What to do if you are in massive debt?

Being buried under a mountain of debt can feel overwhelming, leading to stress, anxiety, and a sense of hopelessness. However, it's crucial to remember that you're not alone and there are steps you can take to regain control of your finances. This article provides a practical guide to navigating massive debt, focusing on realistic strategies for assessment, budgeting, negotiation, and ultimately, achieving financial freedom. We'll explore various options, from debt consolidation and debt management plans to bankruptcy, empowering you to choose the path best suited to your specific circumstances. Let's begin reclaiming your financial future.

What to Do When Facing Crushing Debt

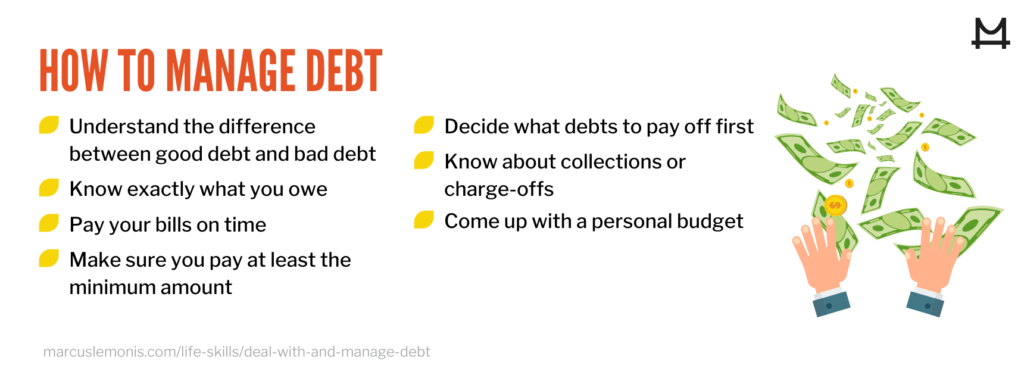

Facing massive debt can feel overwhelming, but it's crucial to remember that you're not alone and there are steps you can take to regain control of your finances. The first and most important step is to stop avoiding the problem. Burying your head in the sand will only make things worse. Instead, gather all your statements – credit cards, loans, medical bills, etc. – and make a detailed list of every debt you owe, including the balance, interest rate, and minimum payment. This provides a clear picture of your financial situation. Facing the reality of your debt is the first step towards resolving it. From there, you can begin to explore solutions and develop a plan to tackle your debts strategically. Don't be afraid to seek professional help from a credit counselor or financial advisor. They can offer guidance, create a personalized debt management plan, and help you negotiate with creditors.

Creating a Realistic Budget

Once you have a clear understanding of your debt, the next critical step is to create a realistic budget. This involves tracking your income and expenses to identify areas where you can cut back. Identify non-essential expenses and eliminate or drastically reduce them. This could include things like dining out, entertainment, subscriptions, or luxury items. Prioritize essential expenses such as housing, utilities, food, and transportation. Building a budget isn't just about cutting expenses; it's also about prioritizing debt repayment. Determine how much you can realistically allocate each month towards paying down your debt. Consider using budgeting apps or spreadsheets to help you track your progress and stay on track. Remember, a successful budget is flexible and adaptable. Review and adjust your budget regularly to reflect changes in your income or expenses.

Exploring Debt Management Options

Several options are available to help manage and reduce overwhelming debt. Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate, simplifying repayments. Debt management plans (DMPs), offered by credit counseling agencies, involve negotiating with creditors to lower interest rates and monthly payments. Balance transfer credit cards offer a temporary 0% APR period, allowing you to pay down debt without accruing interest, but be aware of the balance transfer fees and the interest rate once the promotional period ends. Negotiating with creditors directly can sometimes result in reduced interest rates or payment plans. It's important to understand the terms and conditions of each option before committing to it. Consider the potential impact on your credit score and long-term financial health. Professional guidance from a financial advisor or credit counselor can help you determine the best course of action for your specific circumstances.

Seeking Professional Help

Don't hesitate to seek professional help from a certified credit counselor or financial advisor. These professionals have the expertise and experience to guide you through the complexities of debt management. They can help you create a personalized debt reduction plan, negotiate with creditors, and provide valuable financial advice. A non-profit credit counseling agency can offer guidance and support at a lower cost than a for-profit financial advisor. They can help you understand your options, such as debt management plans, and work with you to develop a strategy to address your debt. Remember, seeking help is a sign of strength, not weakness, and it's a crucial step towards achieving long-term financial stability. Taking proactive steps to address your debt will positively impact your mental health and overall well-being.

This content may interest you! What to do when you are heavily in debt?

What to do when you are heavily in debt?| Debt Management Strategy | Pros | Cons |

|---|---|---|

| Debt Consolidation | Simplified payments, potentially lower interest rate | May require good credit, potential fees |

| Debt Management Plan (DMP) | Lower payments, professional guidance | Impact on credit score, potential fees |

| Balance Transfer Credit Card | 0% APR introductory period | Balance transfer fees, high interest rate after promotional period |

| Negotiating with Creditors | Potential for reduced interest rates or payments | Requires strong negotiation skills, may not always be successful |

What to do if you're in a lot of debt?

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

Assess Your Debt

The first step to tackling significant debt is understanding the full extent of your financial situation. This involves gathering all your debt statements – credit cards, loans, medical bills, etc. List each debt, including the creditor, balance, interest rate, minimum payment, and due date. This will give you a clear picture of how much you owe and the interest accruing daily. Once you have a comprehensive list, you can start to strategize a repayment plan. This assessment is crucial because it provides a realistic understanding of your financial predicament, allowing you to take calculated steps toward recovery.

- Create a detailed spreadsheet or use budgeting software to organize your debts.

- Calculate your total debt and monthly interest payments.

- Identify high-interest debts that need immediate attention.

Create a Budget and Reduce Spending

With a clear understanding of your debt, you need a realistic budget. Track your income and expenses meticulously for at least a month. Identify areas where you can cut back on spending. This might involve reducing dining out, entertainment, subscriptions, or other non-essential expenses. The goal is to free up as much money as possible to allocate towards debt repayment. It's important to remember that creating a budget is an ongoing process – regular review and adjustments are essential to maintain financial control.

- Categorize your expenses (housing, food, transportation, etc.) and identify areas for reduction.

- Use budgeting apps or spreadsheets to track income and expenses effectively.

- Set realistic spending limits for each category and stick to them.

Explore Debt Management Strategies

Several strategies can help manage and reduce debt. Consider these options: the debt snowball method (paying off the smallest debt first for motivation), the debt avalanche method (paying off the highest-interest debt first to save money), debt consolidation (combining multiple debts into one loan with a lower interest rate), balance transfers (moving high-interest debt to a card with a lower introductory rate), or seeking professional help from a credit counselor or financial advisor. Each strategy has its pros and cons, and the best approach depends on your individual financial situation. Careful consideration and research are key to choosing the most effective strategy for your circumstances.

- Research different debt repayment methods to find the one that suits your situation best.

- Consider consulting a credit counselor or financial advisor for personalized guidance.

- Explore options like debt consolidation or balance transfers to potentially lower interest rates.

How do I get out of a huge debt?

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)

How do I recover from so much debt?

How do I recover from so much debt?Getting Out of Huge Debt

Getting out of significant debt requires a multifaceted approach combining careful planning, disciplined execution, and potentially professional guidance. There's no single solution that works for everyone, as the best strategy depends on the type of debt (credit cards, loans, medical bills, etc.), the amount owed, your income, and your overall financial situation. The process generally involves several key steps, working through them methodically is crucial for success.

Create a Realistic Budget and Track Your Spending

The first step to tackling debt is understanding where your money goes. Create a detailed budget that lists all your income and expenses. Track your spending meticulously for at least a month to identify areas where you can cut back. This level of transparency will highlight unnecessary expenses and give you a clear picture of your financial health. Once you have a solid grasp of your spending habits, you can start making informed decisions about how to allocate your funds towards debt repayment.

- Use budgeting apps or spreadsheets to track income and expenses.

- Identify non-essential spending and cut back on these areas.

- Prioritize essential expenses (housing, food, transportation, utilities).

Develop a Debt Repayment Strategy

With a clear budget in place, it's time to strategize how you'll tackle your debt. Two popular methods are the debt avalanche and debt snowball methods. The debt avalanche method focuses on paying off the debt with the highest interest rate first, regardless of the balance. This saves you the most money in the long run. The debt snowball method involves paying off the smallest debt first, regardless of interest rate, for motivational purposes. Choose the strategy that best suits your personality and financial situation. Consider consolidating high-interest debts into a lower-interest loan or exploring debt management programs.

- Calculate the interest rates on all your debts.

- Choose between the debt avalanche or debt snowball method.

- Explore debt consolidation or debt management programs with a credit counselor.

Seek Professional Help if Needed

Dealing with significant debt can be overwhelming. Don't hesitate to seek professional guidance from a certified credit counselor or financial advisor. They can provide personalized advice, help you create a comprehensive plan, and negotiate with creditors on your behalf. They can also help you understand your options and avoid predatory lending practices. Remember, seeking help is a sign of strength, not weakness, and can significantly improve your chances of successfully managing and eliminating your debt.

This content may interest you! How can I improve my credit score when in debt?

How can I improve my credit score when in debt?- Find a reputable credit counseling agency or financial advisor.

- Discuss your financial situation and debt repayment options.

- Follow their advice and actively participate in the debt management plan.

Is $20,000 a lot of debt?

Whether $20,000 is a lot of debt depends entirely on your individual financial circumstances. There's no single answer. It's relative to your income, assets, and the type of debt. For someone with a high income and significant savings, $20,000 might be manageable. However, for someone with a low income and limited savings, it could be crippling. Consider factors like your monthly disposable income, the interest rate on the debt, and the length of the repayment period. A high-interest debt, like a payday loan, will quickly accumulate interest, making $20,000 feel like a much larger burden than a low-interest debt, like a student loan with a favorable repayment plan. The type of debt also matters; a mortgage on a property you can rent out might be a smart investment, but high-interest credit card debt is generally something to reduce quickly.

Factors Influencing the Significance of $20,000 Debt

Several key factors determine the weight of $20,000 in debt. Your annual income plays a crucial role; a higher income allows for easier debt management. The interest rate charged on the debt significantly affects the total amount you’ll repay. High-interest rates dramatically increase the overall cost, making it a larger burden. Finally, the type of debt – whether it's for education, a home, or consumer goods – affects its perceived importance and repaying capabilities. Consider these elements individually to fully assess your situation.

- Annual Income: A higher income generally makes $20,000 debt more manageable. Debt-to-income ratios help gauge this.

- Interest Rates: High-interest debts compound quickly, increasing the overall debt burden. Low-interest debts are easier to manage.

- Debt Type: Good debt (e.g., student loans for a high-earning career) is viewed differently from bad debt (e.g., high-interest credit card debt).

Debt Management Strategies for $20,000

If $20,000 of debt feels overwhelming, several strategies can help alleviate the pressure. Creating a budget to track income and expenses is the first step in gaining control. Prioritizing high-interest debts using methods like the debt avalanche (focus on the highest interest rate first) or debt snowball (focus on the smallest debt first) is a sound approach. Exploring debt consolidation options to simplify repayments and potentially lower interest rates can also significantly improve your financial situation. Seeking professional financial advice can provide personalized guidance.

- Budgeting: Creating a detailed budget to track income and expenses is critical for debt management.

- Debt Reduction Strategies: Using methods like the debt avalanche or snowball can accelerate repayment.

- Debt Consolidation: Consolidating debts can simplify repayments and potentially lower interest rates.

Seeking Professional Help with $20,000 Debt

Facing significant debt can be emotionally challenging, and seeking professional help shouldn't be seen as a sign of failure. Credit counselors can provide guidance on debt management strategies, negotiate with creditors, and develop a personalized repayment plan. Financial advisors offer broader financial planning expertise, considering your entire financial picture to create a comprehensive strategy for long-term financial well-being. Remember, it's beneficial to seek help if the $20,000 debt feels unmanageable or is impacting your mental health.

This content may interest you! How to create a debt repayment plan that works?

How to create a debt repayment plan that works?- Credit Counseling: Credit counselors provide guidance, negotiate with creditors, and create repayment plans.

- Financial Advisors: Financial advisors offer comprehensive financial planning to manage debt and future financial goals.

- Mental Health Support: Addressing the emotional stress associated with debt is crucial for successful management.

How do you deal with severe debt?

Dealing with Severe Debt

Dealing with severe debt requires a multifaceted approach that combines careful planning, decisive action, and potentially professional guidance. It's crucial to understand that there's no one-size-fits-all solution, and the best strategy will depend on your specific circumstances, including the types of debt you have, the amount you owe, and your income and expenses. The first step is always to honestly assess your financial situation. This involves meticulously listing all your debts, including credit card balances, loans, and other obligations, along with their interest rates and minimum payments. You should also create a detailed budget that tracks your income and all your expenses. This will help you understand where your money is going and identify areas where you can cut back. Once you have a clear picture of your finances, you can start developing a plan to tackle your debt.

Creating a Realistic Budget

A realistic budget is the cornerstone of any debt reduction strategy. It's essential to track every dollar you earn and spend to identify areas where you can make adjustments. This often involves making difficult choices, but the long-term benefits of getting your finances under control far outweigh the short-term sacrifices. Cutting unnecessary expenses and finding ways to increase your income are key components of this process. Remember that even small savings can add up over time and contribute significantly to your debt reduction efforts. Consider using budgeting apps or spreadsheets to help you track your spending and stay organized.

- Identify and eliminate unnecessary expenses: Analyze your spending habits and identify areas where you can cut back, such as dining out, entertainment, subscriptions, or impulse purchases.

- Explore ways to increase your income: Consider a side hustle, part-time job, or selling unused items to generate additional funds to put towards your debt.

- Prioritize essential expenses: Ensure you're allocating sufficient funds for necessities like housing, food, transportation, and healthcare before tackling discretionary spending.

Debt Consolidation and Refinancing Options

Debt consolidation involves combining multiple debts into a single payment, often with a lower interest rate. This can simplify your finances and make it easier to manage your payments. Refinancing can also lower your interest rates and monthly payments. However, it's important to carefully consider the terms of any consolidation or refinancing loan to ensure it truly benefits your situation. It may be worth comparing offers from different lenders to find the best deal. It's crucial to thoroughly research any fees involved and ensure the new loan's terms are more favorable than your current debts.

This content may interest you! What is the snowball vs. avalanche method for paying off debt?

What is the snowball vs. avalanche method for paying off debt?- Research different debt consolidation options: Explore balance transfer credit cards, personal loans, or debt management plans offered by credit counseling agencies.

- Compare interest rates and fees: Carefully compare the interest rates and fees associated with each option to choose the most cost-effective solution.

- Understand the terms and conditions: Before committing to any debt consolidation or refinancing plan, thoroughly understand the terms and conditions, including repayment schedules and potential penalties.

Seeking Professional Help

When dealing with severe debt, seeking professional help can be invaluable. Credit counseling agencies can offer guidance on budgeting, debt management, and negotiating with creditors. They can also help you develop a debt management plan (DMP) that involves consolidating your debts and making affordable monthly payments. In some cases, bankruptcy may be an option, although it should be considered a last resort due to its long-term implications on your credit score. A financial advisor can provide personalized guidance and help you navigate complex financial situations. Remember that seeking help is a sign of strength, not weakness.

- Consult with a credit counselor: Credit counselors can provide personalized advice and help you develop a debt management plan.

- Explore bankruptcy as a last resort: Bankruptcy should only be considered as a last resort after exploring all other options and should be discussed with a bankruptcy attorney.

- Seek guidance from a financial advisor: A financial advisor can offer personalized financial guidance and help you create a long-term financial plan.

What should I do first if I'm overwhelmed by debt?

The first step is to stop accumulating more debt. This means cutting unnecessary expenses and creating a realistic budget. Next, gather all your financial statements – credit card bills, loan documents, etc. – to get a clear picture of your total debt. This allows you to determine the amount you owe, the interest rates, and the minimum payments. Then, prioritize debts strategically, focusing on high-interest debts first. Don't be afraid to seek professional help from a credit counselor or financial advisor. They can provide guidance and develop a personalized debt management plan.

How can I negotiate with my creditors?

Contact your creditors directly and explain your financial situation honestly. Many are willing to work with you. You may be able to negotiate a lower interest rate, a longer repayment period, or a temporary reduction in payments. Be prepared to provide documentation showing your income and expenses. Document all your communications in writing. Consider debt consolidation as a way to simplify your payments and potentially lower your overall interest rate. Remember to be polite and persistent in your communication, as successful negotiation often involves multiple conversations.

What are my options if I can't afford my minimum payments?

If you can’t meet minimum payments, explore options like debt consolidation, debt management plans, or bankruptcy. Debt consolidation combines multiple debts into one loan with a potentially lower interest rate. Debt management plans involve working with a credit counseling agency to negotiate lower payments with creditors. Bankruptcy is a legal process that can discharge some debts but has significant long-term consequences for your credit score. It's crucial to understand the implications of each option before making a decision. Consulting with a financial professional is recommended.

Should I consider bankruptcy?

Bankruptcy should be considered a last resort. It severely impacts your credit score and can have long-term financial consequences. Before exploring bankruptcy, exhaust all other options, such as negotiating with creditors, debt consolidation, and debt management plans. Seek legal counsel to fully understand the implications and requirements of bankruptcy. A lawyer can guide you through the process and help determine if it's the right choice for your specific circumstances. Consider the potential impact on your future ability to obtain loans or rent an apartment.

This content may interest you! How to consolidate debt and lower interest rates?

How to consolidate debt and lower interest rates?

Leave a Reply