregular incomes or high debt. It’s a flexible framework that can be tailored to suit different financial situations and goals.

What are the benefits of the 60 saving rule?

The 60 saving rule offers several benefits, including financial discipline, clear allocation of funds, and a balanced approach to spending and saving. It ensures that essential expenses are covered while promoting consistent savings and investments. This rule also helps avoid overspending on non-essentials, making it easier to achieve long-term financial stability and goals like retirement or emergency funds.

Leave a Reply