What is the best app to save your money?

Saving money can be a challenge, but the right app can make all the difference. This article explores the best apps designed to help you reach your financial goals, from budgeting and tracking expenses to investing and building savings. We'll delve into features, user-friendliness, security, and pricing to help you choose the perfect app tailored to your needs and financial personality. Whether you're a beginner or a seasoned saver, finding the right tool is key, and we're here to guide you through the options.

Finding the Best Money-Saving App for You

Understanding Your Needs Before Choosing an App

There's no single "best" money-saving app, as the ideal choice depends heavily on your individual financial situation and goals. Before downloading anything, consider your spending habits. Are you a casual saver looking for a simple budgeting tool, or do you need advanced features like investment tracking or debt management? Think about what aspects of your finances you want to improve most – budgeting, saving for a specific goal, reducing debt, or tracking investments – and look for an app that specifically caters to those needs. Prioritizing your needs will help you narrow down the vast selection of apps available and find one that truly helps you achieve your financial objectives.

Exploring Popular Money Management Apps and Their Features

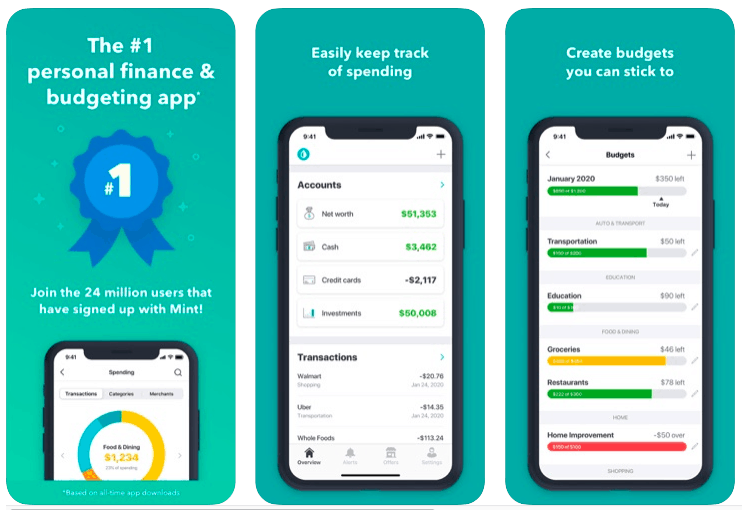

Many excellent apps offer various features. Popular options include Mint, YNAB (You Need A Budget), Personal Capital, and Acorns. Mint excels at providing a comprehensive overview of your finances by linking to your accounts and offering budgeting tools. YNAB focuses on mindful spending and goal-oriented saving through its budgeting method. Personal Capital caters to those with more complex financial needs, offering investment tracking and retirement planning tools. Acorns is ideal for micro-investing, automatically rounding up purchases and investing the spare change. Each app has strengths and weaknesses; researching features and user reviews is crucial to determining the best fit for your specific requirements and financial sophistication.

Factors to Consider When Selecting a Money-Saving App

Beyond features, consider factors like user interface (is it easy to navigate and understand?), security (how well does the app protect your financial data?), fees (are there any subscription costs or hidden charges?), and platform compatibility (is it available on your preferred device?). Reading reviews from other users can offer valuable insights into the app's strengths and weaknesses, helping you gauge its reliability and user-friendliness. Don't forget to check the app's privacy policy to understand how your data will be handled. Choosing the right app is a personal decision, but carefully weighing these factors can greatly increase your chances of finding a tool that truly supports your financial well-being.

This content may interest you! What is the #1 budgeting app?

What is the #1 budgeting app?| App Name | Key Features | Pros | Cons |

|---|---|---|---|

| Mint | Budgeting, expense tracking, bill reminders, credit score monitoring | Free, comprehensive overview | Can be overwhelming for beginners |

| YNAB (You Need A Budget) | Goal-oriented budgeting, mindful spending | Effective budgeting method, strong community | Subscription required |

| Personal Capital | Investment tracking, retirement planning, fee analysis | Advanced features for investors | Steeper learning curve |

| Acorns | Micro-investing, round-up feature | Easy to use, good for beginners | Limited features compared to others |

What is the best app to help you save money?

There's no single "best" app for saving money, as the ideal choice depends heavily on individual needs and spending habits. However, several popular apps offer a range of features to help users track expenses, budget, and save. The effectiveness of any app hinges on consistent use and a commitment to financial discipline. Consider your personal preferences and financial goals when choosing.

Choosing the Right App Based on Your Needs

The app market offers diverse options, each with different strengths. Some excel at simple expense tracking, while others offer advanced budgeting tools and investment options. Before committing to an app, consider what aspects of money management you want to improve. Do you need help tracking daily spending? Are you looking for a budgeting tool to allocate funds to specific goals? Or are you interested in automating investments? Matching the app's capabilities to your needs significantly increases the likelihood of successful money saving.

- Consider apps with features like expense categorization and reporting to analyze your spending habits and identify areas for improvement.

- Look for apps that offer customizable budgeting tools, allowing you to create budgets tailored to your specific income and expenses.

- Explore apps that integrate with your bank accounts for seamless transaction tracking and automatic categorization.

Features to Look for in a Money-Saving App

Effective money-saving apps typically include a range of features designed to improve financial literacy and promote saving. Beyond basic expense tracking, look for apps that offer personalized insights, goal-setting tools, and even investment options. The best app will not only help you track where your money is going, but it will also guide you towards achieving your financial objectives. Think about the level of detail and support you require.

This content may interest you! At what age should parents stop giving money?

At what age should parents stop giving money?- Look for apps that provide clear, visually appealing charts and graphs to visualize spending patterns and progress toward savings goals.

- Consider apps that offer features like automated savings, which automatically transfer a set amount to a savings account each month.

- Explore apps that integrate with credit monitoring services to help maintain healthy credit and prevent overspending.

Security and Privacy Considerations When Choosing a Money-Saving App

When entrusting an app with your financial information, security and privacy are paramount. Ensure the app you choose has robust security measures to protect your data. Read reviews and check the app's privacy policy carefully before providing any personal or financial information. Don't rush into using any app – doing your research is a crucial part of responsible financial management.

- Check for app reviews that mention security features and data protection measures.

- Review the app's privacy policy to understand how your data will be collected, used, and protected.

- Opt for apps that use encryption to protect your financial information.

What is the best app to manage money?

Best Money Management App

There's no single "best" money management app, as the ideal choice depends heavily on individual needs and preferences. Factors like your financial goals, tech savviness, and the complexity of your finances all play a role. However, several apps consistently rank highly and offer a range of features to help users track spending, budget, and save. Popular options include Mint, Personal Capital, YNAB (You Need A Budget), and EveryDollar. Each app has its strengths and weaknesses, so it's crucial to research and compare features before committing to one.

This content may interest you! How to convince your parents to give you $500?

How to convince your parents to give you $500?Factors to Consider When Choosing a Money Management App

Selecting the right money management app requires careful consideration of several key factors. You should assess your personal financial situation and identify the features most important to you. Some individuals may prioritize simple budgeting tools, while others need more advanced features like investment tracking or debt management capabilities. Consider the level of support offered by the app, both through online resources and customer service, as this can be crucial when you encounter problems or need assistance.

- Ease of use: How intuitive and user-friendly is the interface? Can you easily input transactions and track your progress?

- Feature set: Does the app offer the specific tools you need, such as budgeting, bill tracking, investment tracking, or debt management?

- Security and privacy: What security measures does the app employ to protect your financial data? Is your data encrypted and securely stored?

Popular Money Management Apps and Their Features

Several popular apps stand out for their comprehensive features and user-friendly interfaces. Mint, for example, offers a free, comprehensive platform with features that include automatic transaction categorization, budgeting tools, and credit score monitoring. YNAB (You Need A Budget), on the other hand, takes a more methodical approach, emphasizing zero-based budgeting and goal-oriented financial planning. Personal Capital is a robust choice for individuals managing larger investment portfolios, providing advanced investment tracking and analysis. EveryDollar provides a simpler, straightforward approach to budgeting, suited for users who prefer a less complex system.

- Mint: Free, automatic transaction import, budgeting, credit score monitoring.

- YNAB: Subscription-based, zero-based budgeting, goal-oriented planning.

- Personal Capital: Free (with premium options), investment tracking, financial planning tools.

- EveryDollar: Subscription-based, simple budgeting, focuses on giving every dollar a purpose.

Choosing the Right App for Your Financial Goals

The best app for you depends entirely on your financial goals and how you approach personal finance. Are you aiming to pay off debt aggressively? Do you want to save for a down payment on a house? Are you looking to manage a complex investment portfolio? Consider whether you prefer a simplified budgeting system or a more comprehensive approach with advanced features. The app you choose should align with your financial habits and priorities, making the process of managing your money more efficient and less stressful.

- Debt reduction: Apps offering debt payoff calculators and tracking tools can be beneficial.

- Saving goals: Apps with goal-setting features and progress trackers can help you stay motivated.

- Investment management: Apps offering investment tracking, portfolio analysis, and financial advice are ideal for investors.

Which platform is best for saving money?

How can you make your parents give you money?

How can you make your parents give you money?Best Platform for Saving Money

There's no single "best" platform for saving money, as the ideal choice depends heavily on individual needs and financial circumstances. The best platform will offer features that align with your specific saving goals, risk tolerance, and financial habits. Factors to consider include interest rates, fees, accessibility, security, and the availability of additional features like budgeting tools or investment options. Some platforms excel in certain areas while falling short in others. Therefore, a thorough comparison of several options is crucial before committing to one.

High-Yield Savings Accounts

High-yield savings accounts are offered by online banks and credit unions, typically paying significantly higher interest rates than traditional brick-and-mortar banks. This makes them an excellent option for maximizing returns on readily accessible funds. While the interest may not be as high as some investment options, the accessibility and FDIC insurance (up to $250,000 per depositor, per insured bank) provide a secure and convenient way to grow savings. Choosing a high-yield savings account involves comparing Annual Percentage Yields (APYs) across different institutions and carefully reviewing any associated fees.

- Consider online banks and credit unions for better interest rates.

- Compare APYs from multiple institutions before opening an account.

- Check for any monthly maintenance fees or minimum balance requirements.

Money Market Accounts

Money market accounts (MMAs) often offer a slightly higher interest rate than traditional savings accounts, along with check-writing capabilities and debit card access. However, MMAs may have higher minimum balance requirements than savings accounts and might impose fees for falling below that minimum. They're a suitable choice for those who need some liquidity while still earning a competitive interest rate on their savings. Just remember that the interest rates are not fixed and can fluctuate, so it's essential to monitor them regularly.

This content may interest you! What is it called when your parents give you money weekly?

What is it called when your parents give you money weekly?- Evaluate the interest rate and compare it to other savings options.

- Check the minimum balance requirements and any associated fees.

- Assess the convenience of check-writing and debit card access.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits that offer a fixed interest rate for a specified term (e.g., 6 months, 1 year, 5 years). The longer the term, the higher the interest rate usually is. However, accessing your money before the maturity date often incurs a penalty. CDs are ideal for long-term savings goals where you don't anticipate needing the funds before the CD matures. The fixed interest rate provides certainty regarding returns, unlike other accounts with fluctuating interest rates. It's important to carefully consider the length of the term and the penalty for early withdrawal before investing in a CD.

- Consider your time horizon and how long you can commit your money.

- Compare interest rates for different CD terms and institutions.

- Understand the penalties for early withdrawal before investing.

What is the best money saver?

There's no single "best" money saver, as the most effective approach depends heavily on individual circumstances, spending habits, and financial goals. However, the most consistently impactful money-saving strategies revolve around mindful spending, strategic budgeting, and leveraging opportunities to increase income. Ultimately, the best money saver is a combination of techniques tailored to your specific needs and consistently implemented over time. It's not about a single magical solution, but rather a holistic approach to managing your finances.

Budgeting and Tracking Expenses

Creating and sticking to a budget is arguably the cornerstone of effective money saving. This involves meticulously tracking your income and expenses to understand where your money is going. By identifying areas of overspending, you can make informed decisions about where to cut back. A well-structured budget allows for prioritizing essential expenses while strategically reducing non-essential ones. This process helps you gain control over your finances and prevents impulsive spending.

This content may interest you! How much should a 16 year old save?

How much should a 16 year old save?- Use budgeting apps or spreadsheets to track income and expenses.

- Categorize your spending to identify areas of overspending (e.g., dining out, entertainment).

- Set realistic financial goals and allocate funds accordingly (e.g., emergency fund, debt repayment).

Reducing Expenses

Once you have a clear picture of your spending habits, you can start identifying areas where you can reduce expenses. This might involve cutting back on subscriptions you don't use, finding cheaper alternatives for groceries or utilities, or negotiating lower rates for services. Even small reductions across multiple areas can add up to significant savings over time. The key is to be intentional and creative in finding ways to lower your costs without significantly compromising your quality of life.

- Identify and cancel unused subscriptions (streaming services, gym memberships).

- Compare prices for groceries, utilities, and other essential services.

- Cook at home more often instead of eating out.

Increasing Income

While reducing expenses is crucial, increasing your income can significantly boost your savings potential. This could involve taking on a side hustle, negotiating a raise at your current job, or exploring opportunities for professional development to command a higher salary. Increasing your income provides more financial flexibility and allows for faster progress towards your financial goals. Remember to always balance the time commitment required for extra income with the potential financial benefits.

- Explore side hustles (freelancing, gig work, part-time jobs).

- Negotiate a raise or seek a promotion at your current job.

- Invest in professional development to increase your earning potential.

What are the best budgeting apps?

Several budgeting apps excel at helping you save money. Mint and Personal Capital are popular choices offering comprehensive features like tracking spending, setting budgets, and monitoring investments. YNAB (You Need A Budget) focuses on mindful spending and assigning every dollar a purpose. EveryDollar, a simpler option from Dave Ramsey, is suitable for beginners. The "best" app depends on your financial goals and tech comfort level. Consider factors like ease of use, available features, and integration with your bank accounts when making your decision.

Which app is best for tracking expenses?

Many apps effectively track expenses, but some stand out. Mint and Personal Capital automatically categorize transactions, providing a clear overview of your spending habits. They offer detailed reports and charts, allowing you to easily identify areas where you can cut back. While simpler apps may require manual entry, the automated tracking in Mint and Personal Capital saves significant time and effort, providing a more accurate and convenient record of your daily spending.

This content may interest you! What expenses can I deduct from my taxes?

What expenses can I deduct from my taxes?Are there any free money saving apps?

Yes, several excellent money-saving apps are free to use, albeit with potential limitations. Mint and PocketGuard offer free versions with core budgeting and expense tracking features. However, some premium features, such as advanced reporting or investment tracking, may require a paid subscription. Free versions can still be very helpful for many users, especially those new to budgeting. Always check the app's pricing details and features to ensure they align with your needs before committing.

How do I choose the right money saving app for me?

Selecting the right app involves assessing your needs and preferences. Consider factors like your comfort level with technology, the complexity of your finances, and the features you prioritize. If you're a beginner, a simple app like EveryDollar might be ideal. For more advanced users, Mint or Personal Capital offer comprehensive functionalities. Read reviews, compare features, and even try free trials (if available) to determine which app best supports your financial goals and personal style before making a long-term commitment.

Leave a Reply