What saves you the most money in college?

College expenses can be daunting, but savvy financial strategies can significantly reduce the burden. This article explores the most impactful money-saving measures for college students. We'll delve into practical tips beyond simple budgeting, examining strategies that yield substantial long-term savings.

From optimizing financial aid to leveraging resources and making informed choices about living arrangements, we’ll uncover the key approaches that truly make a difference in minimizing college costs. Prepare to discover the secrets to a more affordable college experience.

- What Saves You the Most Money in College?

- How to save your money as a college student?

- What is the 50/30/20 rule for college students?

- What is the 1/3 rule for college savings?

- Is 00 enough for college?

- Tuition and Fees

- Room and Board

- Books, Supplies, and Personal Expenses

- What are the biggest hidden costs of college that I should be aware of?

- How can I reduce my living expenses while attending college?

- Are there any scholarship or grant opportunities I might be overlooking?

- What are some smart strategies for managing my student loan debt?

What Saves You the Most Money in College?

Careful Budgeting and Expense Tracking

One of the most significant ways to save money in college is through meticulous budgeting and expense tracking. Before the semester begins, create a realistic budget that outlines your expected income (financial aid, loans, part-time job earnings) and expenses (tuition, housing, food, books, transportation, entertainment). Utilize budgeting apps or spreadsheets to monitor your spending habits closely.

By actively tracking where your money is going, you can quickly identify areas where you can cut back. This proactive approach prevents overspending and helps you stay within your financial limits throughout the academic year. Regularly reviewing your budget and making necessary adjustments is crucial for long-term financial success.

Smart Shopping and Resource Utilization

Minimizing unnecessary expenses is key to saving money. This means being resourceful and strategic with your purchases. Instead of buying new textbooks, consider renting them, buying used copies, or exploring online resources like open educational resources (OER). Take advantage of free campus resources like libraries, computer labs, and student centers to reduce expenses associated with printing, internet access, and study spaces.

This content may interest you! What is the best savings for college?

What is the best savings for college?Cooking your own meals instead of constantly eating out significantly reduces food costs. By thoughtfully considering your purchasing decisions, you can dramatically reduce overall expenses.

Securing Affordable Housing and Transportation

Housing and transportation are two of the largest expenses for college students. Exploring affordable housing options like on-campus dormitories (if available and financially viable), shared apartments with roommates, or living at home if geographically feasible can significantly lower your housing costs.

In terms of transportation, consider biking, walking, or utilizing public transportation instead of relying on a personal vehicle. Reducing transportation costs through carpooling or opting for cheaper alternatives can dramatically impact your overall budget. Carefully evaluating these two major expense categories can contribute considerably to your financial savings.

| Category | Savings Strategy | Impact |

|---|---|---|

| Housing | On-campus dorm, roommates, living at home | Significant cost reduction |

| Food | Cooking at home, utilizing meal plans strategically | Reduced dining expenses |

| Textbooks | Renting, buying used, OER | Lower textbook costs |

| Transportation | Public transport, biking, walking, carpooling | Reduced fuel and vehicle costs |

| Entertainment | Taking advantage of free campus events and activities | Lower entertainment expenses |

How to save your money as a college student?

Track Your Spending

Understanding where your money goes is the first step to saving it. Many students underestimate their daily expenses. Tracking your spending, whether through a notebook, spreadsheet, or budgeting app, provides valuable insight into your spending habits.

This allows you to identify areas where you can cut back and make informed decisions about your finances. Regularly reviewing your spending helps you stay accountable and on track towards your savings goals.

This content may interest you! How much should a 16 year old save?

How much should a 16 year old save?- Use a budgeting app or spreadsheet to record every transaction.

- Categorize your expenses (e.g., housing, food, entertainment, transportation).

- Review your spending regularly to identify areas for improvement.

Budget Effectively

Creating a realistic budget is crucial for effective money management. A budget outlines your expected income and expenses, ensuring you spend less than you earn.

This involves prioritizing essential expenses like tuition and rent, while carefully considering discretionary spending. A well-structured budget can help you allocate funds for savings and avoid unnecessary debt.

- List all sources of income (e.g., part-time job, financial aid, scholarships).

- List all expenses, separating needs from wants.

- Allocate a specific amount for savings each month and stick to it.

Explore Money-Saving Opportunities

College life offers numerous opportunities to save money. Taking advantage of student discounts, utilizing free campus resources, and finding affordable housing options can significantly impact your overall spending.

Exploring part-time jobs or freelancing can supplement your income and contribute to your savings. Making conscious choices about your daily expenses can lead to substantial savings over time.

- Look for student discounts at local businesses and online retailers.

- Take advantage of free campus resources, such as the library and gym.

- Consider living in cheaper accommodation options, such as shared housing or living at home.

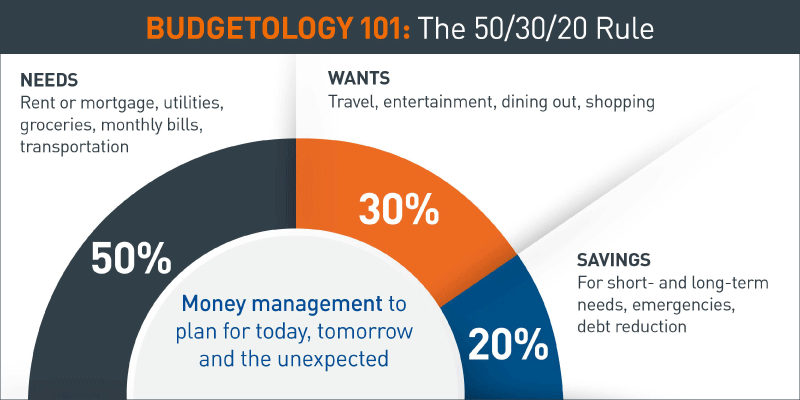

What is the 50/30/20 rule for college students?

Should a 15 year old save money?

Should a 15 year old save money?The 50/30/20 rule is a personal finance guideline that suggests allocating your after-tax income as follows: 50% to needs, 30% to wants, and 20% to savings and debt repayment.

For college students, this rule can be adapted to fit their unique financial situations, often requiring more creative budgeting and prioritizing. While the percentages are flexible, the underlying principle of mindful spending and saving remains crucial.

The challenge for students lies in accurately categorizing expenses and making informed choices to manage limited funds effectively. It's a powerful tool for building good financial habits early on.

Needs: Prioritizing Essentials

For college students, needs encompass the fundamental requirements for survival and academic success. This category should receive the largest portion of their income, approximately 50%. Careful budgeting in this area is crucial to ensuring financial stability.

Prioritizing needs helps to avoid unnecessary debt and financial stress, leaving more room for other aspects of college life.

This content may interest you! How much money should a 14-year-old have?

How much money should a 14-year-old have?- Tuition and fees: These are non-negotiable expenses crucial for completing your education.

- Housing: Rent, dorm fees, or mortgage payments if applicable, form a significant part of student expenses.

- Food: Groceries, meal plans, or eating out should be carefully considered to manage costs effectively.

- Transportation: Costs associated with commuting to campus, such as gas, public transport, or vehicle maintenance.

- Books and supplies: Essential academic materials needed for courses.

- Healthcare: Medical expenses, insurance premiums, or co-pays.

Wants: Managing Discretionary Spending

The wants category (30%) includes non-essential expenses that enhance the college experience but aren't critical for survival or studies. This requires careful self-discipline and prioritizing enjoyable activities within a reasonable budget. Overspending in this area can quickly jeopardize the 50/30/20 balance and hinder financial goals.

- Social activities: Going out with friends, attending events, or engaging in entertainment.

- Dining out: Eating at restaurants or cafes, rather than preparing meals at home.

- Clothing and personal care: Purchasing new clothes or beauty products.

- Hobbies and entertainment: Spending money on hobbies, streaming services, or gaming.

- Travel: Occasional trips or vacations.

Savings and Debt Repayment: Building a Financial Future

Allocating 20% of income to savings and debt repayment sets the foundation for long-term financial well-being. For college students, this might involve saving for future tuition, emergencies, or building a credit history by making timely debt payments. This proactive approach minimizes future financial burdens and fosters responsible financial habits.

- Emergency fund: Building a safety net for unexpected expenses.

- Student loan repayment: Making timely payments to avoid penalties and high interest.

- Savings for future education: Saving for postgraduate studies or professional development.

- Investing: Starting early can make a big difference in long-term wealth building (though this may not be feasible for all students).

What is the 1/3 rule for college savings?

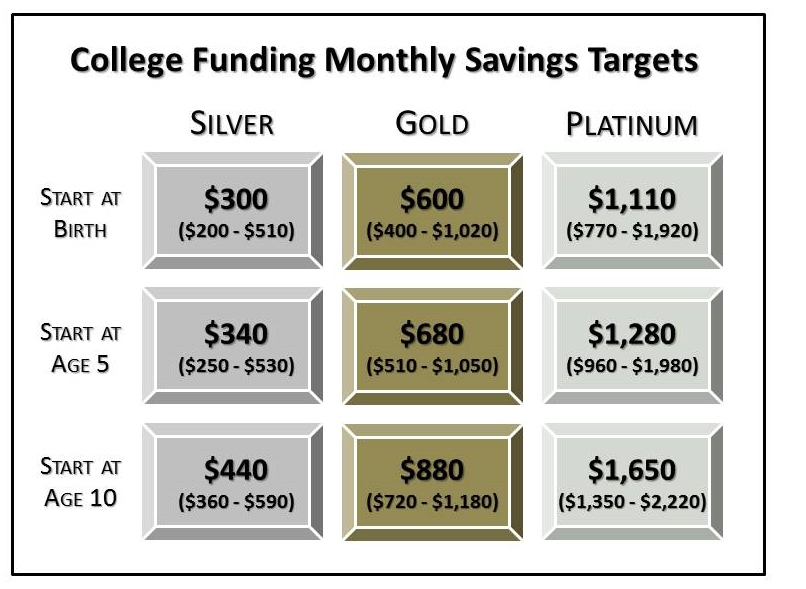

The 1/3 rule for college savings is a guideline suggesting that parents should aim to save one-third of their child's expected college costs by the time their child enters high school. This approach acknowledges that the total cost of college is usually difficult to predict years in advance and attempts to mitigate the risk of falling short by focusing on making significant progress early in the savings process.

It doesn't specify how the remaining two-thirds should be funded, leaving room for various approaches like scholarships, part-time jobs, or loans during the college years. The focus is on establishing a substantial foundation early, aiming to reduce the overall financial burden later.

How Does the 1/3 Rule Work in Practice?

Applying the 1/3 rule involves several key steps. First, you need to estimate the total cost of college for your child. This can be a challenging task, as tuition costs vary significantly by institution and program. Utilizing online college cost calculators and considering potential in-state vs. out-of-state tuition costs can be helpful.

This content may interest you! Should a 12 year old save money?

Should a 12 year old save money?Once you have a projected total cost, you then divide that number by three to determine the savings target to be reached by the start of high school. Regular contributions to a college savings plan, such as a 529 plan, are crucial to achieving this goal. Finally, continuously monitor your progress and adjust contributions as needed based on financial circumstances and the evolving cost projections.

- Estimate total college costs (tuition, fees, room, board, books, etc.)

- Divide the total cost by three to obtain the 1/3 target.

- Save diligently to reach the target by the start of high school. Regularly reassess and adjust savings strategy as needed.

Advantages and Disadvantages of the 1/3 Rule

The 1/3 rule provides a helpful framework for college savings, but it's not without its limitations. A key advantage is its simplicity and ease of understanding, making it accessible to many families. It also encourages early saving, which is crucial for maximizing the benefits of compound interest.

However, a significant disadvantage is that it relies on a somewhat arbitrary division of costs. It doesn't account for individual financial circumstances or the possibility of unexpected expenses. Furthermore, the rule doesn't address how the remaining two-thirds of the college costs will be financed.

- Simplicity and ease of use.

- Encourages early saving and the power of compound interest.

- Doesn't account for individual financial situations, unexpected events, or how the remaining costs will be covered.

Alternatives and Considerations Beyond the 1/3 Rule

While the 1/3 rule offers a useful starting point, families should also explore other strategies and consider their individual circumstances. Alternative approaches include saving a larger percentage earlier, focusing on maximizing scholarships, or incorporating part-time work or summer jobs into the college funding plan.

Factors like the child's academic potential and eligibility for financial aid will significantly influence the ultimate college savings strategy. Regularly reviewing your plan and adjusting it based on changing circumstances, and considering all available funding sources are essential.

This content may interest you! How to budget as a young person?

How to budget as a young person?- Consider saving a larger percentage earlier to leverage compound interest more aggressively.

- Explore maximizing scholarships and grants to reduce the overall cost burden.

- Factor in potential contributions from part-time jobs, summer work, and other earnings.

Is $2000 enough for college?

No, $2000 is almost certainly not enough to cover the costs of college for even a single semester. College expenses are incredibly varied and depend heavily on several factors including the type of institution (public vs. private), location (in-state vs. out-of-state), and student lifestyle. While $2000 might cover a small portion of some expenses, it's insufficient to cover tuition, fees, room and board, books, supplies, and personal expenses for most students.

Tuition and Fees

Tuition and fees represent a significant portion of college costs. These vary dramatically depending on the type of institution and the student's program of study. At public universities, in-state tuition can be considerably lower than out-of-state tuition, and private universities often have the highest tuition rates. Even with financial aid, students often still have substantial tuition and fee expenses to cover.

- Public in-state tuition can range from a few thousand to over $10,000 per year.

- Public out-of-state tuition and private university tuition are frequently significantly higher, often exceeding $20,000 or even $50,000 per year.

- Fees encompass various charges like technology fees, student activity fees, and health insurance fees, adding considerably to the overall cost.

Room and Board

The cost of room and board is another substantial expense. On-campus housing is typically more expensive than off-campus options, but even off-campus housing can be costly, especially in urban areas near universities. Food expenses also contribute to this category. Students need to factor in grocery costs, dining out expenses, and other related costs.

- On-campus housing and meal plans can cost anywhere from $10,000 to $20,000 or more annually.

- Off-campus housing costs vary widely by location and type of accommodation (dorm, apartment, shared house).

- Food expenses can easily reach several thousand dollars per year depending on dietary preferences and eating habits.

Books, Supplies, and Personal Expenses

Beyond tuition, fees, and housing, students need to consider the costs of textbooks, supplies, and personal expenses. Textbooks can be exceptionally pricey, and students also need to account for stationery, technology (computers, laptops, software), transportation, and personal spending money. These expenses can quickly add up and create a significant financial burden.

This content may interest you! How to stay debt-free after paying off what you owe?

How to stay debt-free after paying off what you owe?- Textbooks alone can cost hundreds of dollars per semester.

- Technology costs can range from purchasing new computers to purchasing software and subscriptions.

- Transportation expenses including gas, public transportation, or car maintenance can be substantial.

Hidden costs can significantly impact your budget. These often include things like printing fees, course materials beyond textbooks (like lab supplies or software), transportation to and from campus (gas, public transport, or parking), and unexpected health expenses.

Social events and eating out frequently also add up quickly. Planning ahead and budgeting for these less obvious expenses is crucial for avoiding financial surprises and staying on track with your spending plan. Carefully review your acceptance package and any additional course-specific information to understand potential hidden costs upfront.

How can I reduce my living expenses while attending college?

Minimizing living expenses is vital for saving money in college. Consider living at home if possible, as this drastically cuts down on rent and utilities. If living on campus, opt for a dorm room with fewer amenities to lower costs. Cook your own meals instead of eating out frequently, buy groceries in bulk when possible, and pack your lunch daily.

Explore cheaper transportation options like biking or using public transport rather than owning a car. Avoid impulse purchases and carefully track your spending to identify areas where you can reduce costs further.

Are there any scholarship or grant opportunities I might be overlooking?

Many students overlook potential funding sources. Beyond the general scholarships offered by your college, research external scholarships provided by organizations, foundations, and businesses related to your field of study or personal background. Check with local community groups and professional associations.

This content may interest you! What is the 40-40-20 budget rule?

What is the 40-40-20 budget rule?Don't hesitate to apply for every scholarship you qualify for, even if the amount seems small; it all adds up. Utilize your college's financial aid office for guidance and assistance in exploring these opportunities and completing your applications.

What are some smart strategies for managing my student loan debt?

Managing student loan debt effectively is crucial for long-term financial well-being. Understand the terms of your loans and explore different repayment plans (income-driven repayment can be beneficial). Prioritize paying down high-interest loans first, and consider making extra payments whenever possible to reduce principal and interest accrued over time.

Building good credit is also important for securing better loan terms in the future. Be proactive in managing your debt; avoid late payments and keep track of your loan balances. Seek financial counseling if needed for personalized guidance on debt management strategies.

Leave a Reply