What is the best savings for college?

Planning for college expenses can feel overwhelming, but understanding the best savings strategies is key to mitigating future financial burdens. This article explores various college savings options, including 529 plans, ESAs, and custodial accounts, comparing their tax advantages, contribution limits, and withdrawal rules.

We'll analyze the pros and cons of each, helping you determine the most effective approach based on your individual circumstances and financial goals. Ultimately, the "best" savings plan hinges on careful consideration of your family's specific needs and long-term projections.

What are the Best College Savings Plans?

There's no single "best" college savings plan, as the ideal approach depends heavily on individual circumstances, such as your income, risk tolerance, and the timeline until your child's college enrollment. However, several popular options offer distinct advantages.

Understanding these options and their nuances is crucial to making informed decisions that maximize your savings potential.

Factors to consider include the tax advantages, investment growth potential, and accessibility of funds. Careful planning, starting early, and consistently contributing are key to achieving your college savings goals regardless of the plan you choose.

529 Education Savings Plans

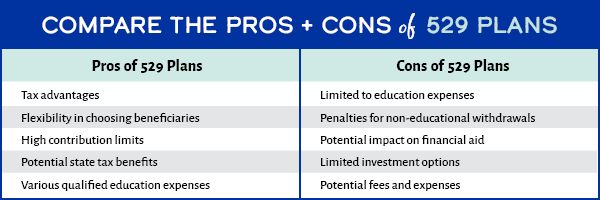

529 plans are state-sponsored savings plans offering significant tax advantages. Contributions aren't tax-deductible at the federal level, but earnings grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

Many states also offer state income tax deductions or credits for contributions. These plans offer a variety of investment options, ranging from relatively conservative to more aggressive, allowing you to tailor your investment strategy to your risk tolerance and time horizon. Keep in mind that some states may have higher fees or limited investment choices compared to others.

Choosing a plan from your own state often provides additional state tax benefits. However, you aren't restricted to your state's plan; you can choose a plan from another state based on its investment options and fees.

This content may interest you! How much should a 16 year old save?

How much should a 16 year old save?Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs provide significant tax advantages, similar to 529 plans. Contributions are not tax-deductible, but earnings grow tax-free, and withdrawals are tax-free for qualified education expenses.

However, there's a crucial annual contribution limit of $2,000 per beneficiary, and contributions stop once the beneficiary reaches age 18. Therefore, ESAs are best suited for those with lower incomes and shorter time horizons until college, acting as a supplemental savings vehicle to larger 529 plans or other savings strategies.

The low contribution limit makes Coverdell ESAs less suitable for long-term, large-scale college savings.

Custodial Accounts (UTMA/UGMA)

Uniform Transfer to Minors Act (UTMA) and Uniform Gift to Minors Act (UGMA) accounts are custodial accounts that allow you to invest money in your child's name. While offering flexibility in investment choices, they do not have the tax benefits of 529 plans or Coverdell ESAs.

Income earned within these accounts is taxed at the child's tax rate, which can be a significant disadvantage depending on the child’s income bracket.

These accounts can be useful as a supplementary savings tool but should not be the primary source of college savings due to the lack of tax benefits, making them less tax efficient. However, they offer significant flexibility in the type of investments that can be used.

| Plan Type | Tax Advantages | Contribution Limits | Investment Options | Accessibility |

|---|---|---|---|---|

| 529 Plan | Tax-deferred growth, tax-free withdrawals for qualified expenses (often state tax benefits as well) | No limit (though state plans may vary) | Varies by plan, typically broad range of choices | Restricted to qualified education expenses |

| Coverdell ESA | Tax-free growth, tax-free withdrawals for qualified expenses | $2,000 per beneficiary per year | Broad range, generally more limited than 529s | Restricted to qualified education expenses |

| Custodial Account (UTMA/UGMA) | No specific tax advantages | No limit | Very broad range | Accessible at age of majority (18 or 21 depending on state) |

What is the best option for college savings?

There's no single "best" option for college savings, as the ideal approach depends heavily on individual circumstances, such as income, risk tolerance, and the timeline until college. However, several strong contenders exist, each with its own set of advantages and disadvantages.

Factors to consider include tax benefits, investment growth potential, accessibility of funds, and potential penalties for early withdrawals. A well-rounded strategy might even involve a combination of these options.

This content may interest you! Should a 15 year old save money?

Should a 15 year old save money?529 Plans

529 plans are state-sponsored education savings plans offering significant tax advantages. Contributions aren't tax-deductible at the federal level (though some states offer deductions), but earnings grow tax-deferred, and withdrawals are tax-free when used for qualified education expenses.

This makes them a very popular and effective tool for long-term college savings. However, there can be penalties for non-qualified withdrawals. Choosing a 529 plan often involves selecting a specific state's plan, which may offer different investment options and fee structures.

- Tax Advantages: Earnings grow tax-deferred, and withdrawals for qualified education expenses are tax-free.

- Investment Options: A variety of investment options are typically available, ranging from low-risk to more aggressive strategies.

- State-Specific Benefits: Some states offer tax deductions or other incentives for contributing to their own state's 529 plan.

Custodial Accounts (UGMA/UTMA)

Uniform Gift to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts allow you to gift assets (cash, stocks, bonds, etc.) to a minor. The assets belong to the child, and they gain control upon reaching the age of majority (typically 18 or 21, depending on the state).

These accounts offer flexibility in investment choices, but the assets are considered the child's, which could affect financial aid eligibility. This is because the assets are included in the student's financial aid application, potentially reducing the amount of aid received.

Furthermore, there are no tax advantages for the contributions themselves.

- Flexibility: Allows for a wide range of investment options.

- Early Access: The assets are available to the child upon reaching the age of majority, even for non-educational purposes.

- Financial Aid Implications: Assets in these accounts are considered the student's assets and may reduce financial aid eligibility.

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs are tax-advantaged savings accounts that can be used for K-12 and college expenses. Contributions are made after-tax, but earnings grow tax-deferred, and withdrawals are tax-free for qualified education expenses.

However, there are contribution limits ($2,000 per beneficiary per year) and income limitations for contributors. This means they are not suitable for high-income families or those needing to save larger amounts annually.

- Tax-Free Growth: Earnings grow tax-deferred, and withdrawals for qualified expenses are tax-free.

- K-12 and College Expenses: Funds can be used for elementary, secondary, and higher education costs.

- Contribution and Income Limits: The relatively low annual contribution limit and income restrictions limit their use for many families.

What is the downside of a 529 plan?

How much money should a 14-year-old have?

How much money should a 14-year-old have?Limited Use

A significant drawback of 529 plans is their restricted usage. While intended for qualified education expenses, the definition of "qualified" is quite narrow. It primarily covers tuition, fees, and certain books and supplies at eligible post-secondary institutions.

Expenses for room and board are only partially covered under specific circumstances, and many other education-related costs, like personal computers or tutoring, are not eligible for 529 plan withdrawals. This limitation can leave families with funds they can't use for their intended purpose, rendering a portion of their investment useless.

- Tuition and fees are typically covered.

- Room and board coverage is often limited and depends on the plan and institution.

- Many other educational expenses, such as personal computers, are not eligible.

State Residency and Fees

Many 529 plans offer state tax deductions or credits to residents, creating an incentive to invest in your state's plan. However, this can become a disadvantage if you move to a different state with less favorable tax benefits or no benefits at all.

Furthermore, 529 plans often incur annual maintenance fees and potentially other charges depending on the investment options selected. These fees can eat into your earnings over time, especially for smaller accounts.

- State tax benefits may not be portable across state lines.

- Annual maintenance fees are common.

- Investment fees vary depending on the chosen investment options.

Investment Risk and Penalties

While 529 plans offer tax advantages, they are still subject to investment risk. The returns are not guaranteed, and the market value of your investments can fluctuate. Furthermore, withdrawals for non-qualified education expenses are subject to income tax and a 10% penalty, impacting the overall returns and potentially creating a financial burden.

This risk is especially relevant for long-term plans where market volatility can significantly affect the final amount available.

- Investments are subject to market fluctuations and may lose value.

- Non-qualified withdrawals are subject to income tax and a 10% penalty.

- Long-term investments are more vulnerable to market volatility.

What is a good amount of savings for college?

There's no single "good" amount of savings for college, as it heavily depends on several factors. The ideal savings goal is a number that minimizes student loan debt while considering the cost of attendance at your chosen institution, the availability of financial aid, and your family's financial situation.

This content may interest you! Should a 12 year old save money?

Should a 12 year old save money?Generally, aiming to cover a significant portion, if not all, of the tuition and fees is a prudent goal. However, even substantial savings may not cover all expenses, such as room and board, books, and personal expenses.

Therefore, a realistic approach involves combining savings with other funding sources like scholarships, grants, and loans.

Factors Influencing College Savings Goals

Several key factors influence how much you should aim to save for college. These factors should be carefully considered when setting a savings target. A realistic plan considers the interplay of these elements to create a financially sound strategy.

- Cost of attendance: Research the total cost of attendance at your target schools, including tuition, fees, room and board, books, and other expenses. This will give you a clear understanding of the overall financial commitment.

- Financial aid eligibility: Explore potential financial aid opportunities, including grants, scholarships, and work-study programs. These can significantly reduce the amount you need to save or borrow. Actively pursuing these opportunities is crucial.

- Family income and resources: Your family's financial situation plays a critical role. If your family has limited resources, the savings goal may need to be more modest, relying more heavily on financial aid and loans.

Strategies for Maximizing College Savings

There are various approaches to maximize your college savings. A well-structured savings plan, combined with smart financial decisions, can significantly contribute to meeting your college funding goals. Remember to start saving early to leverage the power of compounding interest.

- Start saving early: The earlier you start, the more time your savings have to grow due to compound interest. Even small contributions early on can make a big difference.

- Explore different savings vehicles: Consider options like 529 plans, which offer tax advantages for college savings, or other investment accounts tailored to long-term goals. Consult with a financial advisor to find the best fit.

- Set realistic saving goals and adjust accordingly: Your savings plan should be adaptable to changing circumstances. Regularly review and adjust your savings plan as needed, keeping in mind factors like college costs and financial aid opportunities. This flexible approach allows you to remain on track.

Understanding the Role of Student Loans

Student loans often play a significant role in financing college education. While aiming to minimize reliance on loans is ideal, they can be a necessary tool for bridging the gap between savings and the total cost of college.

It's crucial to understand the terms and implications of borrowing before taking out student loans.

- Loan repayment plans: Research different repayment options and understand the long-term financial implications of student loan debt. Choose repayment plans that align with your post-graduation financial expectations.

- Interest rates and fees: Be aware of interest rates and fees associated with student loans, as these can significantly impact the overall cost of borrowing. Compare loan options from various lenders to find the most favorable terms.

- Borrowing responsibly: Only borrow what you absolutely need, and prioritize scholarships and grants over loans. A responsible borrowing approach can help prevent excessive debt accumulation.

Is a 529 better than a college savings plan?

The question of whether a 529 plan is "better" than other college savings plans depends entirely on your individual circumstances and financial goals. There's no single right answer.

While 529 plans offer significant tax advantages, other options like Coverdell Education Savings Accounts (ESAs) or even regular brokerage accounts might be more suitable depending on your income, savings goals, and the specific needs of your child's education.

This content may interest you! What age should I start budgeting?

What age should I start budgeting?Tax Advantages of 529 Plans

529 plans stand out for their substantial tax benefits. Earnings grow tax-deferred, meaning you don't pay taxes on investment gains until the money is withdrawn for qualified education expenses.

Furthermore, withdrawals used for tuition, fees, books, supplies, and even room and board (under certain conditions) are generally tax-free at the federal level. This makes them a very attractive option for long-term college savings.

- Tax-deferred growth: Investment earnings accumulate without incurring annual tax liabilities.

- Tax-free withdrawals for qualified expenses: Money withdrawn for approved education costs is generally not subject to federal income tax.

- State tax benefits: Many states offer additional tax deductions or credits for contributions made to their own state's 529 plan.

Flexibility and Limitations of 529 Plans

529 plans offer a degree of flexibility in terms of investment choices, allowing you to select from various portfolios aligned with different risk tolerances and time horizons.

However, they also have limitations. The funds are primarily intended for higher education expenses, and penalties may apply if the money is used for non-qualified purposes.

Furthermore, contribution limits exist, although they are generally quite generous. The investment options within the plan are also subject to market fluctuations, meaning potential for both gains and losses.

- Investment options: A range of investment options are typically available, though specific choices vary by plan.

- Qualified education expenses: Funds must generally be used for qualified education expenses to avoid penalties.

- Contribution limits: There are annual contribution limits, although they are usually substantial.

Alternatives to 529 Plans

Other options for college savings exist, each with its own advantages and disadvantages. Coverdell Education Savings Accounts (ESAs), for example, offer similar tax advantages but have lower contribution limits and income restrictions.

Regular brokerage accounts allow for more investment flexibility but lack the tax benefits of 529 plans. Understanding the distinctions is crucial for making an informed decision.

- Coverdell Education Savings Accounts (ESAs): Offer tax-free growth and withdrawals for qualified education expenses, but have lower contribution limits and income restrictions.

- Custodial accounts (UTMA/UGMA): Allow for investment in a broader range of assets, but earnings are taxed at the child's tax rate.

- High-yield savings accounts and CDs: Offer safety and liquidity but typically have lower returns than investment-based options.

What types of college savings plans are available?

Several options exist for saving for college, each with its own set of advantages and disadvantages. 529 plans are tax-advantaged savings plans sponsored by states and educational institutions. Coverdell Education Savings Accounts (ESAs) offer similar tax benefits but have lower contribution limits.

This content may interest you! Can you start investing at a young age?

Can you start investing at a young age?UTMA/UGMA accounts are custodial accounts that offer flexibility but don't provide tax advantages on investment growth.

Finally, regular investment accounts can be used, but earnings are taxed annually. The best option depends on your individual financial situation, risk tolerance, and expected college costs. Consider consulting a financial advisor to determine the most suitable plan for your family's needs.

How much should I save for college?

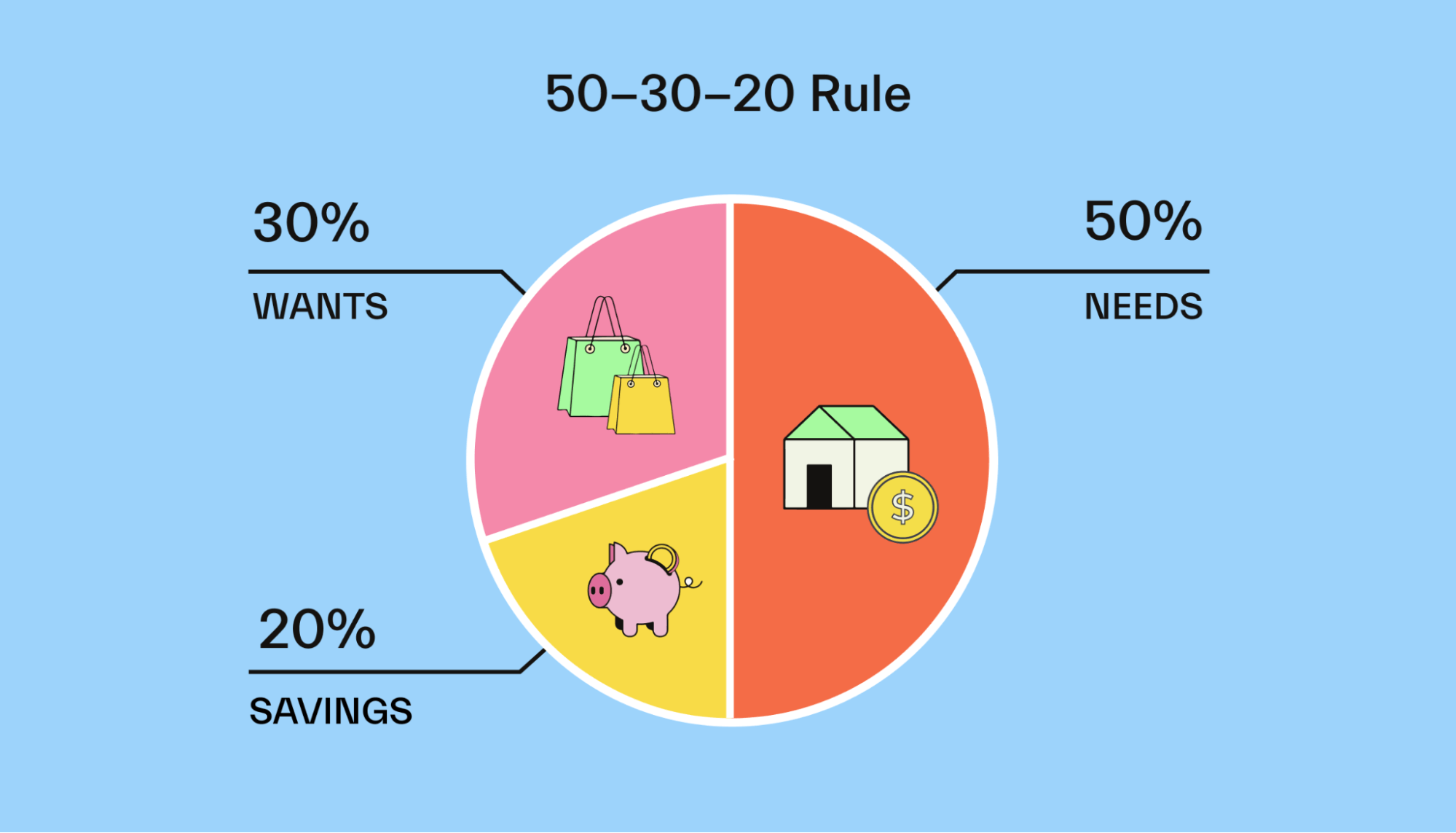

The amount you should save depends heavily on your family's income, the cost of the colleges your child is considering, and the amount of financial aid you expect to receive. Start by estimating the total cost of college, factoring in tuition, fees, room and board, books, and other expenses.

Then, subtract any expected financial aid or scholarships. The remaining amount represents your savings goal. Many families aim to save at least 50% of the total cost. It's crucial to begin saving early to leverage the power of compounding returns and minimize the impact of inflation.

Regular contributions, even small ones, can make a significant difference over time.

When should I start saving for college?

Ideally, you should start saving for college as soon as possible, even before your child is born. The earlier you begin, the more time your investments have to grow through compounding interest. While starting late is not ideal, it is still beneficial to begin saving as soon as you recognize the need.

The sooner you begin, the less you need to contribute each month to reach your savings goal. Even small, consistent contributions over many years can accumulate significantly. Delaying can greatly increase the burden of saving later, making it essential to establish a savings plan early.

What are the tax benefits of college savings plans?

Many college savings plans offer significant tax advantages. 529 plans, for instance, allow earnings to grow tax-free as long as the funds are used for qualified education expenses. This means you won't pay any taxes on the investment gains.

This content may interest you! What is the best investment for a small amount?

What is the best investment for a small amount?Coverdell Education Savings Accounts also offer tax-free growth, but they have stricter contribution limits. Depending on your state of residence, you may also be able to deduct contributions to 529 plans from your state income tax.

These tax benefits make college savings plans a powerful tool for accumulating funds for higher education expenses efficiently and minimizing your overall tax burden.

Leave a Reply